| Study Period | 2019 - 2030 |

| Base Year For Estimation | 2024 |

| Forecast Data Period | 2025 - 2030 |

| CAGR | 9.00 % |

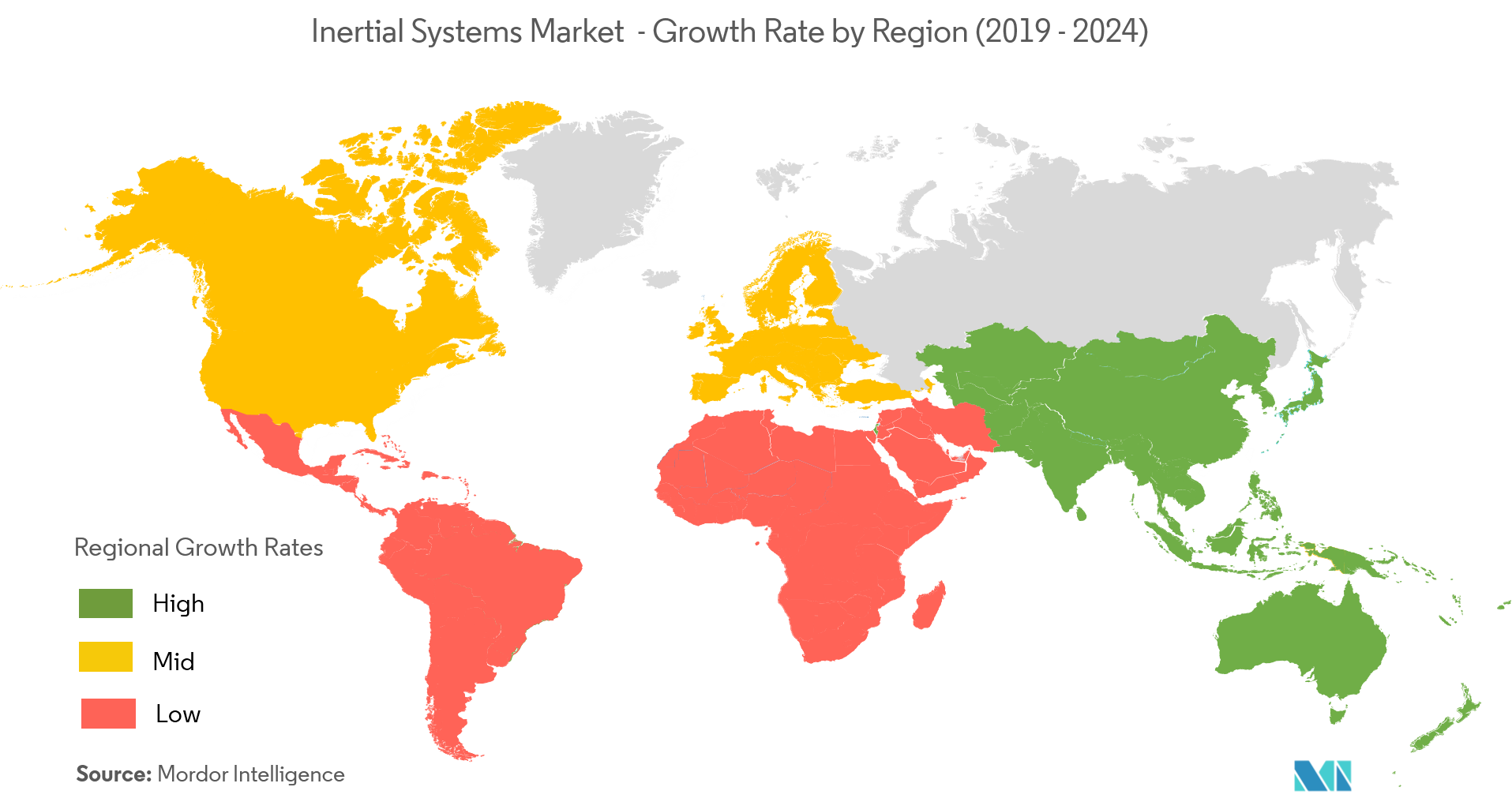

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

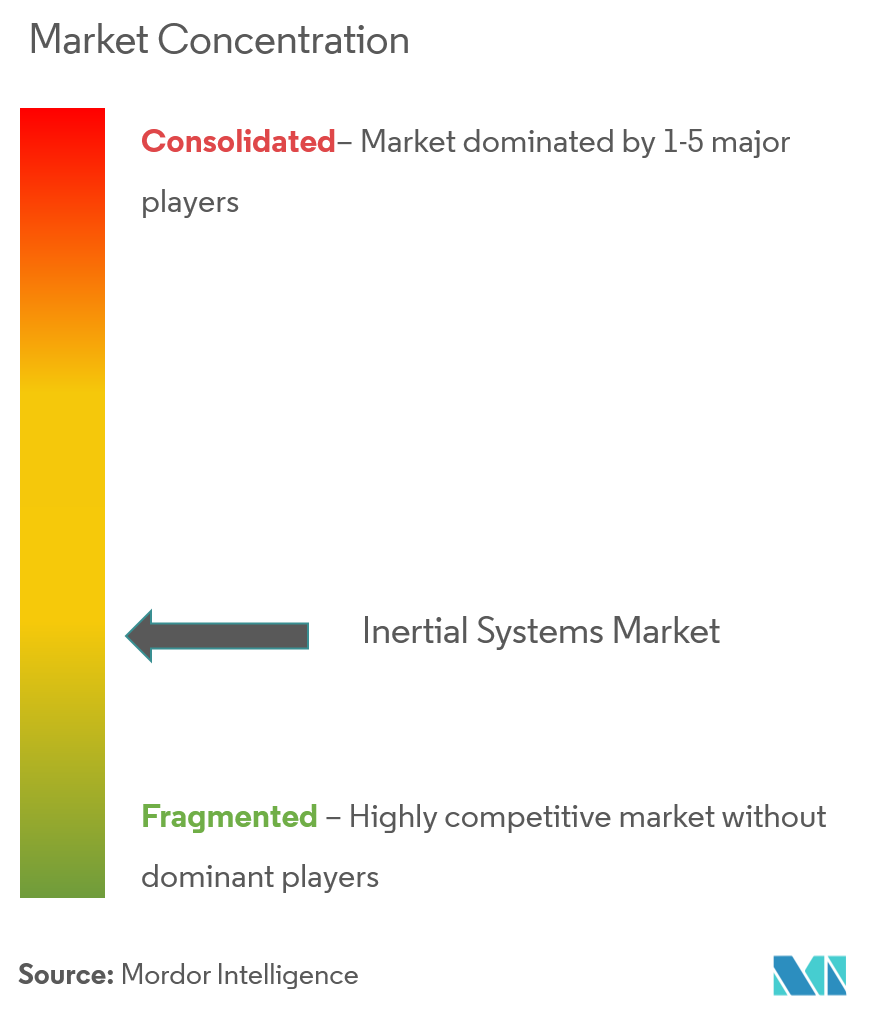

| Market Concentration | Medium |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Inertial Systems Market Analysis

The Inertial Systems Market is expected to register a CAGR of 9% during the forecast period.

- The emergence of Micro Electro Mechanical Systems (MEMS) technology resulted in miniaturization of mechanical and electro-mechanical elements in the field of sensors and semiconductors through the use of micro-fabrication and micro-machining techniques. Hence, MEMS have now become an indisputable part of the future navigation systems and thus increasing the inertial systems market growth.

- Additionally, high-end inertial systems are comprised of IMU's with high-performance sensors (gyroscopes, magnetometers, accelerometers), which provide high accuracy information about the surrounding environment through relative movement. Hence, the need for higher accuracy in the navigation systems is increasing, thus increasing the demand for advanced inertial systems.

- However, the large scale adoption of inertial systems was significantly constrained by large size and exorbitant costs. Also, the integration drift error in the navigation system is expected to pose challenges in the growth of inertial systems market.

Inertial Systems Market Trends

Defense Industry to Hold the Majority Share

- The defense industry holds the maximum share of the market in terms of applications like Missile Guidance, Control and Targeting, Precision Guided Munitions, Tank Turret Stabilization, and Torpedo Guidance. The defense sector also incorporates small-diameter missiles, underwater navigators, and unmanned underwater vehicles that are increasing the demand of the high-end MEMS sensors in military and defense applications.

- The increasing modernization of weaponry with the advent of smart weapons and advanced tanks is also a key driver for the market. The amount of money spent on defense R&D is much more than that for civilian applications, hence is enabling rapid growth in this segment.

- Further, the increasing defense spending across various countries, coupled with government initiatives to establish a cutting-edge defense weapon platform by acquiring latest technologies, such as precision striking, defense electronics, and critical infrastructure protection, is also expected to drive the market significantly.

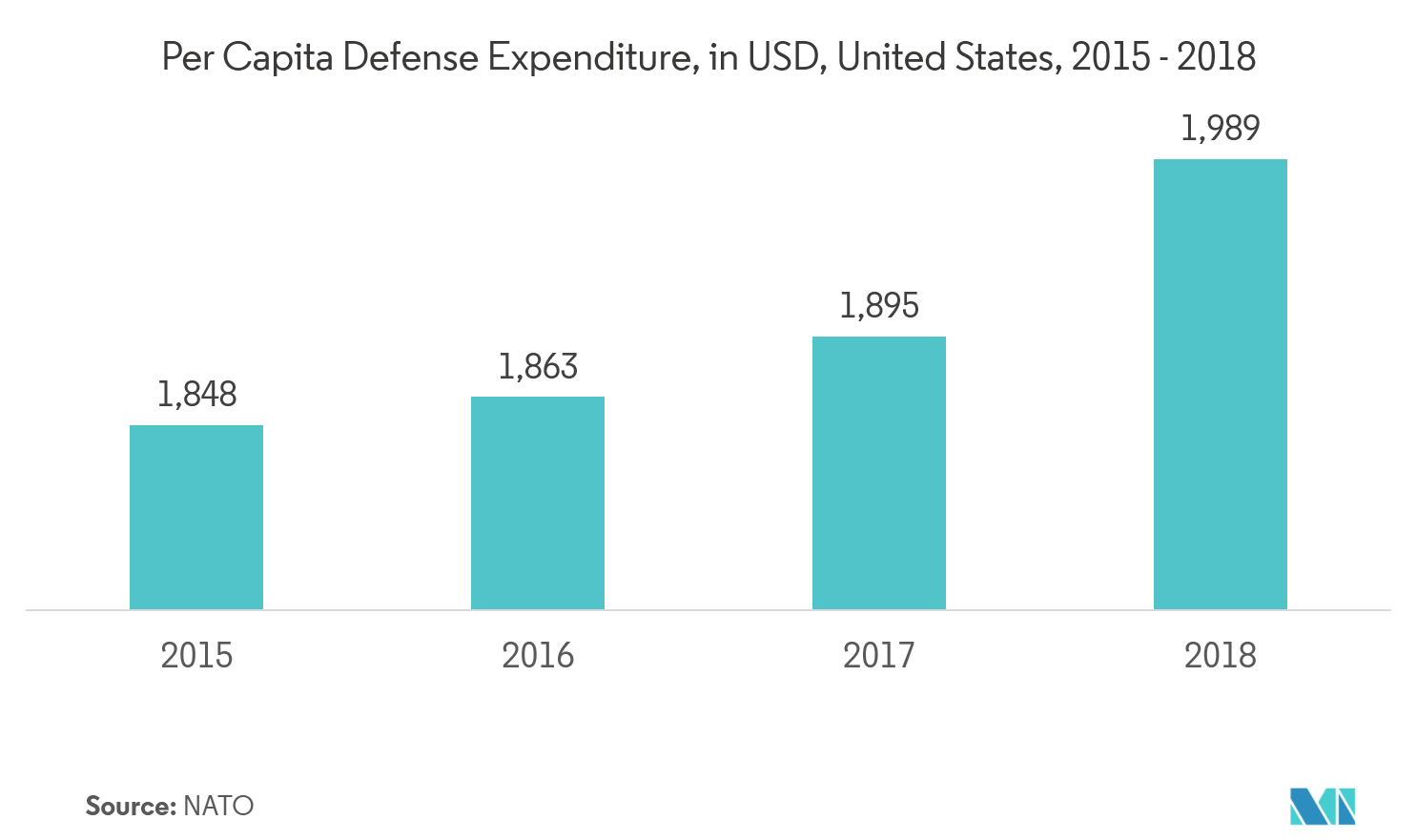

- For instance, in 2017, the US Navy created its dedicated underwater drone unit, Unmanned Undersea Vehicle Squadron One, or UUVRON 1, splitting it off from a secretive submarine unit in the process. To support its activities, the United States allocates the maximum budget for the defense sector. In 2018, the US defense spending was around USD 700 billion.

North America to Account for the Maximum Share

- North America accounted for the maximum share in the market, with the United States contributing the most significantly. The primary demand for inertial systems in the region comes from the maritime sector, owing to the renewed emphasis on oil exploration activities. The exploration activities of oil rigs require high-performance gyroscopes, IMUs, and accelerometers to provide a right self-contained sensing system and highly accurate solutions for platform stabilization.

- Moreover, the rising number of unmanned aerial vehicles along with rising defense spending are the key reasons for the high adoption of these systems in the United States. Besides, under the US Defense Advanced Research Projects Agency (DARPA) program, in order to provide the US Navy with advanced new tools to expand the reach and effectiveness of its underwater sensors, the US defense sector invested in the development of small unmanned underwater vehicle (UUV) to help US submarines detect and engage adversary submarines. Hence, government initiatives and spending on R&D is expected to stimulate the growth of the market in the region further.

Inertial Systems Industry Overview

The competitive landscape of the global inertial systems market is fragmented due to the presence of various inertial systems solution provider. However, the vendors are consistently focusing on product development to enhance their visibility and global presence. The companies are also undergoing strategic partnerships and acquisitions to gain market traction and increase the market share.

- June 2019 -Sensor manufacturer ACEINNA has launched its new open-source Inertial Measurement Unit Sensor that is meant for autonomous off-road, construction, agricultural vehicle applications.OpenIMU300RI it will help determining the direction in a GPS system and track motion on consumer electronics.

- May 2019 - Northrop Grumman Corporation has released SeaFIND(Sea Fiber Optic Inertial Navigation with Data Distribution), a next generation maritime inertial navigation system succeeding the company’s MK-39 Mod 3 and 4 series Inertial Navigation System product line.

Inertial Systems Market Leaders

-

Analog Devices, Inc.

-

Bosch Sensortec GmbH

-

Safran Group

-

Honeywell International, Inc.

-

TDK Corporation (InvenSense)

- *Disclaimer: Major Players sorted in no particular order

Inertial Systems Industry Segmentation

Inertial systems provide systems integrators and end-users with fully-qualified MEMS-based solutions for the measurement of static and dynamic motion in a wide variety of challenging environments, including; remotely operated vehicles, avionics, agriculture and construction vehicles, and automotive test. Inertial system equipment includes Gyroscopes, Accelerometers, Inertial Measurement Units, Inertial Navigation Systems, and Multi-Axis sensors.

| By Application | Aerospace and Defense | ||

| Energy and Infrastructure | |||

| Consumer Electronics | |||

| Industrial | |||

| Automotive | |||

| Medical | |||

| Land and Transportation | |||

| Other Applications | |||

| By Components | Accelerometers | ||

| Gyroscopes | |||

| Inertial Measurement Units (IMUs) | |||

| Magnetometer | |||

| Attitude Heading and Reference Systems | |||

| Other Components | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| India | |||

| Japan | |||

| Rest of Asia-Pacific | |||

| Latin America | |||

| Middle East & Africa | |||

Inertial Systems Market Research FAQs

What is the current Inertial Systems Market size?

The Inertial Systems Market is projected to register a CAGR of 9% during the forecast period (2025-2030)

Who are the key players in Inertial Systems Market?

Analog Devices, Inc., Bosch Sensortec GmbH, Safran Group, Honeywell International, Inc. and TDK Corporation (InvenSense) are the major companies operating in the Inertial Systems Market.

Which is the fastest growing region in Inertial Systems Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Inertial Systems Market?

In 2025, the North America accounts for the largest market share in Inertial Systems Market.

What years does this Inertial Systems Market cover?

The report covers the Inertial Systems Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Inertial Systems Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Inertial Systems Industry Report

Statistics for the 2025 Inertial Systems market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Inertial Systems analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.