Wired Occupancy Sensors Market Size and Share

Wired Occupancy Sensors Market Analysis by Mordor Intelligence

The Wired Occupancy Sensors Market is expected to register a CAGR of 7% during the forecast period.

- Wired occupancy sensors have gone through several technological advancements since their development due to the continuous demand in the market for energy saving devices. This is achieved through the sensors, which shut down devices and other equipment on the basis of occupancy. These sensors help in reducing light pollution and they can be used for indoor and outdoor spaces.

- Energy saving has been crucial for growth in any economy, as a result of which the governments are also coming with several policies to save energy. Combining with other technologies and efficient lighting, it can help to save up to 30% of energy.

- For instance, the rising construction in the real estate sector has started installing occupancy sensors in most places, like washrooms, to save power, which is another major driver for the occupancy sensors market.

- However, the market is expected to face some hindrances, due to the complex installation process and lack of interoperability of wired occupancy sensors, which could be a challenge. Besides, increasing the adoption of wireless sensors is also expected to grab the share of wired occupancy sensors.

Global Wired Occupancy Sensors Market Trends and Insights

Applications in Hotel and Hospitality to Hold a Significant Share

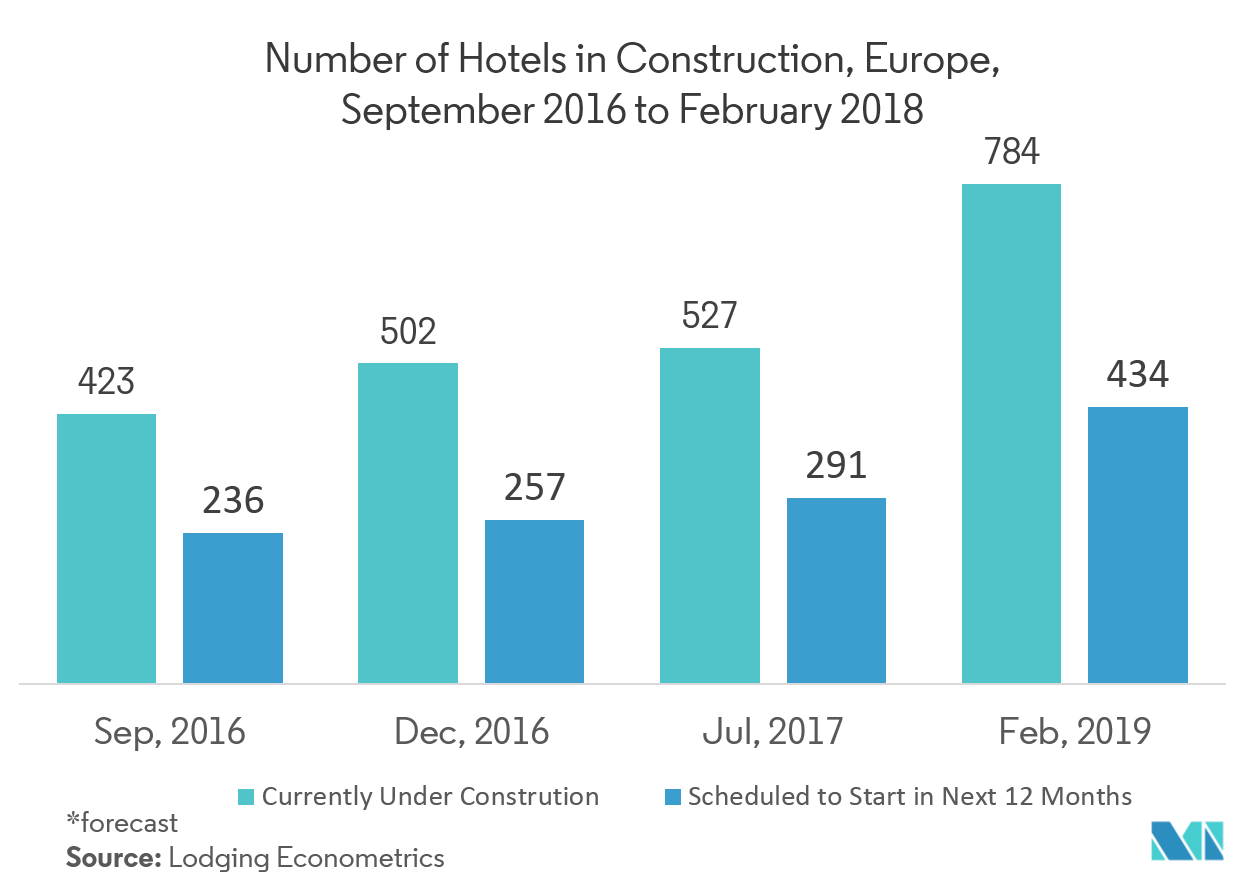

- With the increase in travelling population, the demand for accommodating hotels has increased, and with increasing hotel construction, the segment will further drive the market growth.

- Moreover, a smart city initiative, which includes smart buildings can create an efficient and intelligent services delivery platform for public and municipal workers by installing sensors all over the cites, (eg, in buildings, colleges, hotels, households, etc.,) and to create platforms that allow the share of information and give it for proper use to the public, city managers, businesses, and professionals. This platform also provides significant potential for market growth.

- Besides, energy consumption and wastage at hotels are one of the significant concerns, representing 3% to 6% of hotel operating costs and accounting for approximately 60% of its CO2 emissions, according to Energy Solutions. The primary cause of energy consumption could be technical, architectural, etc. The installation of the occupancy sensor resolves the energy wastage concern.

- Visitors forget to turn off the lights in rooms when not in use, therefore, to address this issue, they have installed occupancy sensors in every room, washrooms, etc. So when a person enters a room, the light will turn on automatically, and it will turn off simultaneously, as the person moves out of the room, which can help development in growing the occupancy sensor market, due to its computing model.

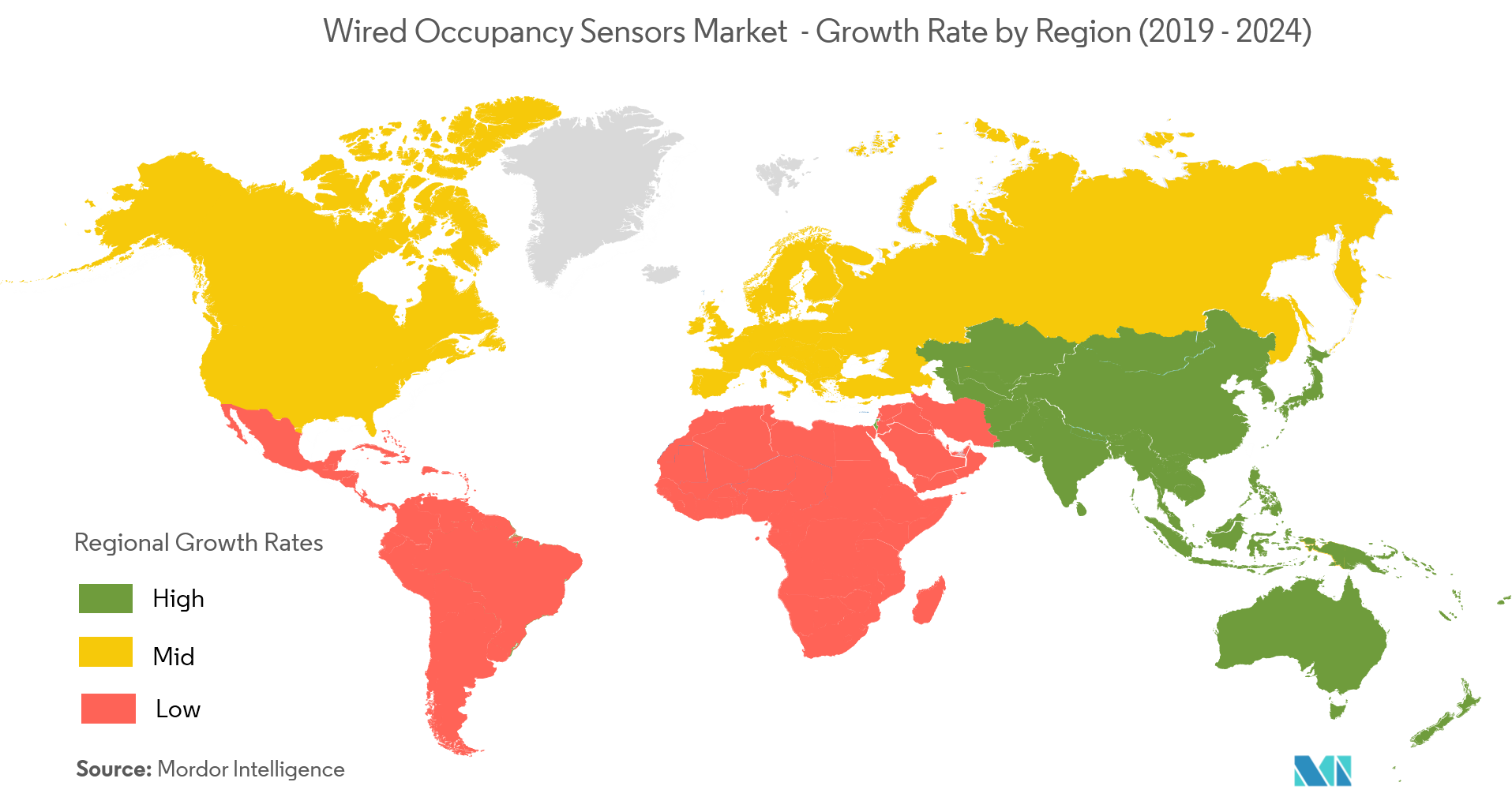

North America to Account for a Major Share

- North America is mainly driven by a higher focus on innovations and advancements in occupancy sensors such as image processing occupancy sensor (IPOS), intelligent occupancy sensor (IOS), and microphonics which has boosted the demand of occupancy sensor in the region.

- Latest advancements in occupancy sensors such as image processing occupancy sensor (IPOS), intelligent occupancy sensor (IOS), and microphonics in the manufacturing of occupancy sensors have led to an increase in the market share of these sensors in a variety of fields.

- The key applications of occupancy sensors are in residential, commercial, educational, healthcare, retail, and hospitality buildings. Occupancy sensors are most widely used in residential and commercial buildings due to the massive growth in the construction sector in various regions across the globe.

- The United States is leading the market due to development in various sectors, such as commercial and residential and increase in the rise of wireless network infrastructure is driving the growth in the home automation, which is helping in the growth of occupancy sensor market. Similarly, the growing demand for HVAC systems in the US region is anticipated to play a crucial role in this market.

Competitive Landscape

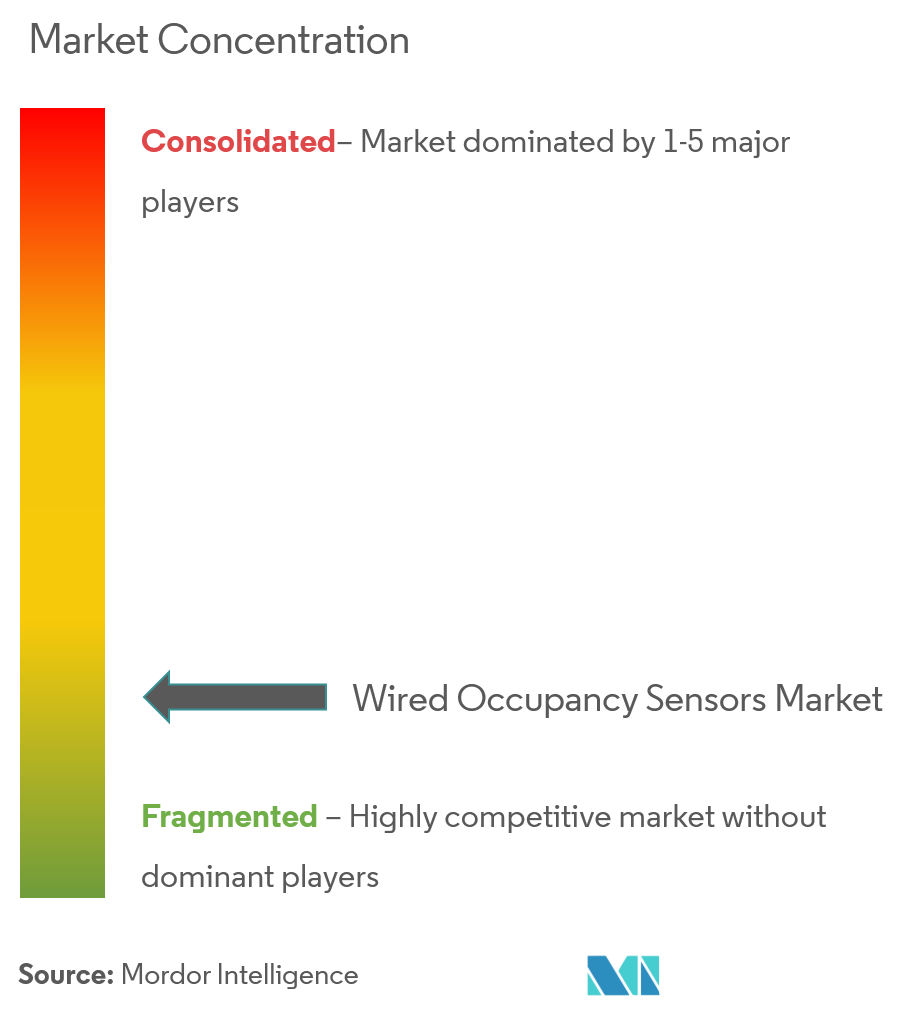

The major players include Honeywell International, Schneider Electric,Eaton Corporation,Legrand, Leviton, General Electric, and Philips, among others. The market is fragmented since there is a significant competition in the market. Hence, the market concentration will be low.

- The market for wired sensors has been taken over by the advent ofwireless sensors by replacing them with wall-mounted sensors. In January 2019, at CES 2019, EnOcean, the world leader in energy harvesting technology launcheda new ceiling-mounted solar-powered occupancy sensor (PIR) for Bluetooth lighting control systems communicating via Bluetooth Low Energy (BLE). These wireless technologies, such as Bluetooth, are expected to challenge the market forwired occupancy sensors.

Wired Occupancy Sensors Industry Leaders

-

Jhonson Controls

-

Texas Instruments

-

Honeywell International

-

Schneider Electric

-

Eaton Corporation

- *Disclaimer: Major Players sorted in no particular order

Global Wired Occupancy Sensors Market Report Scope

Wired occupancy sensors are the kind of sensors that are installed at one particular place, and it gives constant feedback, which results in automatically turning the lights off and on when you enter or leave a particular room. They save energy and have better connectivity in terms of the wireless occupancy sensor.

| Residential |

| Corporate Offices |

| Hotels |

| Educational |

| Industrial |

| Medical and Healthcare |

| Consumer Electronics |

| Other Applications |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Application | Residential |

| Corporate Offices | |

| Hotels | |

| Educational | |

| Industrial | |

| Medical and Healthcare | |

| Consumer Electronics | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Wired Occupancy Sensors Market size?

The Wired Occupancy Sensors Market is projected to register a CAGR of 7% during the forecast period (2025-2030)

Who are the key players in Wired Occupancy Sensors Market?

Jhonson Controls, Texas Instruments, Honeywell International, Schneider Electric and Eaton Corporation are the major companies operating in the Wired Occupancy Sensors Market.

Which is the fastest growing region in Wired Occupancy Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Wired Occupancy Sensors Market?

In 2025, the North America accounts for the largest market share in Wired Occupancy Sensors Market.

What years does this Wired Occupancy Sensors Market cover?

The report covers the Wired Occupancy Sensors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Wired Occupancy Sensors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Wired Occupancy Sensors Market Report

Statistics for the 2025 Wired Occupancy Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Wired Occupancy Sensors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.