Iran Vehicles Market Analysis

The Iran Vehicles Market size is estimated at USD 41.57 billion in 2025, and is expected to reach USD 65.65 billion by 2030, at a CAGR of 9.57% during the forecast period (2025-2030).

The Iranian automotive industry is significant to the country's economy, playing a crucial role in employment, industrial growth, and overall economic development.

The Iranian government has implemented various policies to promote the growth of the automotive industry, including investment incentives, tariff protection, and localized production requirements. These initiatives have attracted domestic and foreign investments, establishing a robust automotive manufacturing ecosystem comprising domestic automakers, joint ventures, and multinational corporations.

Iran's automotive industry encompasses various activities, including vehicle manufacturing, component production, distribution, and after-sales services. The industry is dominated by several key players, including Iran Khodro (IKCO), SAIPA Group, and Pars Khodro, which collectively account for the majority of vehicle production in the country.

Iran Khodro, the largest automaker in Iran, produces various vehicles, including passenger cars, commercial vehicles, and trucks, under various brand names such as Peugeot, Renault, and IKCO. SAIPA Group, another major player, focuses primarily on the production of passenger cars and light commercial vehicles, with brands like Kia, Citroen, and its own SAIPA brand.

In recent years, there has been a growing emphasis on innovation, research, and development within the Iranian automotive industry, driven by the need to enhance product quality, efficiency, and sustainability. Initiatives to develop electric vehicles (EVs), hybrid technology, and alternative fuels reflect a broader commitment to environmental conservation and energy security.

The Iranian automotive industry is witnessing a shift toward digitalization, automation, and connectivity, with automakers and suppliers investing in advanced technologies to meet evolving consumer preferences and regulatory requirements. Digital marketing, online sales platforms, and smart manufacturing processes are becoming increasingly prevalent across the industry value chain.

Considering these factors and the government's leadership in promoting development in Iran's automotive industry, vehicle sales are expected to remain fruitful during the longer-term forecast period.

Iran Vehicles Market Trends

Passenger Vehicles are Expected to Witness the Highest Growth

The Iranian automotive industry is experiencing significant growth, with passenger car production leading this growth. In the current calendar year ending March, passenger car production exceeded 1.13 million units, marking a 6% increase compared to the previous year. This surge in production underscores the pivotal role of passenger cars in driving the Iranian automotive industry forward. The rise in urbanization in Iran is also driving the demand for passenger cars.

The production of pickup trucks also saw a substantial uptick, with a 32% increase to 166 thousand vehicles during the same period. While pickup trucks contribute to the overall automotive output, the passenger vehicles segment remains the primary driver of growth and demand in Iran.

Commercial vehicles, including vans, minibusses, buses, trucks, and trailers, witnessed a modest increase of about 2% compared to the previous year, reaching over 40 thousand units. However, it is essential to note that passenger cars dominate the Iranian automotive landscape in terms of production volume and market share.

The private sector plays a significant role in the Iranian automotive industry, contributing approximately 23% of the total production, with around 307 thousand vehicles. This highlights the diverse ecosystem of manufacturers and suppliers operating within the passenger vehicles segment, catering to various consumer preferences and market segments.

In addition to passenger vehicles and commercial vehicles, the production of motorcycles also showed remarkable growth, surpassing 600 thousand units this year. This notable increase of about 28% compared to the previous year's output demonstrates the overall vibrancy of the Iranian automotive industry across different vehicle categories.

Iranian car manufacturers have also made strides in global car production, contributing 1.3% to the worldwide market in 2023, according to the latest annual report from the European Automobile Manufacturers’ Association (ACEA). This signifies Iran's increasing presence and competitiveness in the international automotive arena, primarily driven by its passenger car manufacturing capabilities.

Considering these factors and developments, Iran's passenger car demand is expected to witness a high growth rate during the forecast period.

Electric Vehicles are Expected to Gain Traction in the Coming Years

In transitioning toward zero carbon emission technologies, alternative fuel vehicles (AFVs) present a promising solution for sustainable transportation, emerging as a critical innovation to tackle environmental challenges. Among AFVs, hybrid electric vehicles (HEVs), plug-in electric vehicles (PHEVs), and battery electric vehicles (BEVs) stand out as the most prevalent types, offering reduced or zero reliance on fossil fuels.

The burgeoning consumer interest in electric vehicles (EVs) signals a significant shift toward decarbonization and underscores the importance of charging infrastructure development. However, the adoption of EVs in Iran is influenced by various factors, including consumer behavior, infrastructure availability, and regional considerations. As consumer preferences increasingly favor EVs, the demand for charging stations is expected to surge proportionally.

Recognizing the evolving consumer sentiment, significant players in the Iranian automotive industry strategically focus on addressing the need for efficient charging solutions. By prioritizing the deployment of fast-charging technologies nationwide, these industry leaders aim to capitalize on the growing demand for EVs and enhance the country's overall adoption rate.

Eventually, the Iranian automotive industry became self-reliant to supply the demand within the country. The country had reached the potential to roll out electric vehicles. For instance:

- In January 2024, Iran announced that designing and manufacturing lithium-ion battery cells is a crucial step in electric car development. This technology, sourced from the Iran Space Research Center, offers high energy density (168 Wh/kg) and fast charging capabilities. Weighing 320 grams, it generates 15 ampere/h of electricity.

- Its key features include long life, high efficiency, and low weight. Primary customers are auto manufacturing industries. Competitive advantages include aiding EV development, creating sustainable employment, preventing capital flight, and potential export opportunities.

Considering these factors and development, the demand for electric vehicles is expected to penetrate Iran's automotive industry during the forecast period.

Iran Vehicles Industry Overview

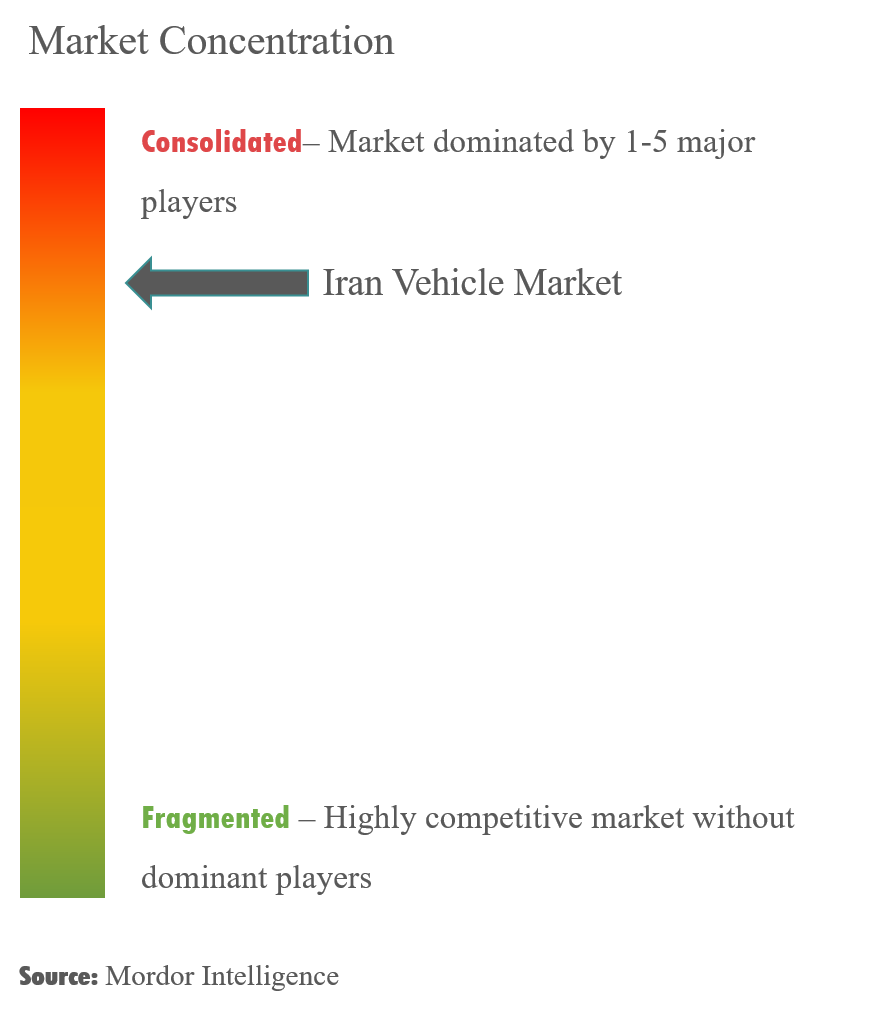

The Iranian automotive industry is consolidated. The major players are Renault-Nissan Alliance, Brilliance Automobile Group, Chery Automobile, Hyundai Kia Automotive Group, Iran Khodro (IKCO), Lifan Industry (Group), Groupe PSA, SAIPA Group, Toyota Group, VW Group, and Great Wall Motor Company Ltd (GWM). Alliances and joint ventures are the major strategies adopted by the companies in this market.

Iran has established trade agreements with various countries, including Venezuela, to export cars. This highlights the country's ambitions to leverage its automotive manufacturing prowess to enhance trade relations and expand its presence in global markets.

There are approximately a dozen state- and quasi-state-owned automakers within Iran, with Iran Khodro and Saipa accounting for 94% of the total domestic production. These two major players dominate the passenger vehicles segment, producing nearly 1.5 million units of light and heavy vehicles annually in 2023. While some of these vehicles may be sub-standard or based on older foreign models, the sheer volume of production underscores the significance of passenger cars in driving the automotive industry of Iran.

Iran Vehicles Market Leaders

-

Iran Khodro

-

SAIPA Corp

-

Groupe PSA

-

Nissan

-

Renault

- *Disclaimer: Major Players sorted in no particular order

Iran Vehicles Market News

- February 2024: MAPNA's MECO and Tehran signed a deal to install 950 electric chargers, including AC and DC chargers, for light and heavy electric vehicles, which may drive Iran's electric vehicle market.

- With 96 stations, including 21 for electric buses and 75 for electric taxis, this initiative will significantly improve the charging infrastructure in the capital. The increased availability of charging stations is expected to encourage the adoption of electric vehicles, making them a more attractive option for consumers and contributing to the growth of the electric vehicle market in Iran.

- July 2023: Following a four-decade absence, vehicles manufactured by Skoda, a wholly-owned subsidiary of Volkswagen, are poised to make a comeback in Iran's automotive market. The Islamic Republic has revised its car import regulations, permitting the importation of new and used cars, paving the way for five Skoda models to be available in Iranian showrooms.

Iran Vehicles Industry Segmentation

A vehicle is a machine that transports people or cargo from one place to the desired location. The Iranian automotive industry is focused on passenger and commercial vehicles.

The Iranian automotive industry market is segmented by vehicle type and fuel type. By vehicle type, the market is segmented into passenger cars and commercial vehicles. By fuel type, the market is segmented into IC engines and electric.

For each segment, the market sizing and forecast are done in terms of value (USD).

| By Vehicle Type | Passenger Vehicles |

| Commercial Vehicles | |

| By Fuel Type | IC Engines |

| Electric |

Iran Vehicles Market Research FAQs

How big is the Iran Vehicles Market?

The Iran Vehicles Market size is expected to reach USD 41.57 billion in 2025 and grow at a CAGR of 9.57% to reach USD 65.65 billion by 2030.

What is the current Iran Vehicles Market size?

In 2025, the Iran Vehicles Market size is expected to reach USD 41.57 billion.

Who are the key players in Iran Vehicles Market?

Iran Khodro, SAIPA Corp, Groupe PSA, Nissan and Renault are the major companies operating in the Iran Vehicles Market.

What years does this Iran Vehicles Market cover, and what was the market size in 2024?

In 2024, the Iran Vehicles Market size was estimated at USD 37.59 billion. The report covers the Iran Vehicles Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Iran Vehicles Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Iran Automotive Industry Report

Statistics for the 2025 Iran Vehicles market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Iran Vehicles analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.