Hopped Malt Extract Market Analysis

The Hopped Malt Extract Market is expected to register a CAGR of 4.8% during the forecast period.

- The market is driven by the increasing demand in brewing industries, especially for the manufacturing of craft beer. Also, its rising application in non-alcoholic beverages processing is contributing to the growth of the market. Additionally, the major opportunity it provides is its application in baking, breakfast cereals, confectionery, and other food applications according to research, although it has not been much used until now, it is anticipated to fuel the market growth in the forecasted period.

- However, less awareness of the wide range of applications offered by the hopped malt extract and lack of raw materials supply are the few of the major factors restraining the market.

Hopped Malt Extract Market Trends

Growing Popularity of Craft Beer

The demand for the craft brewing and distilling industries has experienced a significant growth during the past few years. Consumers across the world are seeking distinctive and flavorful beers, which is pushing the market for hopped malt extract in the beer market space. Moreover, the increasing development of microbreweries and the growing production of craft beer have led to the growing demand for specialty malts. The National Brewers Association revealed that as of January 2018, the consumption of malt by the US craft brewers was approximately 40% of the total malt consumed by all the brewers in the United States.

Europe and North America to Drive The Market

Countries, like the United Kingdom, Germany, and the United States from the European and North American region, are mostly dominating the market owing to the increasing demand for beer in these regions. Also, the government initiatives to incorporate new breweries have been boosting the market growth. These have resulted in a double-digit growth till 2017 in the United States, and the number of small, independent breweries, microbreweries, and brewpubs increased to 7,346 in 2018 as per the data revealed by the Brewers Association. Also, according to a report by the trade organization - The Brewers of Europe, the number of microbreweries in Europe reached over 9500 brewers in 2017.

Hopped Malt Extract Industry Overview

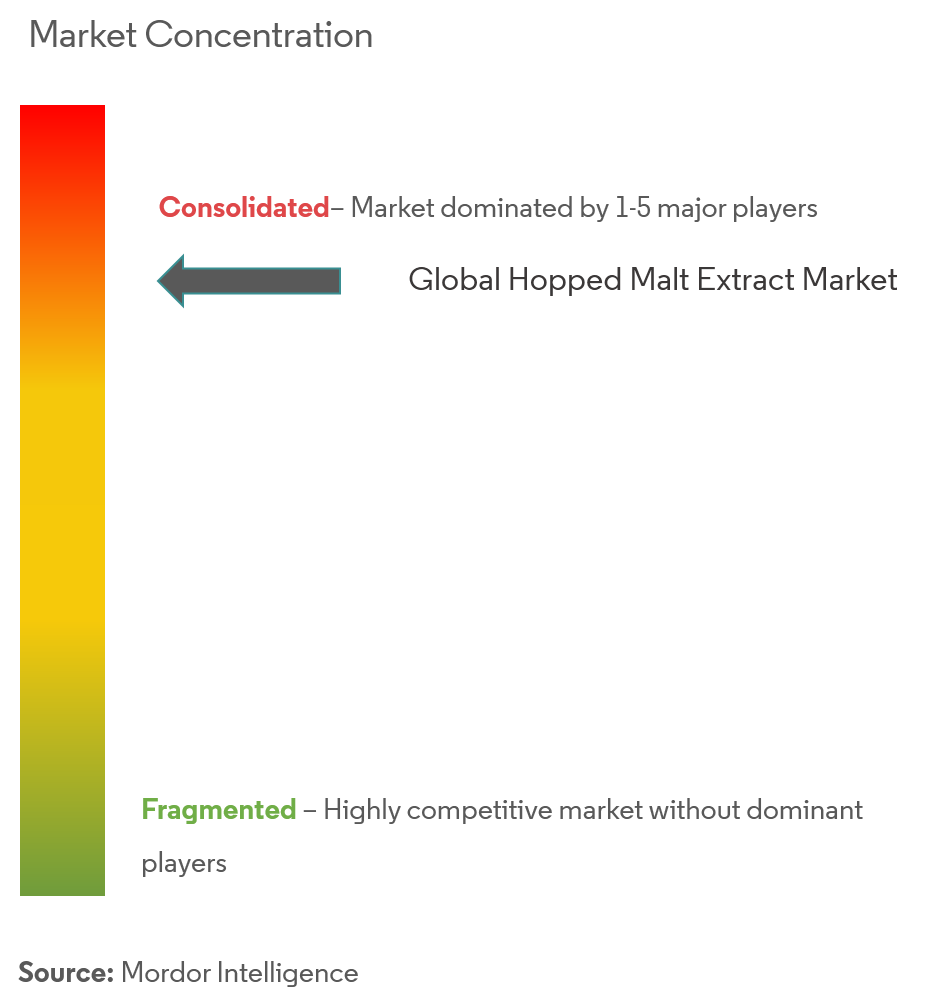

The hopped malt extract market is consolidated in nature having a few numbers of domestic and multinational players competing for market share. Companies focusing on new product launches with healthier ingredients/organic claims along with acquisition, merger, partnership, and expansions as their key marketing strategy. For instance, a hopped malt extract kit for homebrewers was launched in cooperation between Baladin and Mr. Malt, which contain a bag of pellets of Amarillo American hops - small cylinders of pulverized and pressed hops.

Hopped Malt Extract Market Leaders

-

P.A.B. srl - Mr. Malt

-

Hambleton Bard Ltd

-

CereX B.V.

-

Brewtec Bulk Malt

-

BrewOf Brewing Ingredient Supply

- *Disclaimer: Major Players sorted in no particular order

Hopped Malt Extract Industry Segmentation

The hopped malt extract market is segmented by application into food and beverages, pharmaceuticals, cosmetics and personal care, and animal feed. The food and beverage segment is further bifurcated into alcoholic beverages, non-alcoholic beverages, and bakery. Also, the study provides an analysis of the hopped malt extract market in the emerging and established markets across the world, including North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

| Application | Food and Beverages | Alcoholic Beverages | |

| Non-alcoholic Beverages | |||

| Baked Goods | |||

| Pharmaceuticals | |||

| Cosmetics and Personal Care | |||

| Animal Feed | |||

| By Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Spain | ||

| United Kingdom | |||

| Germany | |||

| France | |||

| Italy | |||

| Russia | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Middle-East and Africa | South Africa | ||

| Saudi Arabia | |||

| Rest of Middle-East and Africa | |||

Hopped Malt Extract Market Research FAQs

What is the current Hopped Malt Extract Market size?

The Hopped Malt Extract Market is projected to register a CAGR of 4.8% during the forecast period (2025-2030)

Who are the key players in Hopped Malt Extract Market?

P.A.B. srl - Mr. Malt, Hambleton Bard Ltd, CereX B.V., Brewtec Bulk Malt and BrewOf Brewing Ingredient Supply are the major companies operating in the Hopped Malt Extract Market.

Which is the fastest growing region in Hopped Malt Extract Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Hopped Malt Extract Market?

In 2025, the North America accounts for the largest market share in Hopped Malt Extract Market.

What years does this Hopped Malt Extract Market cover?

The report covers the Hopped Malt Extract Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Hopped Malt Extract Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Hopped Malt Extract Industry Report

Statistics for the 2025 Hopped Malt Extract market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Hopped Malt Extract analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.