Irrigation Controllers Market Analysis

The Irrigation Controllers Market size is estimated at USD 1.27 billion in 2025, and is expected to reach USD 1.65 billion by 2030, at a CAGR of 5.5% during the forecast period (2025-2030).

The irrigation controllers market is experiencing significant growth, driven by the need to apply optimal amounts of water at the right time to maximize agricultural production and achieve high efficiency in water and chemical use. With many regions facing diminishing water supplies and increasing drought conditions, smart irrigation equipment, including controllers, is recommended for its ability to deliver precise water quantities, resulting in both water and cost savings. Unlike traditional systems, smart irrigation controllers automatically adjust watering schedules to meet the specific needs of crops or lawns.

Agricultural water scarcity is projected to increase in over 80% of the world's croplands by 2050, according to a study in the AGU journal "Earth's Future". Regions such as India, China, Africa, and the Middle East, which already face arid climates, are particularly vulnerable as they cultivate water-intensive crops like rice and wheat. These areas depend heavily on rain-fed agriculture, which is becoming increasingly unpredictable due to climate change. The resulting irregular rainfall patterns cause disruptions in planting seasons and recurring crop failures, emphasizing the importance of smart irrigation systems in securing future food production.

Irrigation Controllers Market Trends

Global Water Scarcity Drives Demand for Efficient Irrigation Technologies

Water is essential for agricultural production, with crops requiring different amounts for optimal growth. Agriculture currently accounts for about 70% of global freshwater withdrawals, as reported by the Food and Agriculture Organization (FAO). The World Bank estimates that this figure will rise by an additional 15% by 2050. However, water scarcity poses a serious challenge, reducing agricultural productivity and threatening food security and nutrition. With the global population projected to reach approximately 9 billion by 2050, the need to produce more food using limited water resources is becoming increasingly urgent. This growing demand for agricultural products, driven by population growth, underscores the importance of adopting more efficient and sustainable farming methods. Advanced irrigation technologies, such as irrigation controllers, are critical tools to optimize water use, improve productivity, and address the challenges posed by water scarcity.

Climate change has resulted in unpredictable rainfall patterns, creating new extremes in droughts and floods. For instance, Argentina's agricultural sector has been grappling with a severe drought since May 2022 in certain regions. This drought, intensified by climate change-related high temperatures, has significantly impacted farmers. The country experienced at least eight heat waves during the 2022-2023 season, further exacerbating the challenging conditions for agriculture. This volatility challenges conventional water-resources planning as demand for water increases. In response, farmers are investing in systems that offer better control over water application and adaptability to changing conditions.

Governments are promoting efficient irrigation practices through subsidies and policies to address environmental concerns and ensure food security. Jordan, one of the world's most water-scarce countries with only 61 m3 of water available per person annually, exemplifies this trend. The agricultural sector, consuming 51% of the country's freshwater resources, is particularly vulnerable to climate change and water scarcity. In 2023, Jordan launched a new water strategy for 2023-2040, outlining goals to achieve water security. Key priorities include reducing reliance on freshwater by increasing the use of reclaimed water for irrigated agriculture, implementing more efficient irrigation systems, and expanding rainfed agriculture and rainwater harvesting. These initiatives are projected to drive market growth in irrigation controllers.

North America: A Leader in Smart Irrigation Technology Adoption

North America has become a frontrunner in adopting advanced agricultural technologies, including smart irrigation systems. These systems combine controllers with weather data, sensors, and mobile applications, providing remote control and monitoring capabilities. This integration allows farmers to optimize water application based on real-time conditions.

The United States and Canada are increasingly focusing on water conservation, especially in drought-prone regions like California and the southwestern U.S. Irrigation controllers are crucial in this effort, enabling precise water usage and effective water resource management. According to the Environmental Defense Fund, California's Sierra Nevada snowpack, essential for the state's extensive agriculture sector, is projected to decrease by 48-65% from the historical average by 2100.

Growing consumer and business emphasis on sustainability is prompting farms and landscaping companies to implement eco-friendly practices, including smart irrigation solutions. This shift towards reducing environmental impact is driving the adoption of controllers designed to minimize water waste.

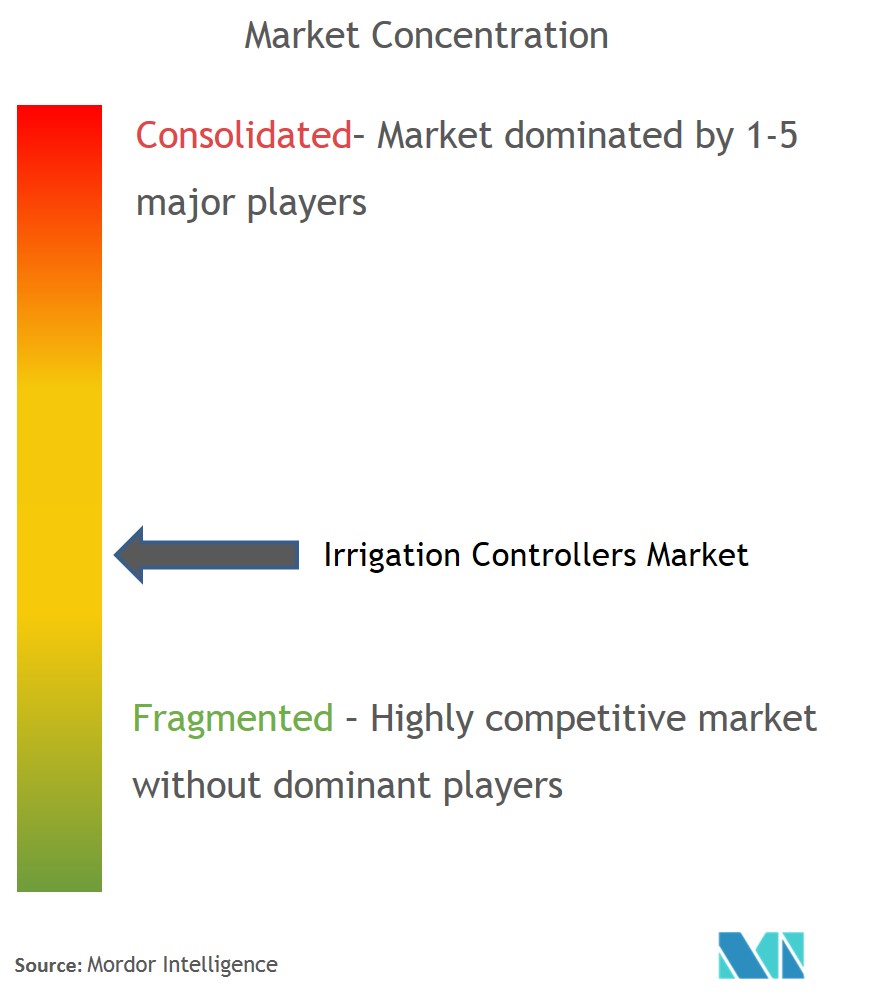

Irrigation Controllers Industry Overview

The irrigation controllers' landscape is fragmented and continually evolving. Major players include (in no particular order) Valmont Industries, Inc., Valmont Industries, Inc., FlyBird Farm Innovations Pvt. Ltd, Hunter Industries, Rain Bird Corporation, and Netafim Ltd. The manufacturers in this segment have a wide range of product portfolios and have great geographical reach. They can foster in the market by how well and efficiently the needs of the buyers are met. New entrants need to contend with the presence of market incumbents as they have a strong presence in several industries. New product developments and the rising trend of automation are creating opportunities in this sector.

Irrigation Controllers Market Leaders

-

Valmont Industries, Inc.

-

FlyBird Farm Innovations Pvt. Ltd

-

Hunter Industries

-

Rain Bird Corporation

-

Netafim Ltd.

- *Disclaimer: Major Players sorted in no particular order

Irrigation Controllers Market News

- September 2024: Netafim has introduced GrowSphere, an integrated irrigation operating system. This technology monitors soil conditions, weather patterns, crop health, and irrigation status, delivering real-time field updates. GrowSphere also provides timely alerts for irrigation needs and system maintenance requirements, improving agricultural management efficiency.

- July 2023: Hydro-Rain Introduces AI-Powered Smart Controller for Landscape Irrigation Management. The HSC Controller offers intuitive solutions for complex water management across various segments.

Irrigation Controllers Industry Segmentation

An irrigation controller is a device that automates the scheduling and operation of irrigation systems for landscapes, gardens, and agricultural fields. It regulates the timing, frequency, and duration of watering, enabling precise and efficient water management.. The report defines the irrigation controller systems market in terms of end-users. Industrial applications are not a part of this report. The component segment of the report does not include the after-sales market.

Irrigation controllers market is segmented by Type (Weather based controllers and Sensor Based Controllers), by Product (Smart controllers, Tap Timers and Basic Controllers), by Irrigation Type (Drip/ Trickle and Sprinkler), by Application (Agriculture and Non-Agriculture) and and Geography (North America, Europe, Asia-Pacific, South America, and Africa).The report offers the market size and forecasts in terms of volume in metric tons and value in USD for all the above segments.

| Type | Weather based controllers | ||

| Sensor based controllers | |||

| Product | Smart controllers | ||

| Tap timers | |||

| Basic controllers | |||

| Irrigation type | Drip/ Trickle | ||

| Sprinkler | |||

| Application | Agricultural | ||

| Non- agricultural | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Russia | |||

| Spain | |||

| Rest of Europe | |||

| Asia Pacific | India | ||

| China | |||

| Japan | |||

| Rest of the Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle East & Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| Rest of the Middle East & Africa | |||

Irrigation Controllers Market Research FAQs

How big is the Irrigation Controllers Market?

The Irrigation Controllers Market size is expected to reach USD 1.27 billion in 2025 and grow at a CAGR of 5.5% to reach USD 1.65 billion by 2030.

What is the current Irrigation Controllers Market size?

In 2025, the Irrigation Controllers Market size is expected to reach USD 1.27 billion.

Who are the key players in Irrigation Controllers Market?

Valmont Industries, Inc., FlyBird Farm Innovations Pvt. Ltd, Hunter Industries, Rain Bird Corporation and Netafim Ltd. are the major companies operating in the Irrigation Controllers Market.

Which is the fastest growing region in Irrigation Controllers Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Irrigation Controllers Market?

In 2025, the North America accounts for the largest market share in Irrigation Controllers Market.

What years does this Irrigation Controllers Market cover, and what was the market size in 2024?

In 2024, the Irrigation Controllers Market size was estimated at USD 1.20 billion. The report covers the Irrigation Controllers Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Irrigation Controllers Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Irrigation Controllers Industry Report

Statistics for the 2025 Irrigation Controllers market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Irrigation Controllers analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.