Internet of Things (IoT) Managed Services Market Analysis

The IoT Managed Services Market is expected to register a CAGR of 27.82% during the forecast period.

- The expansion is anticipated to be fueled by technological developments and the rising affordability of sensors and processors that can deliver real-time information access. The need to increase operational proficiency and excellent cooperation among the key market players is also anticipated to fuel expansion. The methods developed to build a combined digital-human workforce would offer significant growth opportunities.

- The scalability, cost advantages, and data analytics benefits made possible by IoT technologies in the industrial domain are impacting the adoption as Industry 4.0 comes to fruition. For instance, Tech Pro says over 80% of industrial manufacturing organizations either use or plan to deploy IoT devices.

- Enterprises looking to opt for IoT are increasing, and global IoT MSPs are further targeting such enterprises. According to the CompTIA survey on MSPs, MSPs see emerging technology as a significant business opportunity source, and over 50% of respondents offer IoT-managed services.

- Developing connected devices is anticipated to create new opportunities for businesses with expertise in cutting-edge Artificial Intelligence (AI) algorithms to create ground-breaking solutions that may address the issues with the technology. IoT-managed services are becoming more popular in application areas like remote monitoring, asset management, predictive maintenance, remote servicing, and operational information.

- Due to the COVID-19 spread, manufacturing facilities are expected to increase the automation level in the future, wherever possible, due to social distancing norms. It would further push the number of industrial IoT-connected objects to multiply, fuelling the demand for IoT-managed services.

Internet of Things (IoT) Managed Services Market Trends

Manufacturing Sector to Hold a Significant Market Share

- Industry 4.0 is transforming industries, from legacy systems to smart components and machines, to facilitate digital factories and develop an ecosystem of connected plants and enterprises. Industry 4.0 persuaded OEMs to adopt IoT across their operations.

- Maryville University estimates that by 2025 over 180 trillion GB of data will be created worldwide every year. IIoT-enabled industries will generate a large portion of this. A survey by Industrial IoT (IIoT) giant Microsoft found that 85% of companies have at least one IIoT use case project. This number increased, as 94% of respondents said they would implement IoT strategies by 2021.

- The benefits offered by IoT in the manufacturing industry are driving the adoption rates. The benefits include increased machine utilization, predictive maintenance and production, data analytics, monitoring, automation, and cost benefits.

- According to the Information Technology and Innovation Foundation (ITIF), IoT applications for monitoring machine utilization can increase manufacturing productivity by 10% to 25%. %. BC Machining LLC, a metal parts manufacturer, onboarded a machine utilization monitoring solution that helps it improve productivity and optimize computer numerical control (CNC) machines. IIoT solutions capture real-time data from equipment sensors to provide reports on the machines' cycle times, downtime, and other parameters.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- As the Asia-Pacific region is developing, it holds significant expansion potential owing to booming commercial sectors like healthcare, safety and security, manufacturing, energy, and agriculture. It is enabling the IoT market to grow at a faster rate.

- Due to the integration of blockchain and cryptographic processes across IoT security services, IoT offers a centralized network and associated data management, reducing business vulnerabilities and security concerns and fueling the IoT in the engineering services market in this region.

- The countries such as India, Japan, China, Australia, and South Korea, are significant contributors to the Asia-Pacific market, and the growing smart city implementation in this region presents the market with varied potential growth opportunities.

- Moreover, growing government initiatives to encourage healthcare providers and other healthcare organizations to adopt EHR and EMR technologies and aggressive investments from nonprofit entities and private sectors in different applications are expected to drive IoT managed services market in the Asia-Pacific region.

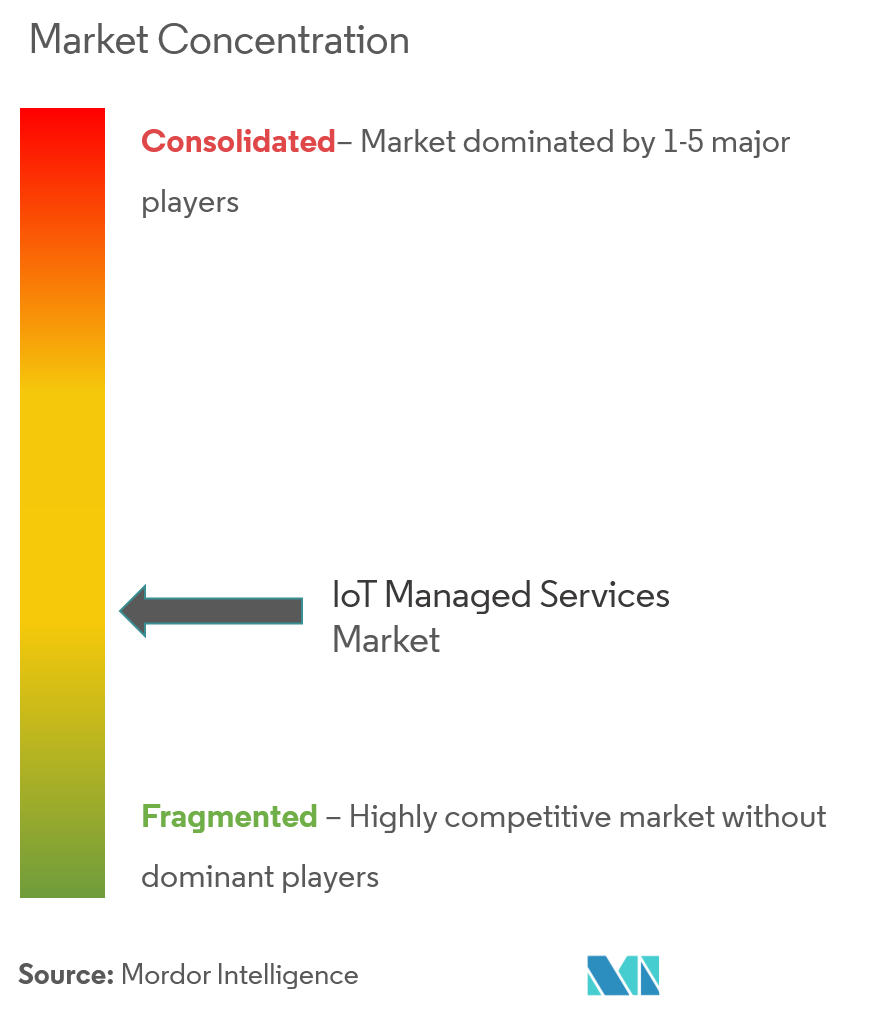

Internet of Things (IoT) Managed Services Industry Overview

The IoT-managed services market is highly fragmented, owing to many players. Most vendors are participating in various marketing strategies to expand their market share. The vendors available in the market are competing on price, quality, brand, and product differentiation. The acquisition of small players ensures an optimum position in IoT-managed services globally. Various key players are IBM Corporation, Accenture PLC, Tech Mahindra Limited, etc. Key current advancements are -

- November 2022 - Argentine Chamber of IoT and Telit, a global Internet of Things (IoT) business, have formed a strategic alliance (CAIoT). CAIoT is a member organization that works to promote the IoT market. It addresses legal and regulatory issues, facilitates communication between suppliers and buyers of IoT solutions, improves knowledge of all industry verticals, and promotes IoT as a new growth engine for the Internet in Argentina.

- August 2022 - Through a recent agreement with Integron, a managed services supplier for the Internet of Things (IoT) market, Stefanini is now offering eHealth outsourcing solutions to the healthcare and pharmaceutical industries. The agreement combines Stefanini's expertise in IT outsourcing, application development, solution deployment, and systems integration with Integron's tried-and-true managed IoT services, which include connection, security, and device monitoring.

Internet of Things (IoT) Managed Services Market Leaders

-

Tech Mahindra Limited

-

Infosys Limited

-

Wipro Limited

-

Cognizant Technology Solutions Corp.

-

HCL Technologies Ltd

- *Disclaimer: Major Players sorted in no particular order

Internet of Things (IoT) Managed Services Market News

- December 2022: KORE, a global provider of Internet of Things (IoT) solutions and global IoT connectivity-as-a-service (IoT CaaS), recently announced the formation of a go-to-market partnership with Google Cloud to enable IoT functionality for organizations worldwide. With the support of KORE's IoT Solutions and Google Cloud infrastructure and capabilities, businesses could develop effective IoT solutions.

- May 2022: HCL Technologies and SAP collaboration were announced on industry-relevant IoT packaged offerings and services. HCL Technologies is a worldwide technology corporation and Internet of Things (IoT) approved business. When implementing Industry 4.0 transformations, companies must deal with a fragmented and complex solution stack. HCL Technologies will package pertinent SAP software with services and hardware that can speed up and simplify this process.

Internet of Things (IoT) Managed Services Industry Segmentation

IoT-managed services are a collection of tools and services that aid in overseeing the entire IoT ecosystem. It outlines a suitable business plan for digital transformation and gives enterprises the power to put together the ideal combination of IoT products and solutions.

The Internet of Things (IoT) Managed Services Market is segmented by application (network management, device management, data management, security management, and other applications), end-user (energy and utilities, manufacturing, retail, healthcare, BFSI, IT & Telecom, and other end-users), and geography (North America (United States, Canada, and rest of North America), Europe (Germany, UK, France, Spain, and rest of Europe), Asia-Pacific (India, China, Japan, and rest of Asia-Pacific), and Latin America (Brazil, Argentina, and rest of Latin America), and Middle East & Africa (UAE, Saudi Arabia, South Africa, and rest of MEA).

The market sizes and forecasts are provided in value (USD million) for all the above segments.

| By Application | Network Management | ||

| Device Management | |||

| Data Management | |||

| Security Management | |||

| Other Applications | |||

| By End-user | Energy and Utilities | ||

| Manufacturing | |||

| Retail | |||

| Healthcare | |||

| BFSI | |||

| IT & Telecom | |||

| Other End-users | |||

| Geography | North America | United States | |

| Canada | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | India | ||

| China | |||

| Japan | |||

| Rest of Asia-Pacific | |||

| Latin America | Brazil | ||

| Argentina | |||

| Rest of Latin America | |||

| Middle East and Africa | UAE | ||

| Saudi Arabia | |||

| South Africa | |||

| Rest of Middle East and Africa | |||

Internet of Things (IoT) Managed Services Market Research FAQs

What is the current IoT Managed Services Market size?

The IoT Managed Services Market is projected to register a CAGR of 27.82% during the forecast period (2025-2030)

Who are the key players in IoT Managed Services Market?

Tech Mahindra Limited, Infosys Limited, Wipro Limited, Cognizant Technology Solutions Corp. and HCL Technologies Ltd are the major companies operating in the IoT Managed Services Market.

Which is the fastest growing region in IoT Managed Services Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in IoT Managed Services Market?

In 2025, the North America accounts for the largest market share in IoT Managed Services Market.

What years does this IoT Managed Services Market cover?

The report covers the IoT Managed Services Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the IoT Managed Services Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

IoT Managed Services Industry Report

Statistics for the 2025 IoT Managed Services market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. IoT Managed Services analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.