Micro Server Market Analysis

The Micro Server Market is expected to register a CAGR of 9.11% during the forecast period.

- Furthermore, the structured and unstructured data created, as a result of millions of enterprise applications, social networks, and devices, worldwide, is likely to act as a massive propeller to the micro server market. Micro servers can carry out trivial workloads more efficiently than alternative high-speed solutions.

- Furthermore, the needs to improve the operational efficiency of server infrastructure, growing demand for cloud services for various applications, increasing requirement of high-density servers, and low power consumption are some of the factors, which are driving the micro server market for small and medium-sized enterprises. This is because the micro servers are easy to install, as well as to maintain, especially because they feature a pre-installed operating system. Currently, micro servers cost up to 63% less than larger, conventional servers.

- However, lack of awareness and standard specification are some of the restraints hindering the growth of the micro server market, during the forecasted period.

Micro Server Market Trends

Cloud Computing Micro Servers to Offer Potential Growth

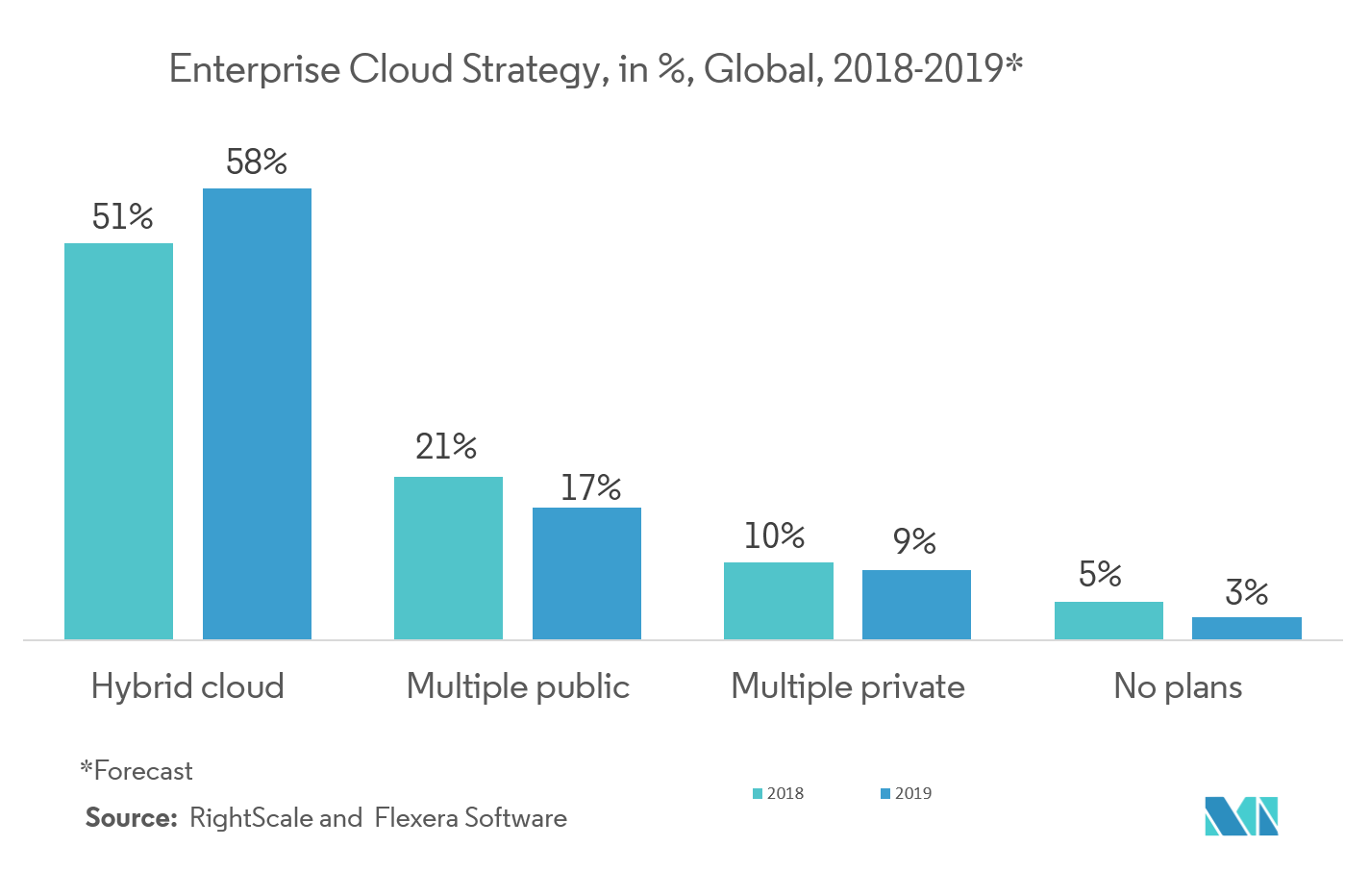

- Hybrid cloud is a combination of a public cloud provider, such as Google Cloud, Amazon web services with a private cloud, i.e., designed to be used by a single organization. Currently, many organizations of any size, be it small or large are transforming from traditional to digital mode of business.

- Furthermore, small or medium-sized enterprises are increasingly making use of Big Data analytics to gain better business insights and are opting to hybrid cloud services to make significant cost savings operations. Thus, cost-effective storage of data requires micro servers, which offer cost benefits, low power consumption, and low space benefits are found to become profitable solutions over rack servers or blade servers for the small enterprises or medium enterprises, as well.

- Furthermore, most of the organizations want to update their applications frequently, several times a day because of demand from users for interactive, rich, and dynamic experience on various platforms. Thus, they deploy micro servers, which can support the achievement of all the above requirements. Additionally, micro-servers provide scalability and agility to the applications having high availability, scalability, and that are easy-to-execute, on the cloud platform.

- Therefore. the abovementioned factors are expected to boost the micro server market, during the forecast period.

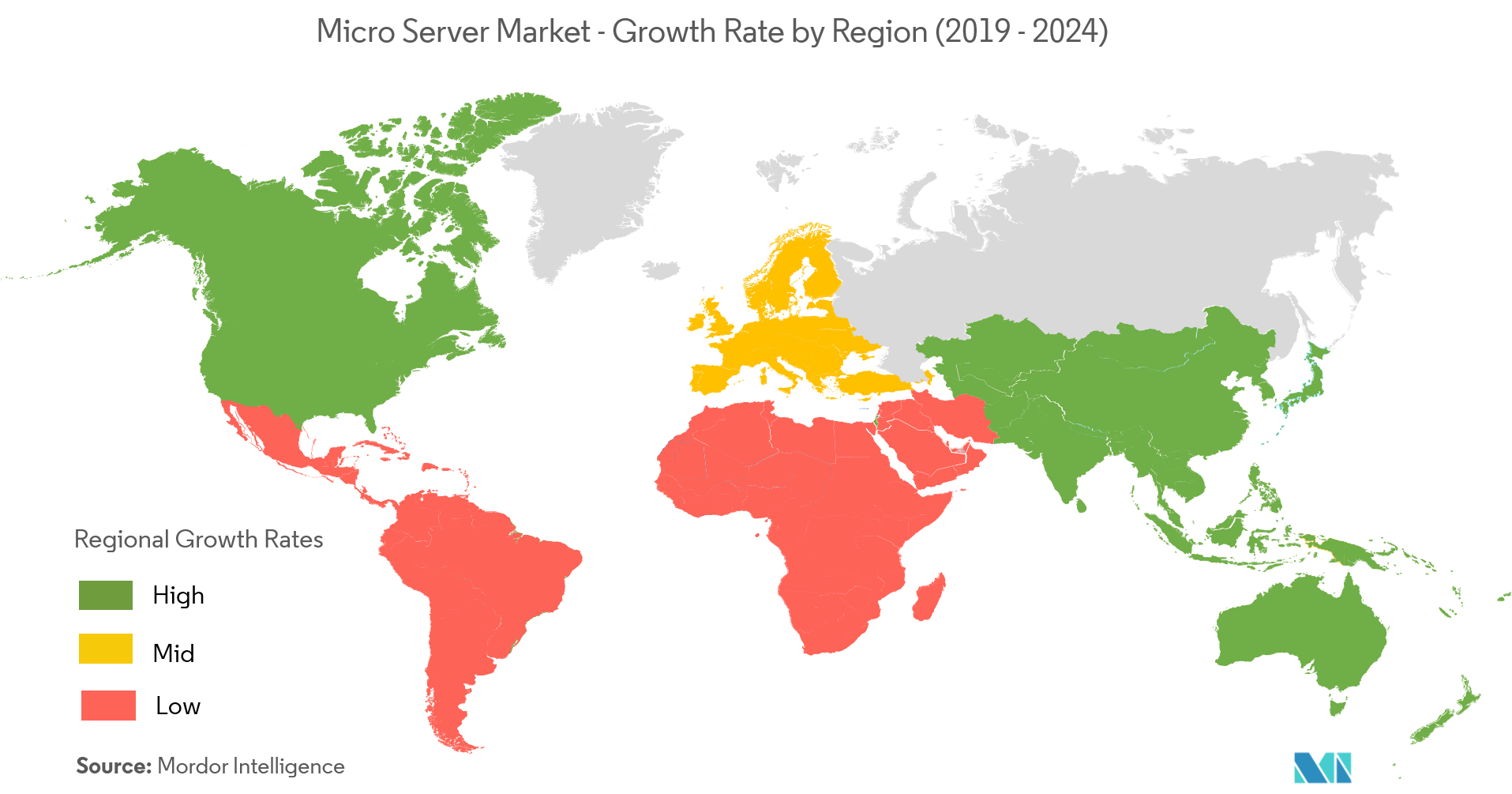

Asia-Pacific to Witness the Fastest Growth

- The Asia-Pacific region comprises of large economies, like China and Japan, with substantial penetration of data analytics and cloud computing.

- Furthermore, in China, 80% of the registered enterprises, being small and micro enterprises, are further acting as a driving force of economic growth. Along with that, the rising labor and technology costs, China's small and also medium enterprises, (including startups), are increasingly relying on public cloud services for infrastructure automation. As the utilization of public cloud services grows, the demand for microservers suited to handling the lighter cloud service workloads is likely to increase as well

- Additionally, in countries like India, with the growing number of startups backed by the ' Make in India' initiative, small and medium enterprises (SMEs) are now increasingly making use of Big Data analytics, in order to gain better insights. Thus, with the growth of data analytics and data center, the demand for micro server may also increase, as they can carry out trivial workloads more efficiently than alternative high-speed solutions.

- Therefore, all the above factors are expected to have a positive outlook on the Asia-Pacific microserver market and thus the region is expected to witness the fastest growth.

Micro Server Industry Overview

The micro server market is highly fragmented because of the presence of major players. Some of the prominent players in the global micro server market are Hewlett Packard, Dell, Fujitsu, Hitachi, IBM, Acer Inc., etc. amongst others.Product launches, high expense on research and development (R&D), partnerships and acquisitions, etc. are the prime growth strategies adopted by these companies to sustain the intense competition.

- November 2018 -Fujitsu Ltd introduceda new line-up of mono socket PRIMERGY servers, which providedversatile office solutions for small and mid-size businesses for less than the price of a high-end smartphone. These new models delivered more storage capacity and efficiency for a range of use cases, including virtualized multi-app environments, collaboration, and online meeting solutions, and for processing and consolidating large datasets.

- November 2018 - Supermicro computer Ltdleveragedits deep expertise in server technology by bringing customers the first Intel Xeon D System-on-a-Chip (SoC) family. This product computedand actedas storage for intelligent edge network appliances, mid-range networking,SMB storage servers, Hadoop, web hosting, controllers, dedicated compute nodes, and other similar applications.

Micro Server Market Leaders

-

Dell Inc.

-

Hewlett-Packard (HP) Enterprise Company

-

Fujitsu Ltd

-

ARM Holdings

-

Super Micro Computer Inc.

- *Disclaimer: Major Players sorted in no particular order

Micro Server Industry Segmentation

Micro servers are usually based on small form factors and system-on-a-chip (SoC) boards, which pack the memory, CPU, and system I/O onto a single integrated circuit. The minimal size of the boards allows tightly packed clusters of micro servers to be built, saving physical space in the data center. The adoption of micro servers in data centers, hospitals, and the retail industry is increasing because of low power consumption and small form factors. Furthermore, edge computing is expected to drive the growth of microservers, over the forecast period, due to the construction of the data center and the implementation of 5G, after 2020.

| By Processor Type | Intel |

| AMD | |

| ARM | |

| Other Processor Types | |

| By Application | Data Center |

| Cloud Computing | |

| Media Storage | |

| Data Analytics | |

| By End User | Small Enterprises |

| Medium Enterprises | |

| Large Enterprises | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Micro Server Market Research FAQs

What is the current Micro Server Market size?

The Micro Server Market is projected to register a CAGR of 9.11% during the forecast period (2025-2030)

Who are the key players in Micro Server Market?

Dell Inc., Hewlett-Packard (HP) Enterprise Company, Fujitsu Ltd, ARM Holdings and Super Micro Computer Inc. are the major companies operating in the Micro Server Market.

Which is the fastest growing region in Micro Server Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Micro Server Market?

In 2025, the North America accounts for the largest market share in Micro Server Market.

What years does this Micro Server Market cover?

The report covers the Micro Server Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Micro Server Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Micro Server Industry Report

Statistics for the 2025 Micro Server market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Micro Server analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.