Monorail System Market Analysis

The Monorail System Market size is estimated at USD 5.97 billion in 2025, and is expected to reach USD 7.23 billion by 2030, at a CAGR of 3.9% during the forecast period (2025-2030).

The monorail systems market is witnessing steady growth globally, driven by increasing urbanization, congestion in cities, and the need for efficient and sustainable transport solutions. Monorail systems offer numerous advantages, including reduced traffic congestion, lower environmental impact, and the ability to transport large numbers of passengers quickly and safely, making them a popular choice for urban transit systems.

Asia-Pacific is expected to dominate the monorail systems market, fueled by rapid urbanization, population growth, and government investments in infrastructure development. China and Japan are the leading countries in the region, driving the growth of the monorail systems market. For instance, China's ambitious urban development plans, such as the construction of new cities and the expansion of existing ones, have led to substantial investments in monorail projects. In addition, Japan has a long history of monorail systems, with cities like Tokyo and Osaka operating extensive networks.

Furthermore, technological advancements and innovations in monorail systems are driving market growth. Manufacturers are increasingly focusing on creating lightweight and energy-efficient monorail trains and implementing automation and digitalization technologies to enhance safety, efficiency, and passenger experience. For example, the integration of predictive maintenance systems and real-time monitoring sensors enables operators to detect and address issues proactively, minimizing downtime and optimizing system performance. Approximately 54% of monorail lines worldwide serve public transportation purposes, while around 17% cater to theme parks, tourism, and similar activities. The remaining 29% are utilized to facilitate public transportation connections to airports. In addition, advancements in materials and construction techniques are leading to the development of elevated monorail tracks with reduced environmental impact and shorter construction timelines. These technological advancements are expected to further propel the growth of the global monorail systems market in the coming years.

Monorail System Market Trends

Straddle Type Monorails are Expected to Hold a Larger Share Compared to Suspended Type Monorails

A straddle monorail is a system where passenger cars can use wheels to travel on the track/beam. Apart from these walking wheels, there are stabilizing and guiding wheels on both sides of the bogie, which clamp on the sides of the track/beam to ensure safety and smooth running.

This makes the straddle monorail system suitable for urban and complex terrains that are surrounded by a high concentration of buildings, mountainous landscapes, landscapes, cities, and suburban areas. It is also a good choice for countries with low economic growth and fiscal revenue to develop urban rail transit in their cities.

The monorail track/beam system comprises a precast reinforced concrete structure integrated with some structural parts, power supply, and signal facilities. As a result, it has characteristics such as small volume, compact design, and a good landscape for passengers. The rail also does not have a pantograph and overhead power supply, thus considerably decreasing the effective height of the whole system. As the fence can travel in a slight curvature, and the track is mainly elevated above the road, it requires less land use than the traditional rail system. This subsequently makes better use of the limited space available in cities and reduces the need for unwanted urban demolition. Hence, this system is preferred over the suspension type. However, there are a few developments regarding suspension-type monorails as well. For instance,

- In October 2023, China introduced its first suspended monorail line to the public in Wuhan, the capital of Hubei province. The initial phase of the line spans 10.5 kilometers, with six stations located in the Optics Valley, a national innovation demonstration zone in Wuhan.

Asia-Pacific Dominates the Monorail Systems Market

Asia-Pacific is experiencing rapid growth in the monorail systems market due to several factors. Firstly, the region is undergoing significant urbanization and population growth, leading to increased demand for efficient and sustainable transportation solutions. Monorail systems offer a viable option for mass transit in densely populated urban areas, helping alleviate traffic congestion and reduce pollution.

Secondly, many countries in Asia-Pacific are investing heavily in infrastructure development, including transportation projects. Governments are prioritizing the expansion of public transportation networks to improve connectivity and enhance mobility for their citizens. Monorail systems are being deployed as part of these initiatives to provide reliable and high-capacity transit options.

Additionally, technological advancements and innovations in the monorail systems market are driving growth in the Asia Pacific region. Manufacturers are developing state-of-the-art monorail trains and infrastructure, incorporating features such as automation, digitalization, and energy efficiency. These advancements make monorail systems attractive for governments and transit authorities seeking modern and sustainable transportation solutions.

Some of the developments include:

- Expectations are high for the revival of Mumbai monorail services following the delivery of the first coach of the four-car mono train to its Wadala depot in March 2024. The Mumbai Metropolitan Region Development Authority (MMRDA) has tasked Medha SMH Rail Pvt. Ltd with the acquisition of ten four-car trains.

- Alstom, a renowned advocate of intelligent and sustainable transportation, announced the initiation of trial passenger service for Bangkok’s MRT Pink Line. The Prime Minister of Thailand, Mr Srettha Thavisin, inaugurated the new rail service on November 21, 2023, offering complimentary public trials until December 30, 2023.

Monorail System Industry Overview

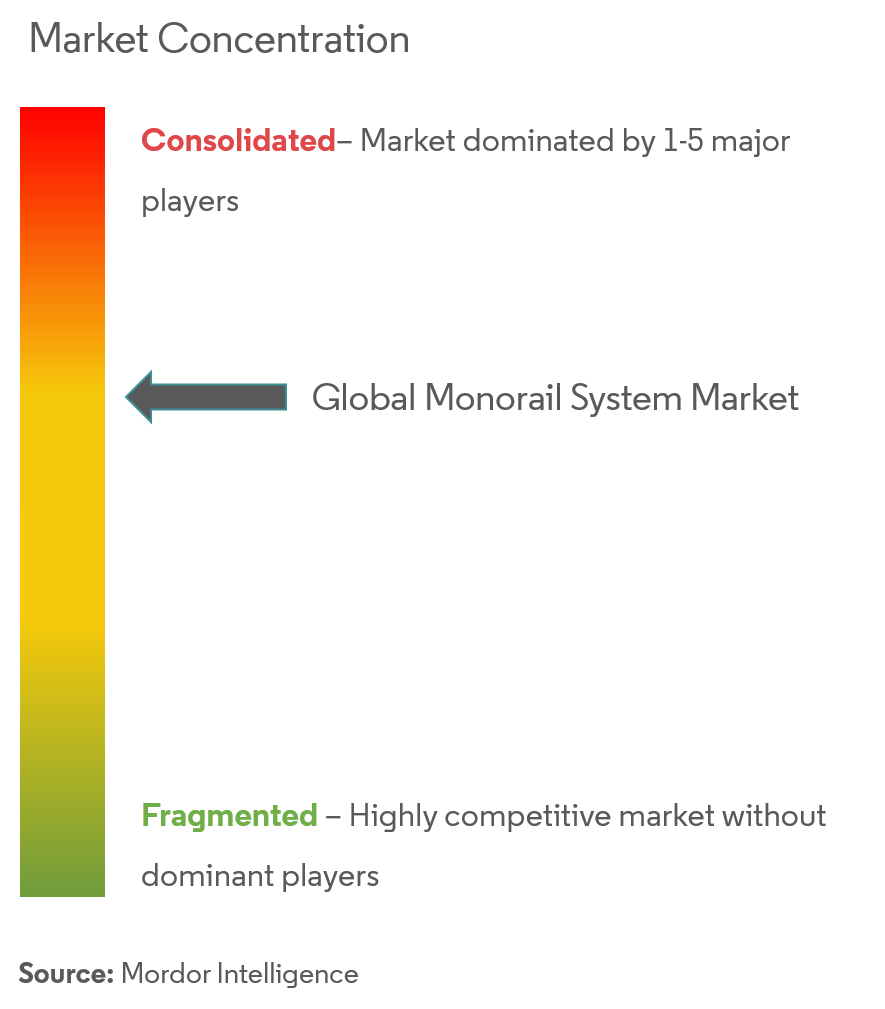

Bombardier, Siemens, CRRC, Hitachi, Intamin Transportation, and BYD Co. Ltd are the major manufacturers operating in the monorail system market. New product launches, acquisitions, mergers, and continuous technological innovations are the characteristics of most companies in the market studied. For instance:

- In March 2024, Egis and its partner, TYLin, secured a contract from the Tainan City government to develop the basic design for Taiwan's inaugural monorail line.

- In August 2023, the Dominican Republic selected an Alstom-led consortium to implement the nation’s first monorail system in Santiago de los Caballeros.

- In October 2022, CRRC, in collaboration with the Portuguese company Mota-Engil, secured a USD 1.4 billion contract to construct three subway lines and supply 132 train cars.

Monorail System Market Leaders

-

Bombardier Inc.

-

Siemens AG

-

CRRC Corporation Limited

-

Hitachi, Ltd.

-

Intamin Transportation

- *Disclaimer: Major Players sorted in no particular order

Monorail System Market News

- February 2024: Panama ushered in a new era of public transportation with the arrival of the first monorail train from the Japanese company Hitachi.

- December 2023: The Greater Cairo Monorail project, a significant infrastructure endeavor in Egypt, is nearing completion. Led by Egypt’s National Authority for Tunnels (NAT), the USD 4.5 billion project aims to enhance Cairo’s transportation network by linking the old city center with the New Administrative Capital.

- November 2023: Riino, a company blending technology influences from various transportation systems, advanced its zero-emission material movement concept with the support of three mining company backers and the Canada Mining Innovation Council (CMIC).

Monorail System Industry Segmentation

A monorail is a fleet of railways where tracks are arranged in a long beam pattern. These tracks consist of a single beam that provides support to hauling the monorail. These monorail tracks serve the daily needs of passengers and freight goods.

The monorail systems market report covers all the key developments in the mentioned regions and regional government incentives to boost the awareness of monorails for transportation benefits.

The market is segmented based on monorail type, propulsion type, and geography. By monorail type, the market is segmented into straddle monorail and suspended monorail. By propulsion type, the market is segmented into electric and maglev. By geography, the market is segmented into North America, Europe, Asia-Pacific, the Middle East and Africa, and South America. For each segment, the market sizing and forecasts have been done based on value (USD).

| Monorail Type | Straddle Monorail | ||

| Suspended Monorail | |||

| Propulsion Type | Electric | ||

| Maglev | |||

| Geography | North America | US | |

| Canada | |||

| Rest of North America | |||

| Europe | Germany | ||

| UK | |||

| France | |||

| Russia | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Middle-East and Africa | Egypt | ||

| Turkey | |||

| Northern Africa | |||

| South Africa | |||

| UAE | |||

| Rest of Middle East and Africa | |||

| South America | Brazil | ||

| Argentina | |||

| Other Countries | |||

Monorail Systems Market Research FAQs

How big is the Monorail System Market?

The Monorail System Market size is expected to reach USD 5.97 billion in 2025 and grow at a CAGR of 3.9% to reach USD 7.23 billion by 2030.

What is the current Monorail System Market size?

In 2025, the Monorail System Market size is expected to reach USD 5.97 billion.

Who are the key players in Monorail System Market?

Bombardier Inc., Siemens AG, CRRC Corporation Limited, Hitachi, Ltd. and Intamin Transportation are the major companies operating in the Monorail System Market.

Which is the fastest growing region in Monorail System Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Monorail System Market?

In 2025, the Europe accounts for the largest market share in Monorail System Market.

What years does this Monorail System Market cover, and what was the market size in 2024?

In 2024, the Monorail System Market size was estimated at USD 5.74 billion. The report covers the Monorail System Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Monorail System Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Monorail Systems Industry Report

Statistics for the 2025 Monorail System market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Monorail System analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.