Industrial X-ray Inspection Equipment and Imaging Software Market Size

Industrial X-ray Inspection Equipment and Imaging Software Market Analysis

The Industrial X-ray Inspection Equipment and Imaging Software Market is expected to register a CAGR of 7.7% during the forecast period.

- Computed Tomography (CT) has found an increasing acceptance in the manufacturing landscape, particularly in the electronics industry, largely due to the evolution of components in focal point sizes and which need advanced inspection systems.

- Increasing number of semiconductor fabrication plants or fabs are expected to drive the demand for X-ray inspection equipment, especially in Asia-Pacific. For instance, in 2019, Screen Holdings, a semiconductor and electronics company (headquartered in Japan), announced the completion of its manufacturing facility, to produce semiconductor equipment.

- According to Shin-Etsu Micro Inc., by 2019, the total number of 300 mm foundries reached 155, opening several opportunities for the X-ray inspection equipment and imaging software market.

- The oil and gas industry remains one of the most prominent industries in the market and is expected to retain its position over the forecast period. Asset protection of aging infrastructure, in contrast to new investments in equipment, due to the plummeting crude oil prices, is driving the radiography market in the oil and gas industry.

- The recent COVID-19 outbreak in China could bring instability in the supply chain of the market; however, according to the latest updates, many companies have restored or will restore their manufacturing operations soon. For instance, in April 2020, Europe-based Detection Technology PLC announced the official production launch at its new production and service site in the Greater Shanghai area.

Industrial X-ray Inspection Equipment and Imaging Software Market Trends

Recovering Demand from Oil and Gas Industry will Drive the Market

- Oil and gas is one of the largest end users of the x-ray inspection equipment and imaging software market. The demand for inspection services from the sector is growing rapidly led by North America.

- For example, in North America, the oil and gas output in both Canada and the United States has grown rapidly in the past few years. In fact, the International Energy Agency predicts that the United State alone is likely to add about 3.7 million barrels of crude oil per day (mb/d) between now and 2023.

- Pipeline construction projects, such as Keystone XL Pipeline by TransCanada, Permian Basin to Cushing Pipeline by Plains All American Pipeline LP, Cactus II Pipeline in Texas, Cimarron Express Pipeline in Oklahoma, EPIC Crude Oil Pipeline in Texas, New Mexico, Gray Oak Pipeline in Texas, Roanoke Expansion Project by Kinder Morgan, and Plantation Pipe Line Co., are some of the projects that are destined to be completed by the first half of 2020. Such projects are expected to create a considerable demand for inspection and imaging systems as a part of safety measures in the United States, over the next few years.

- However, given the COVID situations, the oil and gas companies are cutting down on investments, as a response to the depressed oil prices, and revenue, and production declines. These factors are likely to continue to present major challenges for oil and gas companies for a short term.

Asia-Pacific is Expected to Hold the Largest Market Share

- Heightened global security threats and higher defense spending from major regional powers, such as China, India, and Japan, are likely to drive the global defense sector’s revenue growth. The region accounts for more than a fifth of the global defense budget and is expected to grow further.

- In the automotive segment, Chinese production grew only moderately in 2018, reaching a total of 23.7 million passenger cars. China maintained its leading position in the industry among the global passenger car producers, accounting for 29% of all the cars produced around the world.

- The Government of Japan is encouraging its energy companies to increase exploration and development projects around the world, due to low domestic production in the country, in order to secure a stable supply of oil and natural gas. Furthermore, the Japanese inspection market is very competitive and is experiencing stable growth due to the regulations.

- Moreover, India has planned to invest in the indigenous Nuclear Power Program, by building 10 new reactors of 700 MWe. Also, the country is developing a Russian designed International Reactor in Kudankulam. This is providing an opportunity for the X-ray inspection vendors in the proliferating Indian nuclear energy market.

- All above factors will aid in driving the demand for industrial X-ray inspection equipment and imaging software in the region during the forecast period.

Industrial X-ray Inspection Equipment and Imaging Software Industry Overview

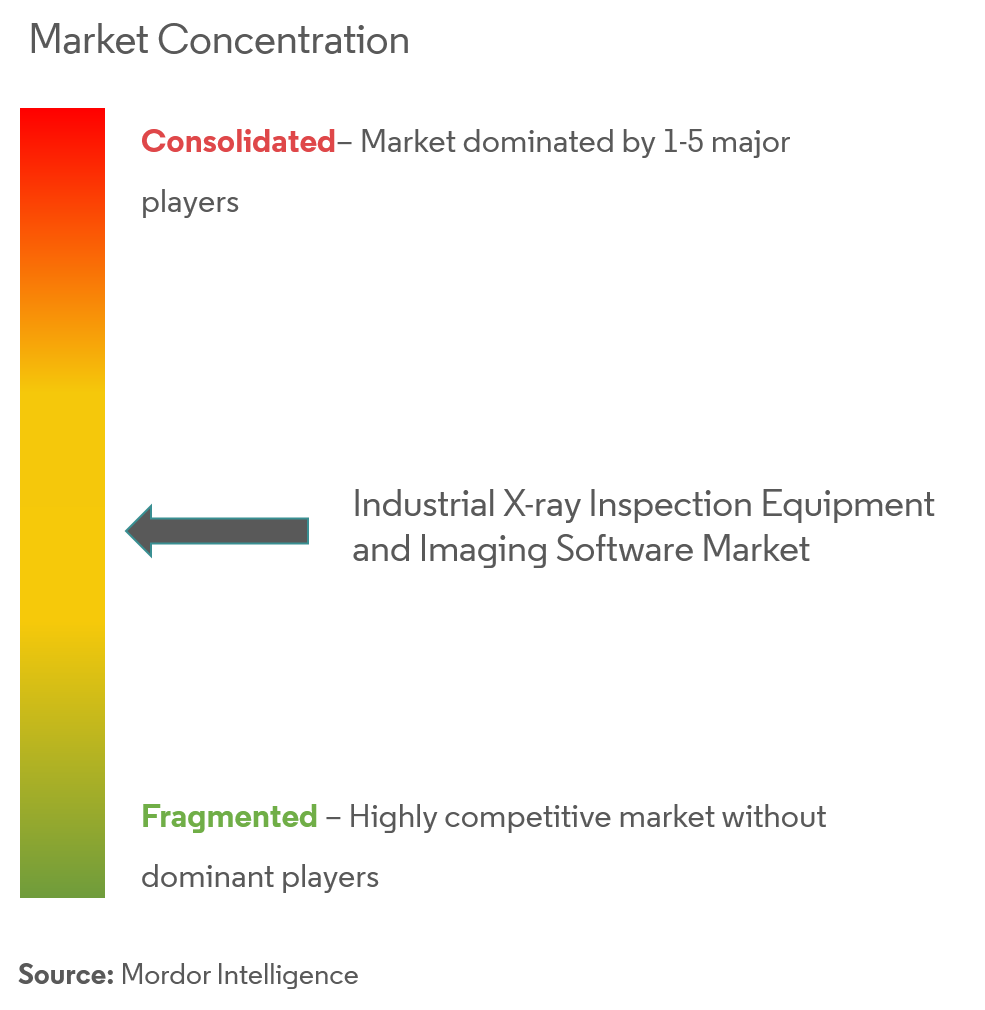

The industrial X-ray inspection equipment and imaging software market appears to be moderately concentrated and is moving towards the fragmented market, due to the decreasing initial investments required for manufacturing and reverse engineering. Some of the key players in the market include North Star Imaging Inc., General Electric Company, Nikon Corporation, YXLON International, among others.

- October 2019 - ULC partnered with Nikon to launch a EUR 4.8 million prosperity partnership, which aims to combine new techniques to gain more information from X-rays, improving disease detection and industrial testing. The five-year initiative is funded by the Engineering and Physical Science Research Council (EPSRC), and is anticipated to put the UK at the forefront of X-ray imaging (XRI), which plays an important role in a range of sectors and industries, from medicine to security, manufacturing, aerospace, and cultural heritage.

- June 2019 - Baker Hughes, a GE company, planned to open a new Customer Solutions Center (CSC) in Silicon Valley for its Inspection Technologies (IT) business. The BHGE Silicon Valley CSC, located in San Jose, Calif., may bring BHGE's most advanced non-destructive testing technologies under one roof. The BHGE Silicon Valley CSC is likely to provide customers for X-ray and computed tomography (CT) machine demonstrations, application development, industrial inspection services, and training.

Industrial X-ray Inspection Equipment and Imaging Software Market Leaders

-

YXLON International

-

General Electric Company

-

Nikon Corporation

-

North Star Imaging Inc.

-

Carestream Health Inc.

- *Disclaimer: Major Players sorted in no particular order

Industrial X-ray Inspection Equipment and Imaging Software Industry Segmentation

X-ray technology has been commonly associated with the healthcare and R&D sectors for several years. However, in recent times, technology has expanded into the manufacturing environments, which is helping several end-user industries improve the quality of production. Industrial x-ray is a method of non-destructive testing where many types of manufactured components can be examined to verify the internal structure and integrity of the specimen.

| Offering | Equipment |

| Software | |

| Technology | Film Radiography |

| Computed Radiography | |

| Direct Radiography | |

| Computed Tomography | |

| End-user Industry | Aerospace |

| Food Industry | |

| Construction | |

| Oil and Gas | |

| Automotive and Manufacturing | |

| Energy and Power | |

| Semiconductor and Electronics | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East and Africa |

| Equipment |

| Software |

| Film Radiography |

| Computed Radiography |

| Direct Radiography |

| Computed Tomography |

| Aerospace |

| Food Industry |

| Construction |

| Oil and Gas |

| Automotive and Manufacturing |

| Energy and Power |

| Semiconductor and Electronics |

| Other End-user Industries |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East and Africa |

Industrial X-ray Inspection Equipment and Imaging Software Market Research FAQs

What is the current Industrial X-ray Inspection Equipment and Imaging Software Market size?

The Industrial X-ray Inspection Equipment and Imaging Software Market is projected to register a CAGR of 7.7% during the forecast period (2025-2030)

Who are the key players in Industrial X-ray Inspection Equipment and Imaging Software Market?

YXLON International, General Electric Company, Nikon Corporation, North Star Imaging Inc. and Carestream Health Inc. are the major companies operating in the Industrial X-ray Inspection Equipment and Imaging Software Market.

Which is the fastest growing region in Industrial X-ray Inspection Equipment and Imaging Software Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Industrial X-ray Inspection Equipment and Imaging Software Market?

In 2025, the Asia Pacific accounts for the largest market share in Industrial X-ray Inspection Equipment and Imaging Software Market.

What years does this Industrial X-ray Inspection Equipment and Imaging Software Market cover?

The report covers the Industrial X-ray Inspection Equipment and Imaging Software Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Industrial X-ray Inspection Equipment and Imaging Software Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Industrial X-ray Industry Report

Statistics for the 2025 Industrial X-ray Inspection Equipment and Imaging Software market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Industrial X-ray Inspection Equipment and Imaging Software analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.