Latin America AMH Market Analysis

The LA AMH Market is expected to register a CAGR of 5.4% during the forecast period.

- Latin America is economically expanding, is resourceful, and demographically buoyant. Thus, it is a promising market for automation. The burgeoning population of the upper and middle classes in the region is expected to increase automation adoption. However, primarily due to a rapid increase in labor costs, many business models are likely to change.

- The delivery of a return on investment (ROI) from automation is generally fast in Brazil. ROI of 2-4 years is achievable, which is less as compared to other emerging countries. Decreasing operating costs and radically reducing inefficiencies in the processes by implementing automation are playing major roles in the adoption of automation in the country. Picking and pallet handling are the major areas in which many gains can be achieved with the help of automation technologies.

- The region has witnessed an increasing investment in e-commerce. For instance, the region witnessed the establishment of several new distribution centers in Argentina, Brazil, and Mexico post the investment of USD 750 million and USD 100 million by PayPal and Dragoneer in Argentina-based e-commerce giant, MercadoLibre.

- Besides, Brazil is expected to account for the most considerable retail e-commerce revenue in the region, with a value of USD 17.35 billion, at a slightly constant rate over the forecast period.

- The Covid-19 pandemic has ushered several companies to incorporate Material Handling products to minimize human interaction on the floor. Thus, to tap into this demand, in July 2021, Eastman Machine Company appointed CMP Trading of São José dos Campos (São Paulo), Brazil, to represent its line of automated cutting systems, material handling equipment, and design software.

Latin America AMH Market Trends

Mexico to witness the Highest Growth

- Mexico is home to various industries, including substantial automotive and aerospace manufacturing sectors. Automation investments can help increase the number of well-paying jobs in Mexico since the country has one of the highest ratios of engineering graduates per capita.

- With the boom of automation in Mexico, any company that employs robotics or advanced automation in the region is poised to register growth. In the past, some companies completely avoided investing in Mexico or only used the resources for cheap labor. However, the automation industry in Mexico is becoming more advanced, which is providing it with a competitive edge over other major countries.

- Furthermore, the country has been witnessing an increase in initiations to promote automation. For instance, the Association for the Advancement of Automation (A3) Mexico promotes the benefits of automation while facilitating gatherings and interchanges between the stakeholders and members of the automation community in the country.

- Moreover, the country is anticipated to witness growth in the adoption of automated material handling systems due to the increasing investments in establishing new airports and enhancing the existing airports' infrastructure.

Food and Beverage to witness the Highest growth rate

- The food and beverage industry is one of the most significant economic contributors to the region. In Latin America, Brazil exports frozen food and meat products, while Argentina is the leading country in the packaged and processed food segment.

- Mexico has a large beverage industry. Due to its proximity to the United States and trade agreements, the Colombian food and beverage industry experienced a growth of over 50% in the last decade, while Peru and Chile were at the forefront in dealing with seafood and frozen food. A high prospect for growth in the food and beverage industry, coupled with the penetration of the automation service providers in the region, is driving the need for AMH systems in the sector.

- Most of the Mexican manufacturers are inclined toward hybrid automation rather than complete automation. Many automation providers support this practice, as the country has a considerable scarcity of skilled workforce. Employing hybrid automation would allow existing workers to cultivate new skills with minimal training.

- As a result, there is a high demand for collaborative robots and semi-automation solutions in the market. This trend is highly visible in the seafood processing companies that are highly renowned for processing complex produce, including Octopus, Sardine, Shrimp, and Lobster.

Latin America AMH Industry Overview

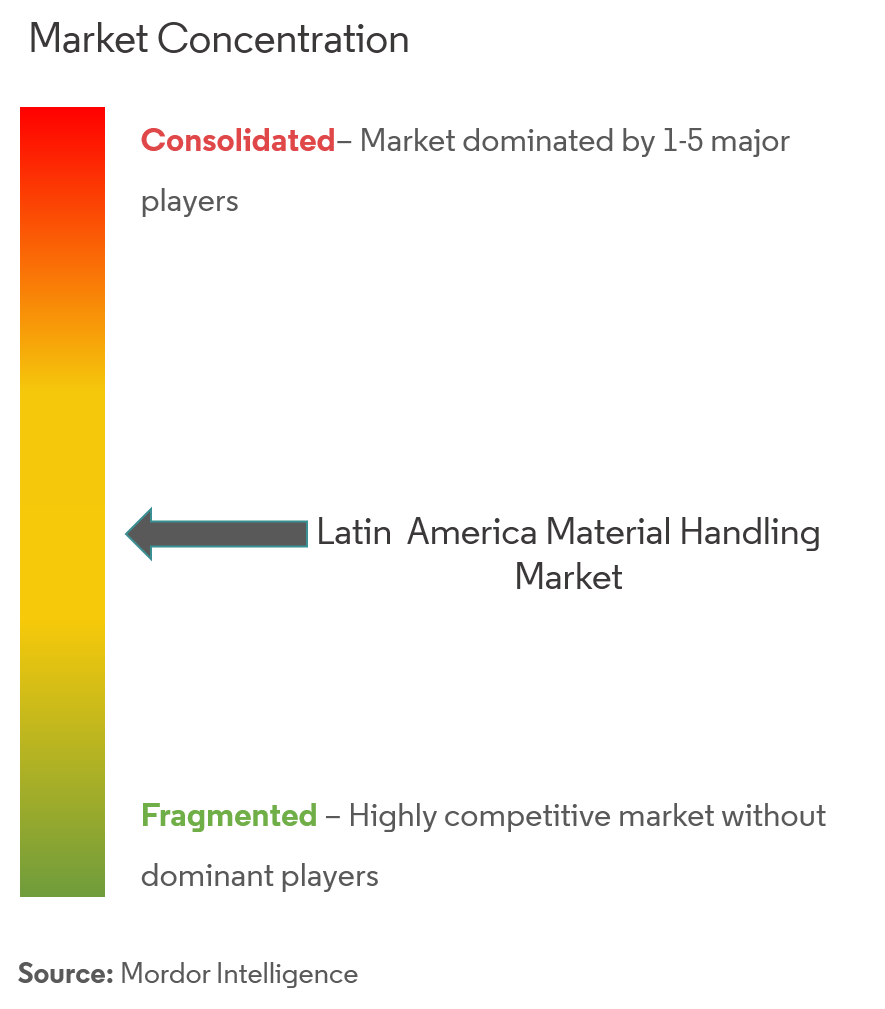

The Latin America automated material handling market is fragmented and moderately competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the country to sustain the intense competition.

- May 2021 - The ZKW Group, the specialist for innovative, premium lighting systems and electronics, has partnered with Swisslog to install Tornado miniload cranes, QuickMove conveyor systems, and aisle racking in its facility located in Silao, Mexico.

Latin America AMH Market Leaders

-

Daifuku Co. Ltd.

-

Interroll Holding AG

-

Kardex Group

-

KION Group

-

Columbus McKinnon Corporation

- *Disclaimer: Major Players sorted in no particular order

Latin America AMH Market News

- April 2021 - Durr, a mechanical and plant engineering firm, modernized the Mercedes-Benz bus chassis production line with individually developed automated guided vehicles (AGVs). It has become one of the most technically advanced production facilities for buses chassis in Brazil in terms of technology, connectivity, and information processing.

- August 2021 - Brazil-based, AGVS which has a portfolio of self-guided vehicles with 100 percent Brazilian development and construction projects, partnered with eSolutech to use its radio frequency identification (RFID) technology to gain even more competitiveness.

Latin America AMH Industry Segmentation

Automated material handling equipment eliminates the need for human interference in a material handling process. Continuous rise in demand for automation with the advent of technologies such as robotics, wireless technologies, and driverless vehicles in different industries like food and beverages, retail, general manufacturing, pharmaceuticals, and post & parcel has revolutionized the adoption of automated material handling equipment. Type of equipment such as AS/RS, AGV, conveyor, palletizer, and sortation systems are considered under the scope of the market.

| By Product Type | Hardware | |||

| Software | ||||

| Services | ||||

| By Equipment Type | Mobile Robots | Automated Guided Vehicle (AGV) | Automated Forklift | |

| Automated Tow/Tractor/Tug | ||||

| Unit Load | ||||

| Assembly Line | ||||

| Special Purpose | ||||

| Autonomous Mobile Robots (AMR) | ||||

| Laser Guided Vehicle | ||||

| Automated Storage and Retrieval System (ASRS) | Fixed Aisle (Stacker Crane + Shuttle System) | |||

| Carousel (Horizontal Carousel + Vertical Carousel) | ||||

| Vertical Lift Module | ||||

| Automated Conveyor | Belt | |||

| Roller | ||||

| Pallet | ||||

| Overhead | ||||

| Palletizer | Conventional (High Level + Low Level) | |||

| Robotic | ||||

| Sortation System | ||||

| By End-user Vertical | Airport | |||

| Automotive | ||||

| Food and Beverage | ||||

| Retail/Warehousing/ Distribution Centers/Logistic Centers | ||||

| General Manufacturing | ||||

| Pharmaceuticals | ||||

| Post and Parcel | ||||

| Other End Users | ||||

| By Country | Brazil | |||

| Argentina | ||||

| Mexico | ||||

| Colombia | ||||

| Peru | ||||

| Chile | ||||

| Rest of Latin America | ||||

Latin America AMH Market Research FAQs

What is the current LA AMH Market size?

The LA AMH Market is projected to register a CAGR of 5.4% during the forecast period (2025-2030)

Who are the key players in LA AMH Market?

Daifuku Co. Ltd., Interroll Holding AG, Kardex Group, KION Group and Columbus McKinnon Corporation are the major companies operating in the LA AMH Market.

What years does this LA AMH Market cover?

The report covers the LA AMH Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the LA AMH Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

LA AMH Industry Report

Statistics for the 2025 LA AMH market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. LA AMH analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.