Market Trends of Integrated Marine Automation System Industry

This section covers the major market trends shaping the Integrated Marine Automation System Market according to our research experts:

Commercial Marine Vessels to Witness Significant Growth to Market

- Cruise ships are the type of passenger ships that come under commercial segments and with an increasing number of tourism activities and increase in disposable income for people, firms are highly investing in cruise ships and various automation firms provide their products for navigation support, equipment monitoring and safety improvements to shipbuilding companies.

- For instance, in 2017, ABB supplied the complete power, propulsion, and automation package for a series of new cruise vessels being built by MV WERFTEN for Genting Hong Kong brands Crystal Cruises and Star Cruises.

- Various cruise ship lines business that operates a fleet of small luxury cruise ships are opening to automation. For instance, in Sep 2019, Windstar Cruises announced to re-engine its Star-class vessels which will involve new automation and control systems, tank monitoring systems, upgraded boilers, and ballast water treatment systems. This will be sourced by Fincantieri who provides ship automation and navigation systems for Naval vessels, Cruise ships, Ferries and Yachts.

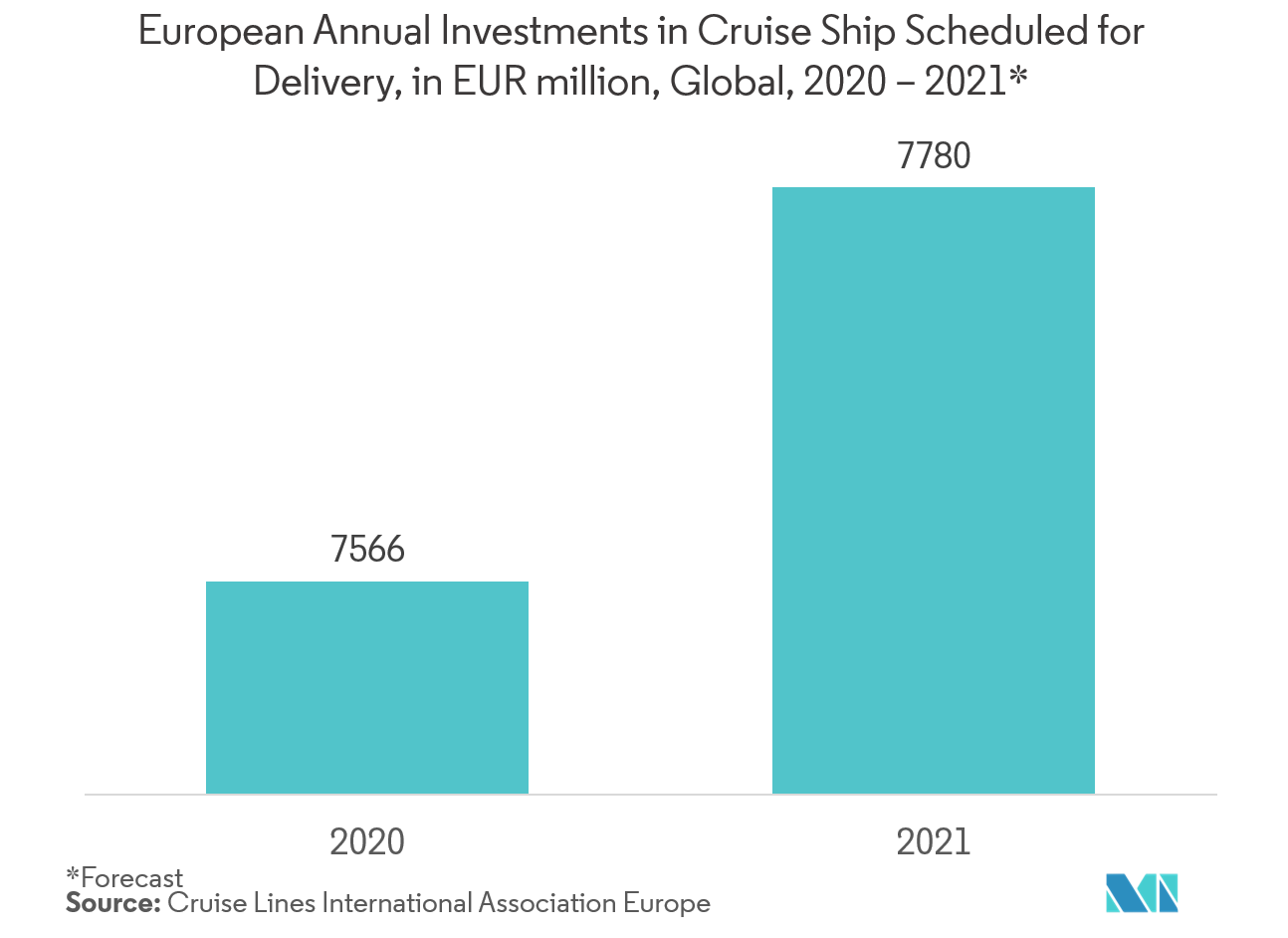

- Moreover, in July 2019, UK cruise business known as Saga Cruises of Europe developed new Spirit-class passenger ships, which integrates navigation, automation, propulsion management and safety systems costing USD 400m. The ships will have a safety monitoring and control system (SMCS) integrated into the ship automation and navigation systems supplying by Kongsberg Maritime. Various other European firms are investing in cruise ships for delivering it globally, by which the market for integrated marine automation will grow high in the future.

Europe Accounts for Highest Market Share

- Europe accounts for remarkable market share in terms of revenue generation with an increasing number of cruise ships and autonomous ships, which are the key factors in propelling growth in this region.

- Hub ports, for instance, Rotterdam, Antwerp, Le Havre, and Hamburg in Europe have little option but to invest in boosting infrastructure and deploying the largest available cranes to handle the giant vessels that can exchange 10,000 TEU in one port call. Developments in technology have empowered terminals in these ports to automate many functions that create faster and more efficient handling solutions. Also, automation will become critical in handling mega-ships and the more digitally connected supply chains of the future.

- In addition, increasing demand for maritime services is another factor expected to drive growth of the target market in Europe region. Kongsberg recently launched two fully automated ferries for crossing the one-mile stretch between Anda and Lote in Norway. These vessels (the GLOPPEFJORD and the EIDESFJORD) have been in operation since 2018, and are fully autonomous with the exception of a human captain’s handling of docking procedures. This enhances the growth of integrated automation in this region.

- Moreover, in Dec 2018, Rolls-Royce successfully demonstrated the world’s first fully autonomous ferry in the archipelago south of the city of Turku, Finland that successfully navigate autonomously during its voyage between Parainen and Nauvo with the return journey conducted under remote control through automation.