Safety Connection Devices Market Analysis by Mordor Intelligence

The Safety Connection Devices Market is expected to register a CAGR of 7% during the forecast period.

- Different categories of personnel work on automated production equipment, ranging from production workers to engineers. This wide range and increasing automation are demanding for safety connection devices from various end-user industries.

- Factory automation ensures a safe working environment for workers. Hence, as the demand for automation in industries is increasing, safety connection devices will also witness an increase.

- On the other hand, the high cost of safety connection devices and lack of awareness about its developments in the industry is restraining the market growth.

Global Safety Connection Devices Market Trends and Insights

Automotive Industry to Drive the Market Growth

- The automotive industry is one of the fastest growing consumers of safety connection devices. With the growing demand for automobiles across the world, companies are pushing toward automated systems, to increase the productivity of the existing plants.

- Many automotive manufacturers are either establishing new manufacturing infrastructures across the world or moving the processes of automotive manufacturing from manual labor to robotic machinery. For instance, BMW is launching a new factory in Hungary by 2023, having a capacity of producing 150,000 vehicles per year.

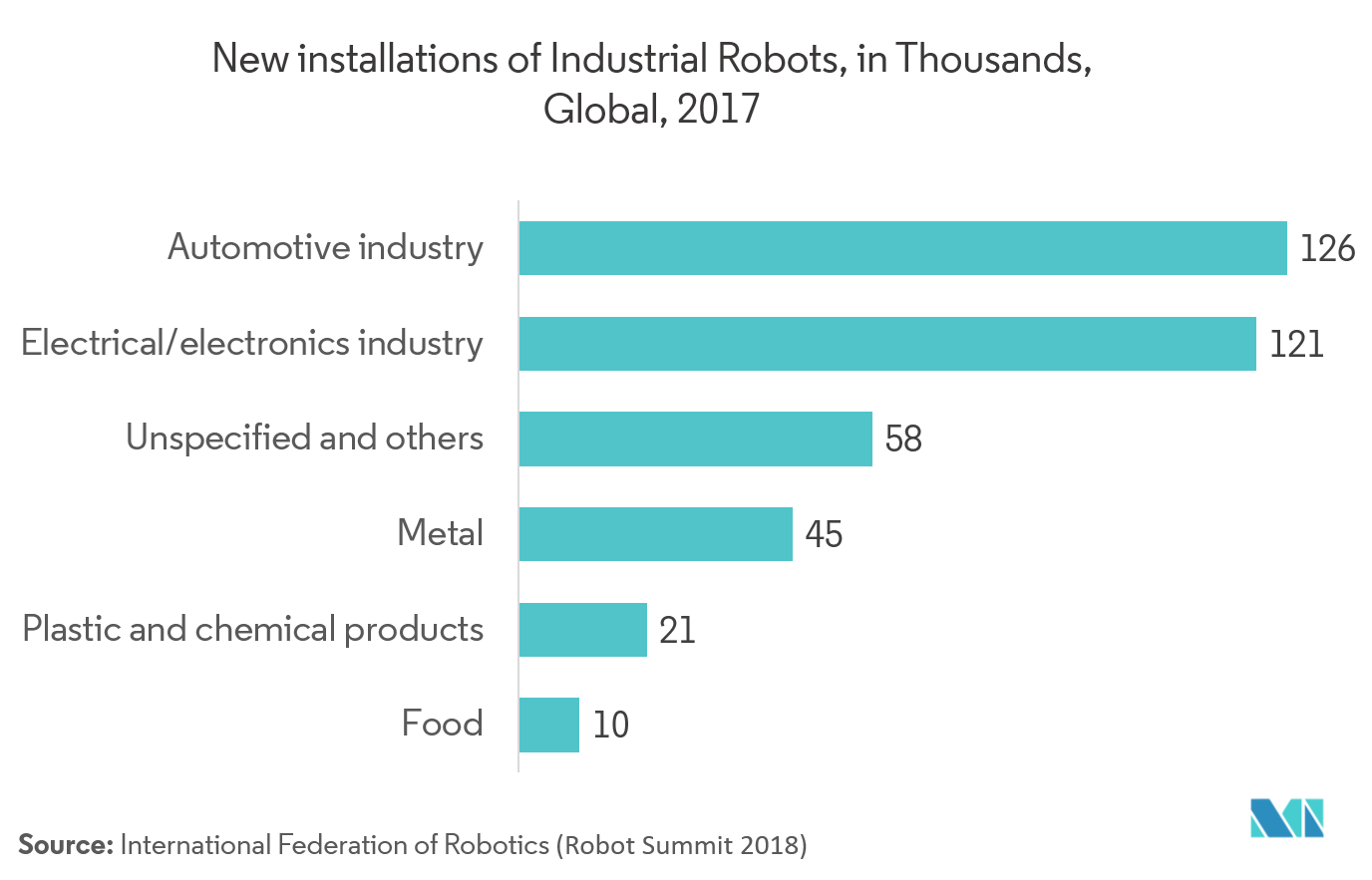

- Thus, with the increase in the number of industrial robots and automation, there is a need for interfacing these systems with centralized controllers. In 2017, the automotive industry had 126,000 new installations of industrial robots, which is the maximum across the industries.

- The automotive industry is thus deploying safety connection devices, so as to make controllers, and other devices communicate with each other.

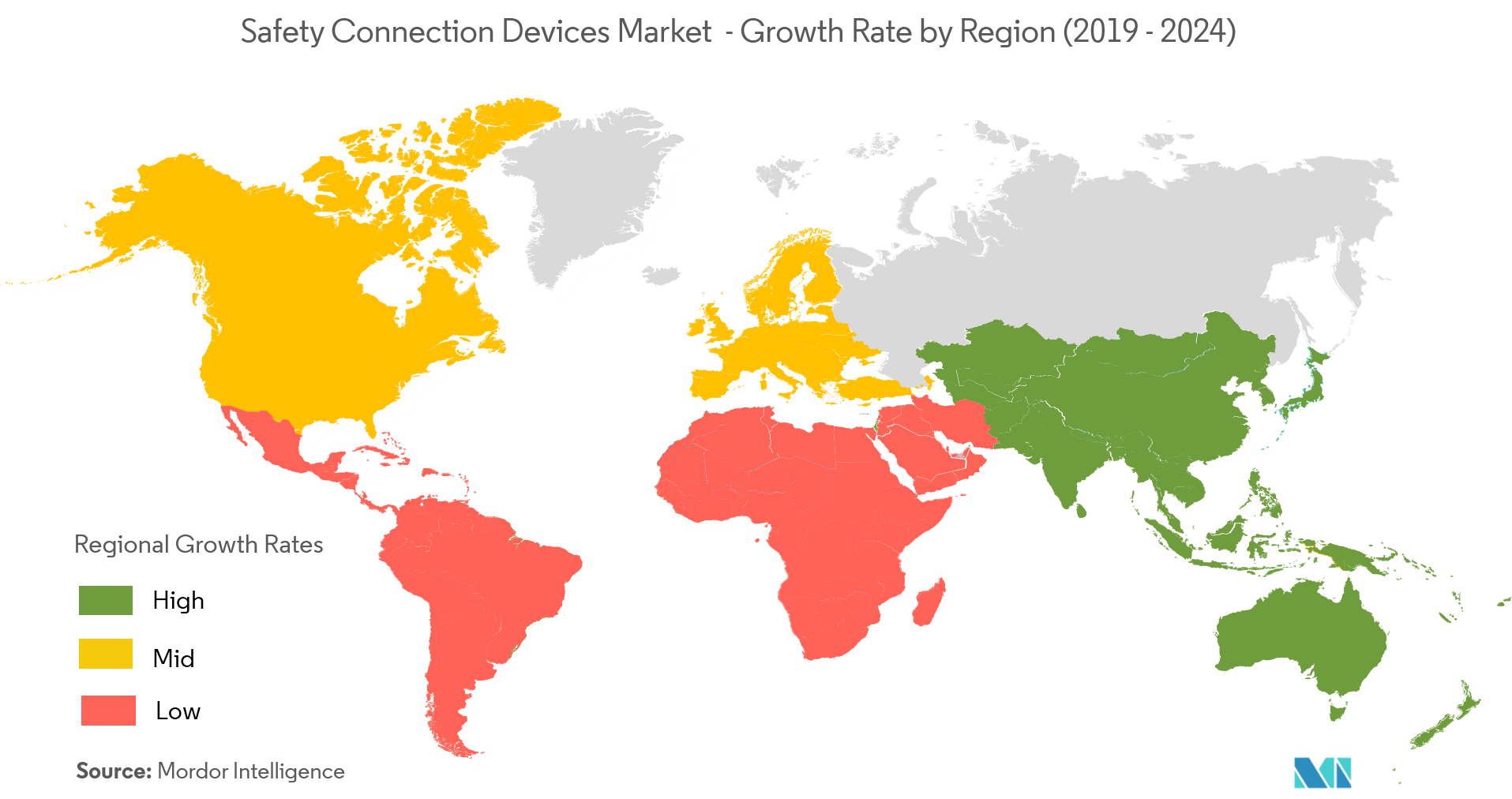

Asia-Pacific to Execute the Fastest Growth

- Asia-Pacific is estimated to be the fastest growing region for the safety connection devices market. The industries are adopting automation, thus making the machines more complex. This ultimately demands more secure and reliable connection devices for the applications.

- The presence of a large number of domestic and international manufacturing companies in the emerging economies of Asia-Pacific, rapid industrialization, and expanding manufacturing activities are projected to drive the machine condition monitoring market in this region.

- India is the third largest economy in the world and the government is taking up initiatives like 'Make in India' to make the country a manufacturing hub. It has a strong emphasis on transforming the domestic manufacturing sector and aims to pull up the GDP share to 25% from 16% by 2022.

- Moreover, the sales of new vehicles in China, which includes passenger vehicles, buses, and trucks, crossed 28 million units in 2018. Therefore, the automotive market in Asia-Pacific is driven strongly by production activities in countries, such as China and India, further demanding safety devices across industries.

Competitive Landscape

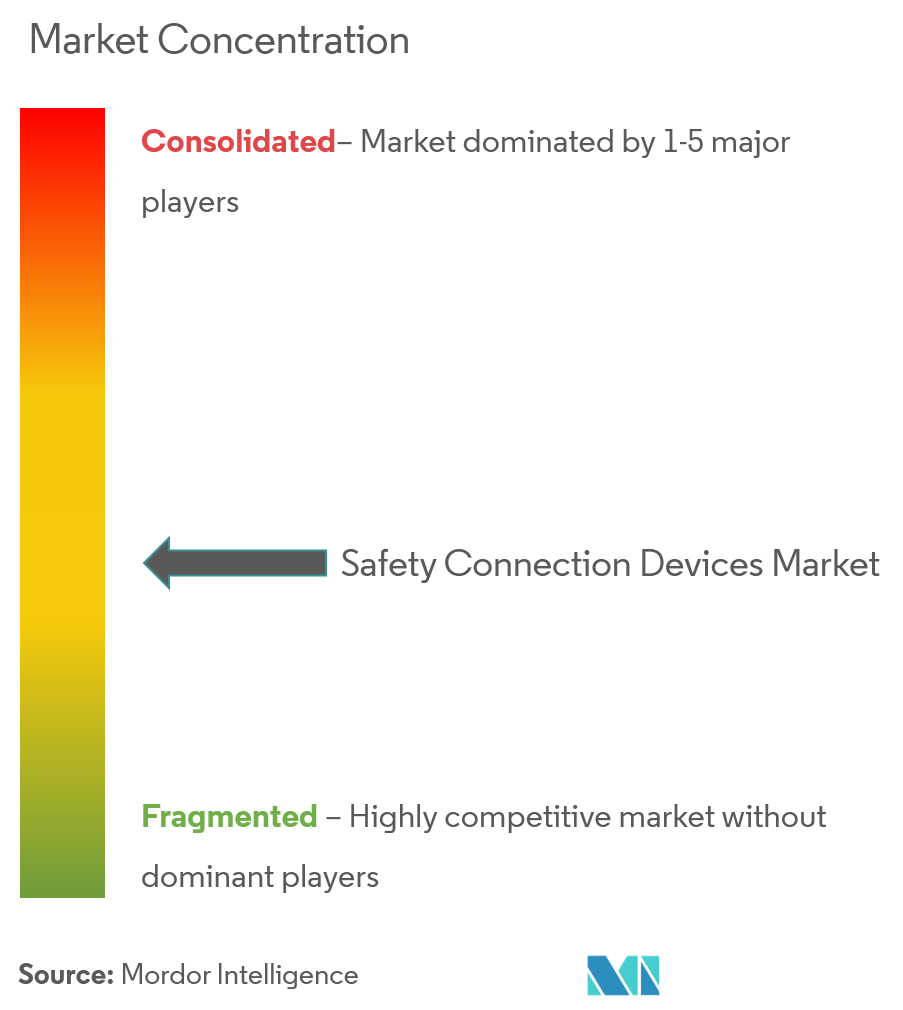

The availability of several players providing cables, connectors, gateways have intensified the competition in the market. Therefore, the market is fragmented with many companies developing expansion strategies.

- May 2019 - LAPP,a leading supplier of integrated solutions in the field of cable and connection technology, launched a new EPIC series of connectors. This new series has increased easeof use and added functionality like robust quick lock system.

- Jun2018 - TE Connectivity launched high current connectors for harsh outdoor environments andextended its range ofheavy duty connectors (HDC). These are suited for applications in new energy, rail, as well as power generation and distribution.

Safety Connection Devices Industry Leaders

-

Rockwell Automation, Inc.

-

ABB Ltd

-

Advantech Co. Ltd

-

Bihl + Wiedemann GmbH

-

Siemens AG

- *Disclaimer: Major Players sorted in no particular order

Global Safety Connection Devices Market Report Scope

Safety connection devices provide reliable and flexible connections between the e-stops, safety interlock switches, safety relays, and cable pull switches. These devices improve communication between different types of machines while helping to increase personal safety. These devices also ensure secure transmission and processing of safety-relevant analog and digital data.

| Cable and Cords |

| Connectors |

| Gateways |

| Adaptors |

| Relays |

| T-Couplers |

| Distribution Box |

| Automotive |

| Manufacturing |

| Healthcare |

| Energy and Power |

| Other End-user Applications |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Type | Cable and Cords |

| Connectors | |

| Gateways | |

| Adaptors | |

| Relays | |

| T-Couplers | |

| Distribution Box | |

| By End-user Application | Automotive |

| Manufacturing | |

| Healthcare | |

| Energy and Power | |

| Other End-user Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Safety Connection Devices Market size?

The Safety Connection Devices Market is projected to register a CAGR of 7% during the forecast period (2025-2030)

Who are the key players in Safety Connection Devices Market?

Rockwell Automation, Inc., ABB Ltd, Advantech Co. Ltd, Bihl + Wiedemann GmbH and Siemens AG are the major companies operating in the Safety Connection Devices Market.

Which is the fastest growing region in Safety Connection Devices Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Safety Connection Devices Market?

In 2025, the North America accounts for the largest market share in Safety Connection Devices Market.

What years does this Safety Connection Devices Market cover?

The report covers the Safety Connection Devices Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Safety Connection Devices Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Safety Connection Devices Market Report

Statistics for the 2025 Safety Connection Devices market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Safety Connection Devices analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.