In-Vitro Diagnostics Packaging Market Analysis

The IVD Packaging Market is expected to register a CAGR of 4.5% during the forecast period.

- The rapidly-rising practice of self-testing by the people, an increasing number of point-of-care testing, increased government expenditures on healthcare, growing awareness of personalized medicine, and the increasing number of chronic diseases are some of the major factors boosting the growth of the in vitro diagnostics (IVD) packaging market.

- The importance of IVD packaging is increasing in the healthcare sector, owing to the demand for faster diagnosis time and increased volume of samples obtained by the automation devices. This has resulted in the increased usage of IVD devices in hospitals.

- Other contributing factors boosting the growth of the market include the pressure from the governments and industries across the world, to comply with the set regulations, due to the increasing demand for integrated healthcare systems. For instance, the FDA uses a risk-based regulatory scheme for medical devices (including IVDs).

In-Vitro Diagnostics Packaging Market Trends

Laboratories Segment to Witness High Growth

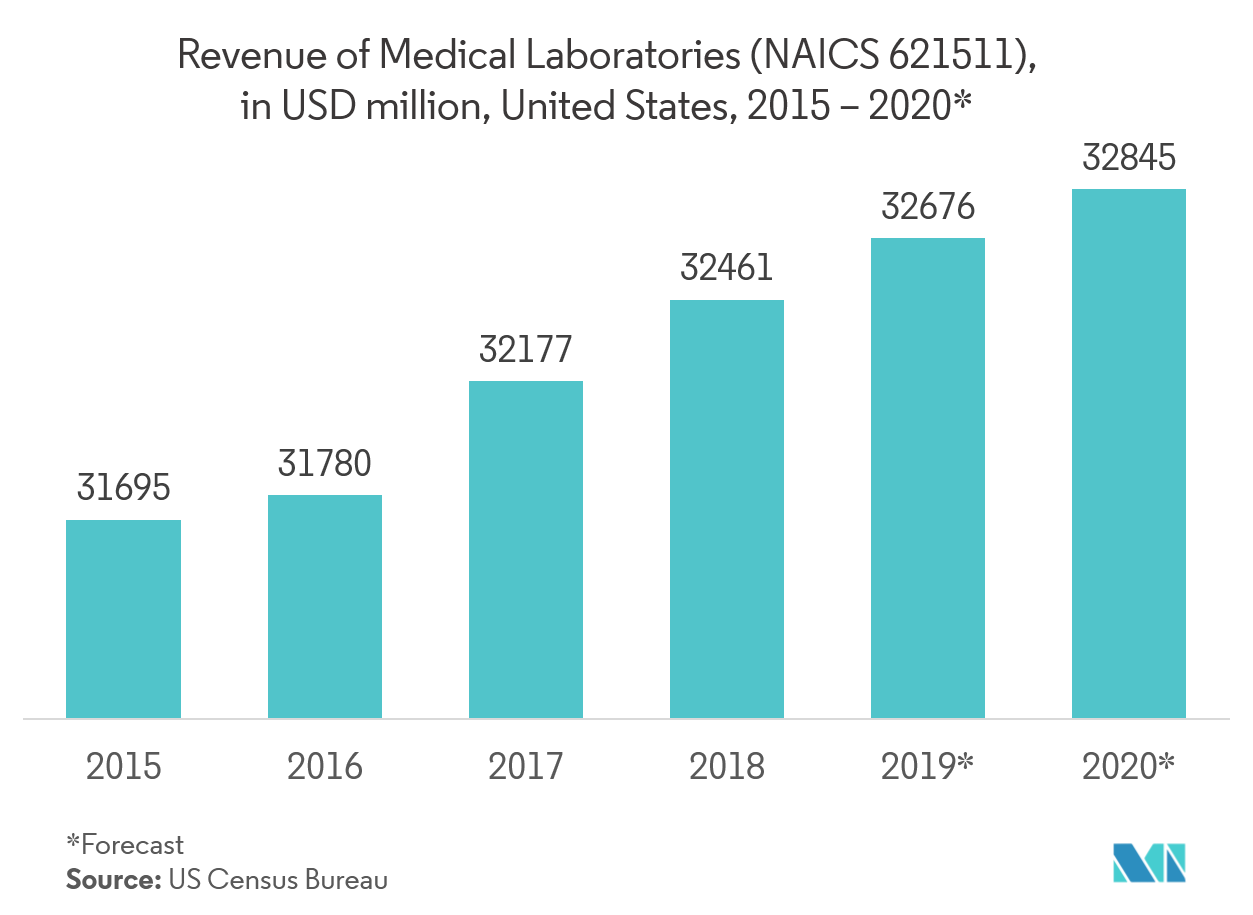

- As the hospitals and laboratories are some of the major consumers of in vitro diagnostic devices, the increasing revenues of these sectors are also expected to develop the market for IVD packaging across the world.

- With the shift from the legacy systems to the commercial solutions favored by the laboratories, the market is expected to grow further as they provide a flexible and reliable method to manage data, resources, and workflows.

- Many governments across the world are also regulating policies for laboratories having IVDs. For instance, in May 2018, Australia’s Therapeutic Goods Administration (TGA) unveiled guidance for laboratories to meet in vitro diagnostics (IVD) regulatory requirements.

- Moreover, the ongoing shift toward personalized medical devices is expected to create a demand for IVD devices. Also, the innovations in IVD devices are likely to accelerate the demand for IVD packaging during the forecast period.

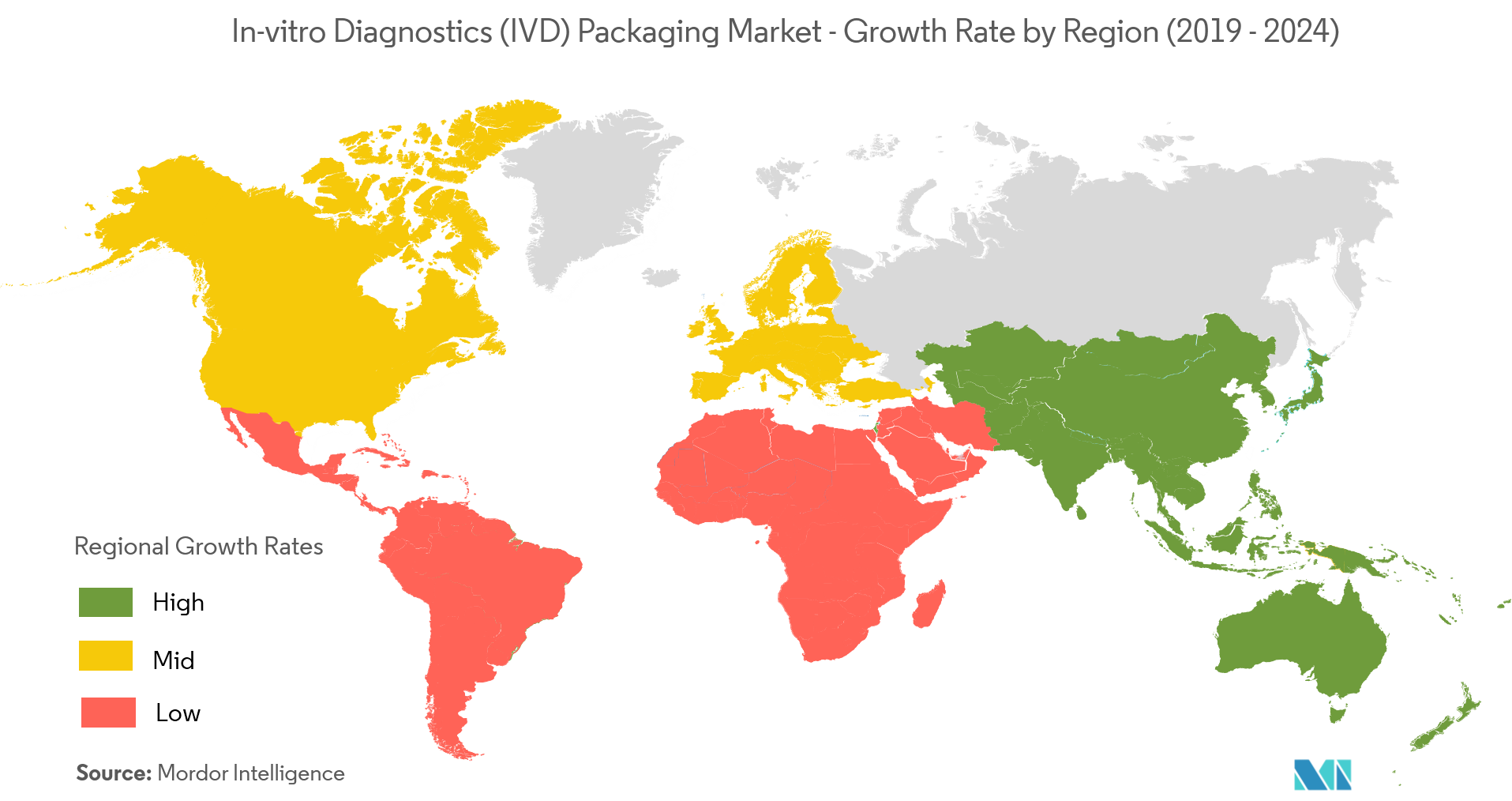

Asia-Pacific to Witness High Growth

- The Chinese government is increasing China’s healthcare expenditure, primarily to focus on public health. With the increasing number of hospitals in China, it is justifying the investment in public health initiative, which is driving the market in this region.

- Moreover, Japan has faced the challenges of shrinking and aging population for several years. The latest population estimate by the Health, Labor, and Welfare Ministry, released in December 2018, points to the rapid decline of Japan’s population with fewer births. The number of babies born in the country, in 2018, is estimated at 921,000, which is 25,000 less than the previous year and falling short of one million for the third year in a row. These circumstances in the country have accelerated healthcare spending in the region.

- India is also considered as a lucrative market for generic R&D activities and manufacturing of pharmaceuticals, owing to its strong capabilities across the value chain. Moreover, India's competitive advantage also resides in the magnified success rate of Indian companies in getting the Abbreviated New Drug Application (ANDA) approvals, which is boosting the market growth.

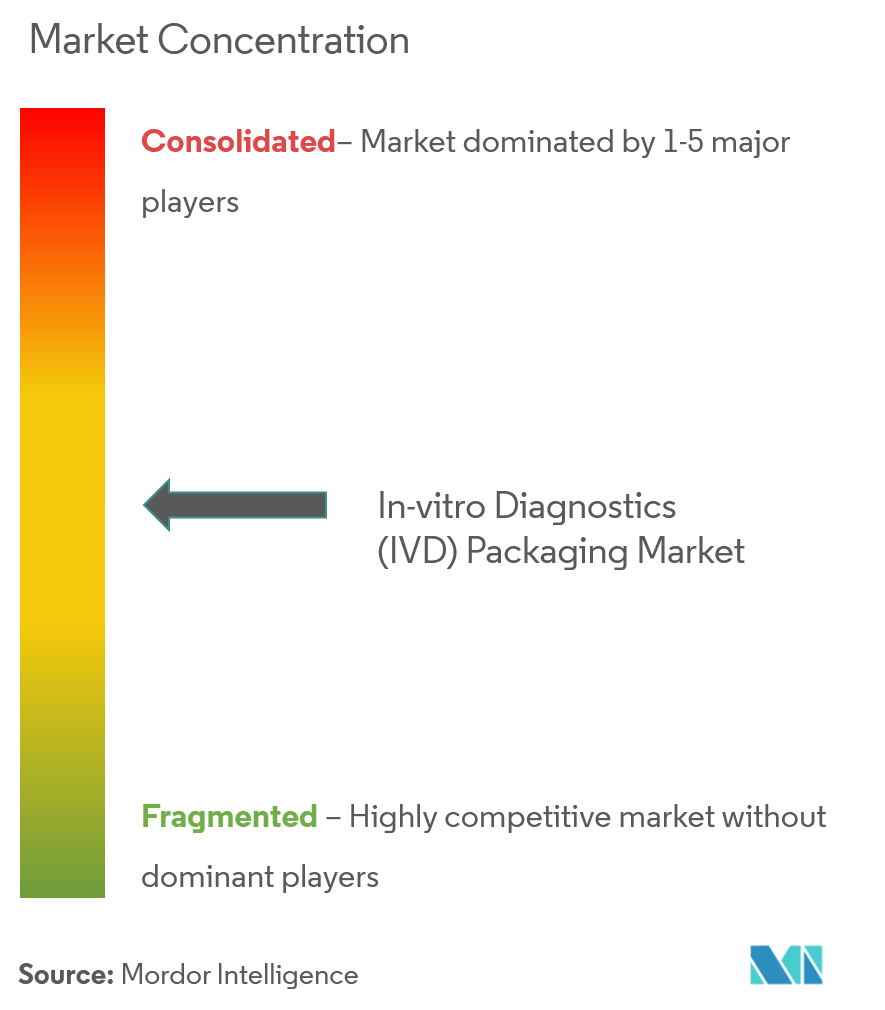

In-Vitro Diagnostics Packaging Industry Overview

The in vitro diagnostics (IVD) packaging market is competitive due to the presence of many players running their business in both the domestic and international markets. The market is moderately concentrated with the major players adopting strategies, like product innovation and mergers and acquisitions. Some of the major players in the market areAmcor Limited,Aptargroup Incorporated,and Thermo Fisher Scientific Incorporated, among others.

- June 2019 - Amcor announced the successful completion of its acquisition of Bemis Company Inc.The combined company will now operate as Amcor Plc (Amcor).The acquisition of Bemis brings additional scale, capabilities, and footprint that will strengthen Amcor’s industry-leading value proposition.

In-Vitro Diagnostics Packaging Market Leaders

-

Amcor Limited

-

Aptargroup Incorporated

-

Thermo Fisher Scientific Incorporated

-

Corning Incorporated

-

DWK Life Sciences

- *Disclaimer: Major Players sorted in no particular order

In-Vitro Diagnostics Packaging Industry Segmentation

In vitro diagnostics are tests done on samples, such as blood or tissue, that are taken from the human body. In vitro diagnostics can detect diseases or other conditions, and can also be used to monitor a person’s overall health to help cure, treat, or prevent diseases.

| By Product | Bottles |

| Vials | |

| Tubes | |

| Closures | |

| Other Product Types | |

| By End User | Hospitals |

| Laboratories | |

| Academic Institutes | |

| Other End Users | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

In-Vitro Diagnostics Packaging Market Research FAQs

What is the current IVD Packaging Market size?

The IVD Packaging Market is projected to register a CAGR of 4.5% during the forecast period (2025-2030)

Who are the key players in IVD Packaging Market?

Amcor Limited, Aptargroup Incorporated, Thermo Fisher Scientific Incorporated, Corning Incorporated and DWK Life Sciences are the major companies operating in the IVD Packaging Market.

Which is the fastest growing region in IVD Packaging Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in IVD Packaging Market?

In 2025, the North America accounts for the largest market share in IVD Packaging Market.

What years does this IVD Packaging Market cover?

The report covers the IVD Packaging Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the IVD Packaging Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

In Vitro Diagnostics Plastics Industry Report

Statistics for the 2025 IVD Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. IVD Packaging analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.