Laser Photomask Market Size and Share

Laser Photomask Market Analysis by Mordor Intelligence

The Laser Photomask Market is expected to register a CAGR of 2% during the forecast period.

- As transistors have become smaller and smaller, photomasks have become more complex, to transfer the pattern to silicon wafers accurately. The process of creating photomasks has become correspondingly more advanced, as even slight defects in a photomask can impact the silicon device's performance.

- Verifying that a photomask pattern is defect-free is very critical, especially in the case of high-revenue earning chips. Each chip is the end product in the semiconductor lithography process, with an integral part being the optical lithography that is enabled by a light source. The sources of light used for these photomasks are deep ultraviolet (DUV) and extreme ultraviolet (EUV) light sources.

- With the growing demand for semiconductors with even higher performance for applications, such as big data analysis, artificial intelligence, and the commercialization of driverless car technology, EUV exposure is garnering attention as a next-generation semiconductor manufacturing technology. This trend has significantly driven the production of effective photomasks. Toppan in 2016 developed a next-generation EUV photomask for leading-edge semiconductors. The new photomask minimizes unwanted reflections of light to peripheral sections during EUV exposure, emerging as a next-generation semiconductor manufacturing technology.

Global Laser Photomask Market Trends and Insights

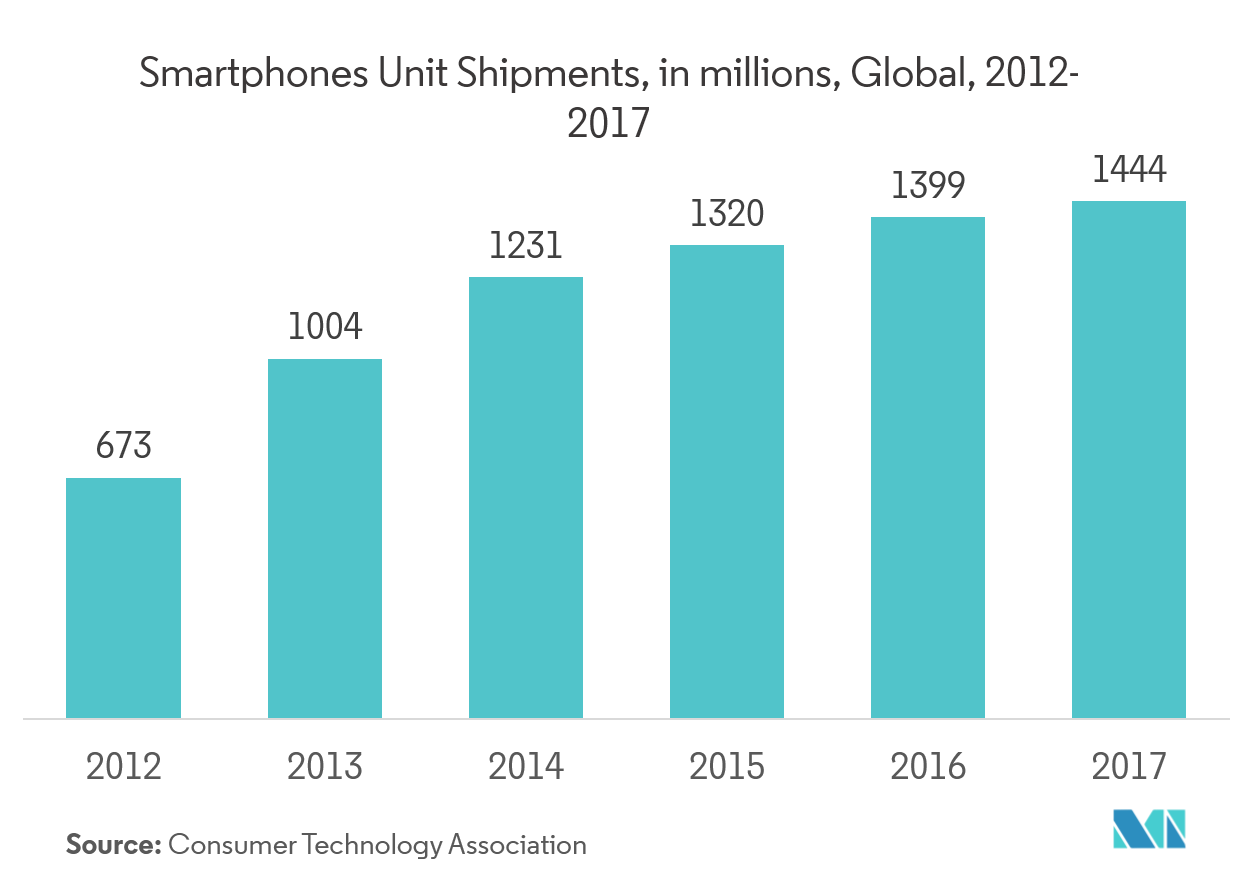

Increasing Use of Electronic Devices

- The demand for electronic devices, such as tablets, smartphones, and phablets, among others are increasing at a rapid rate. A rise in demand for these devices has been growing especially in the developing countries, such as India, China, and other countries.

- Factors, such as an increase in disposable income and emerging middle class, are propelling the demand for these devices even further.

- The aforementioned electronics devices are powered by integrated circuits (microchips); a photomask contains the pattern of an integrated circuit and is used for manufacturing them.

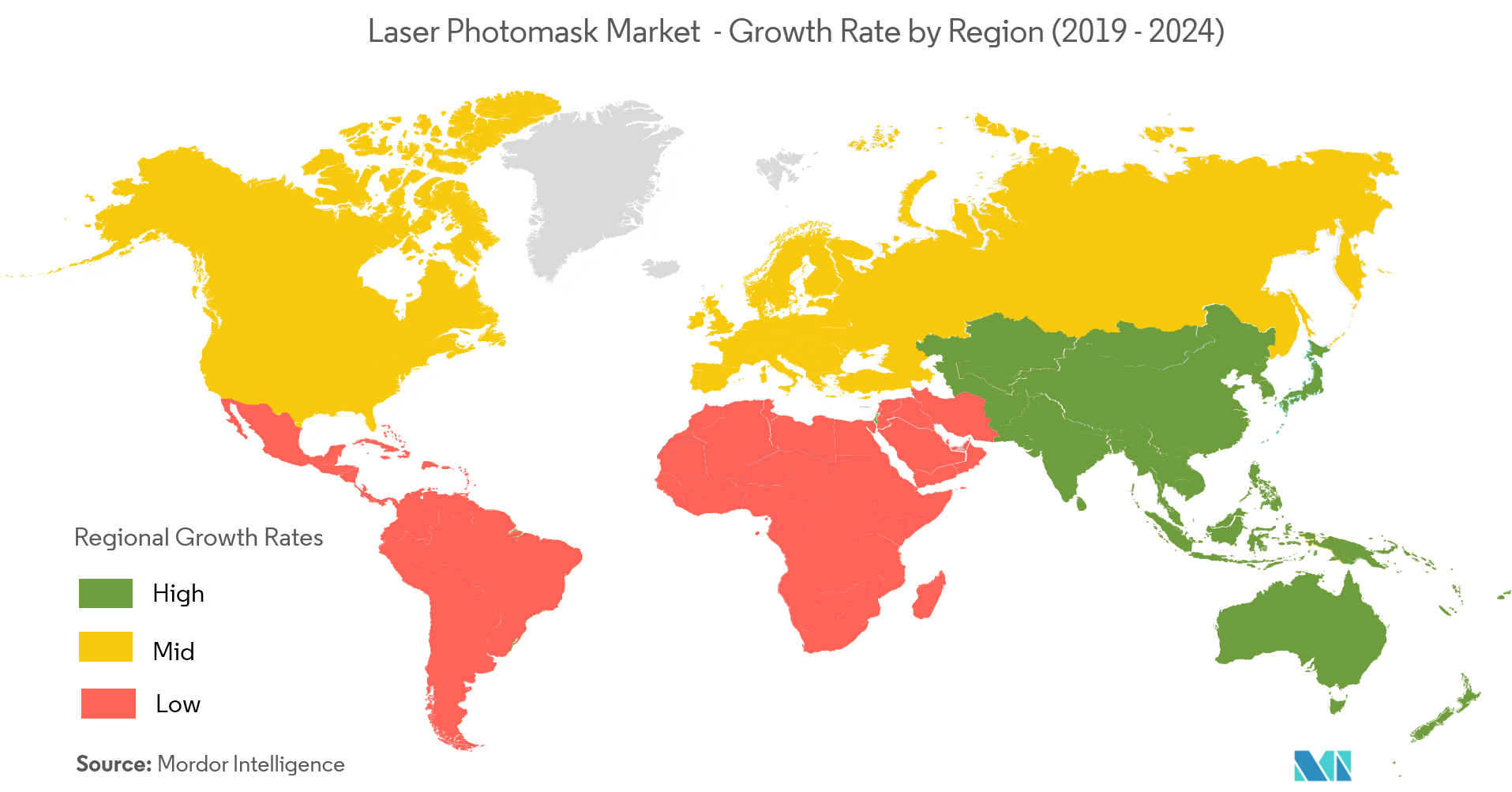

Asia-Pacific is Expected to Hold a Significant Share

- Asia-Pacific countries are the leading regions in the semiconductor industry. China and South Korea are the leading countries in the photomask market. These countries are the home to most of the key electronics manufacturing companies.

- Additionally, China is witnessing a massive demand for semiconductor components, especially integrated chips. The Chinese government has also done some changes in its policy to encourage the development of the domestic semiconductor industry.

- Moreover, trade fairs also contribute significantly to the growth of the region in the market. Photomask Japan is an international symposium and technical exhibition on photomasks and lithography in Japan. The symposium aims to bring together engineers and investigators from all over the world in the field of photomasks, NGL masks, and related technologies to discuss recent progress, applications, and future trends.

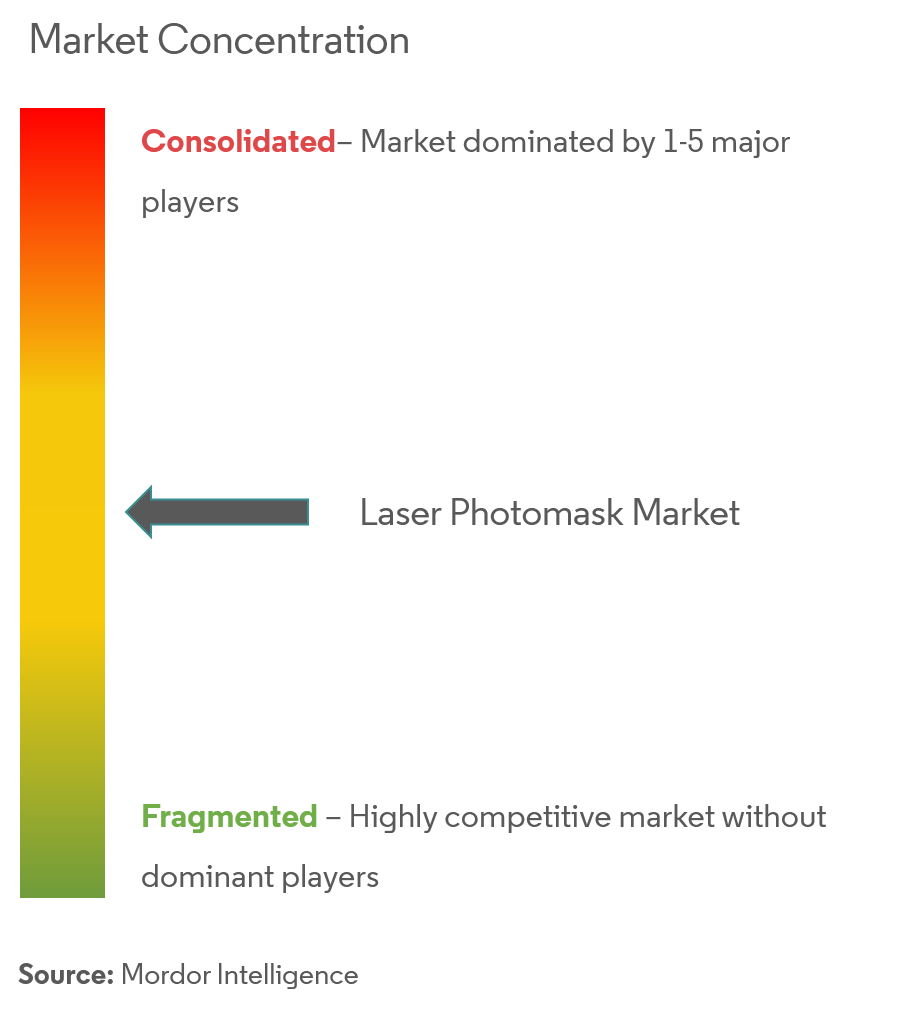

Competitive Landscape

The laser photomask market is highly competitive and consists of several major players. Many companies are increasing their market presence by introducing new products or by entering into strategic mergers and acquisitions.

- October 2018 - Heidelberg Instruments launched the ULTRA Semiconductor Laser Mask Writer, the most economical solution for the production of photomasks with 150 nm design node.With its high throughput, minimum feature size, excellent overlay, 2nd layer alignment, and CD uniformity, ULTRA is ideal to address diverse applications in the semiconductor industry.

- March 2018 - Orbotech Ltd and KLA-Tencor Corporation entered into an agreement, according to which KLA-Tencor may acquire Orbotech to diversify KLA-Tencor Corporation revenue base significantly. This agreement sets out to address the market opportunity in the high-growth printed circuit board, flat panel display, and semiconductor manufacturing areas.

Laser Photomask Industry Leaders

-

KLA-Tencor Corporation

-

Applied Materials Inc.

-

Photronics Inc.

-

Nippon Filcon Co. Ltd

-

Toppan Printing Co. Ltd

- *Disclaimer: Major Players sorted in no particular order

Global Laser Photomask Market Report Scope

A photomask is a tool used for productions of components, including electronic devices (semiconductors), displays, PCB, and MEMS. It is a master copy for the patterning.

- Electronic devices – Devices, such as CPU and other memory devices that require semiconductor/IC use photomasks.

- Discreet components with a single task – Transistors and memories

- Light receiving/ emitting elements - CCD/CMOS image sensors and LED

- Display devices – LCD and OLED

- MEMS (Micro Electro Mechanical System) - Acceleration sensors

- Magnetic heads for hard disks, among various others.

| Reticles |

| Masters |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Photomask Type | Reticles |

| Masters | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Laser Photomask Market size?

The Laser Photomask Market is projected to register a CAGR of 2% during the forecast period (2025-2030)

Who are the key players in Laser Photomask Market?

KLA-Tencor Corporation, Applied Materials Inc., Photronics Inc., Nippon Filcon Co. Ltd and Toppan Printing Co. Ltd are the major companies operating in the Laser Photomask Market.

Which is the fastest growing region in Laser Photomask Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Laser Photomask Market?

In 2025, the Asia Pacific accounts for the largest market share in Laser Photomask Market.

What years does this Laser Photomask Market cover?

The report covers the Laser Photomask Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Laser Photomask Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Laser Photomask Market Report

Statistics for the 2025 Laser Photomask market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Laser Photomask analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.