Lighting Control System Market Analysis

The Lighting Control System Market size is estimated at USD 43.10 billion in 2025, and is expected to reach USD 91.70 billion by 2030, at a CAGR of 16.3% during the forecast period (2025-2030).

The market is moving toward the adoption of the Internet of Things (IoT), with the increasing usage of smart devices, such as smartphones, tablets, etc. As the lighting control market is finding its applications in IoT-connected devices, the increase in adoption is influencing a positive growth of the market.

- The improved connectivity and advancements in technologies solutions have increased the adoption of smart lighting controlling system, globally. Wireless technologies, such as ZigBee and bluetooth, have made installations of smart lighting controlling system seamless across various spaces.

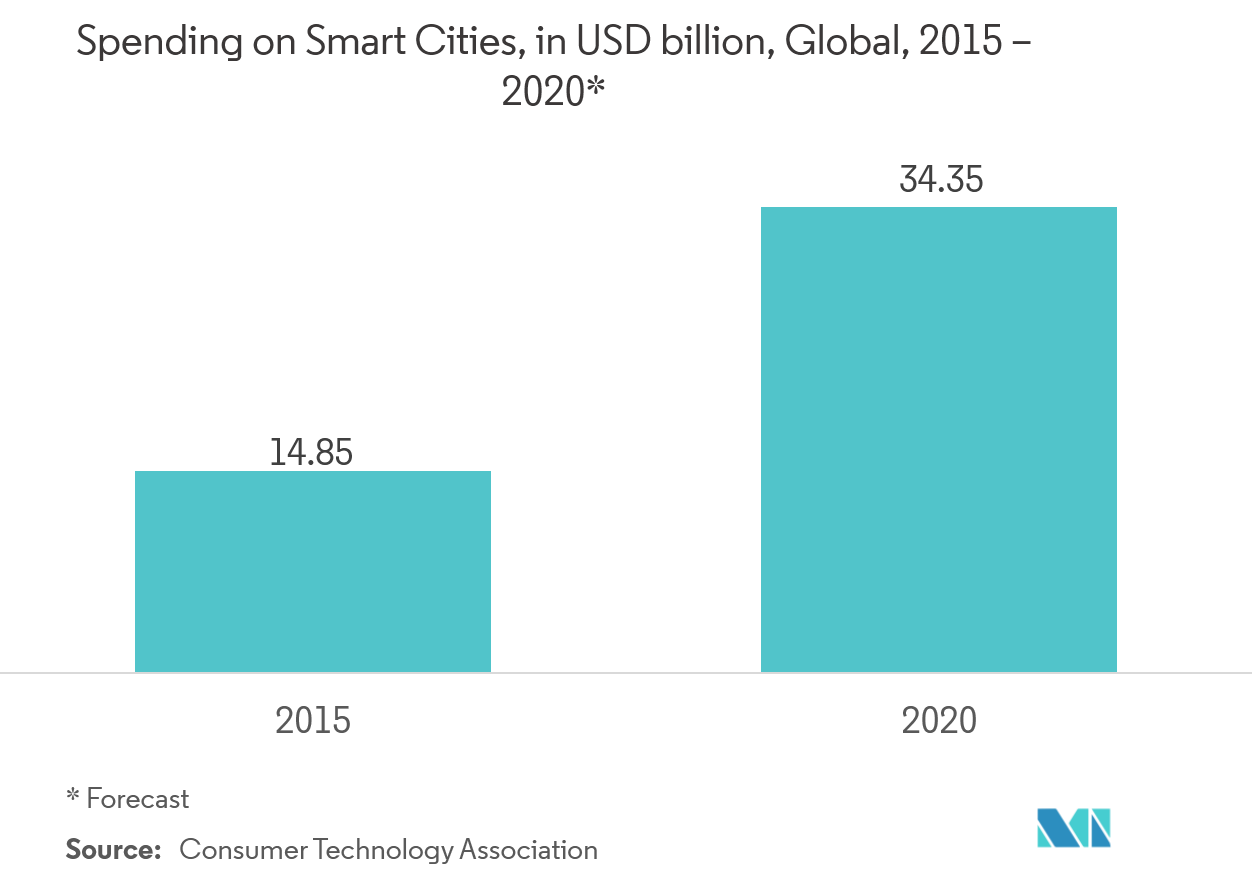

- Moreover, the concept of smart cities is also increasing in different regions and this movement is supported by many government initiatives. As a smart city consists of a connected system, the general lighting application in the smart city requires automated lighting systems. These automated lighting systems use sensor-based control systems.

- For instance, in April 2018, the Council of Australian Governments Energy Ministers have announced to replace halogen lamps with LED lamps to improve energy efficiency.

- However, on the flip side, wireless connections can be unreliable at times and ongoing maintenance are the factors hampering the overall growth of the market. The initial set up cost is also high, which is a major challenge in the large-scale adoption of lighting control systems.

Lighting Control System Market Trends

Smart City Development Initiatives to Drive the market for Smart Lighting

- According to the United Nations Human Settlements Program, cities consume 78% of the world's energy and Philips also predicted that by 2050, 66% of the population may live in cities, due to urbanization. These have resulted in smart cities, where smart cities rely on IoT, where everything is dependent on each other. From streets lights to traffic signals and beyond. Smart lighting can be a backbone for a smart city network.

- Nowadays, most cities that install new smart lighting or retrofit existing fixtures choose systems that already are equipped with sensor technology or that can be upgraded easily to utilize the advantages of IoT applications.

- For instance, in February 2018, London worked on an innovative lighting strategy that would use smart lighting to cut energy and light pollution, and manage light levels and color at different times of the day.

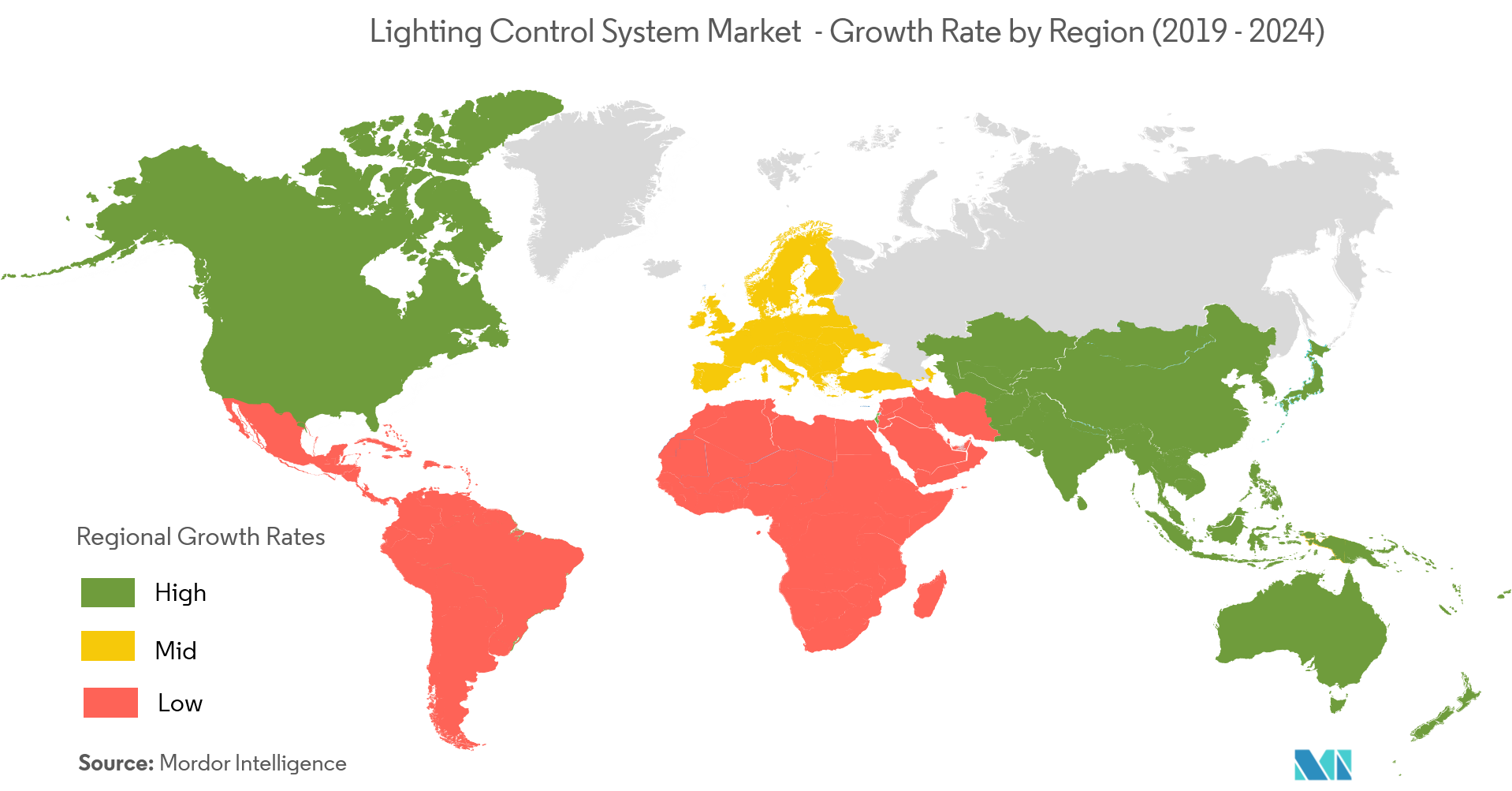

Asia-Pacific to Witness the Fastest CAGR

- The growth in Asia-Pacific is attributed to the rapid infrastructure building activities being undertaken in the region, mainly in China where lighting control systems pave the way for the modernization of infrastructure. It is anticipated to consume more energy resources in the longer run, especially with the growing energy demand from the developing countries, such as China and India. The lighting segment usually consumes the majority of the electricity in a commercial building and draws substantial energy levels for a private residence.

- Apart from this the increasing awareness regarding the efficiency of the connected lighting system in the emerging countries, like China, India, and Taiwan, is enabling significant cost savings through optimal energy consumption.

- India is making an affirmative shift from using conventional lighting to LED and energy efficient smart lights. Due to this change, India is perceived as a market with great potential for international and domestic manufacturers alike.

- According to a report by ELCOMA, the lighting industry is expected to reduce energy consumption for lighting from the present 18% of total power consumption to 13% by 2020, by introducing more energy efficient products and working more closely with the government to execute various schemes and awareness programs.

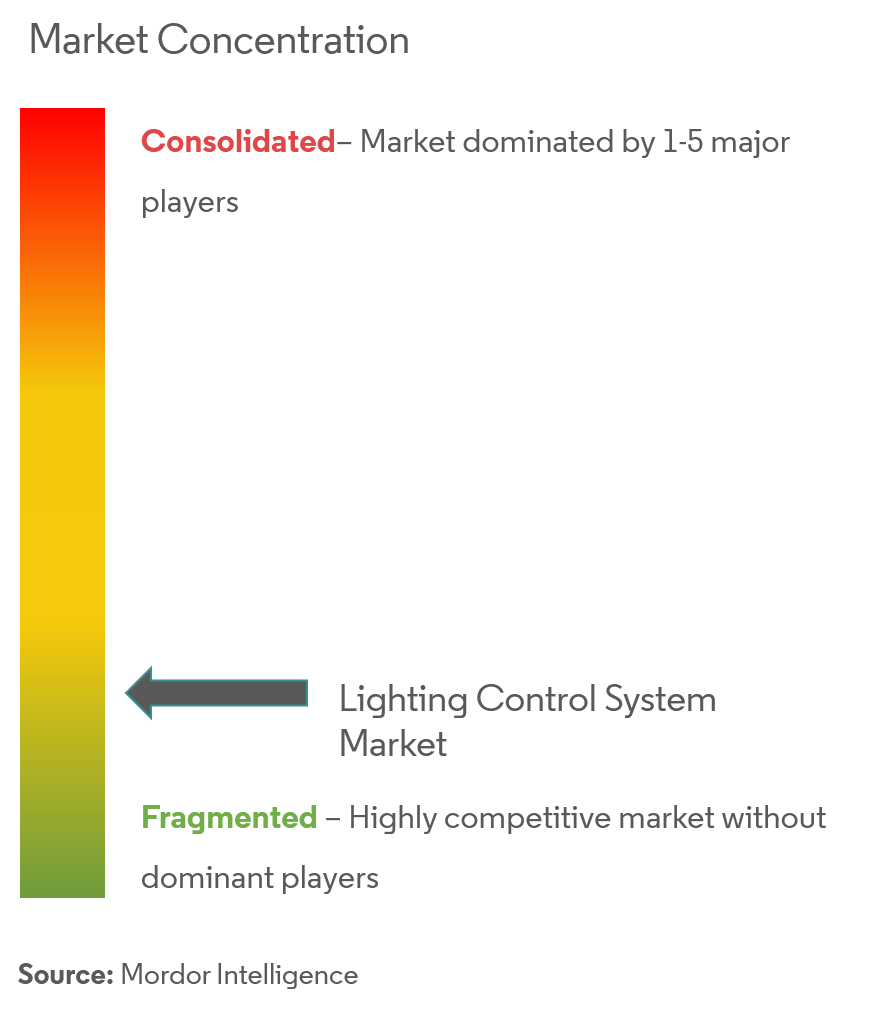

Lighting Control System Industry Overview

The lighting control system market is highly fragmented because of the presence of major players. Some of the key players in the market areTexas Instruments Incorporated,Schneider Electric SE,Philips NV,and Infineon Technologies, among others. Product launches, high expense on research and development, partnerships and acquisitions, etc. are the prime growth strategies adopted by these companies to sustain the intense competition in the intelligent lighting controls market.

- June 2018 -Honeywelllaunched a suite of next-generation energy management software, smart lighting, voice controls, and secure cloud communication systems. With these technologies, the hospitality industry can fully integrate energy management, safety and security systems, property management, and brand network operations for world-class guestroom and building automation.

Lighting Control System Market Leaders

-

Texas Instruments Incorporated

-

Taiwan Semiconductor

-

Cisco Systems Inc.

-

Infineon Technologies

-

Toshiba Corporation

- *Disclaimer: Major Players sorted in no particular order

Lighting Control System Industry Segmentation

Smart lighting control systems improve energy efficiency and performance. These systems have countless applications across diverse verticals, like aircraft, automobiles, home appliances, etc. Smart lighting controls have been increasingly adopted in an effort to reduce energy consumption.

| By Type | Hardware | LED Drivers | |

| Sensors | |||

| Switches and Dimmers | |||

| Relay Units | |||

| Gateways | |||

| Software | |||

| By Communication Protocol | Wired | ||

| Wireless | |||

| By Application | Indoor | ||

| Outdoor | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Rest of the World | Latin America | ||

| Middle-East & Africa | |||

Lighting Control System Market Research FAQs

How big is the Lighting Control System Market?

The Lighting Control System Market size is expected to reach USD 43.10 billion in 2025 and grow at a CAGR of 16.30% to reach USD 91.70 billion by 2030.

What is the current Lighting Control System Market size?

In 2025, the Lighting Control System Market size is expected to reach USD 43.10 billion.

Who are the key players in Lighting Control System Market?

Texas Instruments Incorporated, Taiwan Semiconductor, Cisco Systems Inc., Infineon Technologies and Toshiba Corporation are the major companies operating in the Lighting Control System Market.

Which is the fastest growing region in Lighting Control System Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Lighting Control System Market?

In 2025, the North America accounts for the largest market share in Lighting Control System Market.

What years does this Lighting Control System Market cover, and what was the market size in 2024?

In 2024, the Lighting Control System Market size was estimated at USD 36.07 billion. The report covers the Lighting Control System Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Lighting Control System Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Smart Lighting Control System Industry Report

Statistics for the 2025 Lighting Control System market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Lighting Control System analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.