Insect-Based Ingredients Market Size and Share

Insect-Based Ingredients Market Analysis by Mordor Intelligence

The Insect-Based Ingredients Market size is estimated at USD 2.06 billion in 2025, and is expected to reach USD 3.15 billion by 2030, at a CAGR of 8.9% during the forecast period (2025-2030).

- The market will have a strong growth in the coming years owing to the trends such astechnological improvements in gene mapping, rising costs of animal feed ingredients and increasing demand for consumption of insects which will lead to an increased usage of insect-based ingredients.

- However, around 2,000 insect species are already consumed by humans and domestic animals across the globe as part of their regular diet, due to their high protein content, favorable fats, minerals, and vitamins. This has provided opportunities for food producers to enter this market and launch various products such as protein bars, snacks, whey protein, mealworm cookies, cricket pasta, honey caterpillar croquettes, mixed insect snacks, and candies based on insect protein.

Global Insect-Based Ingredients Market Trends and Insights

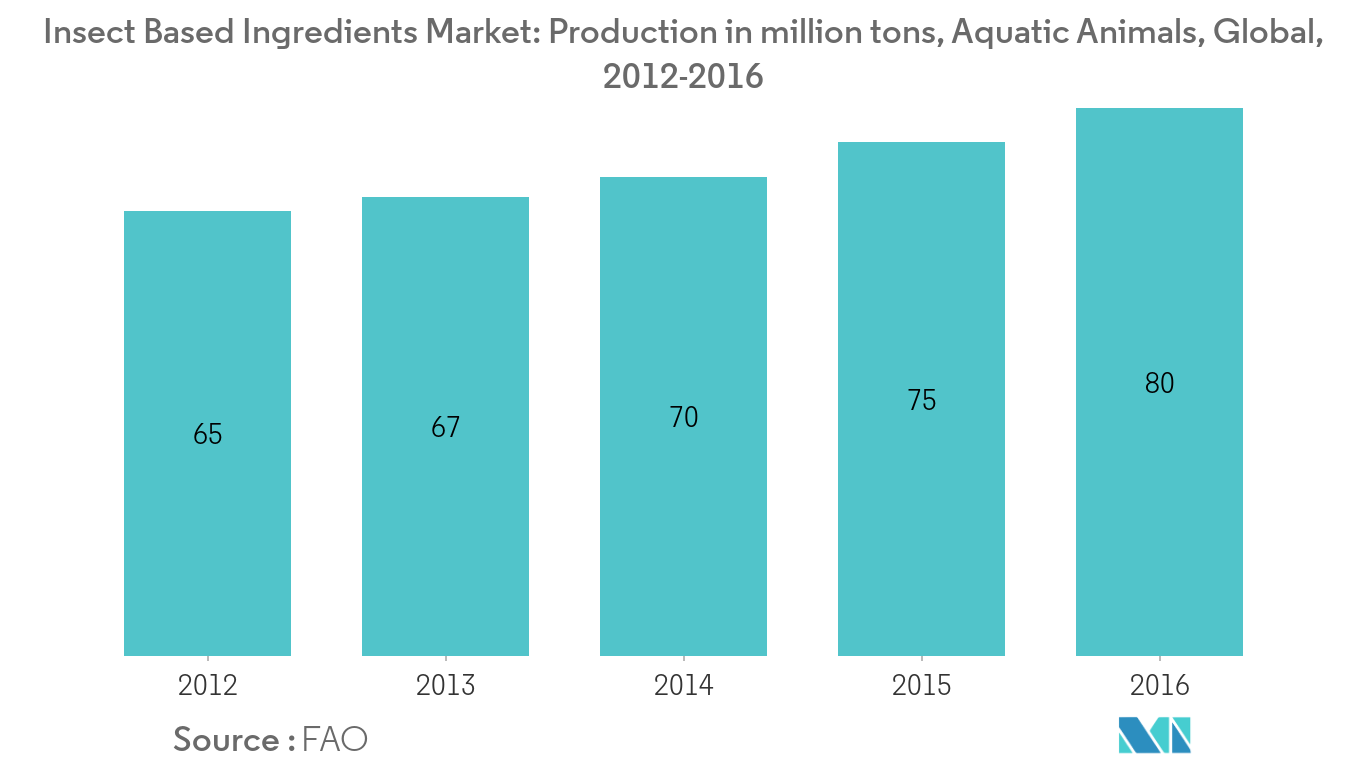

Increasing Demand from the Aquafeed Industry for Edible Insect Feed

Alternative protein sources are necessary for an animal's nutrition and therefore aquafeed industries are demanding edible insects for their feed. This, in turn, leads the companies to demand for insect-ingredients. Prices of fishmeal and soy meal, which are used as aquafeed, are high. Aquaculture production is continuously increasing which increases the demand for alternative and affordable protein sources such as edible insects for animal feed. Edible insect feed products can have a market similar to fishmeal and soymeal, which are used as the main ingredients in feed formulae for livestock feed and aquafeed. Thus, the demand for insect feed can create considerable opportunities for insect feed ingredients manufacturers and farmers in the industry by reducing feed costs for both farmers and suppliers. Thus, the growing aquatic population will lead to increased feed demand which in turn will lead to increased demand for insect-based ingredients.

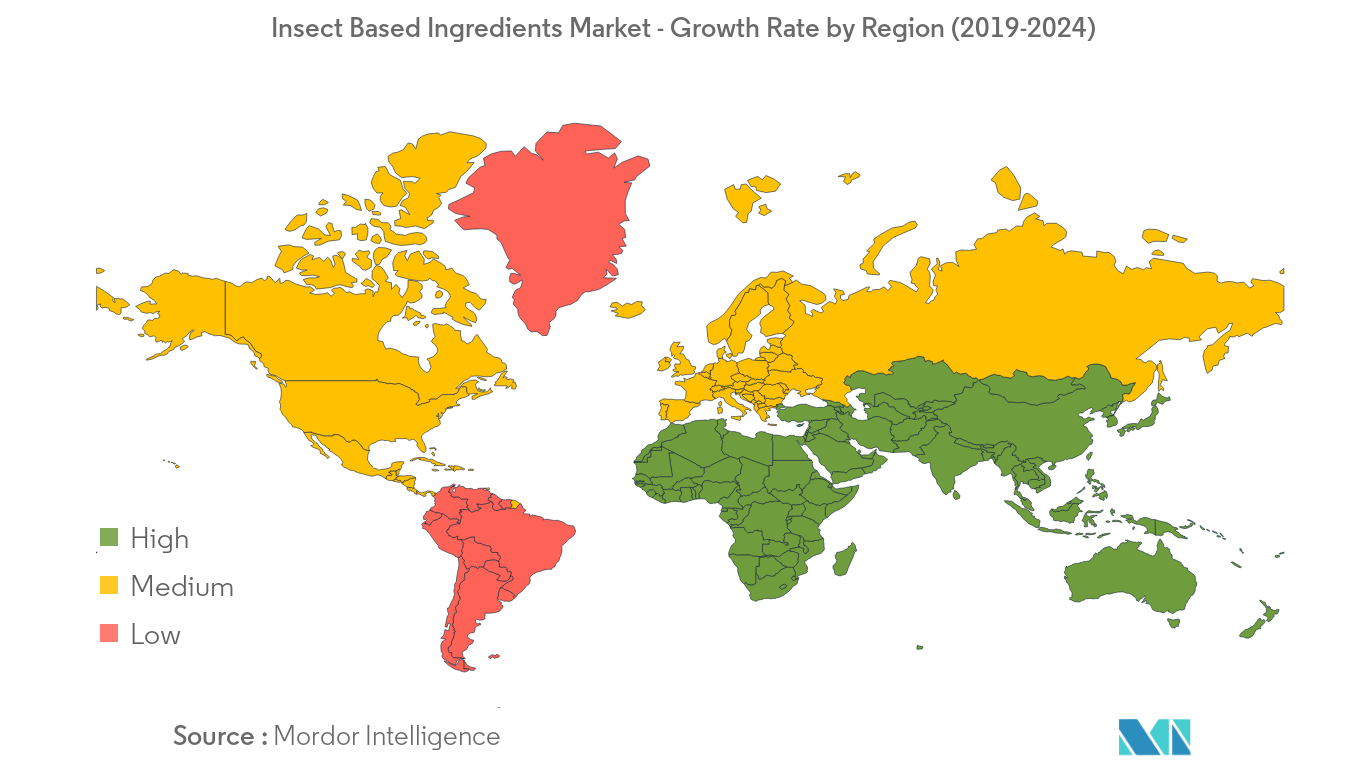

Asia-Pacific is the Fastest Growing Market

Growing concern towards various health issues and a shift in the consumption pattern to a protein-rich diet may drive the Asia Pacific's insect feed market size. The product offers various health benefits, including reducing obesity, and are healthy even for animals when offered as fodder, resulting in an increase in the product demand. moreover, the aquaculture industry is highly inclined towards Asia, particularly Southeast Asia and China. Of all the fish food produced by the aquaculture industry, the majority of it is consumed by Southeast Asia alone. Therefore, to feed the aquatic animals, insect feed is highly demanded in this region. Thus, the manufacturers of insect feed will demand insect feed ingredients to manufacture diverse insect feed portfolio. Thus, the market for insect-based ingredients will grow in the coming years in the Asia-Pacific region.

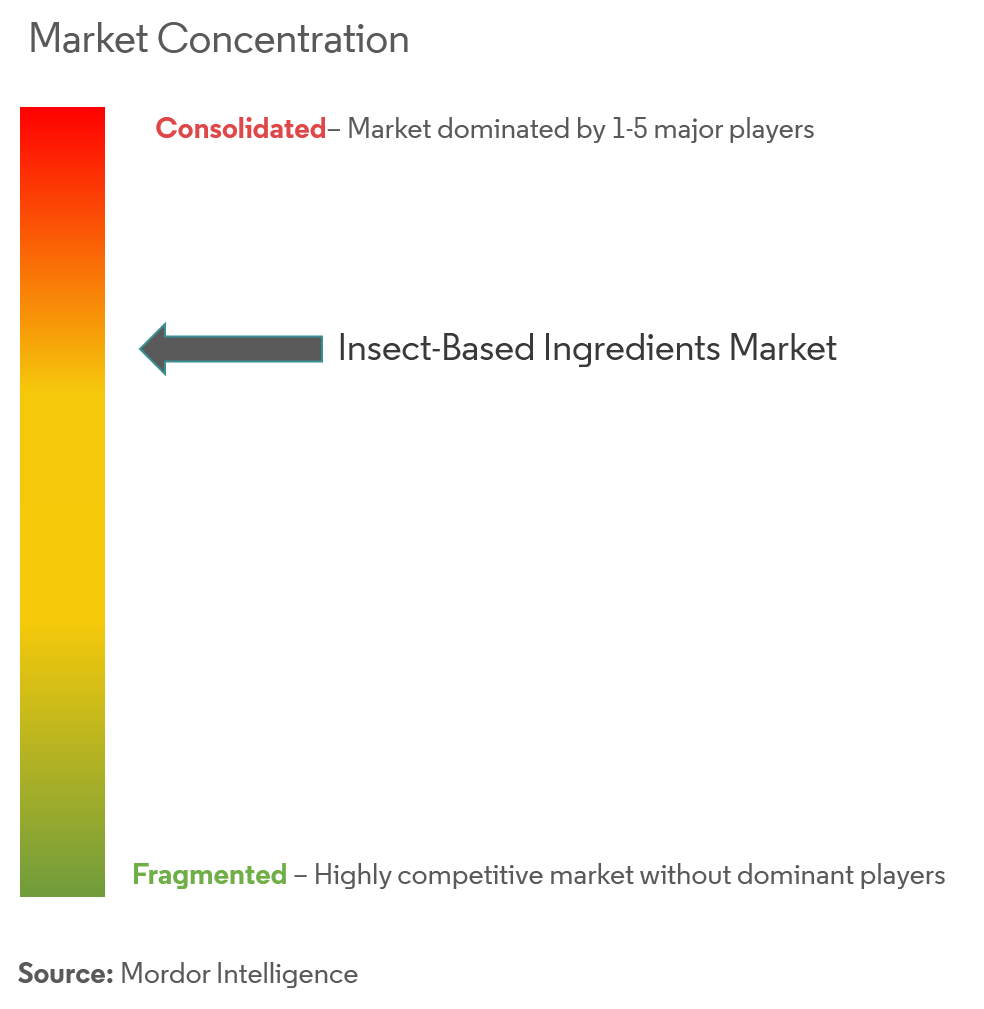

Competitive Landscape

The insect-based ingredients market is highly concentrated, with the top ten companies accounting for more than 50% of the market share. The leading players in the market studied are focused on business expansion. They are targeting countries in Asia-Pacific for business expansion, by either investing in new production units or acquiring established small players in the region. Some of the major players in the market are Enviroflight, Agri Protein, Ynsect, Protix B.V., and, Entomo Farms, etc.

Insect-Based Ingredients Industry Leaders

-

Ynsect

-

Protix

-

AgriProtein

-

EnviroFlight

-

Entomo Farms

- *Disclaimer: Major Players sorted in no particular order

Global Insect-Based Ingredients Market Report Scope

Insects such as grasshopper, locust, and cricket belong to the orthoptera family and are widely used as ingredients for insect-based human foods. Insects used as feed for livestock have less market penetration, as compared to regular feed. Fish meal, fish oil, soybeans, and several other grains (regular feed) are the most commonly used ingredients in animal feed. According to FAO, procurement of these key ingredients accounts for over 65% of the production costs, in the manufacture of animal feed. In addition, the price of these raw materials is observed to be increasing at a significant rate in the recent years. The usage of fish for non-food uses (to make insect feed and to be used as vaccines) is reducing for the past two decades.

| Insect-Based Animal Feed |

| Insect-Based Pharmaceutical Products |

| Insect-Based Human Food and Beverage |

| Others |

| Beetles |

| Caterpillar |

| Hymenoptera |

| Orthoptera |

| Tree Bugs |

| Other Insect Types |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Russia | |

| Spain | |

| Rest of Europe | |

| Asia Pacific | China |

| Japan | |

| India | |

| Thailand | |

| Iran | |

| Rest of Asia-Pacific | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Middle East and Africa | South Africa |

| Egypt | |

| Rest of Middle East and Africa |

| Usage | Insect-Based Animal Feed | |

| Insect-Based Pharmaceutical Products | ||

| Insect-Based Human Food and Beverage | ||

| Others | ||

| Insect Type | Beetles | |

| Caterpillar | ||

| Hymenoptera | ||

| Orthoptera | ||

| Tree Bugs | ||

| Other Insect Types | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Europe | Germany | |

| United Kingdom | ||

| France | ||

| Russia | ||

| Spain | ||

| Rest of Europe | ||

| Asia Pacific | China | |

| Japan | ||

| India | ||

| Thailand | ||

| Iran | ||

| Rest of Asia-Pacific | ||

| South America | Brazil | |

| Argentina | ||

| Rest of South America | ||

| Middle East and Africa | South Africa | |

| Egypt | ||

| Rest of Middle East and Africa | ||

Key Questions Answered in the Report

How big is the Insect-Based Ingredients Market?

The Insect-Based Ingredients Market size is expected to reach USD 2.06 billion in 2025 and grow at a CAGR of 8.90% to reach USD 3.15 billion by 2030.

What is the current Insect-Based Ingredients Market size?

In 2025, the Insect-Based Ingredients Market size is expected to reach USD 2.06 billion.

Who are the key players in Insect-Based Ingredients Market?

Ynsect, Protix, AgriProtein, EnviroFlight and Entomo Farms are the major companies operating in the Insect-Based Ingredients Market.

Which is the fastest growing region in Insect-Based Ingredients Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Insect-Based Ingredients Market?

In 2025, the North America accounts for the largest market share in Insect-Based Ingredients Market.

What years does this Insect-Based Ingredients Market cover, and what was the market size in 2024?

In 2024, the Insect-Based Ingredients Market size was estimated at USD 1.88 billion. The report covers the Insect-Based Ingredients Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Insect-Based Ingredients Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Insect-Based Ingredients Market Report

Statistics for the 2025 Insect-Based Ingredients market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Insect-Based Ingredients analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.