MEMS Combo Sensors Market Size and Share

MEMS Combo Sensors Market Analysis by Mordor Intelligence

The MEMS Combo Sensors Market is expected to register a CAGR of 11.5% during the forecast period.

- The global demand for connected wearable devices is significantly increased owing to the rising popularity of connected devices. According to CISCO Systems, the global number of connected wearable devices stood at 593 million during fiscal 2018 and is expected to reach 1105 million by 2022. Thus, increasing the adoption of wearable devices is expected to contribute to market growth throughout the study period.

- The automotive industry is moving towards a technological shift and is on the verge of adopting autonomous vehicles. Advanced Driver Assistance Systems are increasingly becoming intuitive. According to Goldman Sachs, the ADAS/AV market is expected to be USD 96 billion by 2025. This, in turn, is anticipated to bolster the demand for the MEMS combo sensors.

- The growing global consumer electronics market and IoT devices are expected to positively influence the demand for the MEMS combo sensors market. According to GFU, the expenditure on consumer electronics products worldwide stood at 31.2 billion euros in 2021, an increase of 2.5% compared to 2020.

- The MEMS combo sensors in the chip industry have witnessed immense growth as technology companies globally accelerated innovation in the fight against the COVID-19 pandemic. The need for tiny devices is behind advances in the areas of electronics. Alongside introducing new products, vendors are navigating more ways of technological advancement to address the evolving demand. However, since the COVID-19 pandemic impacted multiple global markets, the automotive, mobility, and civil aviation industries have suffered drastically yet differently.

- Moreover, the pandemic has changed the perception of the global supply chain in manufacturing, where more localized value chains and regionalization have come into the picture. These are primarily done to minimize similar future risks posed by the pandemic.

Global MEMS Combo Sensors Market Trends and Insights

Growing Demand for Connected Handheld and Wearable Devices to Drive the Market

- Microelectromechanical system combo sensors have gained significant traction over recent years due to advantages, such as accuracy and reliability, in addition to the scope for making smaller electronic devices and the ability to provide a combination of measurements. Among the significant factors driving the MEMS combo sensors market are industrial automation and the demand for miniaturized consumer devices, such as wearables, IoT-connected devices, and others.

- The number of smartphone users is increasing significantly across the globe, and the demand for wearable devices is also growing. According to Ericsson, worldwide smartphone subscriptions are expected to increase from 6,259 million in 2021 to 7,690 million in 2027. This increasing adoption of smartphones is expected to propel market demand over the study period.

- The increasing popularity of handheld devices for gaming purposes is also projected to drive the market for MEMS combo sensors, and the popularity of mobile gaming is increasing significantly. According to DeviceAtlas, worldwide spending on mobile gaming stood at USD 98 billion in 2021, a 13% increase from 2020.

- Additionally, the growing inclination towards wearable devices owing to the global trend of health-conscious lifestyles and the adoption of health data tracking applications is expected to drive the MEMS combo sensors market. According to CISCO Systems, 1.1 billion connected wearable devices will be globally by 2022.

North America to Hold Significant Share of the Market

- North America is expected to be a significant shareholder in the MEMS combo sensors market, owing to the increasing demand for compact systems and devices. The region is an active adopter of new technological advancements with significant investments in the R&D sector. The growing drive to reduce the size of consumer electronics, like smartphones, and integrate advanced features in innovative wearable technology has paved the path for generating significant revenue in the region.

- Furthermore, owing to its significant global market share of smart electronic devices, IoT, and the Automotive industry, the region is expected to be one of the pioneers in adopting ADAS-enabled vehicles and self-driven transportation solutions. According to Car of the Future, the US ADAS unit production volume stood at 18.45 million in 2021.

- According to the International Energy Agency (IEA), the sales of plug-in electric light vehicles in the United States nearly doubled from 340,000 units in 2020 to 607,600 units in 2021. At an overall level, the automotive sector in the country has also been growing, contributing to the growth of the MEMS market, especially in the automotive industry, in the region. Further, government initiatives to boost electric vehicles are expected to contribute to the region's growth. For instance, In November 2021, the US government set an ambitious 50% electrified target for new automobiles by 2030, backed up by the declaration of the implementation of 500 000 charge sites to boost customer trust.

- In addition, stringent governmental regulations regarding passenger safety and the growing automotive and aerospace industries drive the market for MEMS combo sensors in North America. The advancements in information technology (IT) and the increased adoption of IoT across a wide range of manufacturing, industrial, and automotive applications have added a new dimension to conducting business operations in the region.

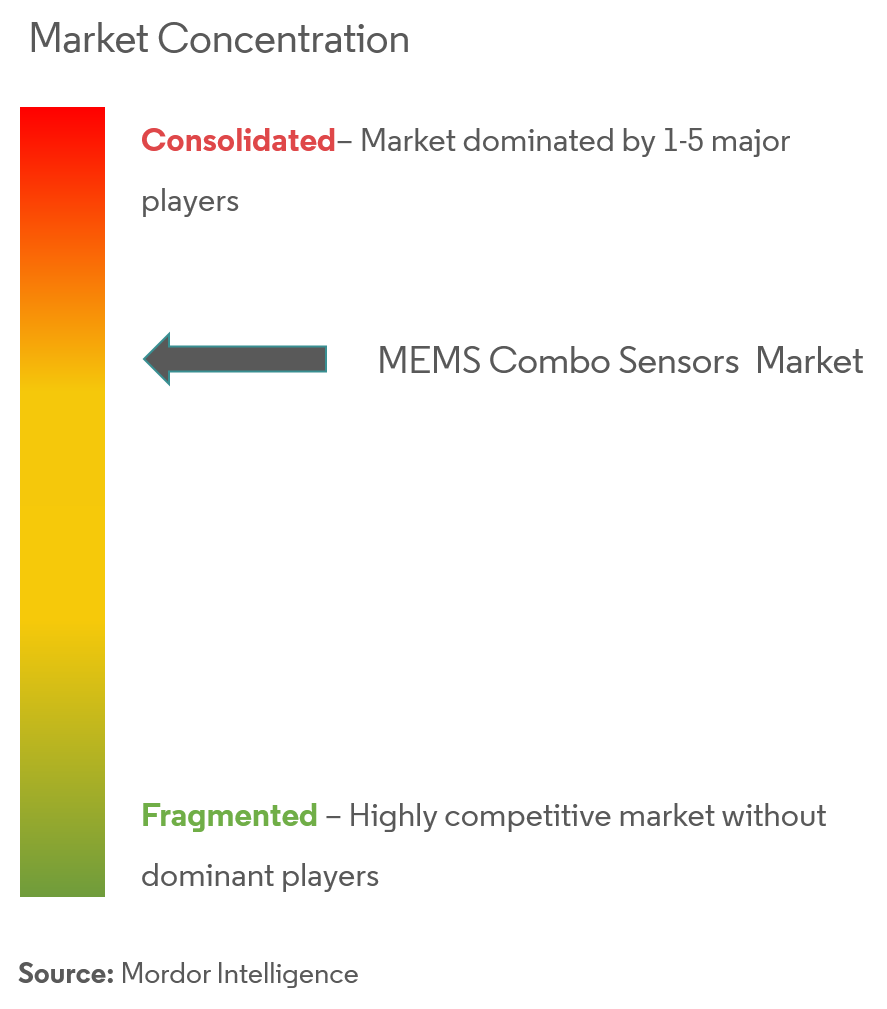

Competitive Landscape

The MEMS combo sensors market is moving towards consolidation as market leaders are banking on diverse product portfolios and product development to gain an edge. Any player's innovation capabilities are dependent on investment in research and development. The industry is capital intensive and poses an entry barrier to new entrants. Key players are Honeywell International, Inc., Bosch Sensortec GmbH, Analog Devices, Inc., Murata Manufacturing Co., Ltd., and InvenSense, Inc., among others.

- January 2022 - TDK launched the InvenSense ICM-45xxx SmartMotion ultra-high-performance (UHP) family of 6-axis MEMS motion sensors which finds applications in equipment that require negligible gyro drift.

MEMS Combo Sensors Industry Leaders

-

Honeywell International, Inc.

-

Bosch Sensortec GmbH

-

Analog Devices, Inc.

-

Murata Manufacturing Co., Ltd.

-

InvenSense, Inc.

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- August 2022 - MEMS, a primary global provider of inertial MEMS sensors, launched the MIC6100AL, its first MEMS 6-axis inertial sensor (IMU), which blends a 3-axis gyroscope and 3-axis accelerometer to enable physical interactive devices, including gamepads and smart remotes with accurate sensing, considerably improving the user experience.

Global MEMS Combo Sensors Market Report Scope

MEMS combo sensors incorporate various sensing functions into a single device. Micromanufacturing technologies are used to create these sensors. These sensors integrate two or multiple sensors into a single device, including accelerometers, gyroscopes, pressure sensors, magnetometers, and compasses. The MEMS Combo Sensors Market is segmented by Type (Movement Combo Sensor, Environment Combo Sensor, Optical Combo Sensor, Other Sensor Type), End User (Aerospace and Defense, Automotive, Consumer Electronics, Water and Wastewater Management, Oil and Gas, Food and Beverage, Other End-User), and Geography (North America, Europe, Asia Pacific, Rest of the World)

| Movement Combo Sensor |

| Environment Combo Sensor |

| Optical Combo Sensor |

| Other Sensor Type |

| Aerospace & Defense |

| Automotive |

| Consumer Electronics |

| Water and Wastewater Management |

| Oil and Gas |

| Food and Beverage |

| Other End Users |

| North America |

| Europe |

| Asia-Pacific |

| Rest of the World |

| By Type | Movement Combo Sensor |

| Environment Combo Sensor | |

| Optical Combo Sensor | |

| Other Sensor Type | |

| By End User | Aerospace & Defense |

| Automotive | |

| Consumer Electronics | |

| Water and Wastewater Management | |

| Oil and Gas | |

| Food and Beverage | |

| Other End Users | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Key Questions Answered in the Report

What is the current MEMS Combo Sensors Market size?

The MEMS Combo Sensors Market is projected to register a CAGR of 11.5% during the forecast period (2025-2030)

Who are the key players in MEMS Combo Sensors Market?

Honeywell International, Inc., Bosch Sensortec GmbH, Analog Devices, Inc., Murata Manufacturing Co., Ltd. and InvenSense, Inc. are the major companies operating in the MEMS Combo Sensors Market.

Which is the fastest growing region in MEMS Combo Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in MEMS Combo Sensors Market?

In 2025, the North America accounts for the largest market share in MEMS Combo Sensors Market.

What years does this MEMS Combo Sensors Market cover?

The report covers the MEMS Combo Sensors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the MEMS Combo Sensors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

MEMS Combo Sensors Market Report

Statistics for the 2025 MEMS Combo Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. MEMS Combo Sensors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.