India Structural Steel Fabrication Market Analysis

The India Structural Steel Fabrication Market is expected to register a CAGR of 8.71% during the forecast period.

- Despite being hit by Covid-19, the construction industry has done well. The steel sector contributed around 1.5% to India's GDP and is one of the core sectors, forming the backbone of the economy and providing direct and indirect employment to around 25,000 people. India is the world's third-largest steel pipe manufacturing center, accounting for 8-10% of steel pipe consumption.

- The Indian structural steel market is expected to witness significant growth during the forecasted period, owing to factors such as the increasing demand from the manufacturing sector, the rising preference toward pre-engineered buildings and components, and government initiatives for infrastructure development.

- The increase in steel prices due to the rise in the price of coking coal (the primary raw material used to manufacture steel) and the governmental regulations and restrictions on the manufacturing of steel to reduce adverse effects on the environment have been identified to be few of the major challenges faced by the structural steel fabrication market in India.

- Additionally, the booming commercial building sector, along with the Indian government's initiatives, such as an increase in the construction of green buildings, smart cities, and the Make in India scheme, are expected to boost the structural steel fabrication market in India.

- The National Steel Policy (NSP) (2017) was implemented to promote industry development and extend global benchmarks. This aspect is very important as the eastern part of the country could potentially add more than 75% of India's steel production capacity. With a capacity of 300 MT, more than 200 MT is expected to flow from the region by 2030-31.

India Structural Steel Fabrication Market Trends

Rising Demand for Pre-engineered Buildings and Components

- Structural steel is one of the major raw materials used to construct pre-engineered buildings. The pre-engineered buildings market in India is expected to register a CAGR of 11%-15% from 2017 to 2021, as the industry has been experiencing an increased focus from various end-user segments, such as automotive, power, logistics, pharmaceuticals, FMCG, and retail.

- The increase in focus is primarily due to the significant cost benefits and reduction in construction time of manufacturing plants, warehouses, etc., compared to the traditional construction model.

- The rising demand for pre-engineered buildings is expected to drive the market for structural steel fabrication during the forecast period.

- The increasing importance of green building construction is also an important factor contributing to the growth of PEB (Pre-Engineered Building) in India. Pre-engineered construction has a comparatively smaller impact on the environment compared to that of the conventional construction model.

- Additionally, the production method of steel used for these structures helps in substantially reducing greenhouse gas emission. Moreover, after demolition, pre-engineered buildings and components, which are 90% recyclable, do not have a significant impact on the environment to that of wastages, like asphalt, concrete, brick, and dust.

Increasing Number of Manufacturing Plants and Infrastructure Development Activities in India

- The rising demand in India, combined with the fact that global manufacturing companies focus on diversifying their production by setting up low-cost plants in countries other than China, is expected to drive India's manufacturing sector to grow more than six times by 2025 USD 1 trillion.

- For instance, the number of mobile manufacturing plants in India has increased more than 60 times since 2014. This shows the increasing demand for structural steel fabrication due to the increasing number of manufacturing units in the country.

- The infrastructure development activities by the Government of India are the major driving factors expected to boost the Indian structural steel fabrication market over the next few years.

- Government initiatives, such as the construction of metro stations, new no-frill airports, international terminals, industry corridors, power plants, and ports, require heavy steel structures. Thus, these factors are expected to drive the growth of the structural steel fabrication market in India.

- Moreover, the construction and infrastructure sector is the largest end-user segment in India. In 2021, the construction and infrastructure sector accounted for the major share of 62% of the overall Indian steel market.

- In the 2021 financial year, more than INR 3 trillion (USD 36.26 billion) in infrastructure investment had flowed into the manufacturing sector across India. In addition, INR 2.2 crore (USD 265, 923) was invested for the construction and maintenance of roads.

- As part of the National Infrastructure Pipeline (NIP), the Indian government has increased its infrastructure investment since 2019. In addition, it also wants to raise private funding for infrastructure projects.

India Structural Steel Fabrication Industry Overview

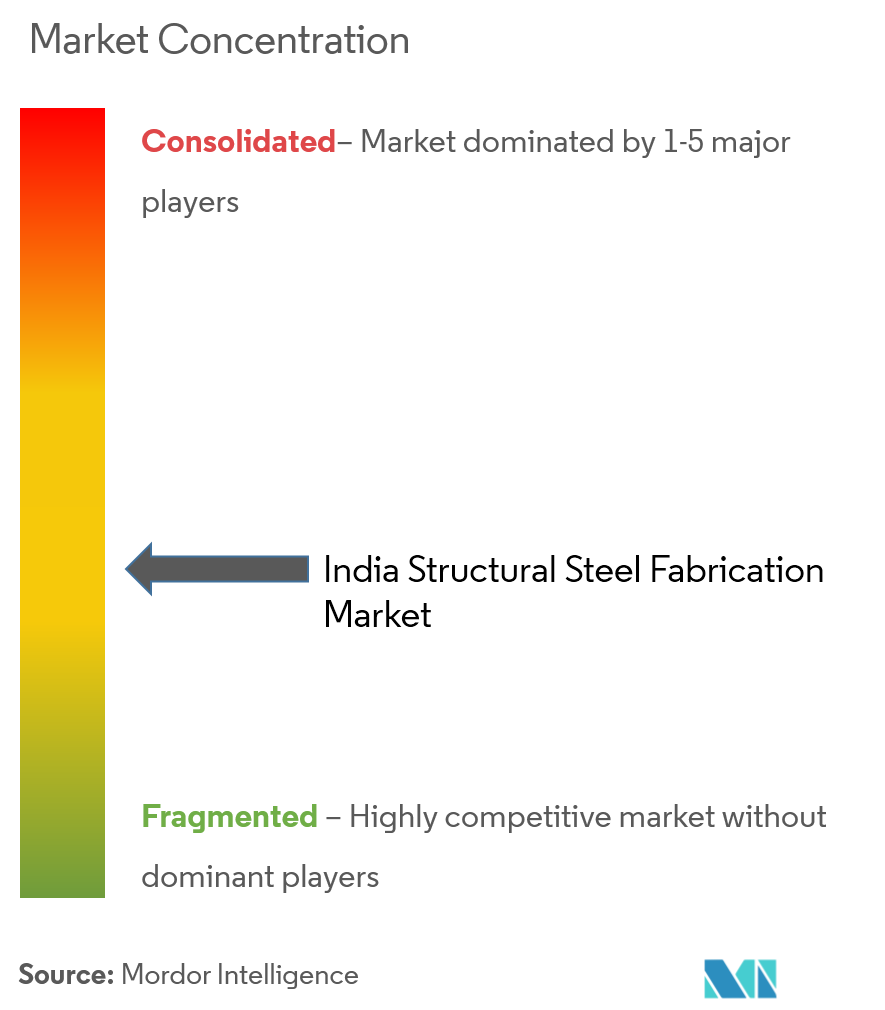

The report covers the major players operating in India's structural steel fabrication market. In terms of market share, the market is fragmented, with many small and medium-sized players.

India Structural Steel Fabrication Market Leaders

-

Onshore Construction Company Private Limited

-

Geodesic Techniques Private Limited

-

Sharp Tanks And Structurals Private Limited

-

UB Engineering Limited

-

Space Chem Engineers Private Limited

- *Disclaimer: Major Players sorted in no particular order

India Structural Steel Fabrication Market News

- April 2023: AM Mining, a joint venture between Arcelor Mittal Luxembourg and Nippon Steel Corporation, Japan to acquire Indian Steel Corpn for INR 897 crore. The acquisition of Indian Steel Corporation will likely enhance downstream capabilities and broaden its product portfolio as the company looks to capitalize on market opportunities presented by the steel industry, especially in high-value-added steel production besides capturing synergies across downstream operations.

- November 2022: AM Mining India completed the acquisition of Uttam Galva Steels. AM Mining India is a joint venture between ArcelorMittal and Nippon Steel. ArcelorMittal is a world-leading steel and mining company based in Luxembourg. Japan's Nippon Steel, on the other hand, is one of the world's leading integrated steel producers.

India Structural Steel Fabrication Industry Segmentation

Structural steel manufacturing is a multi-faceted process of cutting, bending, and assembling steel for the purpose of producing the final structural product. This report aims to provide a detailed analysis of the Indian structural steel fabrication market.

It focuses on market dynamics, technological trends, and insights into various end-user industries and product types. Moreover, it analyzes the major players and competitive landscape in the Indian structural steel fabrication market.

The India Structural Steel Fabrication Market is segmented by End-user Industry (Manufacturing, Power and Energy, Construction, Oil and Gas, Others and Product Type (Heavy Sectional Steel, Light Sectional Steel, and Others). The report offers the market sizes and forecasts for the India Structural Steel Fabrication market in value (USD) for all the above segments.

| End-user Industry | Manufacturing |

| Power and Energy | |

| Construction | |

| Oil and Gas | |

| Other End-user Industries | |

| Product Type | Heavy Sectional Steel |

| Light Sectional Steel | |

| Other Product Types |

India Structural Steel Fabrication Market Research FAQs

What is the current India Structural Steel Fabrication Market size?

The India Structural Steel Fabrication Market is projected to register a CAGR of 8.71% during the forecast period (2025-2030)

Who are the key players in India Structural Steel Fabrication Market?

Onshore Construction Company Private Limited, Geodesic Techniques Private Limited, Sharp Tanks And Structurals Private Limited, UB Engineering Limited and Space Chem Engineers Private Limited are the major companies operating in the India Structural Steel Fabrication Market.

What years does this India Structural Steel Fabrication Market cover?

The report covers the India Structural Steel Fabrication Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the India Structural Steel Fabrication Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Structural Steel Fabrication in India Industry Report

Statistics for the 2025 India Structural Steel Fabrication market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. India Structural Steel Fabrication analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.