Hydrophilic Coatings Market Analysis

The Hydrophilic Coatings Market is expected to register a CAGR of greater than 8% during the forecast period.

- On the flip side, high costs of hydrophilic coatings are likely to hinder the market

- Asia-Pacific dominated the market across the globe with the largest consumption from countries such as China and India.

Hydrophilic Coatings Market Trends

Medical Industry to Dominate the Market

- Hydrophilic coatings are heavily required for the manufacturing of medical devices. This is major because applying hydrophilic coatings on medical devices provides an evenly wet and lubricated surface.

- Additionally, the coating helps in the reduction of surface friction, as compared to an uncoated device surface.

- Various medical devices, such as catheters and guide wires, benefit from such surfaces since there is a reduction in the insertion force, which allows them to traverse the vasculature easily, and avoid abrasions between the vessel walls and device surfaces. It also reduces the occurrence of tissue damage.

- With the ongoing innovation and technological development in medical devices, the demand for catheters and guidewires has been continuously increasing. Due to this, the demand for hydrophilic coatings has increased from the medical sector, thus, providing a boost to the market.

- Moreover, owing to the increasing number of hospitals across the world, along with the increasing requirement of medical assistance, the demand and production of such medical devices have been growing at a strong pace.

- Currently, hospital projects have been increasing significantly in Asia-Pacific and Middle East & Africa, owing to the growing demand for medical assistance and limited healthcare infrastructure in these regions. Regions, like North America and Europe, are also witnessing new and expansion hospital projects, due to a growing aged population and the increasing need for medical assistance. For instance:

- In December 2018, Phase 2, Danat Al Emarat hospital expansion project of USD 81 million was planned in Abu Dhabi, the United Arab Emirates, which is expected to be completed by 2022

- Thus, with growth in medical device production, the demand for hydrophilic coatings from the medical device industry is likely to increase considerably during the forecast period.

China to Dominate the Asia-Pacific Region

- The medical sector is expected to have the highest demand for hydrophilic coatings in China, owing to heavy requirements for these coatings in medical devices.

- The rapid increase in expenditure on high-end medical devices, due to the continuous need for proper medical and healthcare facilities, increasing health awareness, and an aging population, is boosting the demand for hydrophilic coatings in the country.

- There has been a rapid increase in the expenditure of medical devices in China, along with various other investments in the medical industry of the country, in order to meet the medical demands of the aging population.

- Furthermore, automotive continues to remain the largest sector in the country, and it is reflecting positive signs for the near future. A large number of Tier one producers are either in the process of expanding their production or starting new production facilities in the country. According to the OICA, automotive production in China declined by 4.2% Y-o-Y in 2018, over 2017, reaching a total of 27,809,196 vehicles.

- By advocating the aforementioned trend, the country recorded over 29 million automobile production in 2017, which declined in 2018, due to the decreasing car sales as a result of the trade dispute with the United States.

- Additionally, China is on course to overtake the United States as the world's biggest air travel market within the next three years, and still, the country’s appetite for aviation continues to grow exponentially. At present, China needs 6,810 new aircraft in the next 20 years, with a total value of USD 1.025 trillion, owing to the rising passenger throughput.

- Hence, all such trends in the end-user industries are expected to drive the demand for hydrophilic coatings in the country during the forecast period.

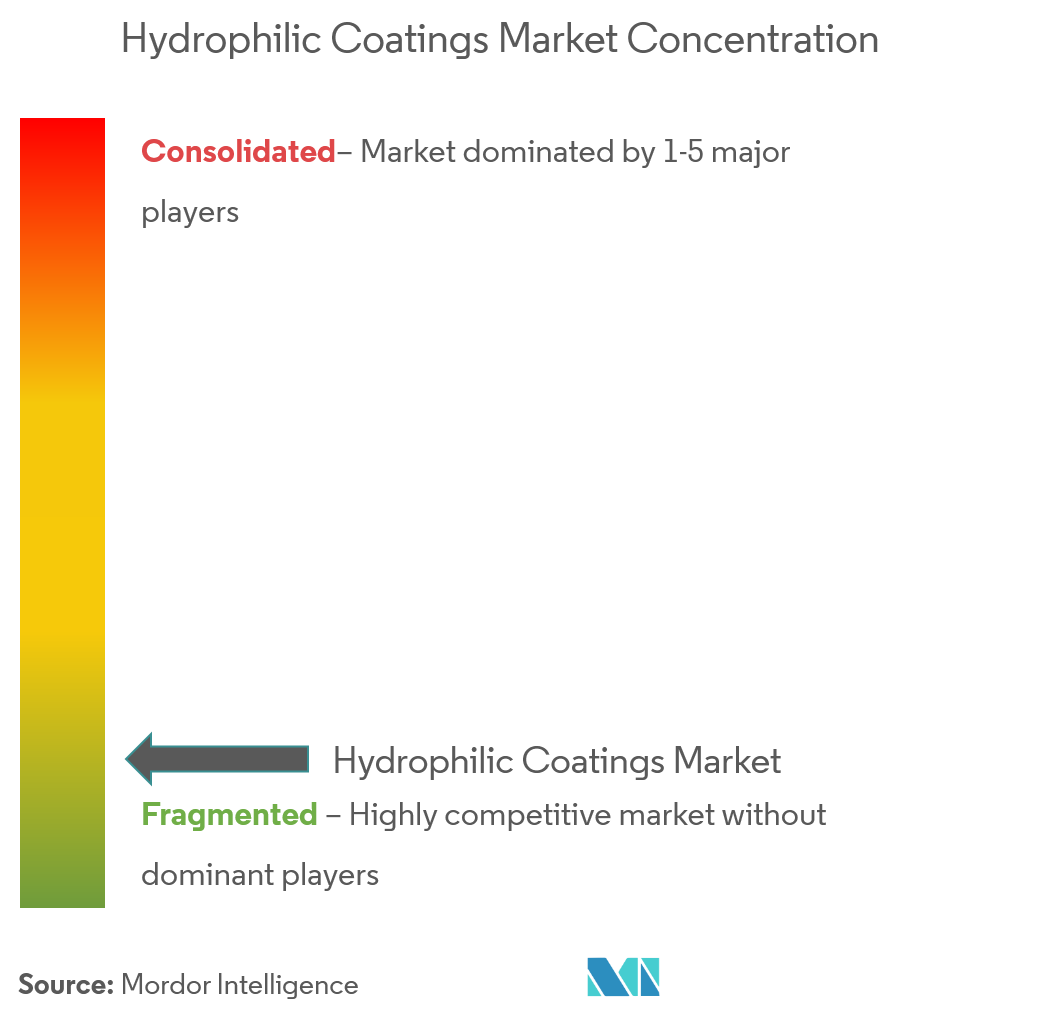

Hydrophilic Coatings Industry Overview

The global market for hydrophilic coatings is fragmented. The key players in the market include Aculon, Applied Medical Coatings, Corning Incorporated, Hdydromer Inc, DSM, among others.

Hydrophilic Coatings Market Leaders

-

Aculon

-

APPLIED MEDICAL COATINGS

-

Corning Incorporated

-

Hydromer Inc

- *Disclaimer: Major Players sorted in no particular order

Hydrophilic Coatings Industry Segmentation

The hydrophilic coatings market report includes:

| Substrate | Polymer | ||

| Glass/Ceramic | |||

| Metal | |||

| Nanoparticle | |||

| End-user Industry | Medical | ||

| Optics | |||

| Automotive | |||

| Transportation | |||

| Other End-user Industries | |||

| Geography | Asia-Pacific | China | |

| India | |||

| Japan | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| North America | United States | ||

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| Italy | |||

| France | |||

| Rest of Europe | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle East & Africa | Saudi Arabia | ||

| South Africa | |||

| Rest of Middle East & Africa | |||

Hydrophilic Coatings Market Research FAQs

What is the current Hydrophilic Coatings Market size?

The Hydrophilic Coatings Market is projected to register a CAGR of greater than 8% during the forecast period (2025-2030)

Who are the key players in Hydrophilic Coatings Market?

Aculon, APPLIED MEDICAL COATINGS, Corning Incorporated and Hydromer Inc are the major companies operating in the Hydrophilic Coatings Market.

Which is the fastest growing region in Hydrophilic Coatings Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Hydrophilic Coatings Market?

In 2025, the Asia Pacific accounts for the largest market share in Hydrophilic Coatings Market.

What years does this Hydrophilic Coatings Market cover?

The report covers the Hydrophilic Coatings Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Hydrophilic Coatings Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Hydrophilic Coatings Industry Report

Statistics for the 2025 Hydrophilic Coatings market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Hydrophilic Coatings analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.