Industrial Direct Radiography Market Size and Share

Industrial Direct Radiography Market Analysis by Mordor Intelligence

The Industrial Direct Radiography Market is expected to register a CAGR of 8.3% during the forecast period.

- Increased demand for image precision and thus electronic transfer of those images is driving the market growth. It leads to reduced cost for image transport from one site to another. It also causes considerable savings on image archiving, retrieval and storage. There is no handling of physical images thus no chances of image degradation.

- High setup cost is one of the challenging factors which is restraining the market growth. The initial cost of equipment is high as compared to conventional radiography.

Global Industrial Direct Radiography Market Trends and Insights

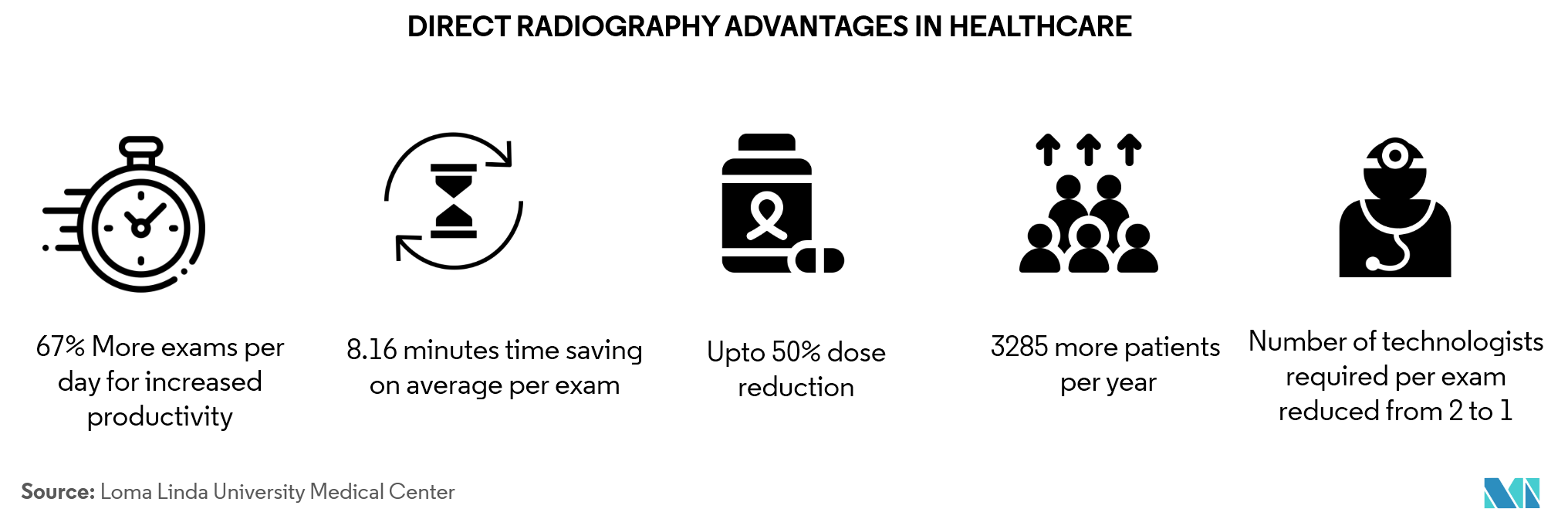

Healthcare to Witness the Highest Growth

- There are many benefits of direct radiography to the healthcare industry. The physician can view the image on his mobile device and the same can be seen simultaneously by physicians who are kilometers apart.

- The American Dental Association has developed recommendations for dental radiographic examinations in partnership with FDA for strengthening the dentist's judgment. ADA has also collaborated with more than 80 health care organizations to promote Image Gently, an initiative to “child-size” radiographic examination of children in medicine and dentistry.

- Three healthcare systems across the United States selected Fujifilm's Digital Radiography Solutions for enhancing imaging capabilities and patient outcomes in April 2018. This signifies an increasing trend of healthcare facilities towards adoption of digital radiography.

- To remain competitive, players are coming out with offerings and innovations which are changing the market landscape. In April 2019, Samsung's new image post-processing engine (IPE), S-Vue 3.02, received FDA clearance. The software is a part of the company's digital radiography (DR) machines – GC85A and GM85 which lowers the dose of digital radiography while producing the same image quality.

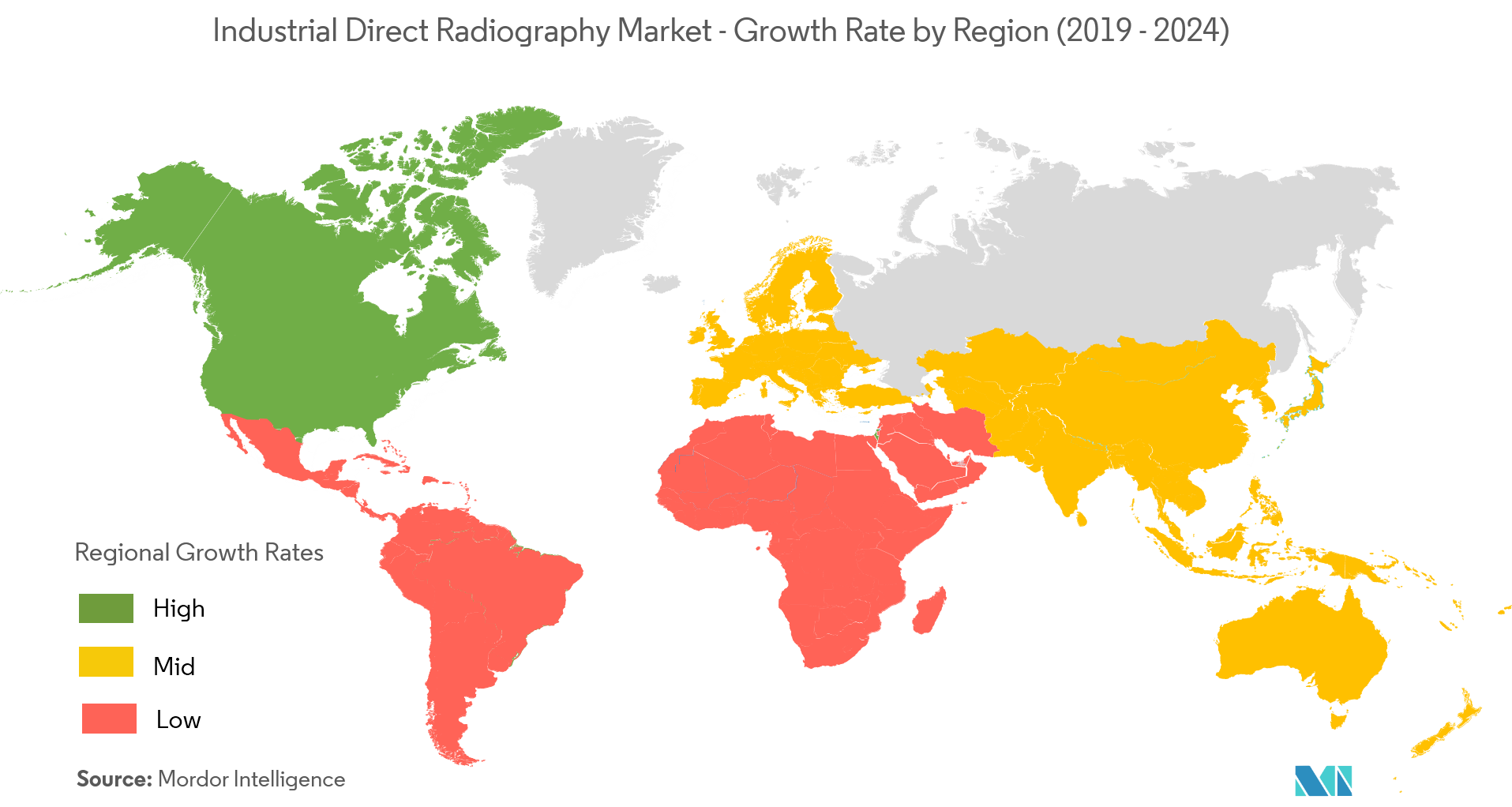

North America to Dominate the Market

- North America market has the largest market share due to increasing demand from healthcare industry and supporting government regulations.

- Healthcare facilities are increasingly adopting mobile radiographic equipment. For instance, UCHealth Greeley Hospital became the first facility in the US in August 2019 to adopt the Mobilett Elara Max mobile X-ray system from Siemens Healthineers. An year before, at the Opelousas General Health System (OGHS) at Louisiana, Visaris Americas installed fully robotic, Vision C ceiling-suspended digital X-ray suite.

- In 2019 Shimadzu Medical Systems USA received U.S. Food and Drug Administration(FDA) clearance for the FluoroSpeed X1 patient side conventional radiographic fluoroscopy (RF) table system. This indicates growing FDA's interest towards radiography equipment.

- Innovations are also being witnessed in the region related to healthcare. Towards the end of 2018, Konica Minolta Healthcare launched Dynamic Digital Radiography or X-Ray in Motion which is enabling to bring digital radiography to life by visualizing movement using conventional X-ray.

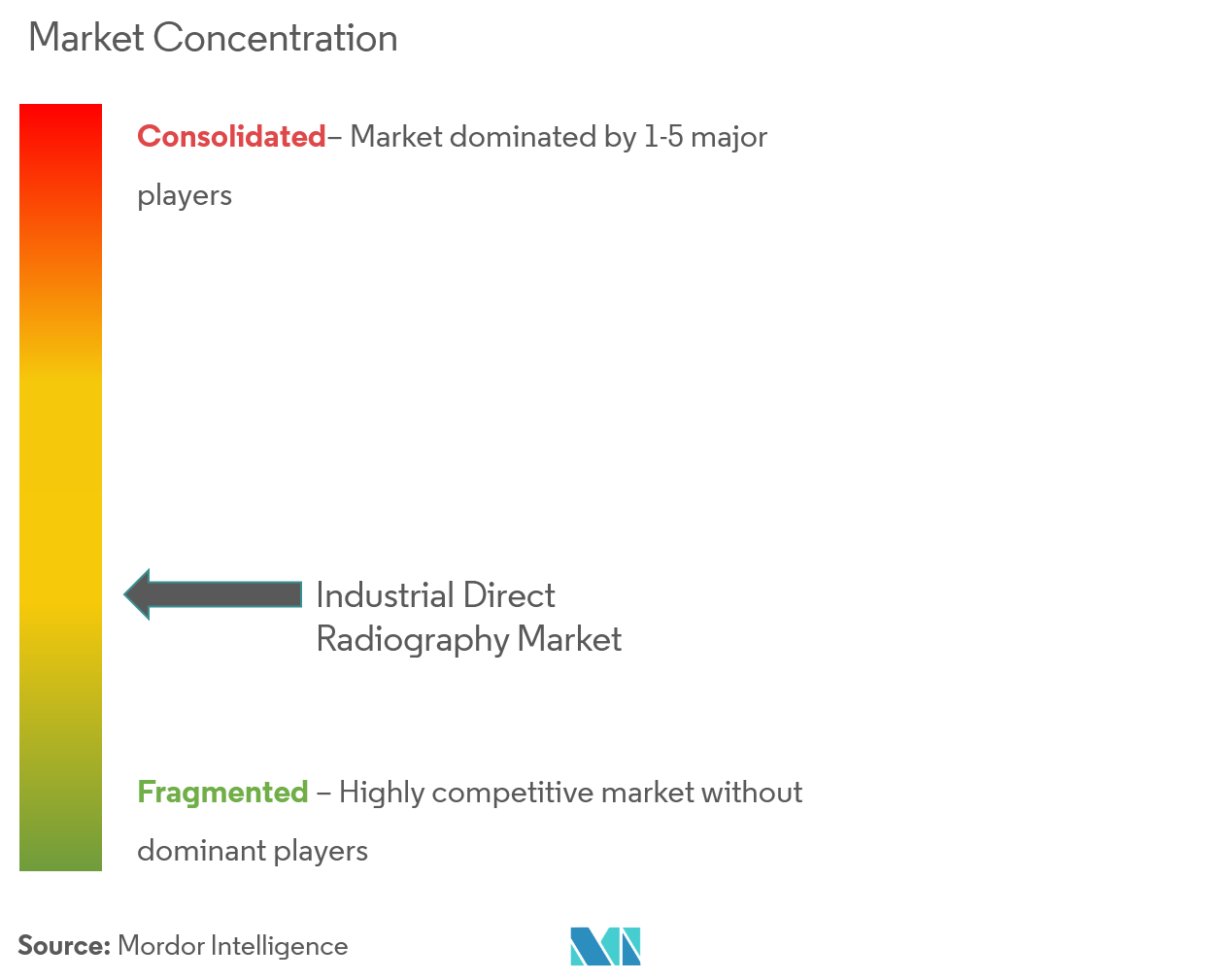

Competitive Landscape

The market for direct radiography is moving towards fragmented end due to demand from various industries forincreased productivityand reduced safety hazards. The companies are shifting their focus from conventional radiography to digital.

- February 2019 -Varex Imaging Corporationshowcasing its latest X-ray tubes, digital flat panel detectors (FPDs), connect and control devices and software solutions at the European Congress of Radiology (ECR) inVienna, Austria.

- November 2018 - Agfa US Corp wasawarded a group purchasing agreement with Premier. This allowed Premier to take advantage of special pricing of Agfa'scomprehensive line of Direct Radiography (DR) systems.

- November 2018 - Durr NDT releasedDRC 2430 NDT flat panel detectorfor maximum portability and the harsh conditions of field radiography. Itcan also be used with both X-rays and gamma sources.

Industrial Direct Radiography Industry Leaders

-

Durr NDT GmbH & Co. KG

-

Intertek Group Plc

-

Mistras Group, Inc.

-

TWI Global

-

OR Technology

- *Disclaimer: Major Players sorted in no particular order

Global Industrial Direct Radiography Market Report Scope

Direct radiography, also known as direct digital radiography uses x-ray sensitive plates to capture data during patient examination and transfers it to computer system. Its widespread uses include corrosion detection & measurement,Wall Thickness Measurement and Valve Inspection to be used in industries such as petrochemical, aerospace, chemical, military, construction and healthcare.

| Healthcare |

| Petrochemical |

| Aerospace |

| Chemical |

| Military |

| Construction |

| Other End-user Industries |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By End-user Industry | Healthcare |

| Petrochemical | |

| Aerospace | |

| Chemical | |

| Military | |

| Construction | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Industrial Direct Radiography Market size?

The Industrial Direct Radiography Market is projected to register a CAGR of 8.3% during the forecast period (2025-2030)

Who are the key players in Industrial Direct Radiography Market?

Durr NDT GmbH & Co. KG, Intertek Group Plc, Mistras Group, Inc., TWI Global and OR Technology are the major companies operating in the Industrial Direct Radiography Market.

Which is the fastest growing region in Industrial Direct Radiography Market?

North America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Industrial Direct Radiography Market?

In 2025, the North America accounts for the largest market share in Industrial Direct Radiography Market.

What years does this Industrial Direct Radiography Market cover?

The report covers the Industrial Direct Radiography Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Industrial Direct Radiography Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Industrial Direct Radiography Market Report

Statistics for the 2025 Industrial Direct Radiography market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Industrial Direct Radiography analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.