Wireless Temperature Sensors Market Analysis

The Wireless Temperature Sensors Market is expected to register a CAGR of 7.7% during the forecast period.

- Wireless temperature sensors are small-sized. The low-cost wireless communication enabled sensors are deployed to build various temperature monitoring and control networks used in diverse fields, like industrial automation, process control, patient monitoring systems, asset tracking, internal, external climate sensing, etc.

- Increasing investments in the industry to innovate and develop new sensor technologies and upgrading existing infrastructure to support and integrate technologies, like IoT and automation, have been the primary trends impacting the industry on a global scale.

- In January 2020, Momenta Ventures invested in SST Wireless. A wireless, industrial-hardened condition-monitoring sensor used to increase worker safety, reduce downtime, extend machinery service life, and conserve resources, such as water and energy.

- Wireless temperature sensors are also vital in smart grids for remote monitoring of power lines and transformers. They are put into service to monitor line temperature and weather conditions. Industrial automation and demand for miniaturized consumer devices, such as wearables and IoT-connected devices, among others, across regions, are among the significant factors driving the wireless temperature sensors market.

- Moreover, due to the increased government regulation for the increased use of the sensor for safety, the demand for wireless temperature sensors is growing. For instance, the areas with challenging environmental conditions, such as extreme high pressure and high temperature, require wireless sensors. It becomes easy to control and monitor the facility from a safe distance continually. They help to acquire the data from the locations, which are difficult to access.

- With the 5G adoption initiated in the significant market, such as North America, Europe, and other major developed cities across the world, has made it possible for this sensor network to transfer multimedia files at a fast rate and enable MIMO networking capabilities.

- The different end-user industry applications require wireless sensors to meet the current standard requirement, such as measuring precisely and accurately moving machinery. This factor creates challenges and acts as a barrier to developing a product that suits all the industry's applications. It also helps to create a market for a customized solution and provides a competitive edge for vendors having such capabilities.

- Due to the outbreak of COVID-19, the global supply chain and demand for multiple products have been disrupted, owing to which wireless temperature sensors adoption is expected to be influenced until the end of 2020. However, the growing demand for medical applications is driving the market growth. Various players in the market are investing and collaborating to cater to the requirements.

- For instance, In April 2020, Semtech and Polysense Technologies have joined forces to develop a series of human body temperature monitoring devices based on Semtech's LoRa LPWAN. The sensors provide real-time data to frontline healthcare workers and quickly screen individuals with a high temperature, one of the most common symptoms of COVID-19.

Wireless Temperature Sensors Market Trends

Building Automation Sector Expected to Hold Significant Share

- Sensor technology is becoming an integral part of the smart, green, and energy-efficient buildings. In building automation, many current designs can adjust for occupancy and compensate for the external conditions, such as outside air temperature.

- The integrated building solution system with wireless temperature sensors accesses control to share information and strategies to reduce energy consumption, improve energy efficiency management, and provide value-added functionality. This factor increases energy and operational efficiency and provides a level of occupant control unmatched by single- purpose and non-integrated systems.

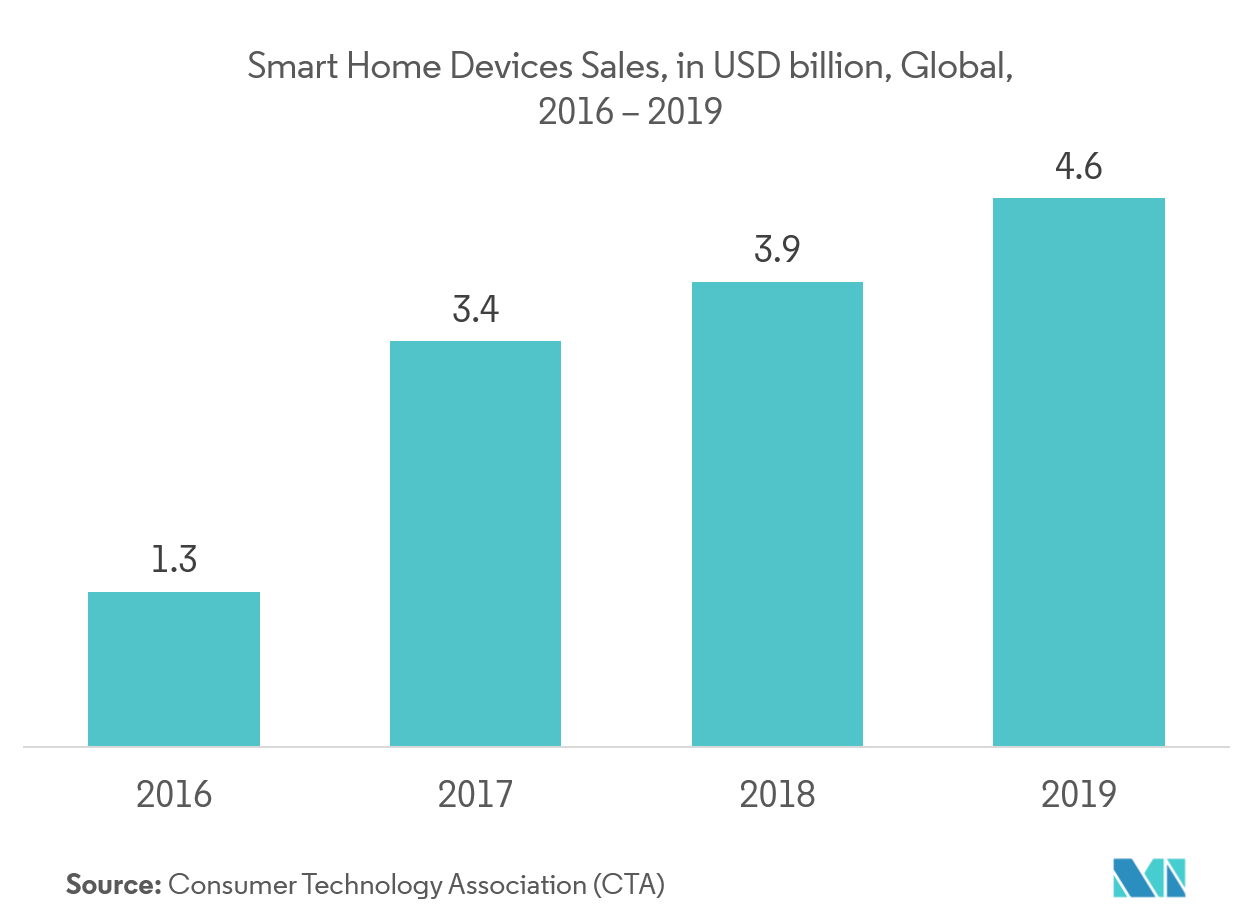

- Globally, due to the increasing government regulations across developed and developing countries, most of the buildings need smarter heating and cooling. The wireless temperature sensors are used in smart home devices to monitor physical and environmental conditions, such as temperature, to pass the data in a structured manner through the network to the primary location. So the growth in smart home devices is directly impacting the growth of the wireless temperature sensors market.

- European standards, like PD 6662 that set standards for intruder and hold-up alarm systems (I&HAS) in buildings, are also aiding in the installation of smart solutions. In India, the penetration of the smart home is expected to increase to almost 10% by the end of 2023 from 0.8% in 2018, which includes expansion of smart home technologies, such as control, connectivity, and other smart appliances.

- Furthermore, the integration of wireless technologies into building control provides significant simplification in wiring requirements for reducing maintenance complexity and setup costs. Some of the prominent players, such as Honeywell International Inc. and Texas Instruments Inc., are developing their wireless temperature sensor module that can be easily integrated across the smart building automation systems.

North America is Expected to Hold a Major Share

- Adopting smart factories, intelligent manufacturing, and the presence of multiple industrial wireless temperature sensor manufacturers and system integrators in the different parts of North America are expected to drive growth in the market.

- In North America, the 5G adoption initiative has made it possible for temperature sensor network to transfer multimedia files at a fast rate and enable MIMO (Multiple Input Multiple Output) networking capabilities. Furthermore, avoiding wired sensors and replace them with wireless temperature sensors in commercial spaces result in reduced maintenance and increased space availability.

- For instance, In the United States, existing wireless technologies in the communication industry, such as the IEEE 802.15.4 communication protocol with reduced power consumption by continuous investment in strengthening the 5G adoption, MIMO communication, and industry 4.0 capabilities are expected to create a supportive ecosystem for the market players.

- The adoption of smart homes integrated with HVAC equipment is expected to witness rapid growth in the future, giving rise to the increased adoption of wireless temperature sensors. In various countries, like China, India, and the United States (twelve of the top 50 smart cities are located in the United States), the demand for such sensors is expected to grow.

- Additionally, the end-user industry’s readiness for the adoption of new technology in the North America region is expected to present the market vendors the potential opportunities for the growth in the wireless temperature sensors market.

Wireless Temperature Sensors Industry Overview

The wireless temperature sensors market is highly competitive and consists of several major players. However, with technological advancement and product innovation, mid-size to smaller companies increase their market presence by securing new contracts and tapping new markets. Some of the key developments in the market are:

- In July 2020 - Siemens AG launched a PM2.5 duct type fine dust sensor, which comes in two variants and creates a healthy as well as productive indoor air climate. By ensuring the early detection of hazardous particles, the sensors help achieve energy and cost-efficient control of the entire HVAC system.

- In June 2020 - Schneider Electric, the global company in the digital transformation of energy management and automation, announced that it had become a Partner of Infrastructure Masons (iMasons), a non-profit professional association for the digital infrastructure industry.

Wireless Temperature Sensors Market Leaders

-

ABB Ltd

-

Schneider Electric SE

-

Emerson Electric Co.

-

Siemens AG

-

Honeywell International Inc.

- *Disclaimer: Major Players sorted in no particular order

Wireless Temperature Sensors Industry Segmentation

The market study involves the study of wireless temperature sensors, which are measurement tools equipped with transmitters to convert signals from process instruments into a radio transmission. The wireless temperature sensors enable the end users to utilize these sensors network protocols and algorithms to possess self-organizing capabilities. These sensors have a wide variety of applications in numerous sectors, including military and security, medical, building automation, industrial monitoring, and medical, which have formed the part of the study in considering the end-user industry estimation.

| By End-user Application | Military and Security |

| Medical | |

| Automotive | |

| Industrial Monitoring | |

| Building Automation | |

| Other End-user Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Wireless Temperature Sensors Market Research FAQs

What is the current Wireless Temperature Sensors Market size?

The Wireless Temperature Sensors Market is projected to register a CAGR of 7.7% during the forecast period (2025-2030)

Who are the key players in Wireless Temperature Sensors Market?

ABB Ltd, Schneider Electric SE, Emerson Electric Co., Siemens AG and Honeywell International Inc. are the major companies operating in the Wireless Temperature Sensors Market.

Which is the fastest growing region in Wireless Temperature Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Wireless Temperature Sensors Market?

In 2025, the North America accounts for the largest market share in Wireless Temperature Sensors Market.

What years does this Wireless Temperature Sensors Market cover?

The report covers the Wireless Temperature Sensors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Wireless Temperature Sensors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Wireless Temperature Sensors Industry Report

Statistics for the 2025 Wireless Temperature Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Wireless Temperature Sensors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.