Market Trends of Pipeline Security Systems Industry

This section covers the major market trends shaping the Pipeline Security market according to our research experts:

SCADA System Segment to Grow Significantly

- Supervisory Control and Data Acquisition (SCADA) software have experienced rapid growth over the past decade. SCADA system helps the end-user industry employees to analyse the data and make crucial decisions from a remote location. It further assists in mitigating the issues with a quick response as it processes, distributes, and displays the data, on Human Machine Interface (HMI).

- Pipeline SCADA systems detect different hazards as well as leaks immediately and effectively alarms the security forces or maintenance crews. It offers a unique solution for the detection of on and underground activities. The applications are specifically used for the detection of digging and leakage.

- The US alone has about 150,000 miles of pipelines for transporting petroleum products. To efficiently monitor and control this massive oil pipeline network SCADA systems are employed. The oil pipeline SCADA has several hundred RTU’s (remote terminal units) that are connected to field instruments that measure pressure, temperature, and rate of flow of the oil flowing through the pipes, as well as change the statuses of valves and pumps along the pipeline.

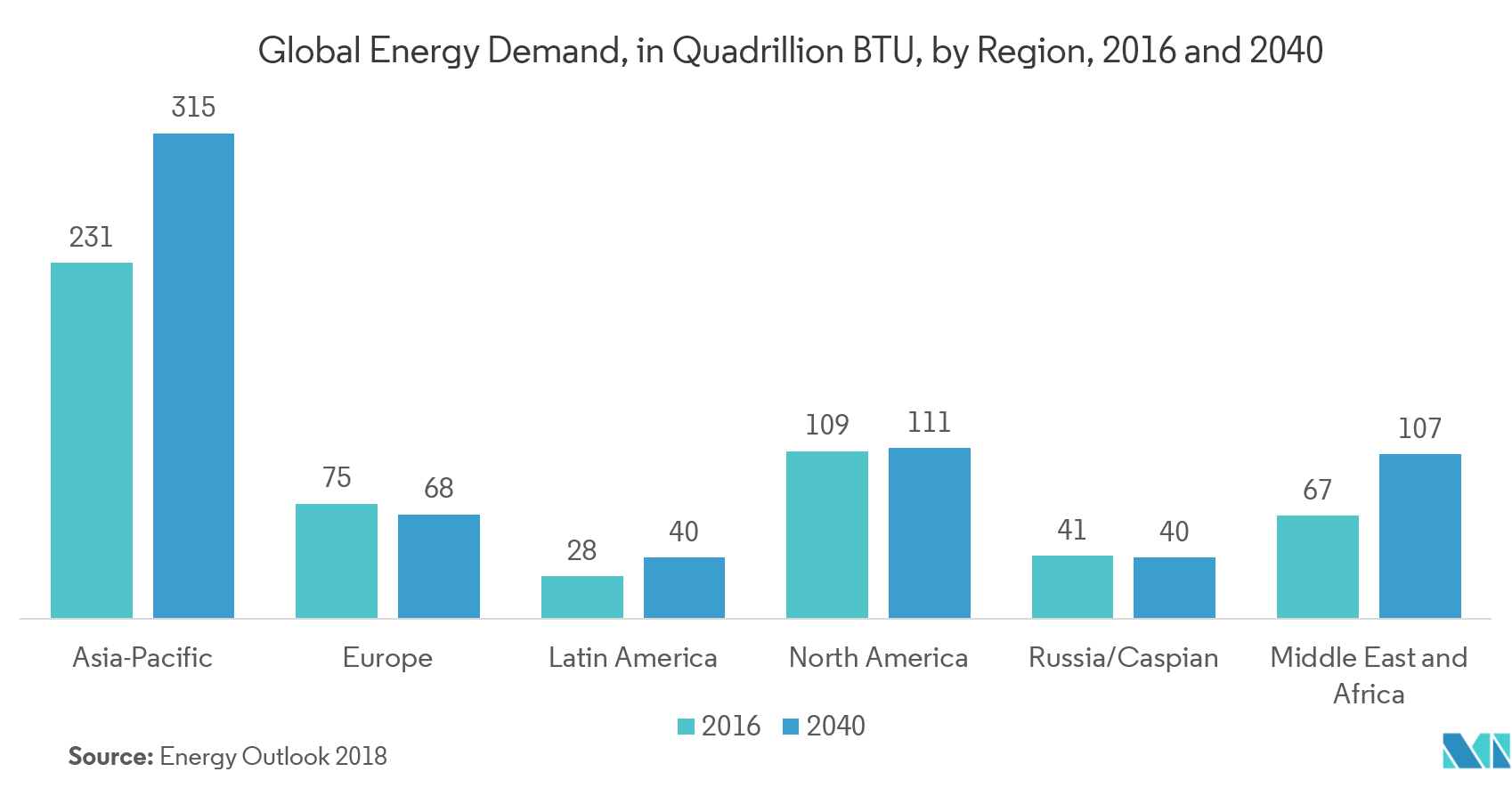

- According to EIA, the global demand for energy is expected to reach 681 quadrillions BTU by the year 2040. The increasing demand for natural gas production and supply globally to gain a reduction in carbon emission is demanding the need for their pipeline security systems.

Europe to Hold Significant Market Share

- The increasing investments in oil and gas are significantly contributing to the growth of the pipeline security market in the region. The European Union (EU) is highly dependent on external natural gas supplies and has experienced severe gas cuts in the past, mainly driven by the high-pressure natural gas system's technical complexity and political instability in some of the supplier countries.

- Declining indigenous natural gas production and growing demand for gas in the EU has encouraged investments in cross-border transmission capacity to increase the sharing of resources between the member states, particularly in the aftermath of the Russia–Ukraine gas crisis in January 2009.

- Amidst the growing need to cut operating costs, companies operating through pipeline in the region seek help from AI to automate functions, predict equipment problems, and increase the output of oil and gas.

- At present, European countries are among the primary consumers of Azerbaijani oil. Italy is Azerbaijan's leading trading partner in the sale of this oil on world markets. In the autumn of this year, Europe will also start consuming Azerbaijani gas. For this purpose, a 3,500-kilometer-long Southern Gas Corridor pipeline is being built and is nearing completion. Its last ring, the Trans-Adriatic Pipeline to the Adriatic Sea's Italian shores, is 97 percent completed. TAP is the Southern Gas Corridor's European section, enhancing Europe's energy security and contributing to decarbonizationand gas supplies diversification.

- In October 2020, the pipeline will start transporting Azerbaijani gas to Europe. Thus, Europe will begin importing natural gas from an entirely new source. The attack on Azerbaijan's Tovuz region shortly before this event is also considered an attack on Europe's energy security. Azerbaijan believes that one of Armenia's latest provocations' main goals is to destabilize the region and hinder the operating of these critical projects, which will allow Europe to access alternative energy sources and new markets.