LED Encapsulation Market Analysis

The LED Encapsulation Market is expected to register a CAGR of 4.2% during the forecast period.

- LEDs have been accepted as an integral part of electronics as a low powered light source. The semiconductor chip in a LED is sensitive and needs protection from moisture, physical damage, and outside elements. Moreover, electrodes may undergo oxidation and work inefficiently if not protected from moisture and oxygen.

- Encapsulation primarily caters to these problems and effectively elongates the life of the LEDs. Special encapsulation materials allow heat dissipation through them while providing protection from fluids and chemicals. Owing to these properties, LED Encapsulation has found its application in various industries such as consumer electronics, automotive, and telecommunication.

- Moreover, global warming has created a huge need for conserving energy, especially for lighting which represents roughly 19% of the world's electricity annual consumption (European Commission, 2018). With LED systems being frequently used in a much broader range of applications, encapsulation is continually providing support for this ever-evolving industry, with continuous advancement and development specifically for the LED market.

- The growth of the market is driven by demand for longer life of LEDs and the need for protection from moisture & chemicals. Moreover, protection from solder joint fatigue in chip-based LED is expected to further augment the growth of this market.

- With regard to TV display application, the industry is shifting from the usage of LED to OLED (Organic Light-emitting diode), which is the most advanced innovation and is supposed to penetrate more into the market. This inclination might hinder the volume growth of the LED packaging market and, thus, the encapsulation market.

LED Encapsulation Market Trends

Silicone Encapsulant is Expected to Witness Significant Growth

- Silicone encapsulation has picked up momentum in the past few years as the material of choice for encapsulation of LEDs, owing to its flexibility and operating capability over a wide range of temperatures, though could have reliability issues in cold weather applications.

- Organic silicones have been utilized as encapsulant materials for light‐emitting diodes (LEDs) for several years, while their performances need to be updated in order to meet the requirements of high‐power LEDs. They have been the material of preference for LED packaging due to their outstanding transparency and stability at operating temperatures.

- Silicones are not only utilized as encapsulants to protect LED devices but also as the polymer matrix for phosphors to convert blue LEDs to white LEDs. With commercial silicones, LEDs have refractive index mismatches at the silicone/LED chip and silicone/phosphor interfaces. This mismatch leads to reduced light transmission and trapped light with-in the LED device. Better light extraction can decrease intrinsic heating, in turn decreasing the dependency on heat transport materials and enhancing reliability.

- Moreover, the demand for the silicon type is primarily due to the strong demand from commercial LED lighting. The advantages silicone encapsulants provide, such as thermal transfer and light emission, are in line with the addressable need of mid- and high-power LEDs, the silicon segment is expected to grow at a substantial rate, during the forecast period.

Asia-Pacific is Expected to witness Significant Growth

- The Asia-Pacific region is expected to witness a significant growth rate during the forecast period. UNEP in the frame of enlightens program estimates that in the absence of new policies, 57% of the lighting energy demand by 2030 would come from Asia.

- Geographically, the market is widespread in the region owing to the availability of plenty of encapsulation raw material. Assertive demand growth from the consumer electronics and automobiles industry in this region, where rapid changes in technology, is resulting in greater demand for high and medium power LEDs is expected to drive the demand for encapsulation products.

- Moreover, huge demand for silicone encapsulants is also expected from countries in this region such as South Korea and Taiwan, primarily owing to the large production of consumer electronics like TV, tablets, and monitors.

- Furthermore, China is assumed to be an important revenue generator, as it holds a major share in the LED market, followed by Taiwan. Also, Australia, which is amongst the top 10 LED importers, in the world is also driving the growth of the LED encapsulation market.

LED Encapsulation Industry Overview

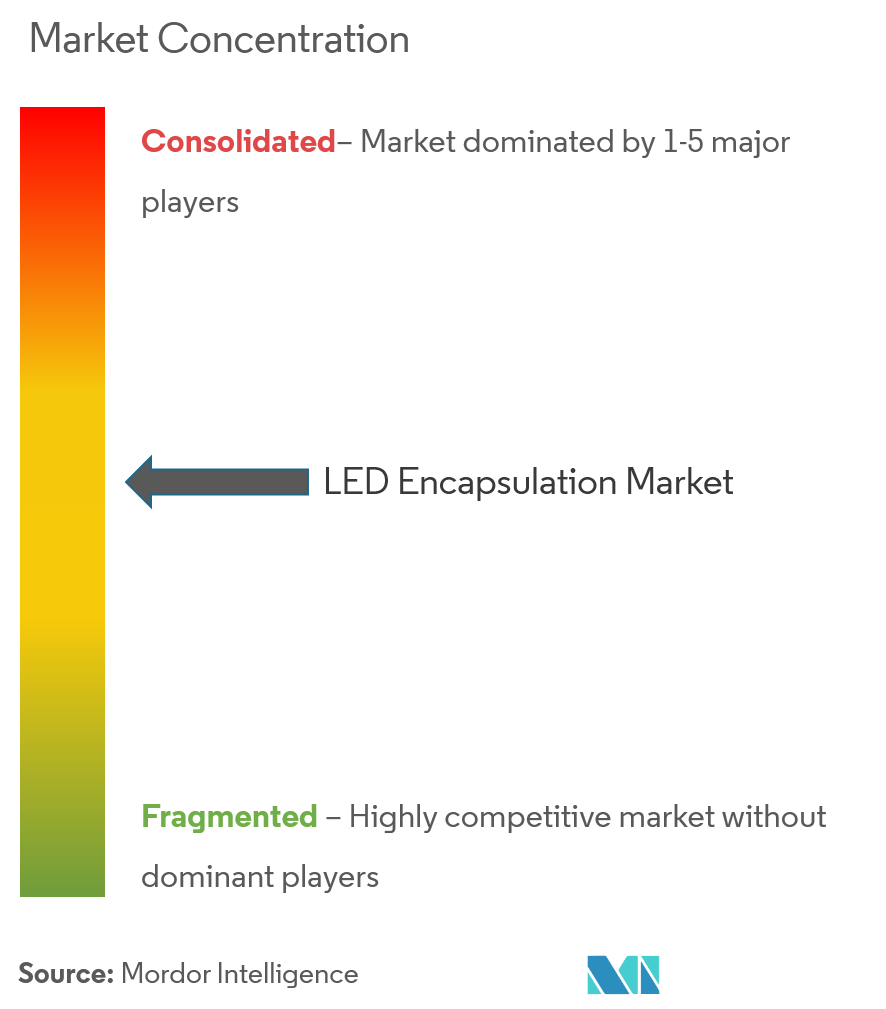

The LED Encapsulation Market is moderately concentrated and consists of several major players. The market is highly competitive and the increasing investments are driving new players that offer products at lower prices into the market. Some of the key players in the market are Dow Corning Corporation, NuSil Technology LLC, H.B. Fuller Company, Shin-Etsu Chemical Co., Ltd., Henkel AG & Co. KGaA. These players are constantly innovating and upgrading their product offerings to cater to the increasing market demand.

- Feb 2020 - Shin-Etsu Chemical started marketing the newly developed materials that will be used in the manufacturing process of MicroLED displays. The company's new materials will be used in the manufacturing of MicroLEDs which can lead to greater productivity in the MicroLED manufacturing process and provide a competitive edge for these displays.

- Jun 2019 - H.B. Fuller Company announced that it has signed a definitive agreement to sell its surfactants, thickeners and dispersants business to Tiarco, LLC, which is a wholly-owned subsidiary of Textile Rubber and Chemical Company, Inc., for USD 71 million. The company will use the net proceeds from the sale for debt reduction.

LED Encapsulation Market Leaders

-

Dow Corning Corporation

-

NuSil Technology LLC

-

H.B. Fuller Company

-

Shin-Etsu Chemical Co., Ltd.

-

Henkel AG & Co. KGaA

- *Disclaimer: Major Players sorted in no particular order

LED Encapsulation Industry Segmentation

LED Encapsulation is a technique used for enhancing the safety of LEDs under diverse environmental conditions, that reduces light coupling losses and directs the LED light towards a specific viewing angle and protect the LED chip and lead frame against certain external stress. It is recognized for its operational advantages like protecting LED chip from being damage, light extraction (couple light from the chip), withstanding low wavelength (high energy) light, and is stable over a wide temperature range.

| Encapsulant | Epoxy |

| Silicone | |

| End-user Application | Commercial Lightning |

| Automotive | |

| Consumer Electronics | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East and Africa |

LED Encapsulation Market Research FAQs

What is the current LED Encapsulation Market size?

The LED Encapsulation Market is projected to register a CAGR of 4.2% during the forecast period (2025-2030)

Who are the key players in LED Encapsulation Market?

Dow Corning Corporation, NuSil Technology LLC, H.B. Fuller Company, Shin-Etsu Chemical Co., Ltd. and Henkel AG & Co. KGaA are the major companies operating in the LED Encapsulation Market.

Which is the fastest growing region in LED Encapsulation Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in LED Encapsulation Market?

In 2025, the Asia Pacific accounts for the largest market share in LED Encapsulation Market.

What years does this LED Encapsulation Market cover?

The report covers the LED Encapsulation Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the LED Encapsulation Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

LED Encapsulation Industry Report

Statistics for the 2025 LED Encapsulation market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. LED Encapsulation analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.