Latin America Textile Market Analysis by Mordor Intelligence

The Latin America Textile Market size is estimated at USD 36.21 billion in 2025, and is expected to reach USD 53.15 billion by 2030, at a CAGR of 7.98% during the forecast period (2025-2030).

A diverse and vibrant industry with solid roots in traditional craftsmanship and a growing presence in the global fashion and home textiles sectors characterize the Latin American textiles market. The region benefits from an abundance of natural resources, including cotton and wool, which are integral to textile production. Key markets such as Brazil, Mexico, and Colombia are leading in manufacturing and export activities, while countries like Peru and Guatemala are renowned for their high-quality, artisanal textiles.

The market is witnessing growth due to increasing demand for sustainable and ethically produced textiles, driven by a global shift toward eco-friendly products. Additionally, technological advancements in textile manufacturing and a rise in e-commerce are further propelling the industry's expansion. However, the market also faces challenges, such as competition from low-cost producers in Asia and economic fluctuations within the region.

Latin America Textile Market Trends and Insights

Rise in the Clothing Industry is Fueling the Market

The clothing industry is a significant driver of the Latin American textile market, fueling growth and innovation across the region. With a strong tradition of textile production, countries like Brazil, Mexico, and Colombia are at the forefront of manufacturing apparel for domestic and international markets. The region's clothing industry is benefiting from increasing consumer demand for fashion, including a rising interest in locally made, sustainable, and ethically produced garments. Latin America's proximity to major consumer markets in North America also enhances its competitive edge, allowing for quicker turnaround times and lower transportation costs compared to Asian producers.

Additionally, the growth of fast fashion and the expansion of e-commerce platforms are accelerating the demand for textiles in the clothing sector. Local designers and brands are gaining recognition, boosting the industry's appeal. However, challenges remain, including competition from global apparel manufacturers and the need for investment in modernizing production facilities to meet international standards. Despite these obstacles, the clothing industry continues to be a pivotal force in driving the market forward.

Rising Cotton Production is Driving the Market's Growth

Increasing cotton production is crucial to the growth of the Latin American textile market. Countries including Brazil, Argentina, and Mexico are among the region's leading cotton producers, contributing significantly to the textile industry's supply chain. Brazil, in particular, has emerged as one of the world's top cotton exporters, with advancements in agricultural technology and sustainable farming practices boosting its production capacity.

The rise in cotton production supports the domestic textile industry by providing a reliable and high-quality raw material source, reducing dependency on imports, and enhancing the competitiveness of Latin American textiles on the global stage. This increase in local cotton availability also supports the growth of the clothing and home textiles sectors, which rely heavily on cotton fabrics.

Competitive Landscape

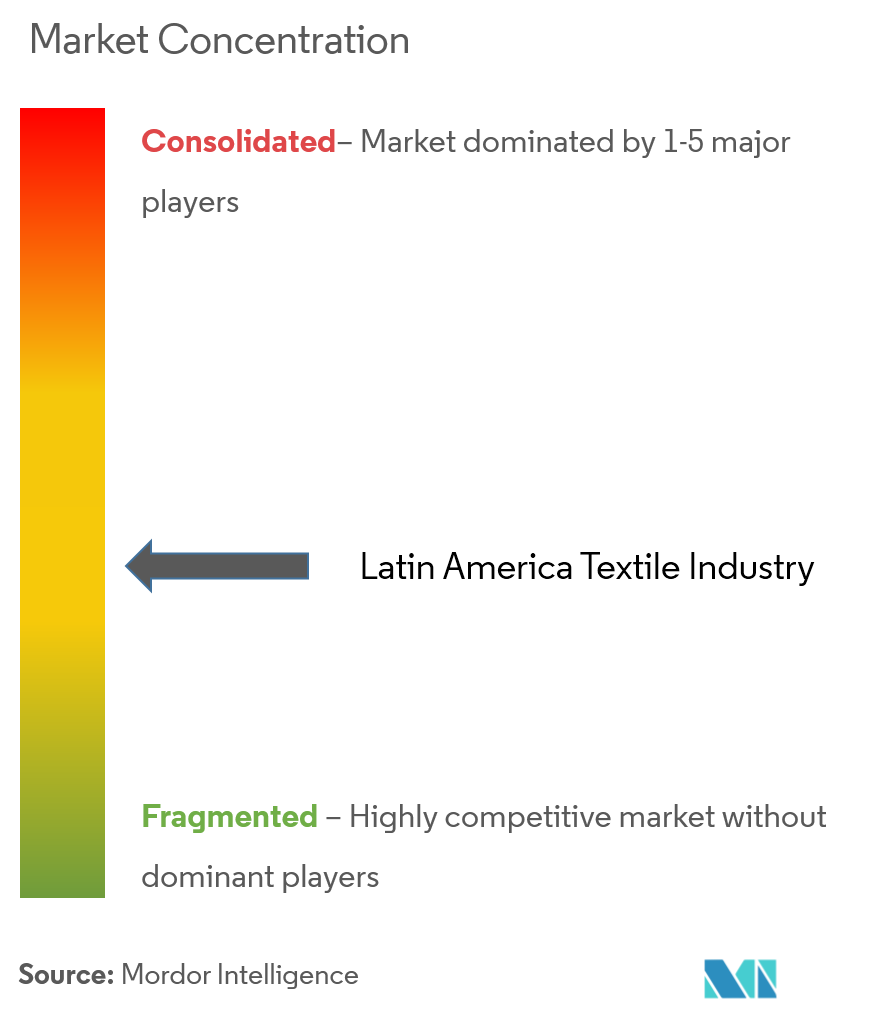

The Latin American textiles market is semi-fragmented, with many players. The market is strong in countries like Peru, Guatemala, and Colombia, where traditional and artisanal textile production is prevalent. These smaller players focus on niche markets, such as handcrafted and culturally significant textiles, which contribute to the market's diversity. The key players include Evora SA, Kaltex SA, Vicunha Textil SA, Alpargatas SAIC, and Santista Argentina SA.

Latin America Textile Industry Leaders

-

Evora SA

-

Kaltex SA

-

Vicunha Textil SA

-

Alpargatas SAIC

-

Santista Argentina SA

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- September 2024: Vicunha, a major global textile company, completed its analysis of acquiring Cedro Têxtil. Vicunha's entry into a new market is focused on professional uniform fabrics.

- January 2024: EVORA Global strategically acquired METRY, the leading platform in Europe for environmental data collection. This acquisition aims to set new benchmarks in data quality and technological advancement, providing holistic data solutions tailored for the global real estate and infrastructure investment sectors.

Latin America Textile Market Report Scope

The textile market refers to the industry concerned with the production, distribution, and sale of various textile products. This includes raw materials like fibers (natural and synthetic), yarns, fabrics, and finished goods such as apparel, home textiles, and industrial textiles.

The Latin American textile market is segmented by application type, material, and process. By application type, the market is segmented into clothing, industrial/technical applications, and household applications. By material, the market is segmented into cotton, jute, silk, synthetics, and wool, and by process, the market is segmented into woven and non-woven. The market size and forecasts are provided in terms of value (USD) for all the above segments.

| Clothing |

| Industrial/Technical Applications |

| Household Applications |

| Cotton |

| Jute |

| Silk |

| Synthetics |

| Wool |

| Woven |

| Non-woven |

| By Application | Clothing |

| Industrial/Technical Applications | |

| Household Applications | |

| By Material | Cotton |

| Jute | |

| Silk | |

| Synthetics | |

| Wool | |

| By Process | Woven |

| Non-woven |

Key Questions Answered in the Report

How big is the Latin America Textile Market?

The Latin America Textile Market size is expected to reach USD 36.21 billion in 2025 and grow at a CAGR of 7.98% to reach USD 53.15 billion by 2030.

What is the current Latin America Textile Market size?

In 2025, the Latin America Textile Market size is expected to reach USD 36.21 billion.

Who are the key players in Latin America Textile Market?

Evora SA, Kaltex SA, Vicunha Textil SA, Alpargatas SAIC and Santista Argentina SA are the major companies operating in the Latin America Textile Market.

What years does this Latin America Textile Market cover, and what was the market size in 2024?

In 2024, the Latin America Textile Market size was estimated at USD 33.32 billion. The report covers the Latin America Textile Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Latin America Textile Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Latin America Textile Market Report

Statistics for the 2025 Latin America Textile market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Latin America Textile analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.