Motor Insurance Market Analysis

The Global Motor Insurance Market is expected to register a CAGR of 6% during the forecast period.

Motor Insurance is the insurance for cars, trucks, motorcycles or any other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Motor Insurance may also offer financial protection from theft of the vehicle and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The rise in the number of accidents, implementation of stringent government regulation for the adoption of auto insurance, and surge in automobile sales across the globe drive the growth of the global auto insurance market.

Motor insurance is the largest segment in the non-life insurance market. The gross premium written for the global non-life insurance is increasing, the major driver being the increase in gross premium written from the motor vehicle insurance. Growth in motor vehicle insurance is often important in explaining the overall trends in the non-life sector as insurers collect the largest amount of premiums in motor vehicle insurance. This line of business was identified as a particular driver of developments in the non-life segments in a number of countries. At the Global level, Motor vehicle insurance contributes about 36.3% of non life insurance premium.

Motor insurance market dynamics is increasingly shifting towards digital ecosystem based on mutual partnerships, Internet of Things (IoT), and big data analytics which is reshaping the global auto insurance industry. The global insurance landscape is changing rapidly and the player which embraces the changes in marketplace early will gain the larger market share.

Motor Insurance Market Trends

Usage-based Insurance and Insurance Telematics in Motor Insurance is on Rise

Usage-based insurance (UBI), which is also referred to as pay-per-mile, pay-as-you-drive, or pay-as-you-go, is a type of auto insurance, in which the insurer can measure how far a vehicle is driven, where it's driven, and how it's driven. UBI is generally powered by telematics technology that is pre-installed in a vehicle's network or can be used through a plug-in device/mobile application. Telematics devices provide the insurers with a wide range of data, such as braking and accelerating, to measure the drivers' behavior and usage of the vehicle. Based on the collected data, the insurers calculate the insurance premium for that particular policy. The Covid-19 crisis emphasizes the need for UBIs. Although a lockdown being the rarest of the rare scenario, it had got the consumers into thinking about differential pricing. Being charged for what one uses is the new trend. The new trends are pay as you drive (PAYD) or pay how you drive (PHYD).

According to the National Association of Insurance Commissioners (NAIC), approximately 20% of all auto insurers in the United States may offer usage-based insurance within the next five years. The usage-based insurance is gaining traction in the market, as it is a win-win for both, the policyholder and the insurance company. It provides an incentive for the driver to adopt safer driving practices that can lower the number of accidents and the number of claims for the insurance company, and the benefit for the policyholder is that as the safety level of the driving increases the premium reduces. Black box insurance, also known as telematics insurance, is an auto insurance program that offers premiums based on current driving behavior as opposed to historical performance. Black box insurance aims to match motorists with personalized premiums according to their driving performance.

Online Channel Is The Most Preferred Channel To Buy Motor Insurance In Developed Economy.

In the developed economies like United Kingdom, US, Japan, Germany, Australia etc. most people prefer to buy motor insurance online than by phone or in person. With the maximum internet penetration rate and development of online technology the online sales of motor insurance is more popular in those developed economy. According to the survey done by Deloitte, UK customer are most strongly in favor of the online channel for the motor insurance. In UK 81% of the respondent preferred the online channel to buy the motor insurance, followed by Australia where 60% of respondent preferred online channel and In Japan by 53% of respondent.

Motor Insurance Industry Overview

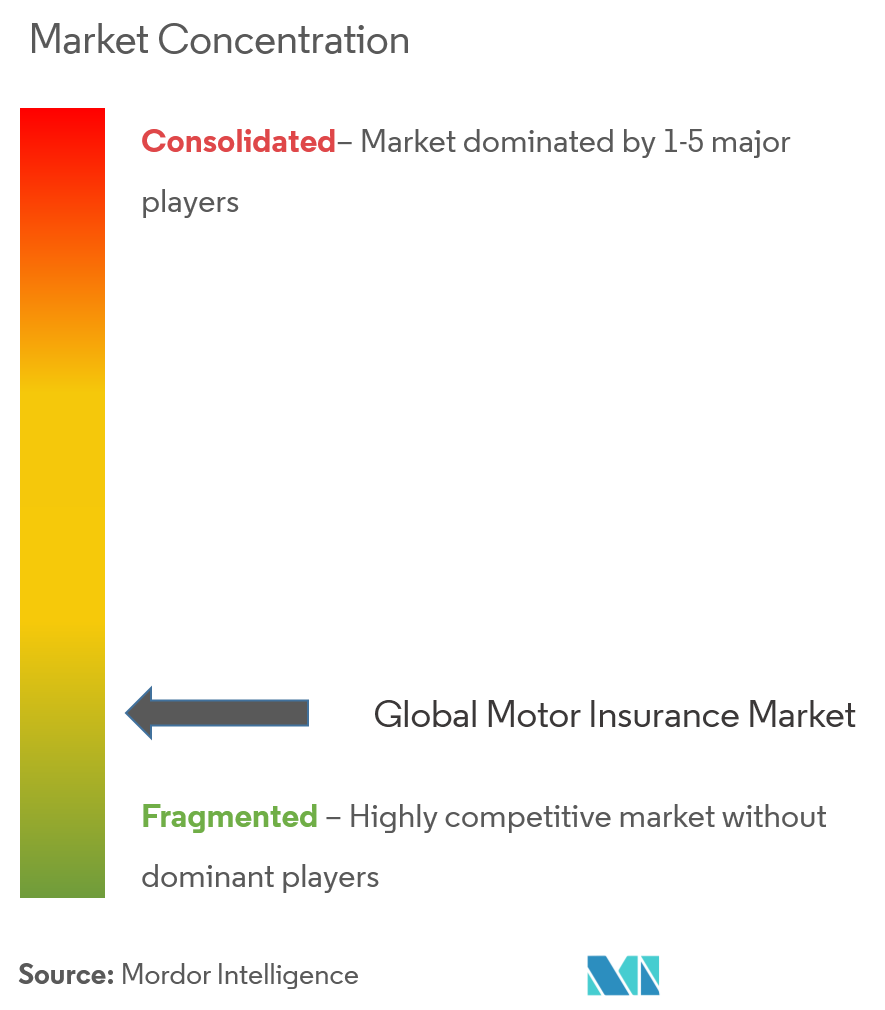

The report covers the major players in the motor insurance market across the world. In terms of market share, the market is highly fragmented with the large number of players operating in the market studied. Companies have been focusing more on providing customized solutions to attract more customers and also enhance their product portfolio. Large insurance players are seeking to team up with the emerging Insurtech Startups to access the new market opportunities. The Major players in the market include; Allianz, State Farm, AXA S.A, Ping An Insurance, Geico, Zurich AG, etc.

Motor Insurance Market Leaders

-

Allianz SE

-

Zurich AG

-

State Farm

-

Assicurazioni Generali

-

Ping An Insurance

- *Disclaimer: Major Players sorted in no particular order

Motor Insurance Market News

- In August 2021, the insurance giant AXA S.A has introduced STeP, a new digital claims solution to help customers simplify their motor insurance process. AXA claimed that through STeP the time taken from customer notification to partners arranging repair or salvage is now down to minutes.

- In May 2021, To accelerate its auto claim and repair processes, GEICO is partnering with AI technology company Tractable. Tractable is the developer of a proprietary computer vision technology that has been trained on millions of historical claims. The AI can assess vehicle damage based on photos, much like a human appraiser. GEICO is looking to utilize Tractable's technology to accurately review estimates within seconds while reducing administrative overheads.

Motor Insurance Industry Segmentation

Motor insurance denotes the insurance for cars, trucks, motorcycles, or any other road vehicles. which, provides financial protection against physical damage or injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. The global motor insurance market can be segmented by Users; (Personal Motor Insurance and Commercial Motor Insurance), By Policy type;(Third Party Motor Insurance, Third Party, Fire & Theft Motor Insurance and Comprehensive Motor Insurance), and By Geography, Europe;( Germany, UK, France, Switzerland, Rest of Europe), North America;( USA, Canada), South America;( Brazil, Argentina), APAC;( China, India, Japan, South Korea, Indonesia, Rest of APAC), MENA;( UAE Saudi Arabia, Lebanon, Rest of North Africa). The report also offers a complete background analysis of the Global Motor Insurance market, including the analysis and forecast of market size, market segments, industry trends, major players, and growth drivers.

| By User | Personal Motor Insurance | ||

| Commercial Motor Insurance | |||

| By Policy Type | Third Party Motor Insurance | ||

| Third Party, Fire & Theft Motor Insurance | |||

| Comprehensive Motor Insurance | |||

| By Geography | Europe | Germany | |

| UK | |||

| France | |||

| Switzerland | |||

| Rest Of Europe | |||

| North America | USA | ||

| Canada | |||

| Latin America | Brazil | ||

| Argentina | |||

| APAC | China | ||

| India | |||

| Japan | |||

| South Korea | |||

| Indonesia | |||

| Rest of APAC | |||

| MENA | UAE | ||

| Saudi Arabia | |||

| Lebanon | |||

| Rest of North Africa | |||

Motor Insurance Market Research FAQs

What is the current Global Motor Insurance Market size?

The Global Motor Insurance Market is projected to register a CAGR of 6% during the forecast period (2025-2030)

Who are the key players in Global Motor Insurance Market?

Allianz SE, Zurich AG, State Farm, Assicurazioni Generali and Ping An Insurance are the major companies operating in the Global Motor Insurance Market.

Which is the fastest growing region in Global Motor Insurance Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Global Motor Insurance Market?

In 2025, the Europe accounts for the largest market share in Global Motor Insurance Market.

What years does this Global Motor Insurance Market cover?

The report covers the Global Motor Insurance Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Global Motor Insurance Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Motor Insurance Industry Report

The Global Motor Insurance Market report provides a comprehensive market overview, covering both personal and commercial motor insurance segments. The industry analysis highlights key factors influencing the market growth, including market segmentation by policy type, such as third-party motor insurance, third-party fire and theft motor insurance, and comprehensive motor insurance.

The market research indicates significant market growth in various regions, including Europe, North America, South America, APAC, and MENA. The industry reports suggest that Europe, particularly countries like Germany, the UK, France, and Switzerland, plays a crucial role in the market's expansion. Similarly, North America, with the USA and Canada, shows a strong market presence.

The market forecast and market predictions emphasize the expected growth rate and market value over the forecast period. The industry outlook and market outlook provide insights into future trends and potential market leaders. The report also includes a market review and market statistics, offering a detailed market analysis and industry information.

The industry profile and industry overview sections offer a historical perspective and current state of the market, while the market report and market data sections provide essential industry research and industry size metrics. The report example and report PDF are available for further reference, ensuring a thorough understanding of the market dynamics.

Overall, the Global Motor Insurance Market report is a valuable resource for research companies, providing detailed industry trends, market leaders, and sector analysis. The industry growth and market trends sections highlight the evolving nature of the market, supported by industry sales and market value data. The report serves as a crucial tool for stakeholders looking to navigate the motor insurance landscape effectively.