Heavy Equipment Lubricants Market Analysis by Mordor Intelligence

The Heavy Equipment Lubricants Market is expected to register a CAGR of less than 2% during the forecast period.

- The major factors driving the growth of the heavy equipment lubricants market are the increasing manufacturing activities in the Asia-Pacific region and the growing usage of high-performance lubricants in the construction and mining sectors.

- The shifting focus toward dry machining and minimum quantity lubrication is acting as a restraint to the market

- The industrial growth in the Middle East & Africa and increase in the exploration of natural gas are likely to act as an opportunity for the heavy equipment lubricants market in the forecast period.

Global Heavy Equipment Lubricants Market Trends and Insights

Engine oils to Witness Steady Growth

- Engine oils are widely used for lubricating internal combustion engines in different types of automotive, off-road vehicles, etc., and are generally composed of 75%-90% of base oils and 10%-25% of additives. They are used in engines of different transportation modes, owing to their advantages, such as fuel efficiency, enhanced performance, temperature control, and engine protection.

- Engine oils are typically used for applications, such as wear reduction and corrosion protection while ensuring the smooth operation of engine internals. The oils function by creating a thin film between the moving parts, for enhancing heat transfer and reducing tension during contact of the parts.

- Furthermore, governments in countries, such as China and India, are introducing new projects for the development of infrastructure, along with providing incentives for growth in FDI. The construction industry in Qatar is growing at a strong rate with a booming public infrastructure sector.

- The FIFA World Cup 2022 is expected to create a huge potential for the heavy equipment and machinery used in the country. Kuwait, Algeria, and Morocco have a similar trend of moderately high growth rates during the forecast period. Iran is also expected to have higher growth in the construction sector, with an average growth rate, during the forecast period. The lifting of international sanctions has given a boost to the infrastructure activities in the country with an easier trade-off.

- Overall, the demand for Engine oils is anticipated to grow with the growing end-user industries.

China to Dominate the Asia-Pacific Market

- The Chinese government has announced its plans to spend about USD 120 billion on railway projects in 2019, of which, a major allocation is for high-speed rail systems.

- In the real estate sector, China has shown volatile growth. Nevertheless the country has seen substantial development in rail & road infrastructure by the Chinese government (in order to withstand the demand stemming from the growing industrial and service sectors) has resulted in significant growth of the Chinese construction industry in the recent years, in turn, driving the consumption of heavy equipment lubricants.

- As the construction industry is dominated by state-owned and private enterprises, increased government and private spending in this regard is pushing the industry toward global primacy. Over the recent years, the entry of the major construction players (from the European Union) in China further fueled the growth of this industry.

- With the growth of the construction sector in China, the demand for lubricants used for heavy equipment, in the construction sector (such as penetrating and coating wire rope lubricants, diesel fuel, engine oil, bearing grease, and others), is expected to increase, over the forecast period.

- China is the world’s largest producer of coal, gold, and the rarest earth minerals. Besides, the country is also the largest consumer of mining products.

- In total, there are over 10,000 (mostly coal) mines in the country, producing a large amount for the world’s supply. The mining sector in China is a fragmented industry in which many companies operate in similar areas.

- Some of the biggest coal mining companies, such as Shenhua Group, China Coal Energy, and Yanzhou Coal Mining, are present in the country. Jianxi Copper Company is the largest copper mining company present in the country. It is also one of the largest gold and silver mining companies.

- Apart from these companies, the China University of Mining & Technology works in collaboration with the mining industry of the country. This university has a worldwide reputation in coal mining technology and research.

- In recent years, the entry of major construction players (from the European Union) in China has further fueled the growth of heavy equipment lubricants market.

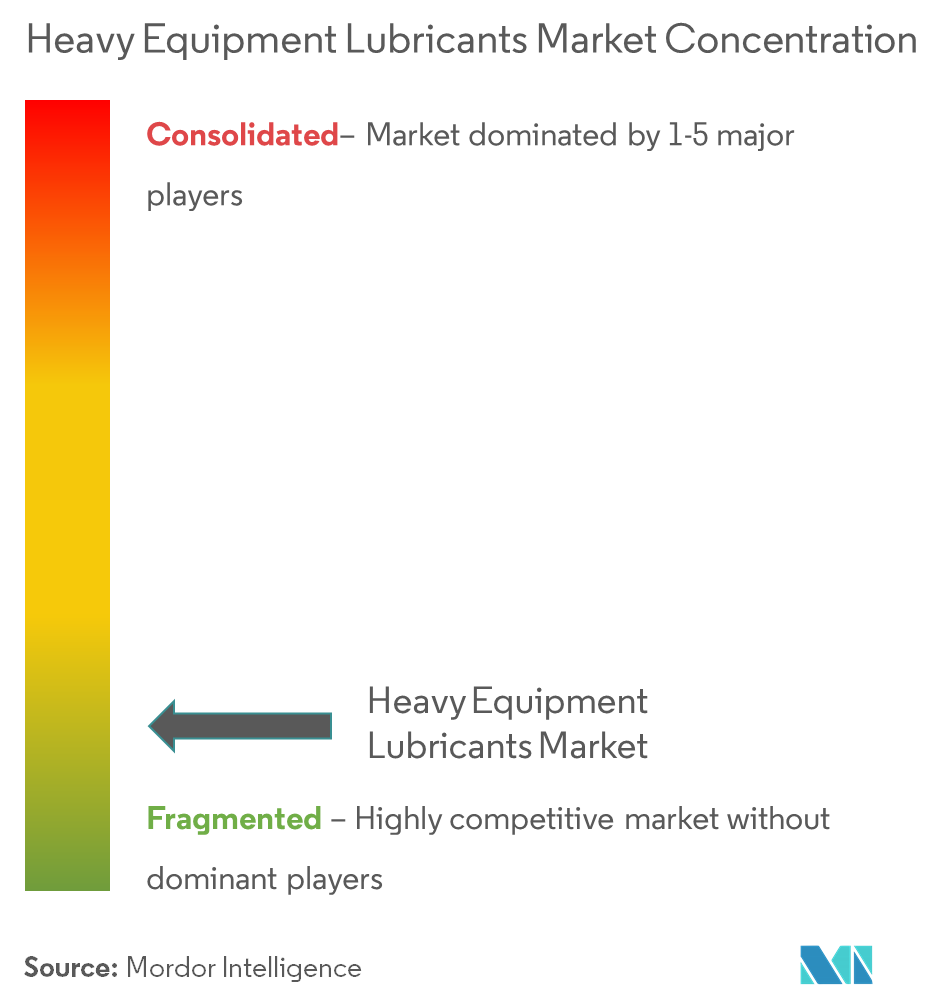

Competitive Landscape

The heavy equipment lubricants market is fragmented in nature. The major companies include BP PLC, Chevron USA Inc., Exxon Mobil Corporation, Royal Dutch Shell PLC, and Total.

Heavy Equipment Lubricants Industry Leaders

BP PLC

Chevron USA Inc.

Exxon Mobil Corporation

Royal Dutch Shell PLC

Total

- *Disclaimer: Major Players sorted in no particular order

Global Heavy Equipment Lubricants Market Report Scope

The heavy equipment lubricants market report includes:

| Engine Oil |

| Transmission and Hydraulic Fluids |

| General Industrial Oils |

| Gear Oil |

| Greases |

| Other Products |

| Construction |

| Mining |

| Agriculture |

| Other End-user Industries |

| Asia-Pacific | China |

| India | |

| Japan | |

| South Korea | |

| Phillipines | |

| Indonesia | |

| Malaysia | |

| Thailand | |

| Vietnam | |

| Rest of Asia-Pacific | |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America | |

| Europe | Germany |

| United Kingdom | |

| Italy | |

| France | |

| Russia | |

| Turkey | |

| Spain | |

| Rest of Europe | |

| South America | Brazil |

| Argentina | |

| Chile | |

| Colombia | |

| Rest of South America | |

| Middle East & Africa | Saudi Arabia |

| Iran | |

| South Africa | |

| Egypt | |

| Nigeria | |

| Rest of Middle East & Africa |

| Product | Engine Oil | |

| Transmission and Hydraulic Fluids | ||

| General Industrial Oils | ||

| Gear Oil | ||

| Greases | ||

| Other Products | ||

| End-user Industry | Construction | |

| Mining | ||

| Agriculture | ||

| Other End-user Industries | ||

| Geography | Asia-Pacific | China |

| India | ||

| Japan | ||

| South Korea | ||

| Phillipines | ||

| Indonesia | ||

| Malaysia | ||

| Thailand | ||

| Vietnam | ||

| Rest of Asia-Pacific | ||

| North America | United States | |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Europe | Germany | |

| United Kingdom | ||

| Italy | ||

| France | ||

| Russia | ||

| Turkey | ||

| Spain | ||

| Rest of Europe | ||

| South America | Brazil | |

| Argentina | ||

| Chile | ||

| Colombia | ||

| Rest of South America | ||

| Middle East & Africa | Saudi Arabia | |

| Iran | ||

| South Africa | ||

| Egypt | ||

| Nigeria | ||

| Rest of Middle East & Africa | ||

Key Questions Answered in the Report

What is the current Heavy Equipment Lubricants Market size?

The Heavy Equipment Lubricants Market is projected to register a CAGR of less than 2% during the forecast period (2025-2030)

Who are the key players in Heavy Equipment Lubricants Market?

BP PLC, Chevron USA Inc., Exxon Mobil Corporation, Royal Dutch Shell PLC and Total are the major companies operating in the Heavy Equipment Lubricants Market.

Which is the fastest growing region in Heavy Equipment Lubricants Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Heavy Equipment Lubricants Market?

In 2025, the Asia Pacific accounts for the largest market share in Heavy Equipment Lubricants Market.

What years does this Heavy Equipment Lubricants Market cover?

The report covers the Heavy Equipment Lubricants Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Heavy Equipment Lubricants Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Heavy Equipment Lubricants Market Report

Statistics for the 2025 Heavy Equipment Lubricants market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Heavy Equipment Lubricants analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.