Heads-Up Display Market Analysis

The Head-up Display Market is expected to register a CAGR of 21.2% during the forecast period.

- The head-up display, also known as a HUD, is any transparent display that presents data without requiring users to look away from their usual viewpoints. Head-up displays have been known since the mid-20th century and were primarily used in aircraft. However, during the 1950s, attempts were made to test this technology for cars. Currently, most luxury car manufacturers, such as BMW, Audi, Volvo, Mercedes-Benz, etc., equip their vehicle model range with HUD.

- According to WHO, approximately 1.35 million people die every year due to road traffic crashes. The HUD is a driver assistance system that reports timely events that conceal a potential risk to drivers and pedestrians.

- Further, trucks carrying freight will likely be the first vehicles to see widespread autonomous use. According to Forbes, the freight business in America is USD 800 billion per year enterprise which explains why a truck driving is the number 1 job in 29 American states. But approximately 4,900 people die each year on US roadways in a truck-involved crash. Safety is a large priority when it comes to the operation of trucks, which might lead to adopting HUD.

- The windshield head-up display shows relevant information directly on the windshield screen. The driver always has all the information he needs in the line of sight. Further, many drivers are so inundated with all these non-contextual warnings from their 'smart' vehicles with bells, chimes, and beeps that they do not always hear them. It has been needed to make sure to build systems that people do not turn off.

- During COVID-19, the lockdown resulted in bringing economic activity to a standstill. The manufacturing of automotive is the most important application of the HUD market. Manufacturing has gone down by 20-50% globally, which would directly impact the HUD market.

Heads-Up Display Market Trends

Growing Adoption of HUD in Automotive Industry Driving the Market's Growth

- Digitalization is a major trend in the automotive industry. The industry has witnessed numerous technological advancements in the digital field over the last couple of decades. The technological enhancement in the form of HUD is one such example.

- A vehicle's HUD keeps drivers focused on the road, safely delivering speed, warning signals, and other vital vehicle and navigation information on the windshield directly in the driver's line of sight.

- The growing need for safety and user comfort is one of the most important factors driving the adoption of HUD in the automotive industry. Moreover, an increasing number of road accidents fuels the need for HUD. For instance, According to the World Health Organization, over 1.35 million people die each year as a result of road traffic crashes globally. Injuries from road traffic accidents are the leading cause of death among people aged between 5 and 29 years. Moreover, according to the Bureau of Infrastructure and Transport Research Economics (BITRE), there were 293 road deaths in New South Wales in 2021.

- Luxury brands such as Audi, BMW, Lexus, Land Rover, and Mercedes-Benz, among others, are offering a HUD system as a standard or optional add-on feature across their premium vehicles.

- However, OEMs have been thinking and making them standard even in economy cars. In May 2022, Ariya, launched by Nissan, is the sixth car model from Nissan to use the WS HUD of Panasonic, following the Skyline, Rogue, Qashqai, Pathfinder, and QX60. The WS HUD is a system that presents a variety of information such as vehicle speed, navigation instructions, and ProPILOT 2.0 driver assist information in the driver's line of sight by projecting it on the windshield.

- Additionally, the implementation of AR has made HUD an important part of Advanced Driver Assistance Systems (ADAS). The OEMs are expected to include more ADAS applications in their vehicles in the next decade.

- BMW also includes entertainment functions in the HUD. It displays radio stations or song lists as one scrolls through them using a button on the steering wheel. Hence the launch of new car models equipped with HUD is anticipated to boost the market's growth.

North America is Expected to Hold a Significant Share

- North America is expected to cater to a significant market share with its major production sites of various automotive brands and innovation trends in military and defense.

- The government regulations in the developed regions of North America are increasingly favoring automotive innovations and technologies that support vehicle and road safety. In October 2018, the US Department of Transportation (USDOT) announced their latest federal guidance for automated vehicles entitled, "Preparing for the future of transportation: Automated Vehicles 3.0." (AV 3.0). AV 3.0 reinforced the USDOT commitment to supporting the safe integration of automation into the broad transportation system.

- Further, the military budget is the largest portion of the United States federal budget allocated to the Department of Defense, or more specifically, the portion of the budget that goes to any military-related expenditures. According to the 61st NDAA bicameral agreement, the United States will spend 777.7 billion dollars on the national defense budget for the fiscal year 2022.

- The United States (US) is one of the world's biggest markets for aerospace, defense, and space. Collins Aerospace is providing the Federal Aviation Administration with a virtual reality system that will be used to investigate how pilots perform when flying with a head-up display. The VR device enables FAA researchers to conduct research in the domain of advanced vision systems on HUDs with flexibility, efficiency, and effectiveness. Such an initiative caters to the market growth adoption in the aviation sector.

- Moreover, in May 2022, BAE Systems unveiled a lightweight LiteWave head-up display for commercial and military pilots, which is 70% smaller and 80% faster to install. This HUD is designed to be mounted above a pilot's head to present critical information directly in their lines of sight, such as direction, altitude, and speed. Powered by BAE's patented waveguide technology, LiteWave can be adjusted to any individual flying position, allowing the pilot to maintain optimal situational awareness, even during poor weather or at night.

Heads-Up Display Industry Overview

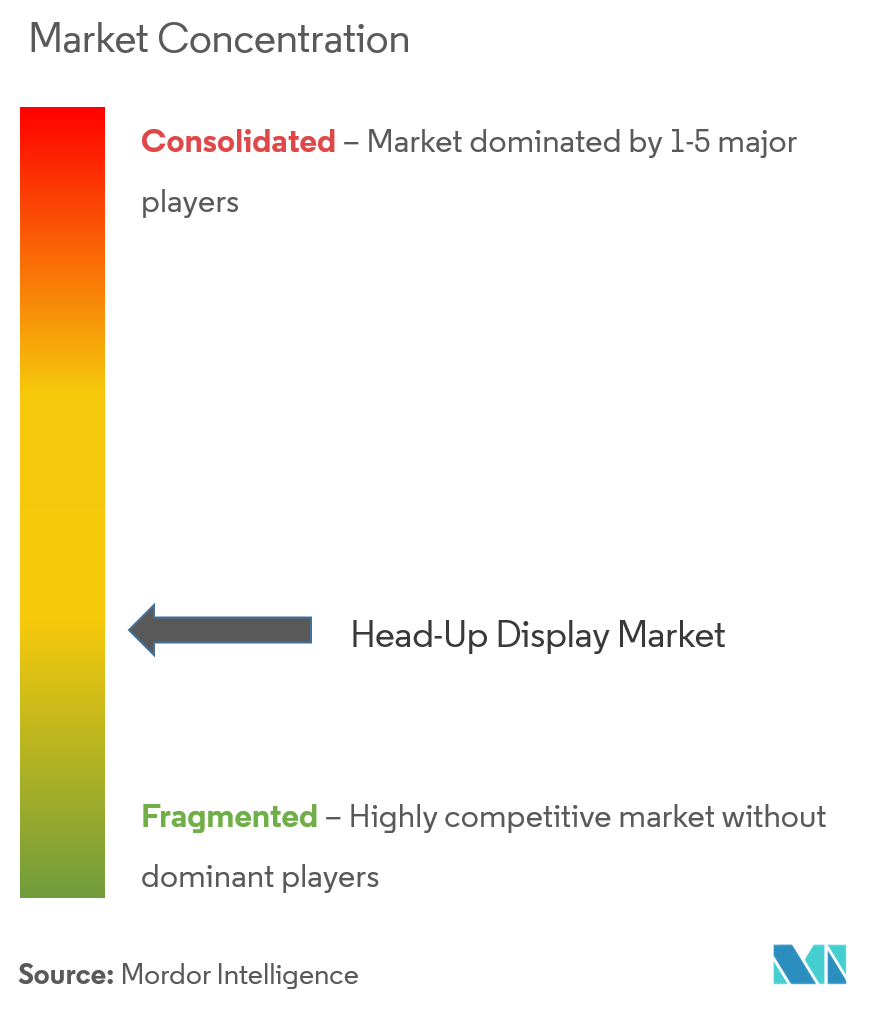

The head-up display market is competitive and fragmented, with the presence of a large number of global and regional players. The vendors are increasingly focusing on product differentiation and innovation.

- December 2021 - Volvo Cars have invested USD 2 million in Spectralics, a company that is working to create a new kind of thin optics film that might be used to transform the entire windshield of a car into an augmented reality (AR) display screen. The technology has the potential to create a wide field of view heads-up display on the windshield, with objects superimposed on the real-world background to give a sense of distance.

- July 2021 - Corning Incorporated has announced a new product category for its Automotive Glass Solutions. Corning curved mirror solutions are key components in the Augmented Reality (AR) heads-up display system by Hyundai Mobis.

Heads-Up Display Market Leaders

-

Continental AG

-

Nippon Seiki Co. Ltd.

-

Denso Corporation

-

Panasonic Automotive Systems (Panasonic Corporation)

-

Visteon Corporation

- *Disclaimer: Major Players sorted in no particular order

Heads-Up Display Market News

- January 2022 - CY Vision announced automotive 3D Augmented Reality Head-Up Displays (3D AR-HUD). It provides the widest field of view in augmented displays on the market today for all weather conditions and all distances.

- September 2021 - Airbus is developing a newly enhanced flight vision system (EFVS) for its A320 family of aircraft. Collins Aerospace will supply the advanced vision sensor that will be used for the development of head-up displays. The EFVS currently under development consists of the sensor, a multi-special camera system, head-up display (HUD), and cockpit controls.

- June 2021 - Hyundai Mobis, the South Korean automaker's component division, has created a clusterless head-up display for gas- and electricity-powered cars. Information is shown on a 15-inch screen, which helps improve interior space usage. The innovative gadget has four different display areas. The driver can examine basic data at the top, including speed, RPM, data about an advanced driver support system, and route direction. Information like shift mode, cooling water temperature, and mileage are shown at the bottom. Additionally, warning lights for system information and turn signals are shown.

Heads-Up Display Industry Segmentation

The Head-Up Display (HUD) is a Human-Machine-Interface that relays real-time information related to the vehicle, traffic, and associated environment for an assisted driving experience. A typical HUD consists of a projector unit, a combiner, and a video generator. HUD is being adopted widely in automotive and military and civil aviation industries. In the Aviation industry, the HUD helps the pilot in the critical phases of a flight - takeoff and landing.

The Head-up Display Market is segmented by Type (Windshield-Based Head-Up Display, Combiner-Based Head-Up Display, AR-Based Head-Up Display), Application (Automotive, Military and Civil Aviation Industry), and Geography.

| By Type | Windshield-Based Head-Up Display | ||

| Combiner-Based Head-Up Display | |||

| AR-Based Head-Up Display | |||

| By Application | Automotive | ||

| Military and Civil Aviation Industry | |||

| Other Applications | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| South Korea | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| Rest of the World | |||

Heads-Up Display Market Research FAQs

What is the current Head-up Display Market size?

The Head-up Display Market is projected to register a CAGR of 21.2% during the forecast period (2025-2030)

Who are the key players in Head-up Display Market?

Continental AG, Nippon Seiki Co. Ltd., Denso Corporation, Panasonic Automotive Systems (Panasonic Corporation) and Visteon Corporation are the major companies operating in the Head-up Display Market.

Which is the fastest growing region in Head-up Display Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Head-up Display Market?

In 2025, the North America accounts for the largest market share in Head-up Display Market.

What years does this Head-up Display Market cover?

The report covers the Head-up Display Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Head-up Display Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Head-Up Display Industry Report

Statistics for the 2025 Head-up Display market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Head-up Display analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.