| Study Period | 2019 - 2030 |

| Base Year For Estimation | 2024 |

| Market Size (2025) | USD 17.16 Billion |

| Market Size (2030) | USD 29.39 Billion |

| CAGR (2025 - 2030) | 11.36 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Medical Billing Outsourcing Market Analysis

The Global Medical Billing Outsourcing Market size is estimated at USD 17.16 billion in 2025, and is expected to reach USD 29.39 billion by 2030, at a CAGR of 11.36% during the forecast period (2025-2030).

The COVID-19 pandemic is expected to have a largely positive impact on market growth. Technology is one of the major differentiators in today's healthcare systems, including localized healthcare systems that existed earlier. The digital development accelerated by the COVID-19 pandemic is expected to significantly positively impact the market studied. This pandemic situation has firmly established the need for active action and the establishment of a robust, collaborative, scalable, and agile digital healthcare infrastructure. As a result, many companies are now building up a new roadmap, such as adopting digitization and outsourcing non-core aspects of their businesses, like billing and accounts, which is expected to augment the market growth. During this period, a sudden shift toward digital billing was observed, which is further expected to drive market growth. Additionally, consumer interest has increased significantly towards online bill payments since the pandemic began, leading to greater demand for medical billing outsourcing as it forms a non-core business operation for most healthcare institutes.

According to a Healthcare Payments Insight Survey Report conducted by Elavon in January 2020, consumers who used different emerging payment methods showed high satisfaction rates in settling their medical bills. 93% of the people who were surveyed said that they had used Interactive Voice Response (IVR) to pay a bill and were somewhat or very likely to use it again. 85% of the people who paid via kiosk networks called the process fast and easy, and 88% were somewhat or very likely to use it again. A profound impact on the market was observed as well. Electronic Health Record systems have been designed for tracking and billing patients versus providing optimal care, which is the need of the hour due to the rising number of COVID-19 patients. The ongoing pandemic is putting healthcare systems under strain worldwide and forcing hospitals and other medical facilities to scramble to ensure that their billing data can be processed and stored effectively. The 'digital front door' is key to how providers should respond to the COVID-19 situation regarding access, triage, and even treatment. With the surge in demand for hospital capacity, one of the challenges faced by hospital IT staffers is figuring out how to quickly deploy billing and revenue management systems to alternative care locations. Thus, many of these functions are being outsourced, which is leading to market growth.

The medical billing outsourcing market is primarily driven by factors, such as the growing emphasis on compliance and risk management by regulators, the increasing need to make the medical billing process efficient, and efforts to decrease in-house processing costs.

Unless a medical practitioner or an office is using the services of an experienced billing provider, there is a high chance that their revenue will not be as high as it was meant to be, creating an increasing need to make the process of billing more efficient. Skilled professionals are required for the process. Efficiency in the billing process can further reduce the company's cost and get maximum benefits for practitioners. Rising patient load in the hospitals and increasing the burden of medical processes, such as records of patient check-in and insurance eligibility, are creating a huge issue in the point of care delivery. There is a need to manage such records. For the sake of improvisation of the medical billing process, medical billing outsourcing is done to help assist the clinicians in managing patient and billings records. Hence, the rising need for efficient medical billing is positively influencing the market.

Medical Billing Outsourcing Market Trends

Hospital Outsourced Medical Billing is Expected to Grow at a Good Rate Over the Forecast Period

A hospital also referred to as a medical center, is a health care institution providing patient treatment with specialized treatment procedures. Hospitals are expected to hold a significant share of the medical billing outsourcing market, as most patients prefer hospitals for disease diagnosis and treatment. Increasing patient visits and the benefits of EHR systems in storing and managing patient health records and the aid in billing is likely to favor the segmental growth over the upcoming period. The ease of handling emergencies during critical care or post-treatment complications can be better manageable in hospitals. Thus most of the disease's treatment and surgeries are being performed in hospitals. Billing systems used in hospital settings are designed to store data accurately and capture a patient's state across time. As per the American Hospital Association 2020, the number of surgeries performed in registered hospitals in the United States was around 8 million for 500 beds. As per the data published by the Centers for Diseases Control and Prevention, there were around 130 million emergency department visits recorded in the United States in 2018. Also, as per the data published by EuroStat in 2020, Europe had a high rate of cesarean section births for which hospital admission is mandatory. These statistics show the rising need to maintain the medical records of patient-generated in hospitals which will boost the adoption of outsourced medical billing in hospital settings.

Hence, the adoption of outsourced medical billing in hospitals is expected to record a substantial growth over the forecast period.

North America is Expected to Dominate the Market Over the Forecast Period

The robust growth of healthcare infrastructure in North America and the increase in hospital admissions lead to the rising demand for software solutions, along with greater government initiatives towards digital health record maintenance is expected to boost the market growth. The emergence of novel technologies and their adoption is helping the United States to expand in the healthcare sector. The rising healthcare cost is the prime factor responsible for the growth of this sector.

In the United States, the healthcare industry is one of the most data-intensive sectors. The industry is deeply invested in applying innovative solutions to enhance the development of advanced healthcare and to support improvements in patient care. Moreover, the United States federal government and other public stakeholders are opening their vast stores of healthcare knowledge, including data and information on patients covered under public insurance programs. Thus, the demand for improvement of healthcare will boost up the overall market in March 2018. The Trump Administration announced the MyHealthEData Initiative, which aims to empower patients by ensuring that they control their healthcare data and can decide how their data is going to be used, all while keeping that information safe and secure. This will also allow an overhaul to Centers for Medicare & Medicaid Services (CMS's) Electronic Health Record Incentive Programs leading to more hospitals and care facilities digitizing their facilities, creating a demand for outsourced medical billing from these organizations.

Medical Billing Outsourcing Industry Overview

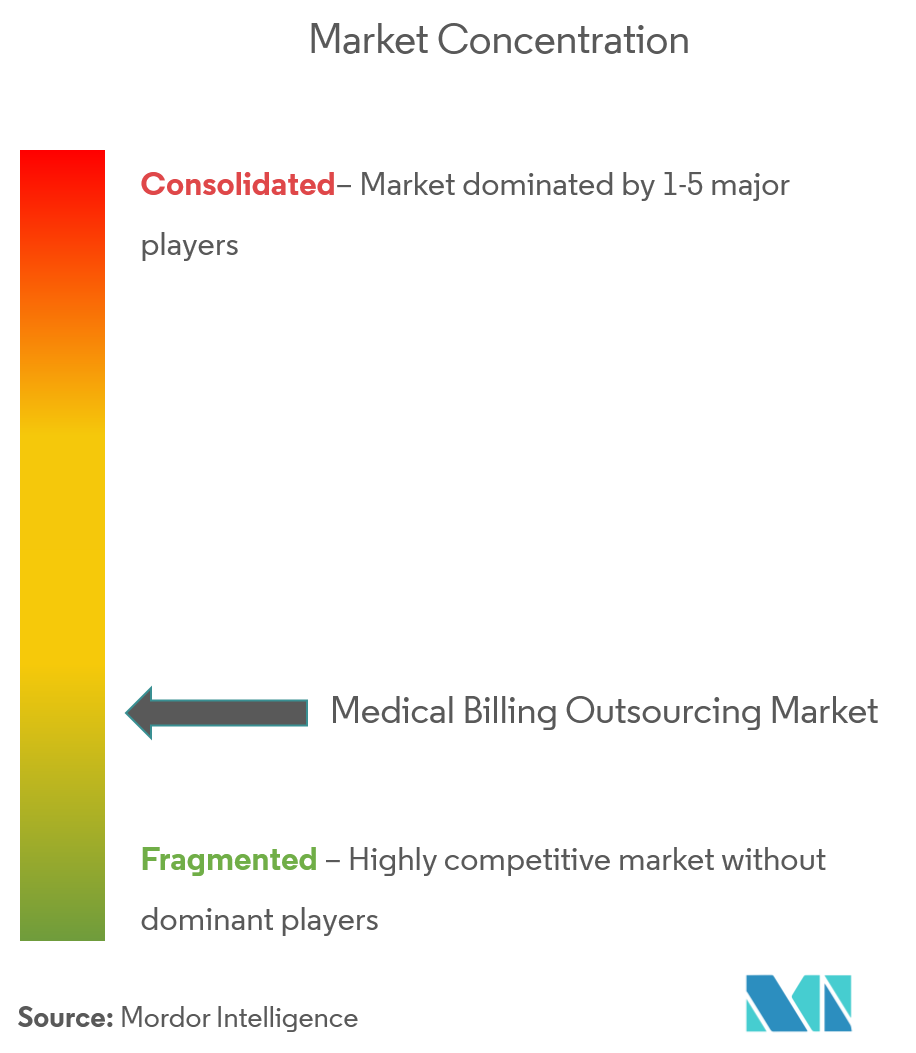

The medical billing outsourcing market is highly competitive, and many small to mid-sized companies are competing among each other and the global players. Due to the advancements and digitalization of the healthcare industry, the demand for medical billing outsourcing services is increasing, which is providing an excellent opportunity for companies to establish their market presence and grab a substantial share.

Medical Billing Outsourcing Market Leaders

-

Mckesson Corporation

-

EClinicalWorks

-

Allscripts Healthcare Solutions, Inc.

-

R1 RCM, Inc.

-

Kareo, Inc.

- *Disclaimer: Major Players sorted in no particular order

Medical Billing Outsourcing Market News

- In November 2020, Conduent Incorporated announced a commercial agreement with Experian Health, a leading provider of revenue cycle management products that include patient engagement, patient access, and patient collections. The agreement allows Conduent's digital IntelliHealth platform to connect with Experian's consumer data and electronic income verification tool to speed prescription drug assistance approvals and shorten prescription fulfillment and time to therapy.

- In June 2020, R1 RCM Inc. announced acquiring Cerner's RevWorks services business and commercial, non-federal client relationships. RevWorks was involved in the revenue cycle management and billing business.

Medical Billing Outsourcing Industry Segmentation

As per the scope of the report, medical billing outsourcing service entails the hiring of a medical billing service provider outside the practice to do all the billing work, often giving a fair percentage cut of the total revenue generated to them.

The medical billing outsourcing market is segmented by service (front end and back end), end user (hospitals, physicians office, and other end users), and geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). The report offers the value (in USD million) for the above-mentioned segments.

| By Service | Front End | ||

| Back End | |||

| By End User | Hospitals | ||

| Physicians Office | |||

| Other End Users | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Middle-East and Africa | GCC | ||

| South Africa | |||

| Rest of Middle-East and Africa | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

Medical Billing Outsourcing Market Research FAQs

How big is the Global Medical Billing Outsourcing Market?

The Global Medical Billing Outsourcing Market size is expected to reach USD 17.16 billion in 2025 and grow at a CAGR of 11.36% to reach USD 29.39 billion by 2030.

What is the current Global Medical Billing Outsourcing Market size?

In 2025, the Global Medical Billing Outsourcing Market size is expected to reach USD 17.16 billion.

Who are the key players in Global Medical Billing Outsourcing Market?

Mckesson Corporation, EClinicalWorks, Allscripts Healthcare Solutions, Inc., R1 RCM, Inc. and Kareo, Inc. are the major companies operating in the Global Medical Billing Outsourcing Market.

Which is the fastest growing region in Global Medical Billing Outsourcing Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Global Medical Billing Outsourcing Market?

In 2025, the North America accounts for the largest market share in Global Medical Billing Outsourcing Market.

What years does this Global Medical Billing Outsourcing Market cover, and what was the market size in 2024?

In 2024, the Global Medical Billing Outsourcing Market size was estimated at USD 15.21 billion. The report covers the Global Medical Billing Outsourcing Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Global Medical Billing Outsourcing Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Outsourced Medical Billing Industry Report

Statistics for the 2025 Global Medical Billing Outsourcing market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Global Medical Billing Outsourcing analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.