Loudspeaker Market Analysis

The Loudspeaker Market size is estimated at USD 7.74 billion in 2025, and is expected to reach USD 10.59 billion by 2030, at a CAGR of 6.47% during the forecast period (2025-2030).

The loudspeaker industry is experiencing a significant transformation driven by changing business priorities and technological advancements. According to recent industry research, 83% of global business leaders now consider audio quality more crucial than it was two years ago, particularly in maintaining client relationships and internal communications. This shift has led to increased investment in audio technology, with 78% of decision-makers expressing a willingness to pay premium prices for superior audio quality. The integration of advanced technologies like artificial intelligence and voice assistance capabilities has become standard in modern loudspeaker systems, reflecting the industry's evolution beyond traditional audio reproduction.

Technological miniaturization and material innovation are reshaping product development in the loudspeaker market. Companies are actively working with newer materials and devices to improve sound quality and overall speaker performance. Notable developments include Australia-based Audio Pixels' work on developing a single chip that can function as a standalone loudspeaker or be cascaded in multiples, while the Fraunhofer Institute's spin-off is advancing silicon-based loudspeaker technology using Nanoscopic Electrostatic Drive based on MEMS technology. These innovations are driving the trend toward smaller, more powerful, and energy-efficient speaker systems.

The industry is witnessing significant convergence with other sectors, particularly in the automotive segment. Major audio manufacturers are forming strategic partnerships with automotive companies to integrate premium sound systems into vehicles. For instance, Bowers & Wilkins has established partnerships with prestigious automotive brands like BMW, McLaren, Volvo, and Maserati, while Klipsch has secured a multi-year collaboration with McLaren Racing as their Official Headphone and Portable Audio Partner. This cross-industry integration is creating new revenue streams and driving innovation in automotive audio solutions.

The speaker industry is experiencing a fundamental shift in consumer preferences toward smart and connected audio solutions. Voice-assisted speakers are gaining prominence across various applications, from portable speakers to home entertainment systems. Industry leaders are responding by incorporating advanced connectivity features, with manufacturers focusing on developing low-power, high-performance compatibility systems. According to industry projections, 57% of business leaders anticipate increased investments in audio equipment over the next two years, with telecommunications, utilities, hospitality, and finance sectors leading this investment trend. This shift is driving innovation in wireless technology and creating demand for more sophisticated, integrated audio solutions.

Loudspeaker Market Trends

Growing Demand for Wireless Speakers in Home Entertainment

The increasing adoption of streaming services and digital content consumption has become a major catalyst for wireless speakers demand in home entertainment settings. The dramatic shift in media consumption from traditional platforms to online streaming services has created new requirements for enhanced audio experiences at home. This is evidenced by the substantial growth in streaming service subscriptions, with Spotify alone reaching 188 million paying subscribers by Q2 2022. The Recording Industry Association of America (RIAA) reported that streaming service revenue in the US music industry reached USD 5.9 billion in the first half of 2021, highlighting the massive scale of digital content consumption that is driving demand for quality wireless audio solutions.

The integration of advanced technologies like voice assistance and smart home compatibility has further accelerated the adoption of wireless speakers in home entertainment systems. According to industry surveys, 41% of US households already own smart speakers, with an additional 23% planning to purchase within the next year. This trend is complemented by the broader home entertainment upgrade cycle, where 52% of US homes now own 4K Ultra HD TVs, representing a significant 16-point increase from 2020. The demand for enhanced audio solutions is particularly evident in the soundbar segment, which has achieved 36% market penetration with a six-point increase, as consumers seek to match their high-quality visual experiences with superior audio performance. Modern wireless speakers are increasingly incorporating sophisticated features such as 3D sound capabilities, multi-room audio streaming, and seamless integration with various streaming platforms, making them an essential component of contemporary home entertainment systems.

Segment Analysis: By Product

Soundbar Segment in Loudspeaker Market

The Soundbar segment has emerged as a dominant force in the global loudspeaker market, commanding approximately 26% of the total market share in 2024. This significant market position is driven by the increasing consumer preference for slim, space-efficient audio solutions that complement modern flat-screen televisions. The segment's growth is further bolstered by technological advancements such as Dolby Atmos integration, voice assistant compatibility, and wireless connectivity features. Major manufacturers are focusing on developing premium soundbars with enhanced features like 3D surround sound capabilities, multi-room connectivity, and smart home integration, which has helped maintain the segment's strong market position. The rise in home entertainment consumption and the growing demand for enhanced audio experiences in compact living spaces have also contributed significantly to the segment's market leadership.

Soundbar Segment in Loudspeaker Market - Growth Analysis

The Soundbar segment is projected to maintain its position as the fastest-growing segment in the loudspeaker market during the forecast period 2024-2029, with an expected growth rate of approximately 9%. This accelerated growth is primarily driven by continuous technological innovations in sound quality, including the integration of advanced features like spatial audio and AI-powered sound optimization. The segment's growth is further supported by the increasing adoption of smart home ecosystems and the rising demand for premium audio experiences in home entertainment systems. Manufacturers are increasingly focusing on developing soundbars with enhanced connectivity options, improved power efficiency, and sophisticated design aesthetics to cater to evolving consumer preferences. The segment is also benefiting from the growing trend of home theater setups and the increasing consumer spending on premium audio equipment.

Remaining Segments in Loudspeaker Market by Product

The loudspeaker market encompasses several other significant segments including subwoofers, in-wall speakers, and outdoor speakers, each serving distinct consumer needs and applications. Subwoofers continue to be essential for delivering powerful bass performance in both home and professional audio setups. In-wall speakers are gaining popularity in the custom installation market, particularly in luxury homes and commercial spaces, offering a clean, architectural audio solution. Outdoor speakers are becoming increasingly important in the residential and commercial sectors, with weather-resistant features and improved durability. These segments collectively contribute to the market's diversity and cater to specific user requirements across different applications and environments.

Segment Analysis: By Application

Home Entertainment Segment in Loudspeaker Market

The home entertainment segment continues to dominate the global loudspeaker market, commanding approximately 57% of the total market share in 2024. This significant market position is driven by the increasing consumer demand for premium audio experiences in home settings, particularly with the rising adoption of home theater systems and smart entertainment solutions. The segment's growth is further fueled by technological advancements in soundbars, wireless speakers, and integrated audio solutions that offer immersive sound experiences. The integration of voice assistance technology and AI-enabled features in home entertainment speakers has also contributed to the segment's dominance, as consumers increasingly seek smart audio solutions that can seamlessly connect with their existing home entertainment systems. Additionally, the trend toward multi-room audio systems and the growing preference for high-fidelity sound systems in residential spaces has strengthened this segment's market leadership.

Automotive Segment in Loudspeaker Market

The automotive loudspeaker market is emerging as the fastest-growing segment in the loudspeaker market, projected to expand at approximately 9% during the forecast period 2024-2029. This remarkable growth is primarily attributed to the increasing integration of advanced audio systems in modern vehicles, particularly in premium and luxury car segments. The rising demand for immersive in-car entertainment experiences, coupled with the growing trend of vehicle customization, is driving the adoption of high-quality automotive speaker systems. Manufacturers are focusing on developing innovative automotive audio solutions that offer superior sound quality while maintaining energy efficiency, particularly important for electric vehicles. The segment is also benefiting from advancements in spatial audio technologies and the integration of smart features that enhance the overall driving experience through premium sound delivery.

Remaining Segments in Loudspeaker Market by Application

The communication and events & outdoor entertainment segments complete the loudspeaker market landscape, each serving distinct user needs. The communication segment plays a crucial role in commercial spaces, educational institutions, and public address systems, with growing applications in smart buildings and integrated communication solutions. The events & outdoor entertainment segment caters to the professional audio industry, including concerts, sports venues, and outdoor gatherings, with a focus on weatherproof and high-performance speaker systems. Both segments are experiencing technological transformations with the integration of digital signal processing, wireless connectivity, and improved durability features, though at a more moderate pace compared to the home entertainment and automotive segments.

Loudspeaker Market Geography Segment Analysis

Loudspeaker Market in North America

The North American loudspeaker market holds approximately 21% of the global loudspeaker market share in 2024, establishing itself as a major hub for audio technology innovation and consumption. The region's market is characterized by high consumer spending on premium audio products and early adoption of new technologies like smart speakers and wireless audio solutions. The stereo speaker systems market continues to evolve, particularly in the United States, where established businesses like Sony, Klipsch, Sonos, Yamaha, and JBL are heavily investing in wireless soundbar technology and smart soundbar audio systems. The region's strong distribution networks, coupled with high disposable incomes and technological literacy among consumers, contribute to robust market growth. The increasing integration of voice assistance technology and the growing smart homes market are adding substantial demand to smart speakers and smart home audio systems, as North America leads in smart buildings and IoT-enabled smart devices. The market is also witnessing significant growth in the automotive audio segment, driven by increasing commute times and the demand for premium in-car entertainment systems.

Loudspeaker Market in Europe

The European loudspeaker market demonstrated a steady growth rate of approximately 4% from 2019 to 2024, reflecting the region's strong consumer base and technological advancement. The market is dominated by soundbars and home cinema systems, Hi-Fi audio systems, and smart speakers with cutting-edge technologies like virtual assistance, Bluetooth connectivity, and Wi-Fi integration. European consumers show a strong preference for premium audio products, supported by the region's stable economy and high per capita income. The market is characterized by rapid product innovation cycles, with new models being launched more frequently compared to other regions. The region's robust regulatory framework, including standardization efforts by organizations like CEN and ETSI, ensures high-quality products and seamless integration with other technologies. The automotive sector represents a significant market segment, with European car manufacturers frequently partnering with premium audio brands to enhance their vehicle offerings. The market also benefits from strong distribution channels and a well-established retail infrastructure.

Loudspeaker Market in Asia-Pacific

The Asia-Pacific loudspeaker market is projected to grow at approximately 8% during 2024-2029, positioning itself as the fastest-growing region globally. The market is driven by rapid urbanization, increasing disposable incomes, and growing technological adoption across major economies like China, Japan, and India. The region presents a unique mix of mature markets like Japan, which demands high-end audio products, and emerging markets like India, where the focus is on affordable yet feature-rich audio solutions. The presence of major manufacturing hubs and electronic component suppliers in countries like China and Taiwan creates a competitive advantage in terms of production costs and supply chain efficiency. The market is witnessing a significant shift towards smart and connected audio devices, particularly in urban areas. The region's strong mobile phone penetration and growing digital ecosystem are driving demand for portable and wireless speakers. The automotive sector's growth, particularly in China and India, is creating additional demand for car audio systems, while the commercial sector's expansion is boosting the market for professional audio equipment.

Loudspeaker Market in Latin America

The Latin American loudspeaker market is characterized by its growing consumer electronics sector and increasing adoption of digital technologies. The region shows particular strength in the compact and portable speaker segment, with Bluetooth speakers being especially popular among the region's outdoor-oriented consumers. Countries like Brazil and Mexico lead the market with their significant consumer electronics sales and growing middle-class population. The market benefits from improving e-commerce infrastructure and increasing internet penetration, which facilitates better access to audio products. Consumer preferences in the region are shifting towards wireless and smart audio solutions, driven by the growing popularity of music streaming services and digital entertainment platforms. The automotive audio segment is also gaining traction, particularly in more affluent markets where vehicle customization is popular. The market is supported by the presence of major international brands that have established strong distribution networks and after-sales service infrastructure throughout the region. Additionally, the Latin America soundbar market is experiencing growth, driven by demand for enhanced home entertainment systems.

Loudspeaker Market in Middle East & Africa

The Middle East and Africa loudspeaker market presents a diverse landscape with varying consumer preferences and purchasing power across different regions. The UAE and Saudi Arabia lead the market in the Middle East, characterized by high demand for premium audio products and smart home solutions. The region's construction boom, particularly in the Gulf countries, drives demand for integrated audio solutions in residential and commercial projects. The market is notably price-insensitive in affluent Middle Eastern countries, where consumers readily adopt high-end audio equipment and innovative technologies. The African market, while more price-sensitive, shows growing potential in urban areas, particularly in countries like Egypt and South Africa. The region's retail sector transformation and increasing adoption of digital technologies are creating new opportunities for loudspeaker manufacturers. The market is also benefiting from the growing hospitality sector, which demands high-quality audio solutions for hotels, restaurants, and entertainment venues.

Loudspeaker Industry Overview

Top Companies in Loudspeaker Market

The loudspeaker market features prominent players like KEF Audio, Sonance, Bose Corporation, Cerwin Vega, Wharfedale, Klipsch, Harman International, Sony, and Panasonic, leading the industry through continuous innovation and strategic expansion. Companies are focusing on developing smart speakers with advanced AI capabilities, voice recognition features, and improved connectivity options to meet evolving consumer demands. The speaker industry witnesses regular product launches incorporating cutting-edge technologies like wireless streaming, multi-room audio solutions, and enhanced sound quality through proprietary acoustic designs. Operational agility is demonstrated through flexible manufacturing processes, robust supply chain management, and quick adaptation to market trends. Strategic partnerships, particularly with automotive manufacturers and technology companies, have become increasingly important for market expansion, while companies are also investing heavily in research and development to maintain competitive advantages.

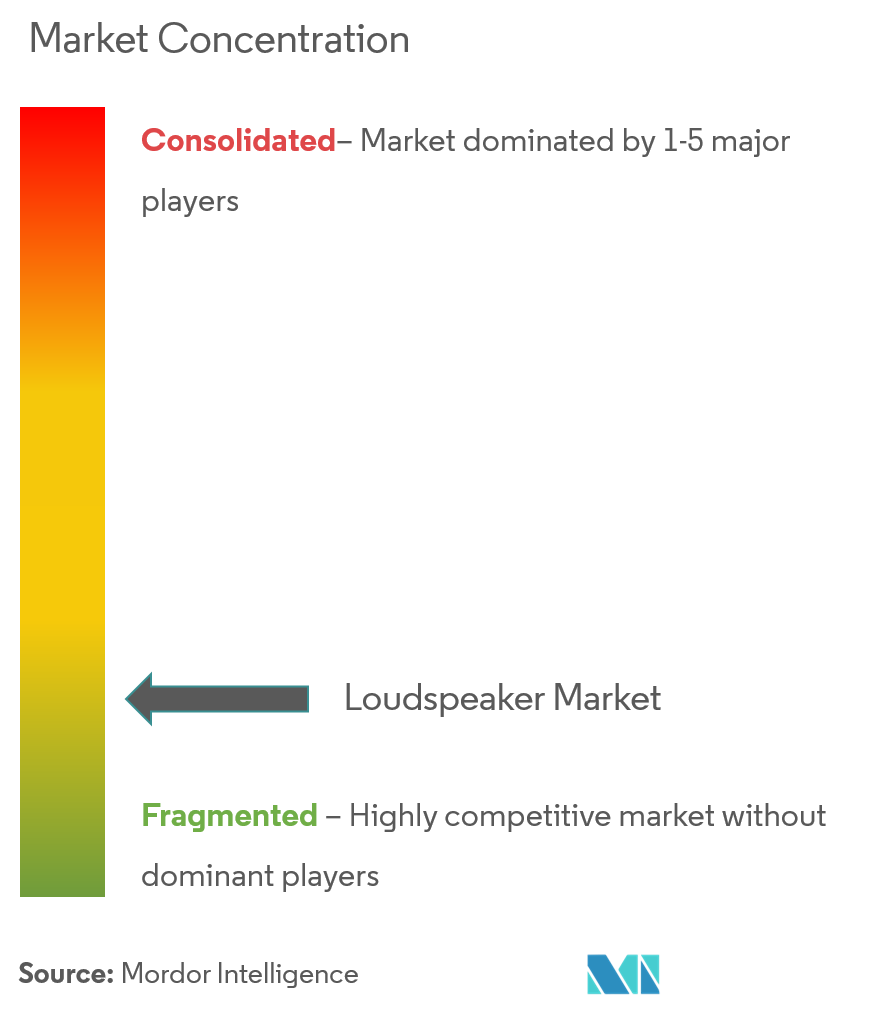

Market Dominated by Global Technology Conglomerates

The loudspeaker market structure is characterized by a mix of established global technology conglomerates and specialized audio equipment manufacturers. Large multinational corporations like Samsung (through Harman), Sony, and Panasonic leverage their extensive distribution networks, brand recognition, and technological capabilities to maintain significant speaker market share. These companies benefit from vertical integration capabilities, allowing them to control component manufacturing and maintain quality standards. The specialized audio manufacturers like KEF, Klipsch, and Bowers & Wilkins focus on premium segments and audiophile markets, differentiating themselves through superior sound quality and innovative design.

The industry has witnessed considerable consolidation through strategic acquisitions and partnerships, particularly as technology companies seek to strengthen their smart speaker portfolios. Notable examples include Samsung's acquisition of Harman International and various automotive audio partnerships. Market competition is intensified by the entry of technology giants like Amazon, Google, and Baidu, who have transformed the landscape through smart speaker innovations. Regional players maintain strong positions in their respective markets through localized product offerings and established distribution channels, though global players continue to expand their presence through strategic partnerships and local manufacturing facilities.

Innovation and Adaptability Drive Market Success

Success in the speakers industry increasingly depends on companies' ability to integrate advanced technologies while maintaining sound quality and user experience. Incumbent manufacturers must focus on developing proprietary technologies, expanding their smart speaker capabilities, and strengthening partnerships with technology providers and automotive manufacturers. Companies need to maintain a balance between premium audio quality and smart features while investing in research and development to stay ahead of rapidly evolving consumer preferences. The ability to offer seamless integration with various streaming services and smart home ecosystems has become crucial for maintaining market share.

Market contenders can gain ground by focusing on niche segments, developing innovative features, and establishing strong distribution partnerships. The rising importance of e-commerce channels provides opportunities for newer players to reach customers directly, though building brand recognition remains challenging. Companies must consider potential regulatory impacts, particularly regarding data privacy and connectivity standards in smart speakers. The risk of substitution from alternative audio technologies necessitates continuous innovation and product differentiation. Success also depends on understanding regional preferences and adapting product offerings accordingly, while maintaining competitive pricing strategies in an increasingly crowded market.

Loudspeaker Market Leaders

-

KEF

-

Bose Corporation

-

Sonance

-

Cerwin Vega

-

Wharfedale

- *Disclaimer: Major Players sorted in no particular order

Loudspeaker Market News

- September 2022: Polaroid, an American photography business, launched a new development of its brand, Polaroid Music, which includes numerous new items and an associated app. The firm introduced four new speakers: P1, P2, P3, and P4.

- August 2022: Ultimate Ears, a trademark of Logitech, expanded its popular collection of portable Bluetooth speakers. The expansion includes the much-anticipated release of WONDERBOOM 3 and a new color for the popular HYPERBOOM.

- July 2022: PSB, a Canadian audio firm, introduced the Passif 50 loudspeaker. The speaker's performance is stated as being superior to previous versions; the titanium dome tweeter employs strong neodymium magnet and ferrofluid absorption for better output, improved power management, and decreased distortion.

- May 2022: The Moon launched voice 22 loudspeakers. Simaudio's Voice 22 is a stand-mounted loudspeaker representing 40 years of sound design. The Voice 22 may be used on any surface since it features a Hover Base design that provides stability and reduces vibration.

- March 2022 : Steinway Lyngdorf announced the release of the innovative free-standing Steinway & Sons Model A loudspeakers. The innovative Model A is a full-range loudspeaker that delivers the famed Steinway & Sons audio quality from a loudspeaker that is particularly built for installation against a wall.

Loudspeaker Market Report - Table of Contents

1. INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

- 4.1 Market Overview

-

4.2 Market Drivers

- 4.2.1 Growing Demand For Wireless Speakers In Home Entertainment

- 4.2.2 Compact Size of In-Wall Loudspeakers

-

4.3 Market Restraints

- 4.3.1 Harmful Health Effects on Children And Operating frequency rules and regulations by the Government

- 4.4 Industry Value Chain Analysis

-

4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the market

5. MARKET SEGMENTATION

-

5.1 Product

- 5.1.1 Soundbar

- 5.1.2 Subwoofer

- 5.1.3 In-wall

- 5.1.4 Outdoor

- 5.1.5 Other Product Types

-

5.2 Application

- 5.2.1 Communication

- 5.2.2 Home Entertainment

- 5.2.3 Automotive

- 5.2.4 Events and Outdoor Entertainment

-

5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6. COMPETITIVE LANDSCAPE

-

6.1 Company Profiles

- 6.1.1 KEF Audio UK Ltd

- 6.1.2 Sonance

- 6.1.3 Bose Corporation

- 6.1.4 Cerwin Vega

- 6.1.5 Wharfedale

- 6.1.6 Bowers & Wilkins (EVA Automation)

- 6.1.7 Behringer (Music Tribe Global Brands Ltd)

- 6.1.8 Peavey Electronics Corporation

- 6.1.9 Klipsch Audio Technologies

- 6.1.10 Jamo (Klipsch LLC)

- 6.1.11 Dynaudio AS

- 6.1.12 Vandersteen Audio Inc.

- 6.1.13 Koninklijke Philips NV

- 6.1.14 Amazon

- 6.1.15 Alphabet

- 6.1.16 Harman International

- 6.1.17 Sonos Inc.

- 6.1.18 Baidu

- 6.1.19 Lenovo

- 6.1.20 Sony Corporation

- 6.1.21 Alibaba Group Holding Ltd

- 6.1.22 Onkyo Corporation

- 6.1.23 Panasonic Corporation

- *List Not Exhaustive

7. INVESTMENT ANALYSIS

8. MARKET OPPORTUNITIES AND FUTURE TRENDS

Loudspeaker Industry Segmentation

The loudspeaker is an electronic transducer that converts an electrical audio signal into a corresponding sound. The growing popularity and increasing applications of loudspeakers in different places are among the key drivers of the loudspeaker market. The market is growing as loudspeakers have become a top priority for outdoor and indoor entertainers.

The Loudspeaker Market is segmented by Product (Soundbar, Subwoofers, In-wall, Outdoor, Other products), by Application (Communication, Home Entertainment, Automotive, Events, and Outdoor Entertainment), and by Geography (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa). The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| Product | Soundbar |

| Subwoofer | |

| In-wall | |

| Outdoor | |

| Other Product Types | |

| Application | Communication |

| Home Entertainment | |

| Automotive | |

| Events and Outdoor Entertainment | |

| Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East and Africa |

Loudspeaker Market Research FAQs

How big is the Loudspeaker Market?

The Loudspeaker Market size is expected to reach USD 7.74 billion in 2025 and grow at a CAGR of 6.47% to reach USD 10.59 billion by 2030.

What is the current Loudspeaker Market size?

In 2025, the Loudspeaker Market size is expected to reach USD 7.74 billion.

Who are the key players in Loudspeaker Market?

KEF, Bose Corporation, Sonance, Cerwin Vega and Wharfedale are the major companies operating in the Loudspeaker Market.

Which is the fastest growing region in Loudspeaker Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Loudspeaker Market?

In 2025, the North America accounts for the largest market share in Loudspeaker Market.

What years does this Loudspeaker Market cover, and what was the market size in 2024?

In 2024, the Loudspeaker Market size was estimated at USD 7.24 billion. The report covers the Loudspeaker Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Loudspeaker Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Loudspeaker Market Research

Mordor Intelligence provides a comprehensive analysis of the loudspeaker market. We leverage our extensive expertise in speaker industry research and consulting. Our detailed examination covers diverse segments, including industrial loudspeaker systems, multimedia speakers, and automotive loudspeaker technologies. The report offers an in-depth analysis of high resolution audio speakers and emerging trends across global markets. It spans established regions and growing markets like the speaker market in delhi.

Stakeholders gain valuable insights through our detailed report, which is available in an easy-to-download PDF format. It examines crucial aspects of the speaker industry trends and market dynamics. The analysis includes the market size for speakers, technological innovations in automotive audio speakers, and developments in multimedia loudspeaker applications. Our research methodology ensures thorough coverage of key market indicators, growth drivers, and strategic developments. This enables businesses to make informed decisions based on reliable market intelligence and forecast data.