Logging While Drilling Market Analysis

The Logging While Drilling Market is expected to register a CAGR of greater than 2% during the forecast period.

- The onshore segment is expected to have the maximum share in the market, in 2019. Onshore drilling encompasses all the drilling sites located on dry land and accounts for 70% of worldwide oil production.

- North America is estimated to hold the maximum share in the logging while drilling (LWD) services market, in 2019. Additionally, the growth rate of the South America region is expected to be the highest during the forecast period, primarily due to the rapidly increasing oil and gas activities in the region, over the forecast period.

- The increasing oil and gas discoveries coupled with the liberalization in the industry globally, has been leading to creation of new opportunities for the players to invest in.

Logging While Drilling Market Trends

Onshore Segment to Dominate the Market

- Onshore drilling encompasses all the drilling sites located on dry land and accounts for 70% of worldwide oil production. Onshore drilling is similar to offshore drilling but without the difficulty of deep water between the platform and the oil.

- The global crude oil prices have shown signs of recovery and are improving at a good pace and the onshore projects are easier to kick start than offshore ones. Therefore, riding on the optimism associated with the recovery of crude oil prices, onshore projects are expected to record significant growth over the forecast period, in turn, driving the demand for logging while drilling (LWD) market.

- In August 2018, Baker Hughes was awarded a development contract by Cairn, Vedanta Limited, to construct approx. 300 new wells and deploy a chemical enhance oil recovery program aimed at increasing production from the Rajasthan area. The project marks the largest integrated project for Baker Hughes Company in India, expanding its presence in the country and supporting the government's mission of reducing dependency on imports.

- In 2019, ONGC announced that it had allotted INR 6,000 crore in drilling 200 wells over the next seven years in Assam to increase the output from the state. The wells are expected to be drilled during the next seven years.

- Hence, with the new investment in onshore oil & gas industry, increasing exploration of unconventional resources, and the crude oil price stability, which in turn are expected to increase the demand for logging while drilling (LWD) market around the globe.

North America to Dominate the Market

- North America is expected to dominate the logging while drilling (LWD) market and is expected to grow at a significant rate over the forecast period.

- The United States, as of 2019, is the largest producer of oil and gas. In the United States, there are more than 900,000 active oil and gas wells, and more than 130,000 have been drilled since 2010.

- In 2018, the United States has witnessed three significant oil discoveries, including two in the Gulf of Mexico, at Ballymore (545 Mb) at a depth of 2,000 m underwater, and at Appomattox (140 Mb) under 2,300 m of water.

- According to Canadian government report published in 2018, oil production from Canada is anticipated to reach 4.5 mmbpd by 2020, and production is expected to increase from an offshore well situated in the West Orphan Basin, offshore Newfoundland, and Labrador, which is estimated to hold 25.5 bbl of oil and 20.6 tcf of gas.

- The annual oil output of Mexico has been dropping, over the years, as the giant Cantrell field in the shallow waters of the Gulf of Mexico drying up. However, the Mexican government is trying to increase private investments in its controlled areas of the Gulf of Mexico.

- Therefore, increasing oil and gas drilling and completion activities in the region are expected to increase the demand for logging while drilling (LWD) market over the forecast period in North America region.

Logging While Drilling Industry Overview

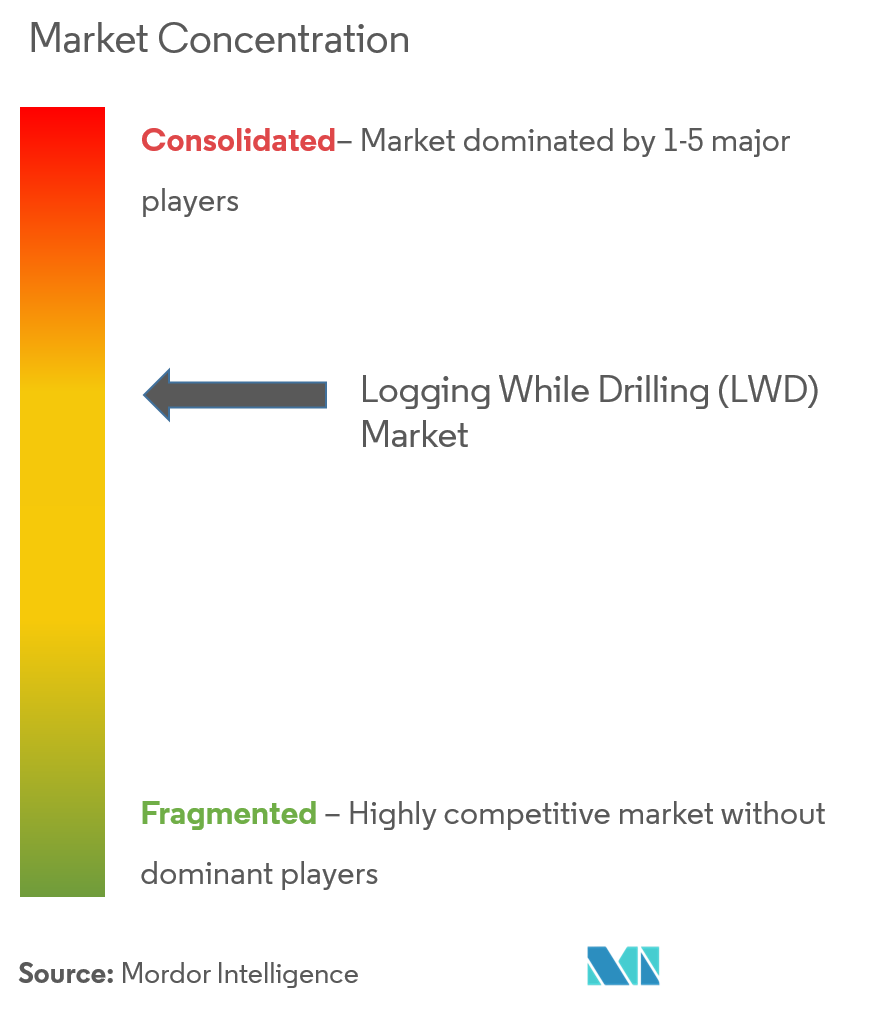

The global logging while drilling (LWD) market is partially consolidated, due to the small number of companies operating in the industry. The key players in this market include Schlumberger Limited, Halliburton Company, China Oilfield Services, Weatherford Plc. and Baker Hughes Company.

Logging While Drilling Market Leaders

-

Schlumberger Limited

-

Halliburton Company

-

China Oilfield Services Limited

-

Weatherford International Plc.

-

Baker Hughes Company

- *Disclaimer: Major Players sorted in no particular order

Logging While Drilling Industry Segmentation

The logging while drilling (LWD) market report include:

| Location of Deployment | Onshore |

| Offshore | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| South America | |

| Middle-East and Africa |

Logging While Drilling Market Research FAQs

What is the current Logging While Drilling (LWD) Market size?

The Logging While Drilling (LWD) Market is projected to register a CAGR of greater than 02% during the forecast period (2025-2030)

Who are the key players in Logging While Drilling (LWD) Market?

Schlumberger Limited, Halliburton Company, China Oilfield Services Limited, Weatherford International Plc. and Baker Hughes Company are the major companies operating in the Logging While Drilling (LWD) Market.

Which is the fastest growing region in Logging While Drilling (LWD) Market?

South America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Logging While Drilling (LWD) Market?

In 2025, the North America accounts for the largest market share in Logging While Drilling (LWD) Market.

What years does this Logging While Drilling (LWD) Market cover?

The report covers the Logging While Drilling (LWD) Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Logging While Drilling (LWD) Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Medical Gases and Equipment Industry Report

Statistics for the 2025 Logging While Drilling (LWD) market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Logging While Drilling (LWD) analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.