Well Intervention Market Analysis

The Well Intervention Market size is estimated at USD 9.07 billion in 2025, and is expected to reach USD 12.60 billion by 2030, at a CAGR of 6.8% during the forecast period (2025-2030).

- Over the medium period, factors such as increased drilling and completion activities globally have been driving the demand for well intervention services over the study period.

- On the other hand, the volatile oil prices over the recent period, owing to the supply-demand gap, geopolitics, and several other factors, have been restraining the growth in the demand for the well-intervention market.

- Nevertheless, the increasing oil and gas discoveries, coupled with the global liberalization in the industry, have created new opportunities for the players to invest in. The new emerging markets are several developing nations in the Middle East and Africa, Asia-Pacific, and South America.

Well Intervention Market Trends

Offshore Segment to have a Significant Market Share

- In recent years, the global oil and gas drilling industry is experiencing significant growth in new offshore exploration activities. Oil and gas players worldwide are focusing on increasing the uptake of new projects to capitalize on the current lower-for-longer oil prices scenario, which, in turn, is expected to increase the growth of the well instervention market in the forecast period. According to Baker Hughes, as of May 2023, the global offshore oil rig count reached 231.

- For instance, in May 2023, Aker BP announced that it is nearing the completion of drilling activities of the Øst Frigg Beta/Epsilon offshore prospect, Norway, and announced an oil discovery near its Yggdrasil development. The production is planned to start in 2027. Based on the estimation, the total volume of the Epsilon and St Frigg structures is estimated to be between 8.5 and 14.3 million standard cubic meters of recoverable oil equivalent.

- In February 2023, Shell Offshore Inc., a subsidiary of Shell PLC (Shell), announced the commencement of production in the Vito field located at Outer Continental Shelf (OCS) blocks in the Mississippi Canyon in the US Gulf of Mexico (GoM), at a depth of 4,000 feet (1,220 meters) of water below sea level.

- Further, the Middle East and Africa are also witnessing a significant rise in offshore reserves development to counter its depleting onshore reserves, and it is one of the prominent offshore oil and gas producing regions worldwide. The availability of abundant resources from several countries (including Saudi Arabia, Iran, Iraq, the United Arab Emirates, and others), coupled with increased potential to recover oil and gas from deep and ultra-deep-water areas, is likely to witness an increased capital investment in the coming years.

- For instance, Abu Dhabi National Oil Company (ADNOC) has been fast-tracking the development of several major oil and gas projects, including some of the largest offshore fields in Abu Dhabi. The company has declared that over 2022-2026, it aims to invest nearly USD 127 billion in growth projects. With this, ADNOC is expected to offer multiple offshore oil and gas contracts in the coming years.

- Furthermore, oil companies are interested in exploring alternative fields to replace the maturing offshore producing sites. The activities include Shell's high-profile discovery via the Graff-1 well offshore Namibia, Italy's Eni’s exploration at its Mlima-1 wildcat block in Kenya, and TotalEnergies' Venus-1X, which showed promising results. In 2023, ten additional high-impact wells are expected to be drilled, most of which are sited in unexplored basins in East and North Africa.

- Norway has had several significant oil and gas discoveries in recent years. In January 2023, the Norwegian Ministry of Petroleum and Energy announced that it had sent out a proposal to announce the APA (Awards in Pre-defined Areas) 2023 licensing round. The proposal for a tender has been submitted for consultation, including the addition of 92 blocks. These discoveries are essential for both Europe and Norway. The additional areas in the Barents Sea and the Norwegian Sea will be included in the APA area.

- Overall, the increase in investments in offshore oil and gas activities owing to the surging energy demand, depleting onshore reserves, and efforts from governments across nations to explore their offshore resources are expected to drive the growth of the well intervention market in the coming years.

North America to Dominate the Market

- North America is expected to dominate the well-intervention market and grow significantly over the forecast period.

- In North America, offshore oil and gas projects are becoming more competitive, owing to improving efficiencies and tightening the supply chain, which led to declining offshore drilling costs.

- The recent development of shale plays, horizontal drilling, and fracking resulted in a massive increase in the country's demand for drilling and completion fluids. For instance, in 2023, the HESS Corporation, a United States Oil & Gas company, declared an oil discovery in an exploration well in the United States Gulf of Mexico. The oil discovery at Pickerel-1 exploration well holds about 90 feet of net pay in an oil-bearing, high-quality, Miocene age reservoir and expects first production in the middle of 2024. As the oil discovery is likely to start production, it is also expected to drive the country’s well internvention market in the forecast period.

- The annual oil output of Mexico has been dropping, over the years, as the giant Cantrell field in the shallow waters of the Gulf of Mexico is drying up. However, the Mexican government is trying to increase private investments in its controlled areas of the Gulf of Mexico.

- For instance, in May 2023, BP initiated oil production at its Argos offshore platform in the deepwater US Gulf of Mexico. With a gross production capacity of up to 140,000 barrels of oil per day, Argos is bp’s fifth platform in the Gulf of Mexico and the region's first new bp-operated production facility since 2008.

- Therefore, increasing oil and gas drilling and completion activities in the region are expected to increase the demand for the well intervention market over the forecast period in the North American region.

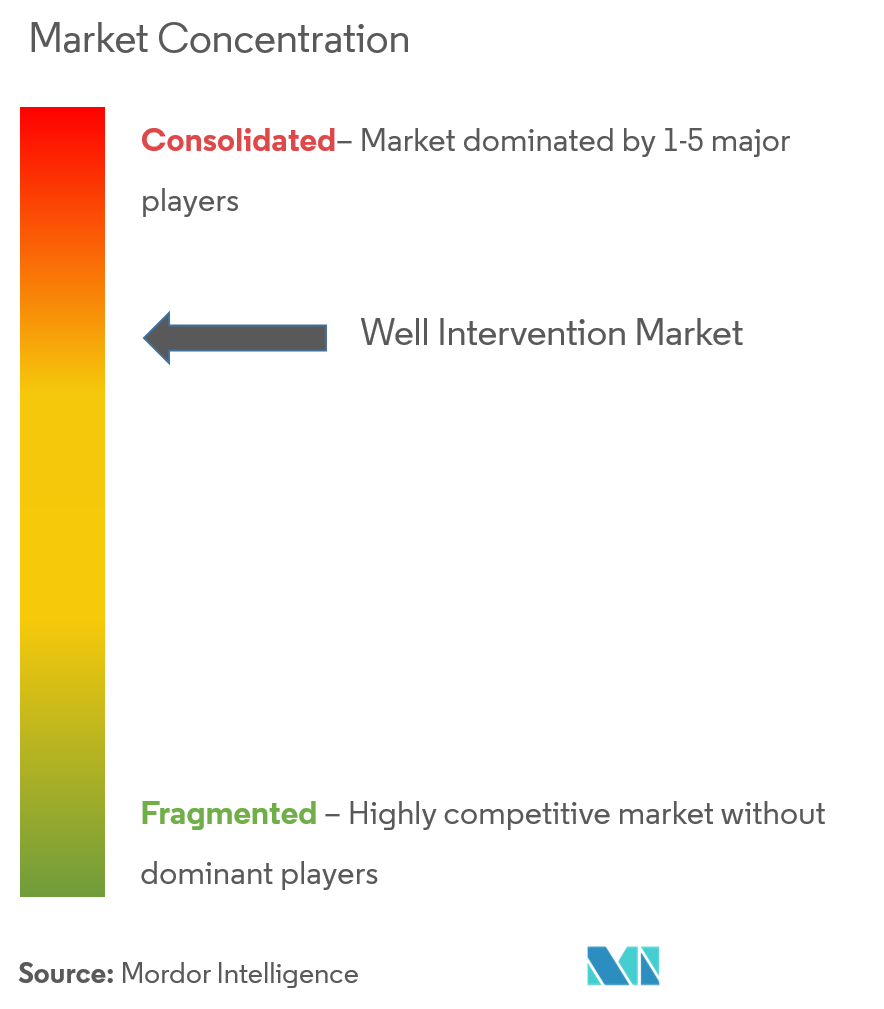

Well Intervention Industry Overview

The well intervention market is semi-consolidated. Some of the key players in this market (in no particular order) include Schlumberger Limited, Halliburton Company, China Oilfield Services, Weatherford PLC, and Baker Hughes Company., among others.

Well Intervention Market Leaders

-

Schlumberger Limited

-

Halliburton Company

-

China Oilfield Services Limited

-

Weatherford International Plc.

-

Baker Hughes Company

- *Disclaimer: Major Players sorted in no particular order

Well Intervention Market News

- In May 2023, TechnipFMC got a contract from Equinor to provide riserless light well intervention (RLWI) services on the Norwegian Continental Shelf. The contract includes production enhancement, production data, and pre-plug-and-abandonment services with a time bond from 2024 to 2025, with options to extend for the three subsequent years.

- In March 2023, Petroleum Safety Authority Norway (PSA) consented Norske Shell to use the Island Constructor vessel for well intervention on the Knarr and Gaupe fields.

Well Intervention Industry Segmentation

A well intervention is an operation carried out at the time or after the well's productive life that changes the state of the well or well geometry, provides well diagnostics, or manages the production of the well.

The well-intervention market is segmented by location of deployment and geography. By location of deployment, the market is segmented into onshore and offshore. The report also covers the market size and forecasts for the well-intervention market across major regions. For each segment, the market sizing and forecasts have been done based on revenue (USD).

| Location of Deployment | Onshore | ||

| Offshore | |||

| Geography | North America | United States of America | |

| Canada | |||

| Rest of the North America | |||

| Europe | United Kingdom | ||

| France | |||

| Germany | |||

| Italy | |||

| Rest of the Europe | |||

| Asia-Pacific | China | ||

| India | |||

| South Korea | |||

| Rest of the Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of the South America | |||

| Middle-East and Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| Rest of the Middle-East and Africa | |||

Well Intervention Market Research FAQs

How big is the Well Intervention Market?

The Well Intervention Market size is expected to reach USD 9.07 billion in 2025 and grow at a CAGR of 6.80% to reach USD 12.60 billion by 2030.

What is the current Well Intervention Market size?

In 2025, the Well Intervention Market size is expected to reach USD 9.07 billion.

Who are the key players in Well Intervention Market?

Schlumberger Limited, Halliburton Company, China Oilfield Services Limited, Weatherford International Plc. and Baker Hughes Company are the major companies operating in the Well Intervention Market.

Which is the fastest growing region in Well Intervention Market?

South America is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Well Intervention Market?

In 2025, the North America accounts for the largest market share in Well Intervention Market.

What years does this Well Intervention Market cover, and what was the market size in 2024?

In 2024, the Well Intervention Market size was estimated at USD 8.45 billion. The report covers the Well Intervention Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Well Intervention Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Well Intervention Industry Report

Statistics for the 2025 Well Intervention market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Well Intervention analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.