Middle East and Africa Whey Protein Market Analysis

The Middle East And Africa Whey Protein Market is expected to register a CAGR of 5.75% during the forecast period.

The key factors that drive the growth of the whey protein market in the region are rising demand for dairy ingredients, consumer awareness towards a healthy diet, and the rising trend of health clubs and fitness centers. With increasingly busier lifestyles, consumers cannot regularly consume a nutritionally complete diet, which prompts them to seek nutrients from packaged food products. Therefore, packaged food manufacturers fortify food products with nutritious ingredients, including protein ingredients. The growing demand for nutrient-enriched food products among consumers, along with the increased incorporation of protein ingredients in various functional foods to enhance their nutrient profiles by manufacturers, are contributing to the growth of the market. Furthermore, whey protein is highly used by food and beverage manufacturers, which is enabling whey protein manufacturers to introduce innovative protein ingredients in the market.

Flavors, nutritional values,and ease of carrying are making whey snacks a popular choice amongst not only health-conscious people but millennials who are looking for quick snack options to full meals and older people looking for protein in their diet. Whey protein is frequently employed to enhance biological value, produce superior physical, textural, and other functional aspects of food, enhance sensory qualities, and develop high-protein and low-lactose products. Additionally, efforts to find novel uses, such as creating edible films, will help the sector expand.

Middle East and Africa Whey Protein Market Trends

Increasing Health and Fitness Club Memberships In The Region

The Middle East and Africa region is flourishing in terms of health and fitness culture, as there has been an increase in the number of memberships around the region. Consumers are willing to spend more on health and fitness clubs with healthy aspects, which is playing a key role in driving market growth across the region. The rising number of health clubs and gyms with personal training and the latest fitness equipment is attracting consumers, which will continue to influence the growth of the whey protein market in upcoming years. The new research, from the travel loyalty program Marriott Bonvoy, found that travelers from the UAE and Saudi Arabia prioritize fitness when they go on vacation, so gyms are increasing in the region. Among all, countries like South Africa, Saudi Arabia, the United Arab Emirates, and Kuwait are expected to surge the demand for whey protein in the region. For instance, according to IHRSA, South Africa had around 2,845 health and fitness club memberships in 2021. South Africa also has gyms fully dedicated to women to encourage women to adapt gym. For instance, Femfit is a gym owned and run by women in the country. The increasing inclination of consumers toward physical fitness and workouts and the strong growth in the number of health clubs and fitness centers are the major factors fostering the growth of the market.

The younger generation, which is more oriented toward living a fit and healthy lifestyle, is becoming more and more enamored with whey protein powder. Also, high-intensity workouts and sports like kickboxing and martial arts are expected to make more people want to buy whey protein powder in the next few years.

Whey Protein Concentrate (WPC) segment is expected to dominate the market

The Whey Protein Concentrate (WPC) segment is expected to dominate the market. WPCs are whey proteins that remain soluble in the whey after casein precipitates at pH 4.6 and 20°C. These concentrates contain lipids, lactose, and minerals and are a heterogeneous mixture of different proteins.

Furthermore, WPC is a low-cost alternative for blending caramel with superior flavor and processability. WPCs are employed in a variety of applications, such as the manufacturing of yogurt, beverages, and dairy desserts. In addition, whey protein has a longer shelf life than other dairy products, allowing it to last for weeks while preserving its characteristic state, thereby driving its applications in bakery and packaged food products. Surging adoption of whey protein in infant food will continue augmenting the growth in the market over the forecast period. Whey protein concentrate contains more than 76% protein and all the essential amino acids required by a growing infant. When concentrated into a high-quality powder, it offers a superior whey protein source for infant formula. The increase in demand from working women for quality protein infant foods and the nutritional requirements of athletes is driving the growth rates. Whey protein concentrate is now being adopted in applications in the food and beverage segment as it is used in the production of cereals, dairy products, and chocolates, among others. The market's growth is escalating as new products are continuously introduced in the market.

Middle East and Africa Whey Protein Industry Overview

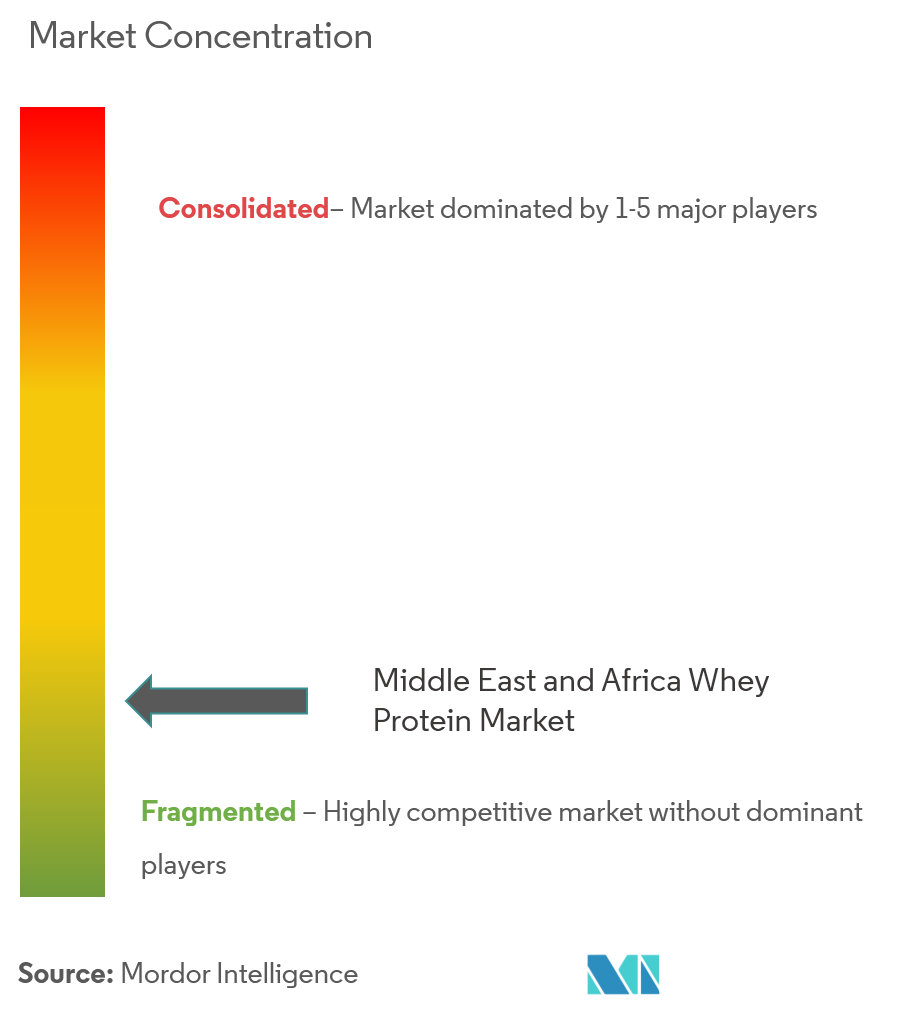

Key players try to stand out from the crowd by making their products different and competing on different things, like ingredients, packaging, price, functionality, and marketing activities. Companies are putting more money into research and development, marketing, and expanding their distribution channels in order to keep their place in the market. The market is dominated by players such as Arla Foods, Lactalis Ingredients, Carbery Group, The Agropur Dairy Co-operative, Friesland Campina, and others.

Middle East and Africa Whey Protein Market Leaders

-

Arla Foods Ingredients

-

Carbery Group

-

Lactalis Ingredients

-

The Agropur Dairy Cooperative

-

Frieslandcampina

- *Disclaimer: Major Players sorted in no particular order

Middle East and Africa Whey Protein Market News

November 2022: Arla Foods partnered with First Milk on whey protein. The innovative patented microparticulate whey protein concentrate product, Nutrilac FO-7875, developed by Arla Foods Ingredients, is used as an ingredient to enhance the level of protein in food and drink products whilst retaining texture and taste.

October 2022: Glanbia Nutrionals has launched FerriUp, a whey protein concentrate that provides lactoferrin and vitamin B12 for active women, a group that may experience depleted iron and energy levels.

June 2021: Arla Food Ingredients Innovation Center, announced the launch of new whey protein hydrolysate ingredient for patients with mal-digestion and mal-absorption. The company also became the first supplier with commercial production capacity of pure BLG (beta-lactoglobulin).

Middle East and Africa Whey Protein Industry Segmentation

Whey protein is one of the primary proteins found in dairy products. Whey protein is a mixture of beta-lactoglobulin, alpha-lactalbumin, bovine serum albumin, and immunoglobulins. It is a mixture of proteins isolated from whey, the liquid material created as a by-product of cheese production. Whey protein is made from whey, which is a watery portion of milk that separates from the curds during the cheese-making process. It increases muscle mass, keeps blood sugar levels stable, promotes weight loss, decreases inflammation, and aids in the treatment of diabetes. The Middle East and Africa whey protein market is segmented by product type and application. By product type, the market is segmented into whey protein concentrate, whey protein isolate, and hydrolyzed whey protein. Based on application, the market is segmented into sports and performance nutrition, infant formula, functional or fortified food, and other applications. For each segment, market sizing and forecasts have been done based on the value in USD million.

| By Product Type | Whey Protein Concentrate |

| Whey Protein Isolate | |

| Hydrolyzed Whey Protein | |

| By Application | Sports and Performance Nutrition |

| Infant Formula | |

| Functional/Fortified Food | |

| Other Applications | |

| By Country | South Africa |

| Saudi Arabia | |

| United Arab Emirates | |

| Kuwait | |

| Rest of Middle East and Africa |

Middle East and Africa Whey Protein Market Research FAQs

What is the current Middle East and Africa Whey Protein Market size?

The Middle East and Africa Whey Protein Market is projected to register a CAGR of 5.75% during the forecast period (2025-2030)

Who are the key players in Middle East and Africa Whey Protein Market?

Arla Foods Ingredients, Carbery Group, Lactalis Ingredients, The Agropur Dairy Cooperative and Frieslandcampina are the major companies operating in the Middle East and Africa Whey Protein Market.

What years does this Middle East and Africa Whey Protein Market cover?

The report covers the Middle East and Africa Whey Protein Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Middle East and Africa Whey Protein Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Middle East and Africa Whey Protein Industry Report

Statistics for the 2025 Middle East And Africa Whey Protein market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Middle East And Africa Whey Protein analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.