Push Buttons & Signaling Devices Market Analysis

The Push Buttons and Signaling Devices Market is expected to register a CAGR of 5% during the forecast period.

- Push buttons are widely used in industrial applications due to their additional functionality over other switches. Unlike normal switches, which only perform one function, pushbuttons can be utilized to connect to other mechanical applications via linkages. In industrial applications, this flexibility allows staff to control numerous features of a machine with the push of a button. These devices are widely used in commercial vehicles by the automotive industry.

- Furthermore, According to the United Nations of Industrial Development Organization, the global manufacturing output increased by 5.7% in the third quarter of 2021 compared to the previous quarter, following a 17.7% gain in the preceding quarter. While economic paths differ significantly among countries, most of them had solid improvements in industrial production over the preceding year. Such high growth in the manufacturing sector may drive the push button and signaling devices market to decrease the manufacturing time and increase production.

- Rising industry safety regulations are a critical market driver. Today, industries are frequent sites of accidents. Machinery failure, accidents, and other tragedies are all too common. However, safety is becoming increasingly important. As a result, governments are enforcing stringent industrial safety regulations. As such, Push Buttons & Signaling Devices are increasingly gaining traction across various industries, including food and beverage, chemical, and oil industries.

- In December 2021, the new Siemens SIRIUS ACT push buttons and signaling devices offered by APS Industrial matched all of these criteria, forming the perfect product line of food and beverage push buttons and signaling devices. The food and beverage business in Australia has high standards for cleanliness, toughness, and quality. Equipment that does not fulfill these requirements wastes time due to avoidable breakdowns and downtimes. Such product developments may increase the demand for push buttons in this region.

- According to the International Organization of Motor Vehicle Manufacturers, in 2021, between January and September, about 5.7 million vehicles were manufactured, compared to 5.2 million vehicles in 2020, indicating a gradual growth in vehicle production. Usually, three types of push buttons are used for start, regular stop, and emergency stop actions in industrial operations. These factors facilitate greater freedom and industrial functionality and make it a better choice for industries.

- COVID-19 has impacted negatively on a variety of sectors around the world. The COVID-19 pandemic showed a significant effect on the automobile sector. Lockdowns implemented in many countries have slowed vehicle production and forced the closure of small-scale businesses, negatively impacting the adoption of push buttons and signaling devices in the automobile industry.

Push Buttons & Signaling Devices Market Trends

Automotive Industry to Drive the Market Growth

- Keyless entry in vehicles has been implemented using push buttons. Because of their convenience and dependability, push-button ignition is widely used by numerous automotive manufacturers.

- With a rise in traffic accidents and internal vehicle damage, automobile manufacturers focus on improving vehicular safety. Push-buttons, for instance, are used to power the indicators if the vehicle must travel through a cross-section. This significantly enhances user convenience and also increases passenger safety.

- The most frequent signaling devices in vehicles are panel lights and horns. Additional features, including video surveillance and strobes, are also being considered by automakers. All newly manufactured automobiles will also include emergency lighting. This is also expected to drive market expansion throughout the forecast period.

- Automobiles with keyless entry push-buttons are considered premium automobiles. As a result, most automotive manufacturers include them to gain traction with buyers. Both visual and audible signals are critical components that alert passengers and drivers when doors are left open or seat belts are not correctly buckled. Furthermore, the market is expected to increase due to strict regulations in various markets over the forecast period.

- These increased applications and the extension of the serviceable life are likely to stimulate demand. Furthermore, these devices are reasonably priced, making them a viable option in all automobiles. Governments all around the world are enacting regulations to increase vehicle driver safety. As a result, automakers are working on finding innovative methods to secure automobiles.

North America Expected to Hold Largest Market Share

- Signaling devices are widely used in the food and beverage industries to store food items at certain temperatures, especially in cold storage. These devices alert workers if there are any changes or fluctuations. As a result, they are utilized to prevent food spoilage or waste, such as RTD sensors and temperature transmitter solutions for dairy products.

- Automation of push-button and signaling devices is preferred and chosen by large-scale companies, primarily to avoid the human error factor. The rise of industrial control technologies such as SCADA, PLC, and IT control aided market expansion. The key reason driving demand is the flexibility in control and functionality that devices provide in the industrial sector and the improvement in the safe work environment on factory floors.

- As per (UNIDO) United Nations Industrial Development Organization, worldwide manufacturing output increased by 5.7 percent in the third quarter of 2021 compared to the previous quarter, after rising by 17.7 percent in the last quarter. While economic trajectories range widely across countries, most of them had huge increases in industrial production in the previous year. Rapid growth in the manufacturing sector may drive the market for push buttons and signaling devices to save manufacturing time and increase productivity.

- Various vendors in the region are also focusing on developing novel products to cater to a larger number of customers. In September 2021, CUI Devices' Switches Group announced the addition of push-button switches to its product portfolio. Due to the compact footprint, these mini push button switches are ideal for a variety of space-constrained consumer electronics and industrial control applications.

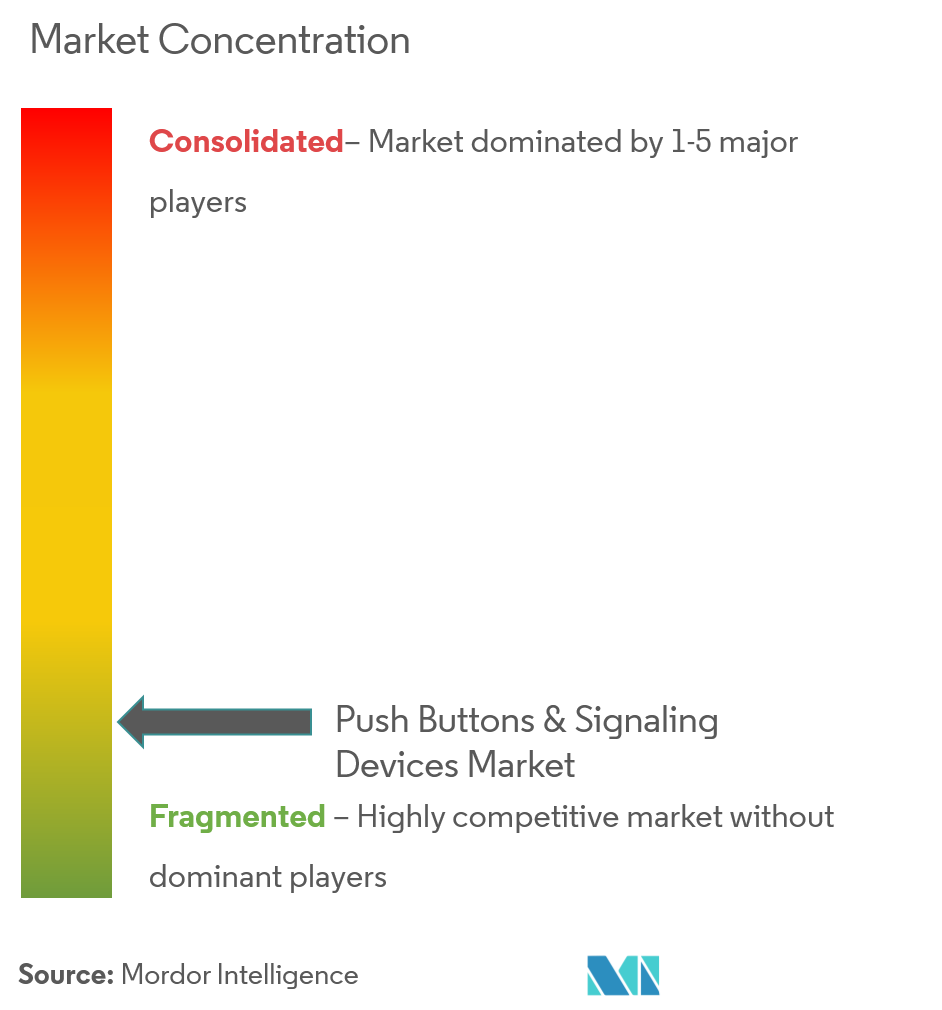

Push Buttons & Signaling Devices Industry Overview

The Push Buttons and Signaling Devices Market is fragmented, with high competition present among the players. The major players with significant shares in the market are focusing on expanding their customer base across foreign countries. They are leveraging strategic collaborative initiatives to increase their market shares and profitability.

- September 2022 - Kurin, Inc., the inventor and manufacturer of the Kurin blood culture collection sets, announced full-scale manufacturing of the Push-button needles. The Advance needle was tested in 2021, has been used in Kurin accounts since last year, and is now widely available.

Push Buttons & Signaling Devices Market Leaders

-

Rockwell Automation Inc.

-

Siemens AG

-

ABB Ltd

-

Schneider Electric

-

Federal Signal Corporation

- *Disclaimer: Major Players sorted in no particular order

Push Buttons & Signaling Devices Market News

- September 2022 - The Blue Valley School District announced a new crisis alert system that allows Blue Valley staff members to call for help by pushing a button with a specialized badge. This system will be added to schools during the 2022-23 school year.

Push Buttons & Signaling Devices Industry Segmentation

The Push Buttons and Signaling Devices Market is segmented by Products (Round or Square Body Type, Non-Lighted Push Button), Type (Audible, Visible), End-user Industry (Automotive, Energy and Power, Manufacturing, Food, and Beverages), and Geography.

Push buttons are machine or appliance power control switches. They are often metal or thermoplastic switches that allow the user convenient access. Push buttons are widely utilized in industries due to their comfort and safety in various industrial and commercial applications. The study includes switches and control pushbuttons used in construction and industrial applications.

| By Product | Round or Square Body Type |

| Non-lighted Push Button | |

| Other Products | |

| By Types | Audible |

| Visible | |

| Other Types | |

| By End-user Industry | Automotive |

| Energy and Power | |

| Manufacturing | |

| Food and Beverage | |

| Other End-user Industries | |

| By Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East and Africa |

Push Buttons & Signaling Devices Market Research FAQs

What is the current Push Buttons and Signaling Devices Market size?

The Push Buttons and Signaling Devices Market is projected to register a CAGR of 5% during the forecast period (2025-2030)

Who are the key players in Push Buttons and Signaling Devices Market?

Rockwell Automation Inc., Siemens AG, ABB Ltd, Schneider Electric and Federal Signal Corporation are the major companies operating in the Push Buttons and Signaling Devices Market.

Which is the fastest growing region in Push Buttons and Signaling Devices Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Push Buttons and Signaling Devices Market?

In 2025, the North America accounts for the largest market share in Push Buttons and Signaling Devices Market.

What years does this Push Buttons and Signaling Devices Market cover?

The report covers the Push Buttons and Signaling Devices Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Push Buttons and Signaling Devices Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Push Buttons & Signaling Devices Industry Report

Statistics for the 2025 Push Buttons and Signaling Devices market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Push Buttons and Signaling Devices analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.