Hazardous Location Connectors Market Analysis by Mordor Intelligence

The Hazardous Location Connectors Market is expected to register a CAGR of 5.4% during the forecast period.

- Rising industrial safety measures are driving the market, as the tools and equipment used in manufacturing can produce heat and flame, thereby, increasing the risk for fires, especially in Class I location, by which connectors play an important role to prevent these types of explosions.

- Increasing applications in the industrial sector are driving the market as every application requires different connector designs, due to its industry need to overstand shock, vibration, and extreme temperatures. In the oil sector, high-quality flexible connectors are used by properly connecting all metallic non-current carrying equipment to prevent shock, whereas waterproof electrical connectors, which are rubber molded are used in the wastewater treatment facilities.

- However, higher product installation and maintenance costs challenge the market growth, as wire-terminated or PCB-mounted connectors have additional costs associated with them, which is the main reason behind the cost high.

Global Hazardous Location Connectors Market Trends and Insights

Oil Refineries to Increase the Growth of Market

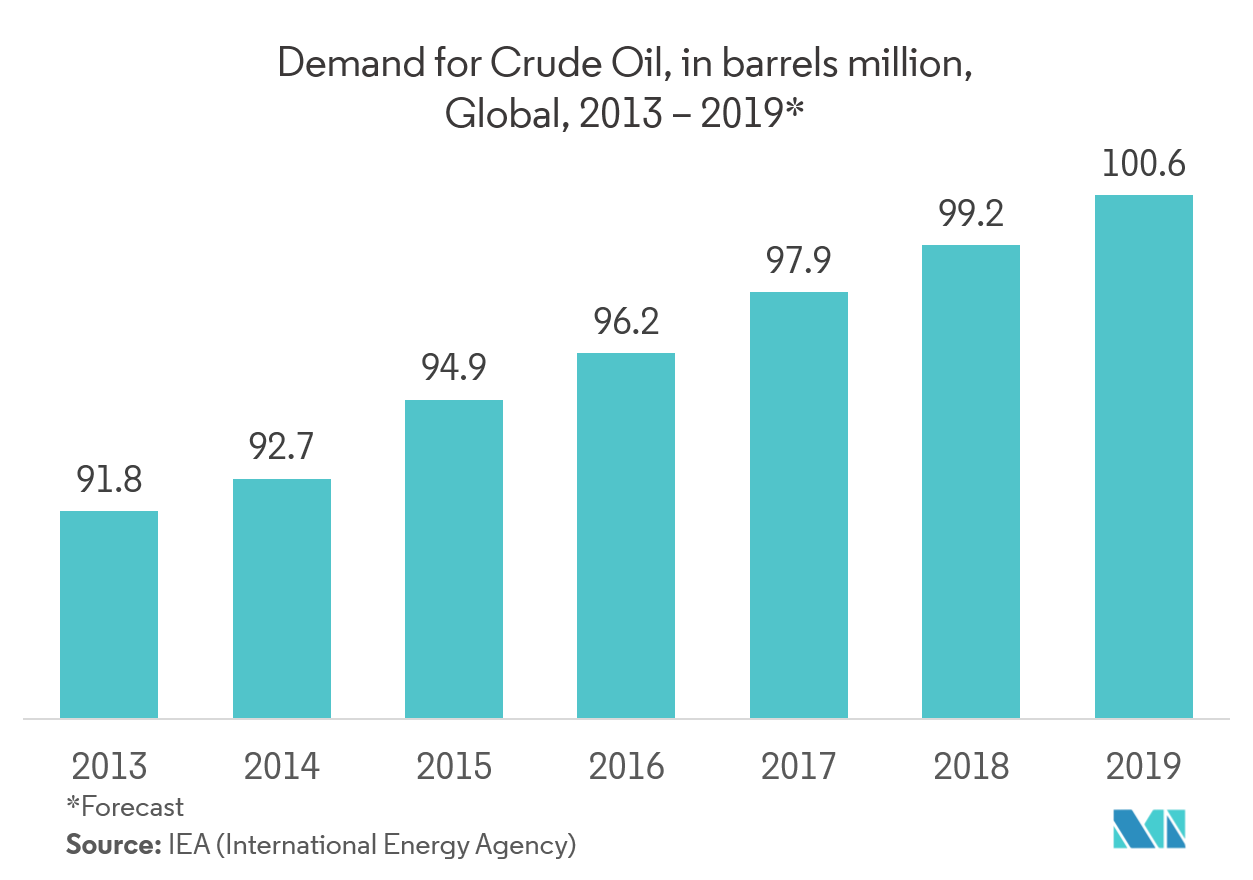

- As the demand for crude oil is growing yearly, there is a need of safety equipment, which can prevent any fatality at the hazardous zone in the refineries factories, as some areas of a refinery are inherently dangerous, with levels of explosive gases and chemicals that are potentially present at all times. Explosion-proof parts, such as connectors, can be placed inside an enclosure, which can withstand an internal explosion caused by a spark.

- Thomas & Betts products named mechanical grounding connectors, which are flexible connectors are very effective by properly connecting all metallic non-current carrying equipment at the oil and gas facility, which greatly reduce the potential for electric shock and explosions.

- Vector Techlok clamp connectors of Freudenberg Oil & Gas Technologies are the most effective and economical pipe connection systems, which can withstand considerable bending moments and axial forces under pressure without leaking to prevent hazardous fatality or the bolts becoming loose, which greatly reduce the maintenance costs and major fatal incidents.

- In June 2018, an explosion and fire rocked the Chevron Refinery in El Segundo, which prompted a call for residents to shelter in places, as thick black smoke billowed into the sky due to oil-fueled flame. It burned some power lines, causing big electrical flashes and sending some of the lines falling to the ground. Thus, the use of connectors is highly in demand, which causes growth of the market studied.

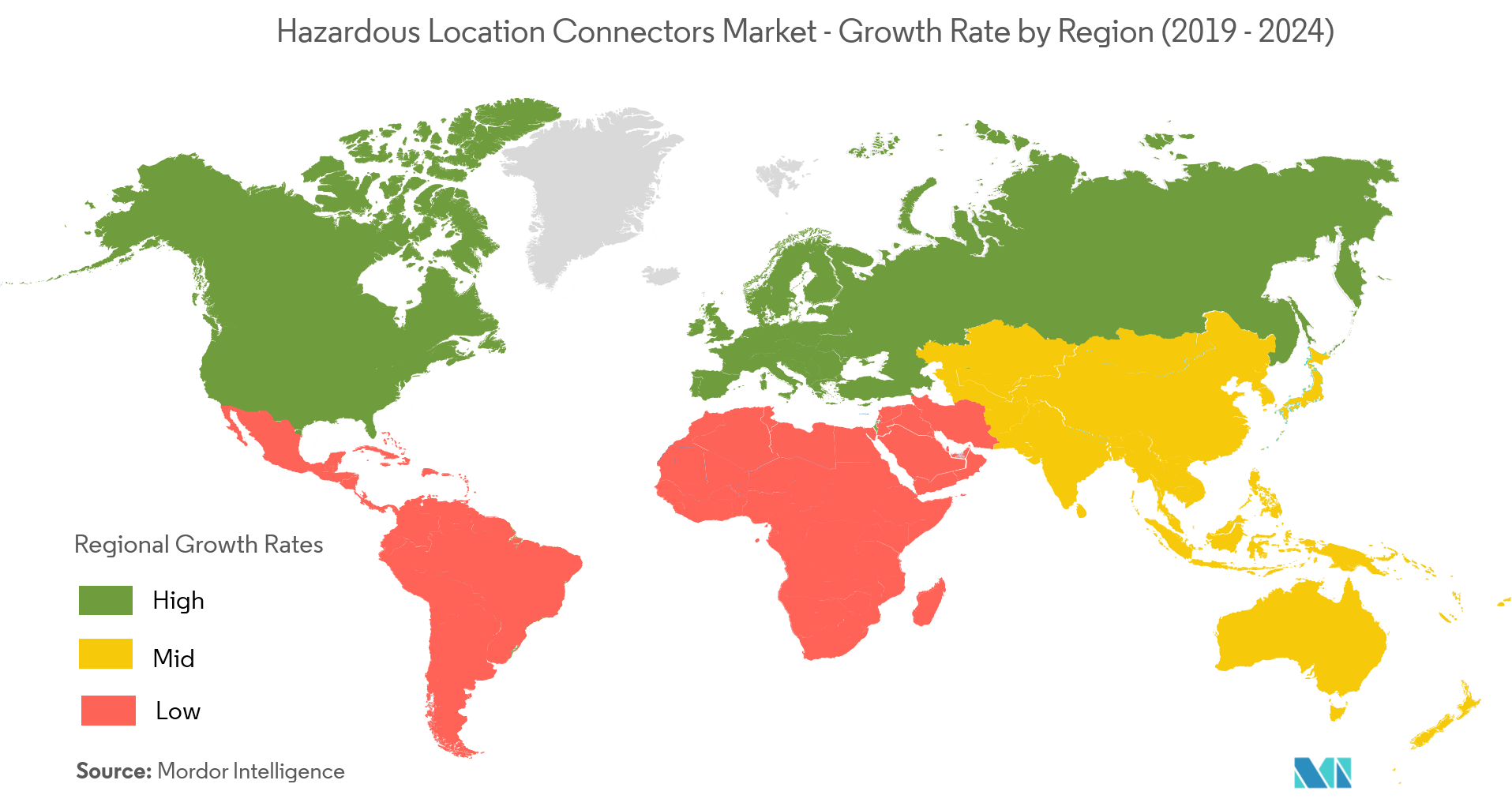

North America to Account for a Major Share

- North America is growing in this market as various government safety standards have made the use of safe connectors compulsory in almost all the industrial sectors. The hazardous connection interface is designed to meet the requirements for ignition protection under a Class 1 Div ll environment according to the American standard NEC 500 (National Electrical Code).

- The United States is having high growth among countries. HARTING’s Han Ex connector series have been certified to the National Electric Code’s NEC 500 standard for use in Class I, Division II hazardous locations, making them available for use across the countries, where metal locking levers lock the connectors and can be released only with a tool, preventing opening by accident in an explosive atmosphere.

- In the United States, BICON's range of compact barrier glands provides an efficient and cost-effective means of terminating electrical cables in hazardous areas. The BICON barrier connectors are easy to inspect as the compound chamber has been specifically designed to facilitate a quick visual check after assembly.

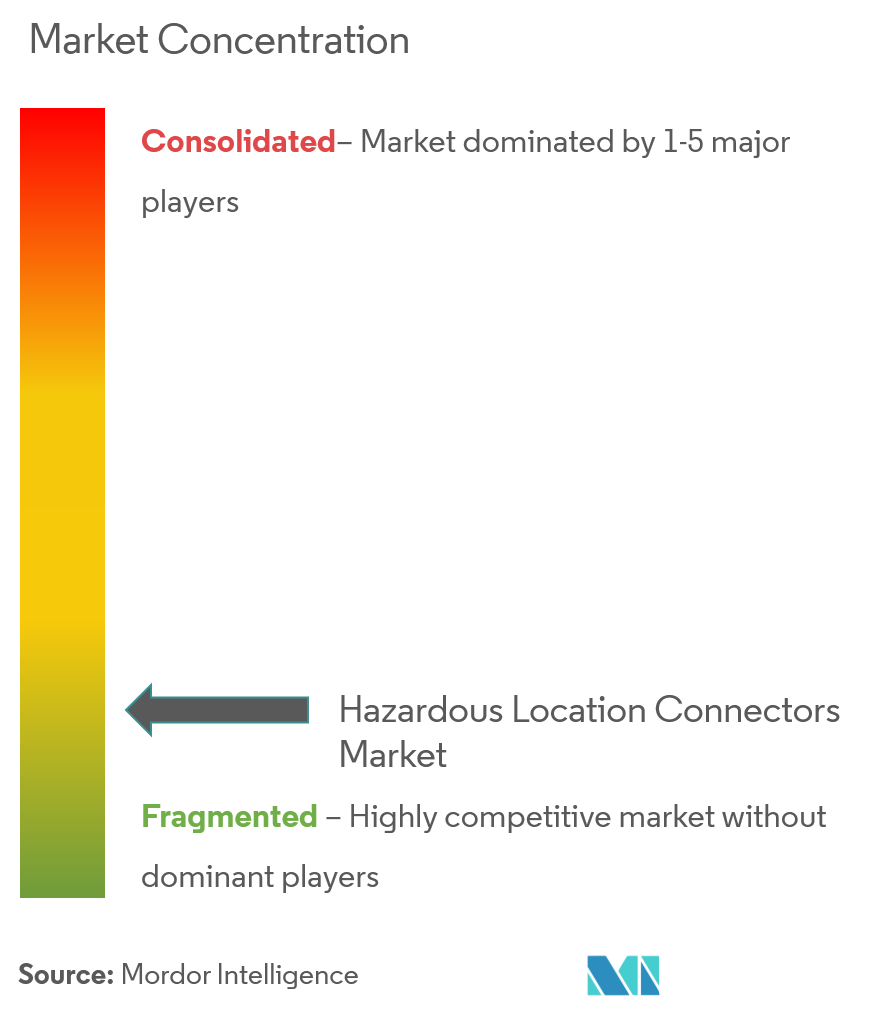

Competitive Landscape

The hazardous location connectors market is highly fragmented and the major players have used various strategies, such as new product launches, joint ventures, expansions, partnerships, acquisitions, and others, to increase their footprints in this market, which is giving a high rivalry to the local players. Key players areAmerican ConnectorsInc.,Steck Connections,Thomas & Betts, etc. Recent developments in the market are -

- May 2019 - ITT BIW Connector Systems showcased Metal-Lok Slimline Wellhead Penetrator, which is a high-utility system that is ideally suited for 300°F (149°C) and 5000 psi service.It is a user-friendly well-head penetrator system with advanced features, like crimp-free high voltage cable connections and BIW’s QuickThread connector engagement.

Hazardous Location Connectors Industry Leaders

-

American Connectors Inc.

-

Amphenol Industrial Products Group

-

Thomas & Betts

-

Texcan

-

Hubbell-Killark

- *Disclaimer: Major Players sorted in no particular order

Global Hazardous Location Connectors Market Report Scope

The hazardous location connectors market is contributing to the growth by rising industrial safety measures, increasing applications in the industrial sector, and reducing costs and growing awareness among industry personnel. The various safety standards laid down by the government have made the use of environment-safe connectors obligatory in nearly all the industrial sectors, such as oil refineries, pulp and paper mills, pharmaceutical manufacturing, etc.

| Class I |

| Class II |

| Class III |

| Zone 0 |

| Zone 1 |

| Zone 2 |

| Food and Beverage Processing |

| Oil and Gas Production |

| Oil Refineries |

| Petrochemical Refineries |

| Pharmaceutical Manufacturing |

| Wastewater Treatment Facilities |

| Other Applications |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Class | Class I |

| Class II | |

| Class III | |

| By Hazardous Zone | Zone 0 |

| Zone 1 | |

| Zone 2 | |

| By Application | Food and Beverage Processing |

| Oil and Gas Production | |

| Oil Refineries | |

| Petrochemical Refineries | |

| Pharmaceutical Manufacturing | |

| Wastewater Treatment Facilities | |

| Other Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Hazardous Location Connectors Market size?

The Hazardous Location Connectors Market is projected to register a CAGR of 5.4% during the forecast period (2025-2030)

Who are the key players in Hazardous Location Connectors Market?

American Connectors Inc., Amphenol Industrial Products Group, Thomas & Betts, Texcan and Hubbell-Killark are the major companies operating in the Hazardous Location Connectors Market.

Which is the fastest growing region in Hazardous Location Connectors Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Hazardous Location Connectors Market?

In 2025, the North America accounts for the largest market share in Hazardous Location Connectors Market.

What years does this Hazardous Location Connectors Market cover?

The report covers the Hazardous Location Connectors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Hazardous Location Connectors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Hazardous Location Connectors Market Report

Statistics for the 2025 Hazardous Location Connectors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Hazardous Location Connectors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.