Graphic Processors Market Analysis

The Graphic Processors Market is expected to register a CAGR of 33.35% during the forecast period.

- The market for gaming applications is rising due to increased consumer spending on tablets, smartphones, and notebooks, driving the demand for graphics processors to provide high-quality visual effects and high-speed gaming applications.

- The factor fueling the graphic processor market's growth is the increasing usage of processors to support graphics applications and 3D content in various industry verticals such as manufacturing, automotive, real estate, and healthcare. For instance, to support manufacturing and design applications in the automotive sector, CAD and simulation software leverages GPUs to create photorealistic images or animations.

- The rise of geographic information systems (GIS) and immersive multimedia are also driving the graphics processing market. Increasing usage of applications such as GIS that provide real-time spatial and geographical data is rising owing to the penetration of smartphones, tablets, and other mobile computing devices. A GIS allows users to generate a query, analyze spatial information, map data, and provide output. However, to provide real-time information, mobile computing devices incorporate graphic processors on a large scale.

- The metaverse offers an enhanced experience. Many activities people can perform in the real world are also possible in this virtual representation of the real world. The software will need to advance to support this because interoperability between platforms, applications, and services will be essential for a working ecosystem. Hardware will be essential to allow people to interact with this new online environment, despite software being an important pillar in the convergence of different realities.

- With full-body haptics and virtual reality equipment still available, AR and VR technologies will likely be the primary ways of experiencing the metaverse during the transition. This offers enormous potential for the electronics sector, particularly from the perspective of GPUs, to spearhead widespread innovation that will aid in immersing users while utilizing parallelism to address data issues.

- Moreover, the inability to properly balance system performance, efficiency, and power consumption poses a challenge to market growth. Further, declining workstation sales may hamper the graphic processors' market growth over the forecast period.

Graphic Processors Market Trends

Gaming Industry to Augment Market Growth

- The gaming hardware market is huge, spreading across all platforms, from handheld devices to tablets, phones, PCs, consoles, location-based arcades, and gaming parlors. Gaming machines evolved from powerful location-based machines found in arcades, restaurants, and bars to in-home machines in the form of dedicated gaming consoles, microcomputers, and then PCs.

- Gaming machines use two types of CPU processors: ARM and x86-based machines. Those machines fall into five or more platforms, including consoles, notebooks, desktops, mobile devices, and various types of location-based devices found in arcades, restaurants, bars, amusement parks, casinos, and iCafe/net cafes. For instance, AMD integrates a GPU into an x86 processor and calls it an accelerated processor unit APU.

- High-performance gaming is synonymous with gaming laptops. They enable quicker command execution and swift running since they are quick and effective. When it comes to relative speeds and overall performances, for instance, the Nvidia GeForce RTX 3090, a Titan class card, offers highly demanding performance. Additionally, it supports Ray Tracing and DLSS exceptionally well without reducing the graphics settings on the gaming laptop.

- However, Nvidia is also investing significantly in technology and offering gamers customizable solutions. The company announced its powerful GPU, titled Titan RTX, which uses Nvidia's Turing architecture and delivers 130 teraflops of deep learning performance and 11 gigarays of ray-tracing performance. The new display port on the GPU is designed for next-generation VR headsets, which will only need one wire to connect to PCs.

- Moreover, the hardware landscape is constantly in flux. For instance, the latest graphics cards in the USD 500-USD 1500 price range completely changed, with AMD and Nvidia overhauling their lineups for the growing 1440p gaming market. Compared to the previous flagship RTX 3090 Ti, Nvidia's new flagship RTX 4090 can perform up to two times better in raster-heavy games and up to four times quicker in fully ray-traced games, while the RTX 4080 will be up to three times faster.

- The gaming environment has been further expanded with the resurrection of virtual reality and the introduction of augmented reality for gaming. For instance, AR games like Niantic Lab's Pokemon Go are location-based games and use Google Maps to augment a mythical world filled with characters from the Pokemon. Users are encouraged to explore new alleys or hunt for hidden characters on their mobile screens; in the real world, they walk several miles.

Asia-Pacific to be Fastest-Growing Market

- Developing countries in the Asia Pacific, such as China, Japan, Singapore, and India, are expected to witness high demand. This may be attributed to the increasing adoption of mobile computing devices and the region's high demand for gaming applications.

- The Japanese gaming market is the third-largest in the world due to the continued success of several mobile gaming companies in the country. Japanese gamers spend more than players in any other country. The average spending per Japanese player is approximately 2.5 times higher than that in western Europe and nearly 1.5 times higher than in North America.

- China developed its own GPU compute engines by introducing the BR series of products from Biren Technology. China now has access to a dedicated local GPU for graphics and computing, which will intensify the fierce GPU market competition.

- With its upcoming game-focused GPUs, Shanghai-based chipmaker Muxi is anticipated to put China on the global map and promote Asia's growth. In order to meet the needs of the expanding high-end PC gaming sector in the nation, the company is reportedly creating China's in-house GPU. The GPU explicitly designed for gaming is currently under development and is anticipated to be available in 2025.

- With the growing adoption of IoT devices that gather huge amounts of data that needs to be monitored and analyzed, the demand for high-end computing systems has effectively increased in the automotive sector in the Asia-Pacific Region.

- Moreover, countries such as China, India, Japan, and Singapore are shifting the paradigm toward technological enhancement. Therefore, the region has the highest smart device sales, from smartphones and tablets to PlayStation and gaming PCs. This attribute explains the increasing demand for graphics processors.

Graphic Processors Industry Overview

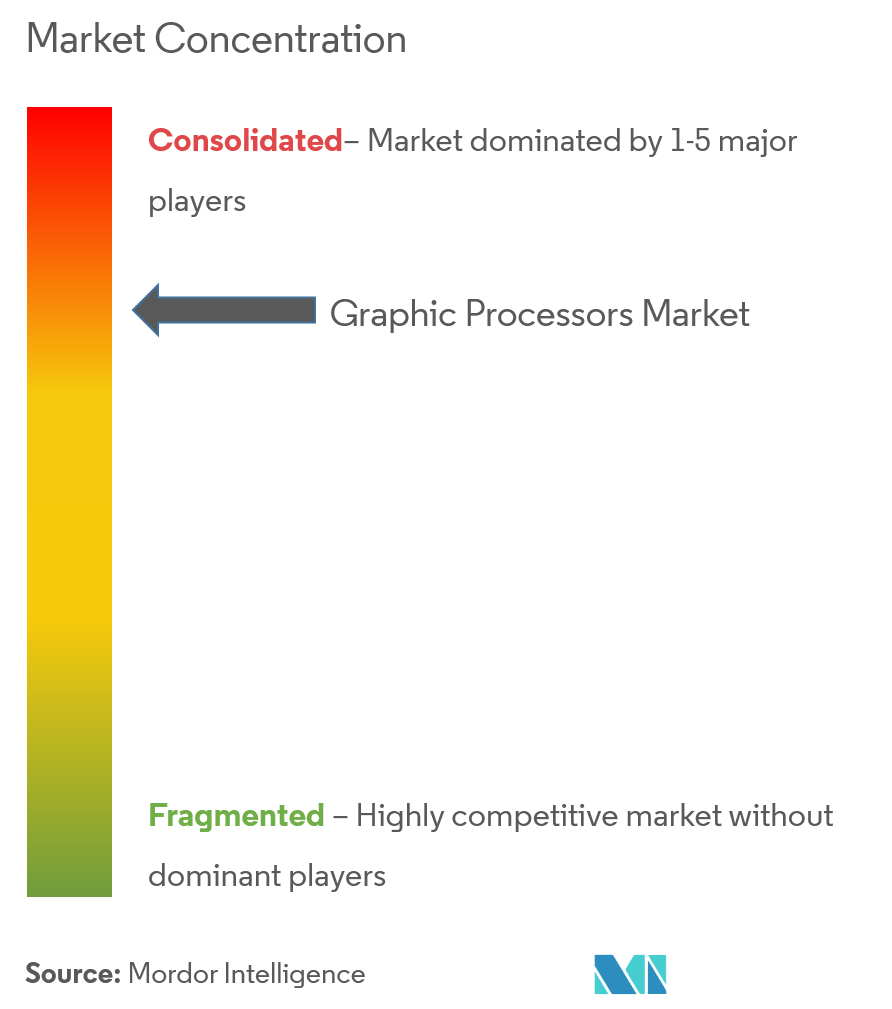

The graphic processors market is consolidated due to major market players adopting novel strategies to improve manufacturing techniques and widen their product portfolios to gain a competitive edge over other market players. The major players in the market are Samsung Electronics Co. Ltd, Qualcomm Incorporated, NVIDIA Corporation, Advanced Micro Devices Inc., Intel Corporation, Taiwan Semiconductor Manufacturing Company Ltd, Fujitsu Ltd, IBM Corporation, Sony Corporation, and Apple Inc., among others. Some developmental strategies adopted by market players are:

- In September 2022, new GeForce RTX GPUs and technologies were launched by NVIDIA. The GeForce RTX 40 Series graphics cards from NVIDIA are so fast that they provide gamers and creators with a quantum leap in performance, AI-powered graphics, more immersive gameplay, and the quickest content creation workflows. The newest games have a 2X increase in gaming performance. By utilizing DLSS 3 and other Ada developments, developers can increase performance in fully ray-traced games by up to a 4X increase. The GeForce RTX 40 Series graphics cards offer up to two times as much performance in 3D rendering, video export speed, and AI features for creative apps.

- In November 2022, The AMD Radeon RX AMD introduced 7900 XT and Radeon RX 7900 XT graphics cards. They are based on the newest, high-performance, energy-efficient AMD RDNA 3 architecture. The new graphics cards are the first gaming graphics cards in the world to include an innovative AMD chipset design, following the hugely popular AMD "Zen"-based AMD Ryzen chipset processors. They provide exceptional performance and superb energy efficiency to enable high-framerate 4K and greater resolution gaming in the most demanding titles.

Graphic Processors Market Leaders

-

NVIDIA Corporation

-

Advanced Micro Devices Inc.

-

Intel Corporation

-

Samsung Electronics Co. Ltd.

-

Qualcomm Incorporated

- *Disclaimer: Major Players sorted in no particular order

Graphic Processors Market News

- July 2022: The first 16-gigabit (Gb) Graphics Double Data Rate 6 (GDDR6) DRAM with processing speeds of 24 gigabits per second (Gbps) was launched by Samsung Electronics. The new memory, which is built using extreme ultraviolet (EUV) technology and Samsung's third-generation 10-nanometer-class (1z) process, is intended to significantly improve graphics performance for next-generation graphics cards (Video Graphics Arrays), laptops, game consoles, artificial intelligence-based applications, and high-performance computing (HPC) systems.

- November 2022: Qualcomm Technologies, Inc launched the Snapdragon 8 Gen 2 premium mobile platform. The Snapdragon 8 Gen 2 Mobile Platform, strategically developed with ground-breaking AI on every level to allow amazing experiences, will set a new benchmark for connected computing. Snapdragon 8 Gen 2 launched new Snapdragon Elite Gaming capabilities, such as real-time hardware-accelerated ray tracing, which gives mobile games realistic lighting, reflections, and illuminations. Users may enjoy champion-level gaming with longer battery life thanks to the updated Qualcomm Adreno GPU's up to 25% faster performance and the Qualcomm Kryo CPU's up to 40% greater power efficiency.

Graphic Processors Industry Segmentation

Graphics processors are devices used for the purpose of accelerating a wide range of tasks, from drawing simple text and graphics on a computer to designing and analyzing complex three-dimensional (3D) models. A graphics processor is a single-chip processor that boosts the performance of video and graphics and is used to lower the burden on the CPU. Graphic processors are used in embedded systems, consoles, workstations, personal computers, and mobile phones to deliver faster performance and better rendering.

The Graphic Processors Market is Segmented by Type (Dedicated Graphics Card, Integrated Graphics Solutions, and Hybrid Solutions), by Deployment(On-premise, Cloud), by Applications (Smartphones, Tablets and Notebooks, Workstations, Gaming PC, Media and Entertainment, and Automobiles), and by Geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa).

The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

| By Type | Dedicated Graphics Card |

| Integrated Graphics Solutions | |

| Hybrid Solutions | |

| By Deployement | On-premise |

| Cloud | |

| By Applications | Smartphones |

| Tablets and Notebooks | |

| Workstations | |

| Gaming PC | |

| Media and Entertainment | |

| Automotives | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East and Africa |

Graphic Processors Market Research FAQs

What is the current Graphic Processors Market size?

The Graphic Processors Market is projected to register a CAGR of 33.35% during the forecast period (2025-2030)

Who are the key players in Graphic Processors Market?

NVIDIA Corporation, Advanced Micro Devices Inc., Intel Corporation, Samsung Electronics Co. Ltd. and Qualcomm Incorporated are the major companies operating in the Graphic Processors Market.

Which is the fastest growing region in Graphic Processors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Graphic Processors Market?

In 2025, the North America accounts for the largest market share in Graphic Processors Market.

What years does this Graphic Processors Market cover?

The report covers the Graphic Processors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Graphic Processors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Graphics Processor Industry Report

Statistics for the 2025 Graphic Processors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Graphic Processors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.