IC (Integrated Circuit) Socket Market Analysis

The IC Socket Market is expected to register a CAGR of 9.11% during the forecast period.

- The major characteristic requirements for test sockets by IC manufacturers in the current market is long insertion life without contact degradation. However, a long-life, high-performance IC test socket is at least ten times costlier. Providing for a removable interface is a significant reason for using a test socket and is essential for ease of assembly and cost savings in the IC manufacturing process.

- With growing advanced applications, more and more functions are integrated into ICs with size reduction; hence, there is increased demand for higher frequency sockets to test larger BGA packages. IC tests are becoming a critical issue for the semiconductor industry. This places pressure on the testing supply chain and will result in new test & burn-in strategies, such as combining TBI and wafer-scale tests. IC packaging is also changing toward flip chips, and 3D chip packaging will also bring changes in the studied market.

- Also, the growing adoption of ICs in products that are used in a harsh environment is further driving the demand for burn-in test sockets. Till now, IC test sockets are majorly used for measuring electrical characteristics; however, growing adoption in applications like Electric Vehicles and DRAM in data centers servers, have also fuelled the demand for testing temperature reliability and durability of ICs. This is fuelling the demand for burn-in test sockets.

- Further, the advancements in the manufacturing process are also bringing development into the studied market. For instance, socket manufacturers invest tooling cost for generic packages and amortize the cost over tens of thousands of sockets. When it comes to custom packages, it is not profitable to invest initially and amortize over tens of thousands of sockets because the test need will be only for a few hundred sockets. Therefore, US-based Ironwood Electronics has developed a unique problem using a stamped spring pin contact technology that provides a robust solution for Burn-in & Test applications.

- Additionally, the increasing demand for power management and power-efficient products, and expanding industrial applications scope for analog ICs, are expected to drive the growth of burn-in test sockets over the forecast period.

IC (Integrated Circuit) Socket Market Trends

Consumer Electronics Segment is Expected to Have Significant Growth

- Consumer electronics lead the market on account of the massive sales of laptops, smartphones, PCs, tablets, and other consumer electronic devices that incorporate integrated circuits. These electronic appliances are manufactured with some simple or complex circuits. Electronic components in these circuits are connected by wires or conducting wires for the flow of electric current through the circuit's multiple components, such as resistors, capacitors, inductors, diodes, and transistors. Due to the increasing sales of consumer electronics, IC sockets are expected to witness a greater adoption in these devices.

- Sales growth in both smartphones and personal computing systems is being bolstered by increasing memory prices. However, the ongoing decline in shipments of standard personal computers, along with the slow growth of tablets, is aiding the mobile IC sales to override total personal computing sales over the forecast period.

- In the consumer electronics industry, the demand for more precise results, along with smaller chips, is rapidly increasing due to ascending profit margins and reduced transportation costs.

- With the miniaturization and fabrication of multiple technologies onto a single disk in consumer devices, like smartphones, tablets, wearable's, smart TVs, and gaming consoles, the need for IC's is expected to grow to evaluate the inputs into an actionable function, which can be then followed by the device. The rise in IoT also resulted in increased usage of chips for consumer electronic devices.

Asia-Pacific Expected to Have Significant Growth

- Asia-Pacific is expected to have significant growth in this market. Various companies have almost reduced the product development period by half, owing to the changing consumer demands. This trend requires companies to continuously design and test products, driving the adoption of IC sockets.

- Countries in the region, including China, have the most significant markets for the ICs and IC test sockets, owing to its dominance in the manufacturing of the global semiconductor industry, consumer electronic industry, and communication equipment, among others. The country is also one of the major investors in the global automotive manufacturing industry. Along with these, favorable government policies and initiatives and motivating many domestic players to increase their investment in the region.

- Further, the IC manufacturing business in China set to grow driven by a strong global IC market and increased market share. Growing government initiatives are also fuelling the domestic IC market. For instance, the Chinese government raised around USD 23 to 30 billion to pay for the second phase of its National IC Investment Fund. The National IC Investment Fund, or Big Fund, was introduced in 2014 to support the semiconductor sector, and since 2015 China's semiconductor industry has been thriving.

- Made in China 2025 policies clearly outline that the nation is aiming to raise its self-sufficiency rate for ICs to 40% in 2020 and 70% in 2025. Therefore, domestic China-sourced ICs will grow significantly over the next five years, especially for memory chips. More and more decisions made in China will be from local chip designers, which is beneficial for local vendors in the studied market. Such initiatives are expected to promote the demand for tests and burn ICs.

- Although, presently, the IC test sockets consumed in China are mostly supplied by foreign vendors. However, local suppliers will have more opportunities for sales of higher-margin products in the future. However, the pandemic COVID-19 led by disruptions in supply chain and manufacturing operation is expected to hinder the market growth temporally.

IC (Integrated Circuit) Socket Industry Overview

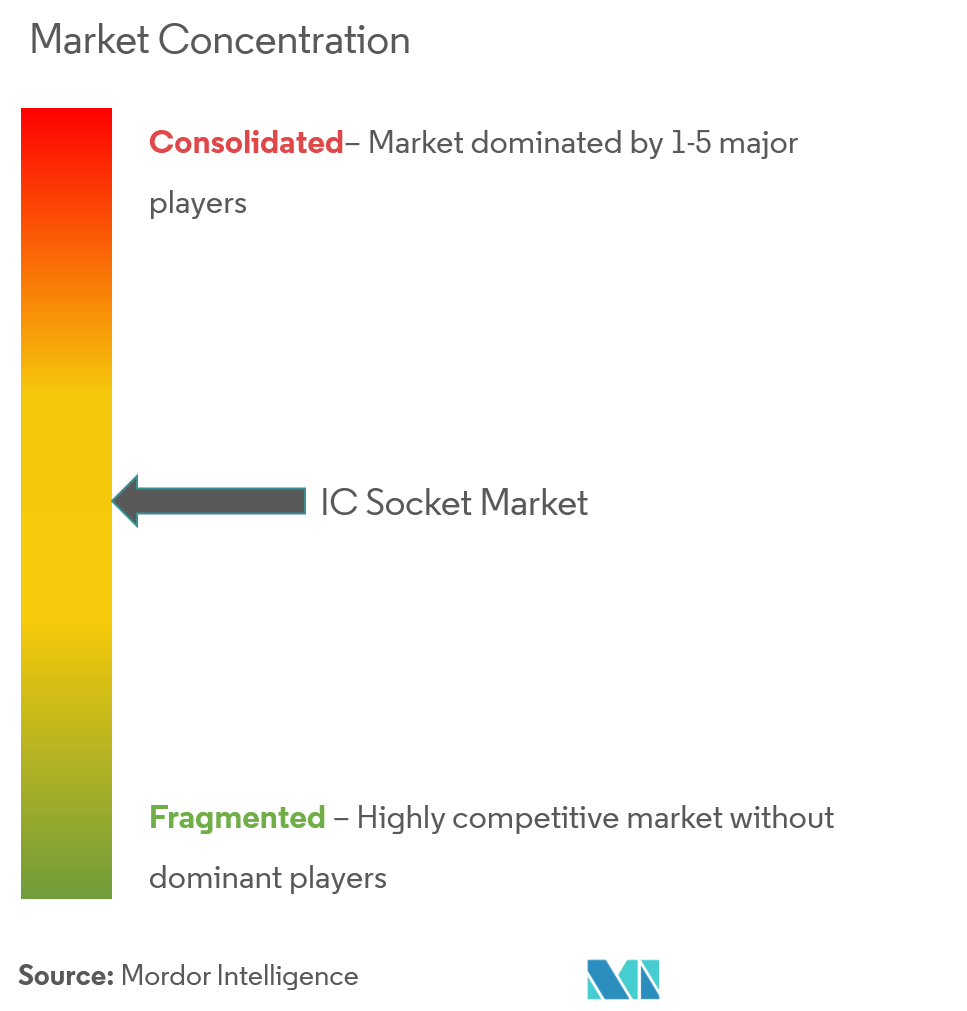

The IC Socket market is neither highly competitive nor has a limited number of players. The IC Socket market is witnessing many mergers and acquisitions among regional players. In the past few years, acquisitions have been one of the major growth strategies of the companies to increase their revenue share in the market.

- March 2020: TE Connectivity Ltd announced the acquisition of First Sensor AG. This tech startup primarily develops and produces sensors for applications, including advanced electronics, pressure, and photonics for industrial, transportation, and medical industry. This acquisition will allow the company to leverage its combined expertise to provide a broader range of products, including sensors, connectors, and sockets. The company aims to leverage the acquisition as part of the growth strategy.

IC (Integrated Circuit) Socket Market Leaders

-

TE Connectivity Ltd.

-

Smiths Interconnect Inc.

-

Yamaichi Electronics Co. Ltd.

-

Enplas Corporation

-

Leeno industrial Inc

- *Disclaimer: Major Players sorted in no particular order

IC (Integrated Circuit) Socket Industry Segmentation

An IC socket is deployed in devices that consist of an integrated circuit. It even acts as a placeholder for IC chips. The major role that an IC socket performs is of enabling secure removal and insertion of IC chips as IC chips may get impaired from heat due to soldering. The extended form of the IC socket is known as an integrated circuit socket. IC sockets have a wide range of applications attached to it. They are widely used in the applications where integrated circuit devices possess short lead pins. They are mostly discovered in desktop and server computers. They are also employed for prototyping new circuits as they enable easy and simple component swapping.

| By Application | Memory |

| CMOS Image Sensors | |

| High Voltage | |

| RF | |

| SOC,CPU,GPU,etc | |

| Other non-memory | |

| Geography | North America |

| Europe | |

| China | |

| Japan | |

| South Korea | |

| Taiwan | |

| Singapore | |

| Rest of the world |

IC (Integrated Circuit) Socket Market Research FAQs

What is the current IC Socket Market size?

The IC Socket Market is projected to register a CAGR of 9.11% during the forecast period (2025-2030)

Who are the key players in IC Socket Market?

TE Connectivity Ltd., Smiths Interconnect Inc., Yamaichi Electronics Co. Ltd., Enplas Corporation and Leeno industrial Inc are the major companies operating in the IC Socket Market.

Which is the fastest growing region in IC Socket Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in IC Socket Market?

In 2025, the North America accounts for the largest market share in IC Socket Market.

What years does this IC Socket Market cover?

The report covers the IC Socket Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the IC Socket Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

IC (Integrated Circuit) Socket Industry Report

The Market Report Covers Global IC Test Socket Manufacturers and is Segmented By Application (Memory, CMOS Image Sensor, High Voltage, RF, SOC, CPU, GPU) and Geography. Statistics for the IC Socket market share, size, and revenue growth rate, created by Mordor Intelligence™ Industry Reports. IC Socket analysis includes a market forecast outlook and historical overview. Get a sample of this industry analysis as a free report PDF download.

The market report provides comprehensive industry information and industry statistics on IC Test Socket manufacturers. The market forecast and market outlook indicate a positive market growth, driven by various applications such as Memory, CMOS Image Sensor, High Voltage, RF, SOC, CPU, and GPU. The report also highlights market leaders and market trends that are shaping the future of the IC Socket industry.

Through detailed industry analysis and market segmentation, the report offers valuable insights into the market value and market size. The industry research and market review provide a thorough understanding of the market dynamics, including market data and market predictions. The industry reports and research companies involved in the study ensure the accuracy and reliability of the market analysis.

The market overview and industry outlook presented in the report emphasize the significance of the IC Socket market in the global electronics industry. The report example and report PDF available for download offer a glimpse into the comprehensive research conducted. The industry sales and industry size are expected to witness significant growth, supported by the market trends and market segmentation.

In conclusion, the IC Socket market is poised for substantial growth, with a detailed market forecast and industry trends indicating a promising future. The industry reports and industry research provide a solid foundation for understanding the market dynamics, making this report an essential resource for stakeholders in the IC Socket industry.