| Study Period | 2019 - 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 - 2030 |

| CAGR | 5.23 % |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

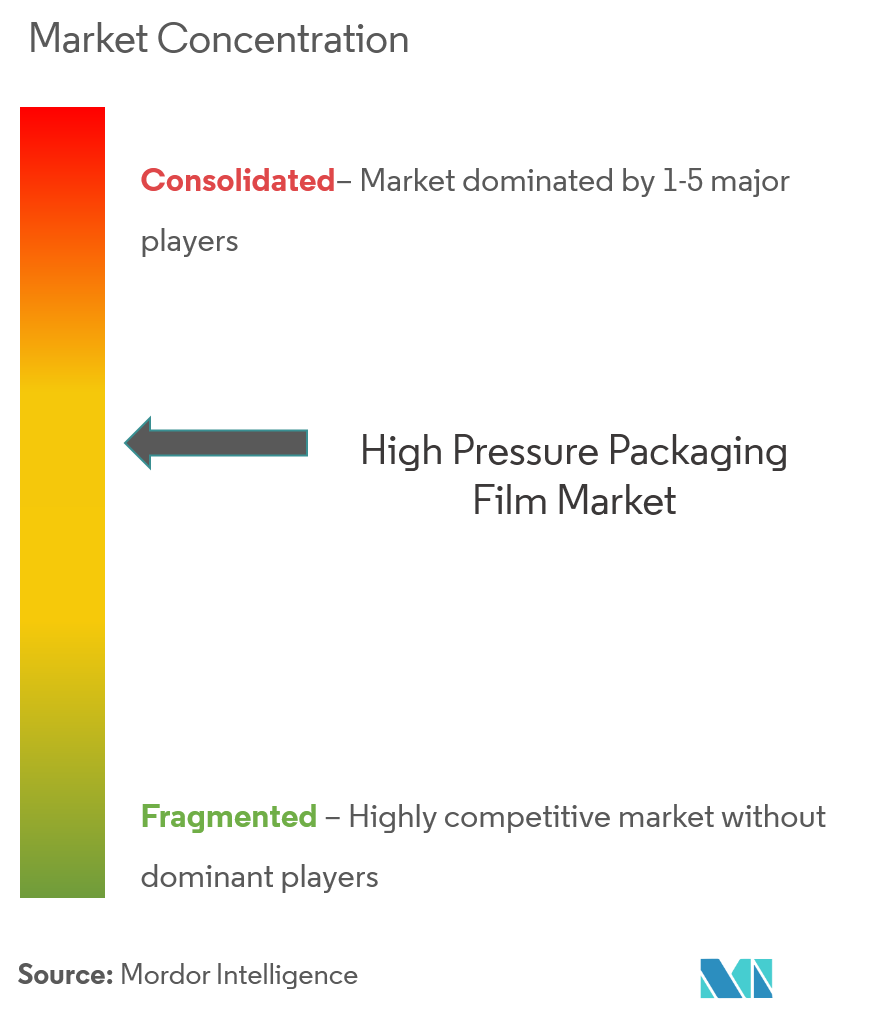

| Market Concentration | Low |

Major Players

*Disclaimer: Major Players sorted in no particular order |

High Pressure Protective Packaging Film Market Analysis

The High Pressure Protective Packaging Film Market is expected to register a CAGR of 5.23% during the forecast period.

- According to gfu Consumer & Home Electronics GmbH, the market for consumer goods reached over one trillion euros in 2017 and it is expected that the market to grow to Euro 1,050 billion in 2019 and this will continue to grow during the studied period. There has always been a need to protect the products while shipping, which in return will fuel the market for high pressure protective packaging film market.

- Moreover, according to Eurostat in 2018, the members of EFPIA exported pharmaceutical products worth Euro 410,000 million and imported Euro 305,000 million. While in 2017, it was Euro 369,036 million of export and Euro 294,632 million of import. The resistance to shocks & abrasion and inherent flexibility give an advantage while packing a host of diverse products like pharmaceutical goods and increasing the import and export of pharmaceutical goods among the nations is also having a positive outlook on the high pressure protective packaging film market.

- However, most of the protective films are made up of plastics therefore, stringent governmental regulation over the use of plastic is restraining the market to grow.

High Pressure Protective Packaging Film Market Trends

E-commerce Sector Offers Potential Growth

- With the safe delivery of goods being a key concern for e-commerce players, the demand for bubble wrapping is expected to increase substantially in the coming years.

- Moreover, E-commerce giants such as Amazon, Walmart, and Alibaba are adopting new technologies such as identifying the purchasing patterns of the customers and then targeting them. This increases the probability of purchasing the good. In response to this, high-pressure protective packaging film providers are offering robust packaging solutions to sustain damages during handling and logistics.

- Additionally, Amazon also introduced a package delivery drone which is expected to be functional by the end of 2020. Such air delivery drone would need a robust packaging of goods, to avoid any damage. This in return, it will drive the market for the high-pressure protective packaging film.

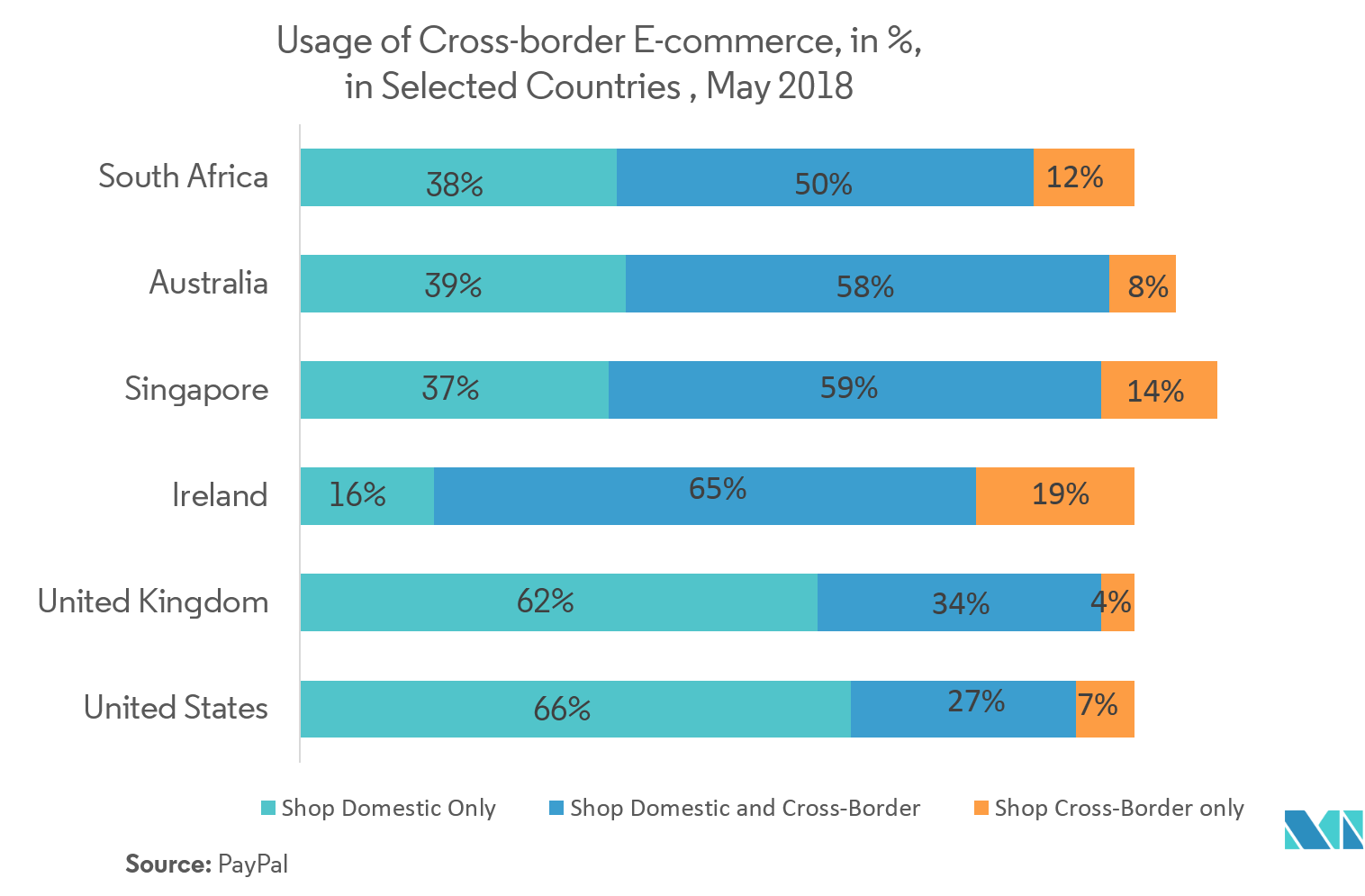

- Moreover, with the globalization, the trend of cross border e-commerce is also growing because of the availability of wide options and high quality of products. Hence, the demand for the e-commerce packaging for secure delivery of goods will also increase.

- Therefore, all the above factors are expected to drive the market.

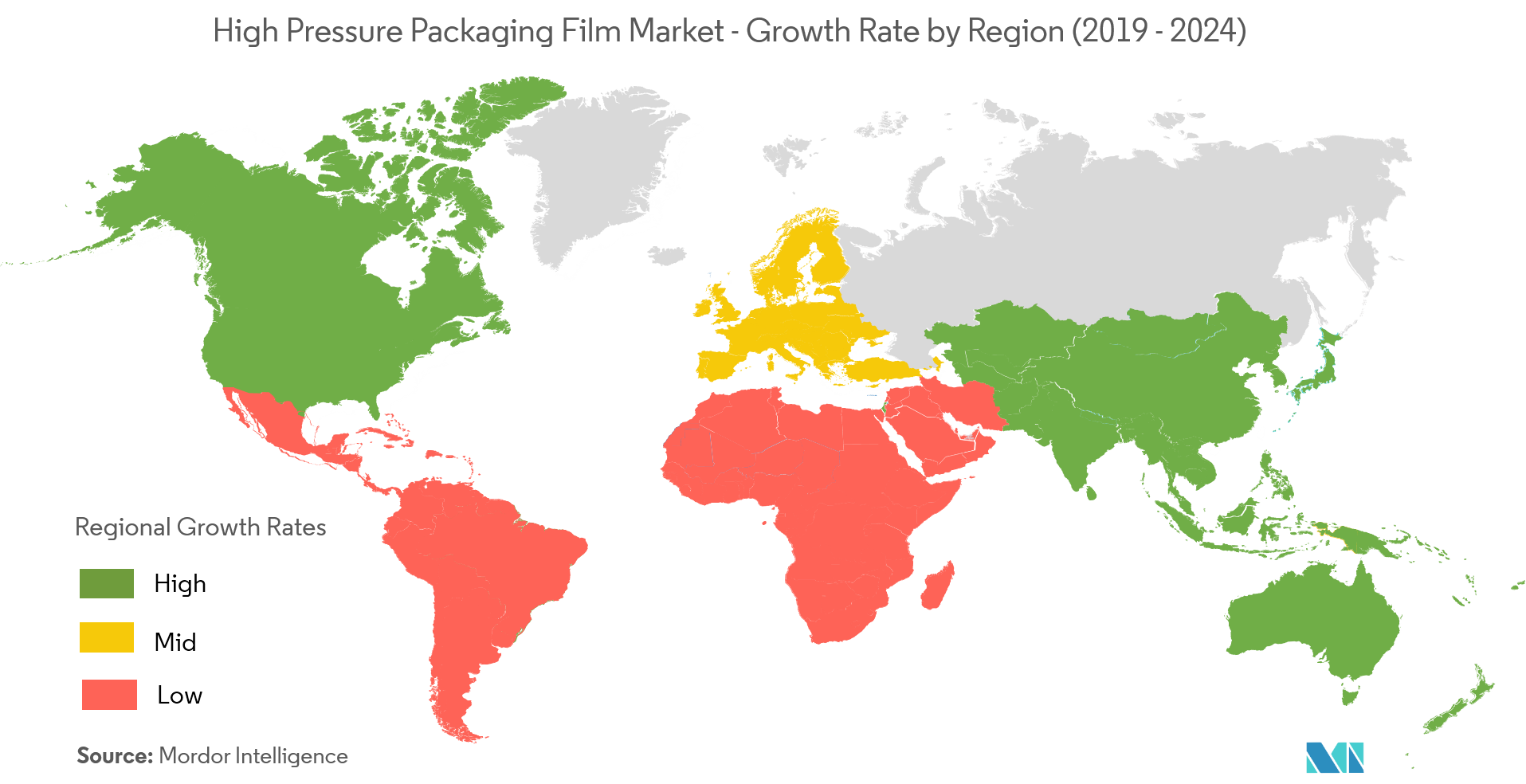

Asia- Pacific to Witness Fastest Growth

- Asia-Pacific is expected to witness the fastest growth of the high-pressure protective packaging film during the studies period. Owing to the booming e-commerce industry coupled with the increasing purchasing power of people, in countries such as India and China, are offering a significant push to the high-pressure protective packaging film market in the coming year.

- Moreover, these nations are seeing a trend of single-person living due to an increase in jobs in different industries. Thus, the consumers are of especially of a young age and mostly they are inclined to go shopping for online because of the convenience. This has driven the growth of the high-pressure packaging films such as bubble wraps etc.

- Further, rising life expectancy will lead to an aging of the population especially in key developed markets, like Japan. Hence, it will increase demand for healthcare and pharmaceutical products. Simultaneously there will be the demand for high-pressure protective packaging film to protect the goods during the import/ exports.

High Pressure Protective Packaging Film Industry Overview

Thehigh pressure protective packaging film market is competitive and fragmented in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc. are the prime growth strategies adopted by these companies to sustain the intense competition. Some of the major players in this market areSealed Air Corporation, Pregis LLC,Barton Jones Packaging Ltd, Abco Kovex andSupreme Industries Limited. Some of the recent developments are:

- May 2019 -Sealed Air Corporationsigned a definitive agreement to acquire Automated Packaging Systems, Inc fora purchase price of USD 510 million on a cash and debt-free basis. This transaction is expected to expand the customer base and strengthen the product portfolio for theSealed Air Corporation.

- September 2018 -Pregis LLC, under itsInspyre protective packaging brand, added pink and black color options to itshybrid cushioning (HC) packaging film products. HC features multiple air chambers in a proprietary square pattern that provides superior, high-pressure cushioning.

High Pressure Protective Packaging Film Market Leaders

-

Sealed Air Corporation

-

Barton Jones Packaging Ltd

-

Pregis LLC

-

Supreme Industries Limited

-

Rajapack Limited (Raja S.A.)

- *Disclaimer: Major Players sorted in no particular order

High Pressure Protective Packaging Film Industry Segmentation

High-pressure protective packaging films are specially designed for packaging a product that requires high-pressure cushioning and protection. It includes bubble packaging and Void-fill pillows.

| By Type | Bubble wrap |

| Void-fill Pillows | |

| Other Types | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa | |

| By End Users | Electronics |

| E-commerce | |

| Automotive | |

| Glass | |

| Pharmaceutical | |

| Industrial components | |

| Other End Users |

High Pressure Protective Packaging Film Market Research FAQs

What is the current High Pressure Protective Packaging Film Market size?

The High Pressure Protective Packaging Film Market is projected to register a CAGR of 5.23% during the forecast period (2025-2030)

Who are the key players in High Pressure Protective Packaging Film Market?

Sealed Air Corporation, Barton Jones Packaging Ltd, Pregis LLC, Supreme Industries Limited and Rajapack Limited (Raja S.A.) are the major companies operating in the High Pressure Protective Packaging Film Market.

Which is the fastest growing region in High Pressure Protective Packaging Film Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in High Pressure Protective Packaging Film Market?

In 2025, the North America accounts for the largest market share in High Pressure Protective Packaging Film Market.

What years does this High Pressure Protective Packaging Film Market cover?

The report covers the High Pressure Protective Packaging Film Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the High Pressure Protective Packaging Film Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

High Pressure Protective Packaging Film Industry Report

Statistics for the 2025 High Pressure Protective Packaging Film market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. High Pressure Protective Packaging Film analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.