High Availability Server Market Analysis

The High Availability Server Market is expected to register a CAGR of 16% during the forecast period.

- The high-availability server market is influenced by the proposed investments in data center construction projects by Google, AWS, Alibaba Cloud, and Microsoft. Server vendors are reducing the prices of their products to specifically target the small and medium enterprises (SMEs). Vendors are focusing on designing and manufacturing energy-efficient processors to cater to the increasing demand for energy-efficient servers.

- The growing requirements for cloud service solutions in the various end-user industry, such as BFSI, IT& Telecom, will influence the demand for the high availability server market.

- Further, the demand for big data analytics and cloud-enabled applications will influence the growth potential of cloud service providers, thereby fueling the growth of the high availability server across the emerging economies.

High Availability Server Market Trends

BFSI Sector is Expected to Have a Significant Growth Rate

- A properly designed high availability server offers minimum processing latency and maximum uptime by means of hardware redundancy feature, which serves to lower the risk of hardware failure. This advantage has led to its swift uptake by the banking and financial institutions that need to store vast amounts of data and access those quickly, efficiently, and securely.

- Low or almost zero risks of system failure enables BFSI organizations to run their business without interruptions, protect companies from lost revenue when the process of accessing their business application and data resources get disrupted.

- These servers are operated using high-availability software to harness the redundant computers that provide continued service when the server components fail. Without high-availability software, if a server is running a particular application and crashes, the application will be unavailable until the server is restored or fixed.

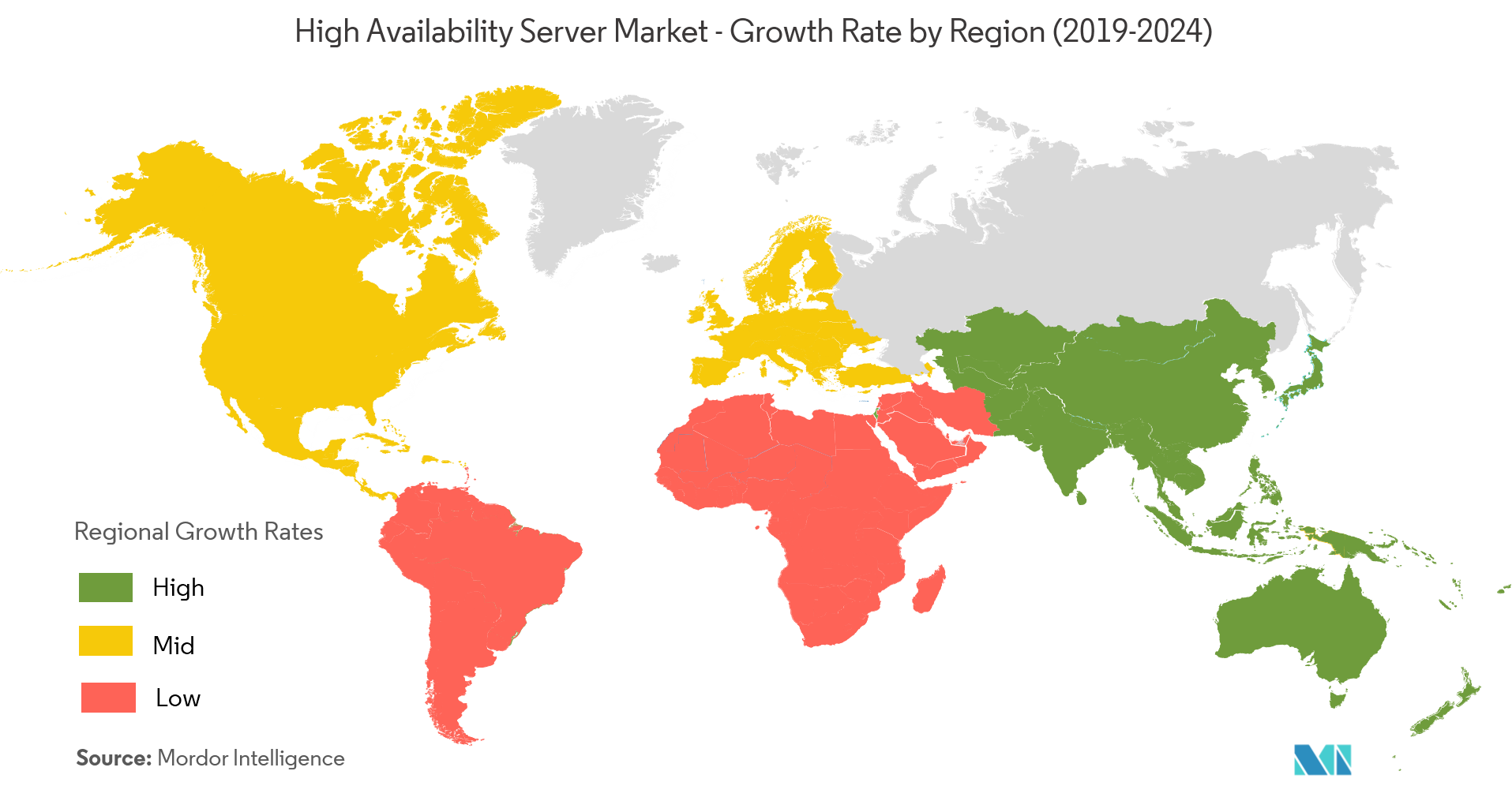

North America Region is Expected to Grow at a Significant Rate

- North America is expected to maintain its dominance in the global market place as the growth is attributable due to the presence of prominent players such as Dell Inc, Cisco System Inc., IBM Corp., AWS Inc., among others. These players are putting efforts to strengthen their market position across the U.S. and Canada thereby covering majority of the share.

- Moreover, the early adoption of advanced technologies in this region pushes growth in the overall market. The penetration of high availability server set up is increasing across end-use industries, which creates growth opportunities for the market in North America.

- Further, the growing number of mergers and acquisitions among some of the prominent players are putting efforts to strengthen their market position across the region.

High Availability Server Industry Overview

Thehigh availability server market is moderately competitive and consists of a few major players. In terms of market share, some of the players currently dominate the market. However, with the advancement in the server infrastructureacross the enterpriseservices, new players are increasing their market presence thereby expanding their business footprint across the emerging economies.

- July 2019 -CiscoSystem and Acacia Communicationsannounced that they have entered into a definitive agreement under which Cisco has agreed to acquireAcacia. An existing Cisco supplier,Acacia designs and manufactures high-speed, optical interconnect technologies thatallow webscale companies, service providers, and data center operators to meet the fast-growing consumer demands for data.

- June 2019 -VMwareInc.announced its intent to acquire Avi Networks, a leader in multi-cloud application delivery services. Avi Networks will further enable VMware to bring the public cloud experience to the entire data center automated, highly scalable, and intrinsically more secure with the ability to deploy applications with a single click, upon close of the acquisition.

High Availability Server Market Leaders

-

Dell Inc.

-

Oracle Corp.

-

Cisco System Inc.

-

IBM Corp.

-

CenterServ International Ltd.

- *Disclaimer: Major Players sorted in no particular order

High Availability Server Industry Segmentation

A High Availability dedicated server is an advanced system equipped with redundant power supplies, a fully redundant network, RAID disk towers, and backups, ensuring the highest uptime and the full reliability with no single point of failure. Built on a complex architecture of hardware and software, all parts of the system work quite independently of each other so that any failure of in the single component will not affect the entire system.

| By Deployment | Cloud-based |

| On-premise | |

| By Operating System | Windows |

| Linux | |

| Other Operating System ( (UNIX, BSD) | |

| By End-user Industry | IT & Telecommunication |

| BFSI | |

| Retail | |

| Healthcare | |

| Industrial | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

High Availability Server Market Research FAQs

What is the current High Availability Server Market size?

The High Availability Server Market is projected to register a CAGR of 16% during the forecast period (2025-2030)

Who are the key players in High Availability Server Market?

Dell Inc., Oracle Corp., Cisco System Inc., IBM Corp. and CenterServ International Ltd. are the major companies operating in the High Availability Server Market.

Which is the fastest growing region in High Availability Server Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in High Availability Server Market?

In 2025, the North America accounts for the largest market share in High Availability Server Market.

What years does this High Availability Server Market cover?

The report covers the High Availability Server Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the High Availability Server Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

High Availability Server Industry Report

Statistics for the 2025 High Availability Server market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. High Availability Server analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.