Meat Substitutes Market Size

| Study Period | 2019 - 2029 |

| Base Year For Estimation | 2023 |

| CAGR | 7.00 % |

| Fastest Growing Market | Europe |

| Largest Market | North America |

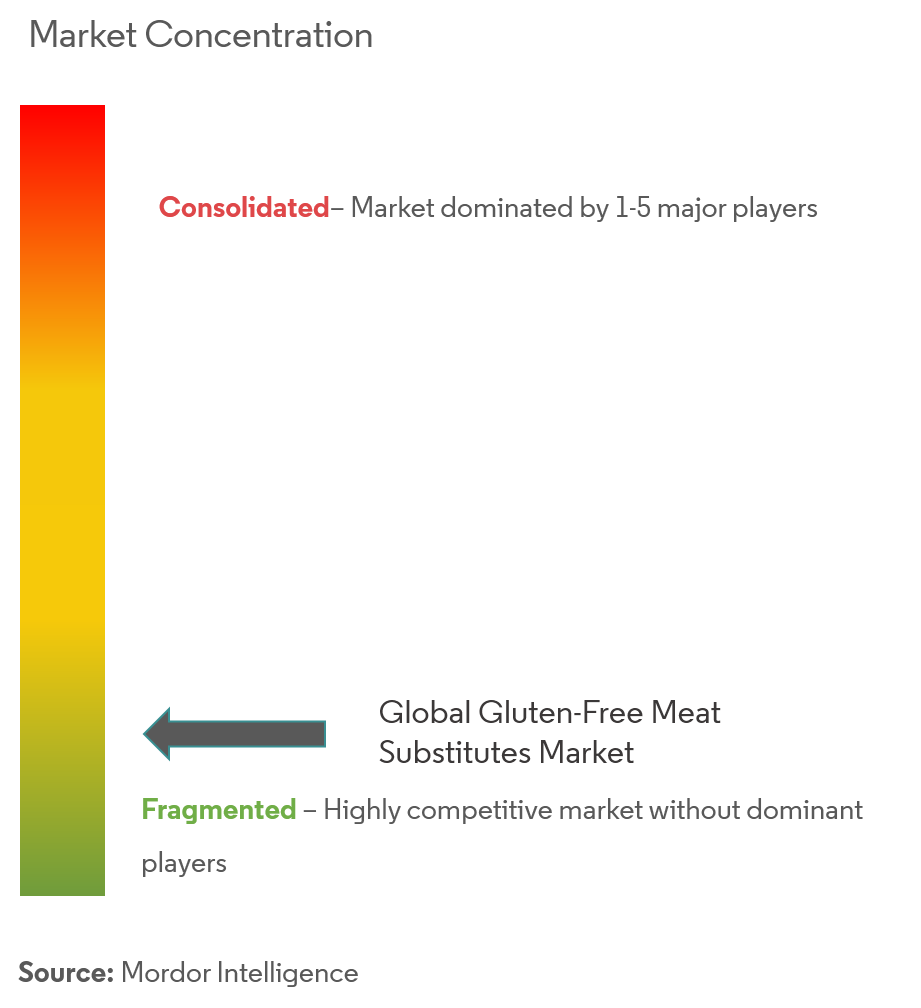

| Market Concentration | High |

Major Players

*Disclaimer: Major Players sorted in no particular order |

Need a report that reflects how COVID-19 has impacted this market and its growth?

Meat Substitutes Market Analysis

The global gluten-free meat substitutes market is growing at a CAGR of 7.0% during the forecast period (2019-2024).

- The market is driven by the rising consumer awareness on adverse effects associated with the consumption of meat such as increased risk of total mortality, cardiovascular disease, colorectal cancer and type 2 diabetes, in both men and women according to NIH, is leading to a shift toward a vegan diet. In addition, the benefits of cholesterol-free protein, with meat-like texture, is one of the key factors promoting the growth of meat substitute products.

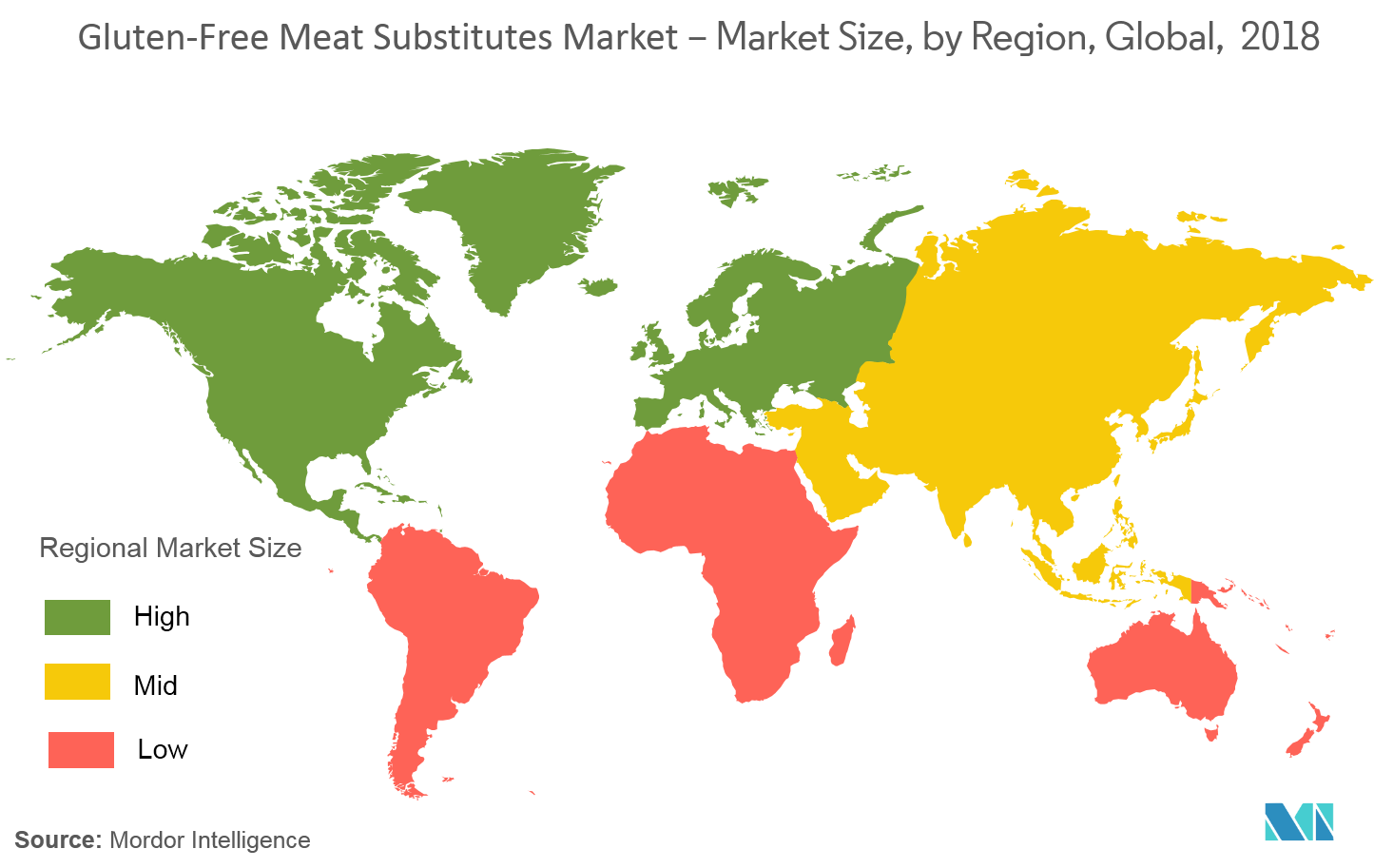

- However, the major challenge in this sector is the high processing cost involved in the production of gluten-free meat substitutes as compared to natural meat, has led to a high price of meat substitute products like tofu and mycoprotein, which is restraining the market growth, especially in low-income regions, like India, Brazil, Africa, etc.

Meat Substitutes Market Trends

This section covers the major market trends shaping the Meat Substitutes Market according to our research experts:

Increased demand for soyfoods & beverage

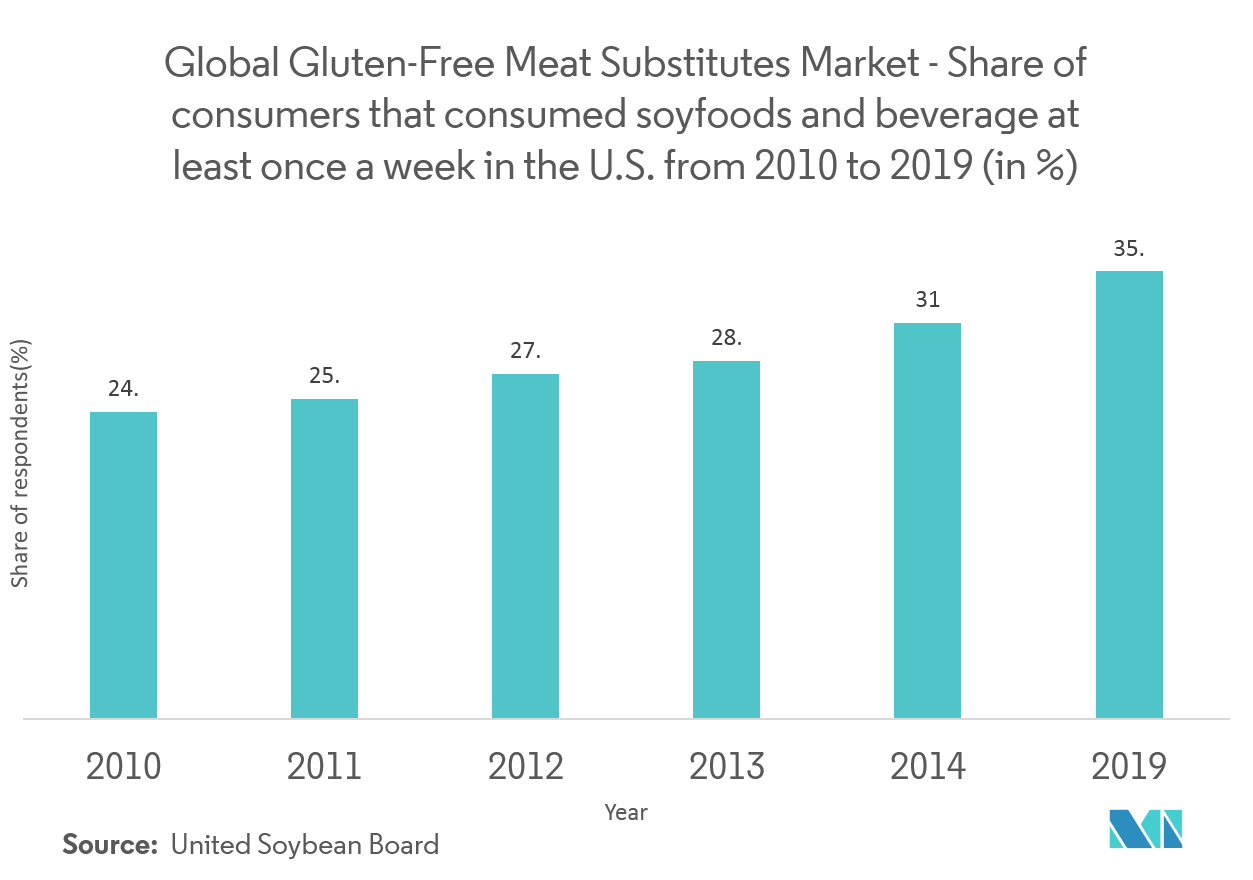

Consumer preference for healthier foods has led to the demand for vegetarian and vegan foods such as soyfoods which includes tofu & tofu ingredients, tempeh, textured vegetable protein (TVP), seitan and quorn. The soy segment is estimated to growing significantly in the recent years owing to the growing awareness among consumers regarding its health benefits such as reduction of obesity and blood sugar levels and its wide application in various food products such as baked goods and snacks. Also, innovations in this sector have further fueled the market growth. For instance, ADM expanded its non-GMO soybean processing capabilities in Germany to meet the growing demand for non-GMO and high-protein soybean meal across Europe in 2017. The company also acquired Harvest Innovations (US), an industry leader in minimally processed, expeller-pressed soy proteins, oils, and gluten-free ingredients to increase its product portfolio. According to the United Soybean Board, the shares of consumers that consume soyfoods in United States from 2010 to 2019 have been showing a constant increasing trend.

North America to the drive the market

According to a survey done by the Barclays, a British multinational investment bank and financial services company, US has been estimated to have the highest meat substitute consuming country,followed by United Kingdom, and Germany. They have also stated that Impossible Foods and Beyond Meat partnered with burger chains White Castle and Red Robin has been offering meat-free burger patties as both Impossible Foods and Beyond Meat are pioneers in meat substitutes at the molecular level using plant-based proteins and nutrients. Also, competitors in the market such as Tyson Foods and Nestle are introducing their own plant-based meat alternatives. These innovations in the country are fueling the country’s meat substitute market.

Meat Substitutes Industry Overview

The gluten-free meat substitute market is highly competitive in nature having large number of domestic and multinational player competing for market share and with innovation in products being a major strategic approach adopted by leading players. Additionally, merger, expansion, acquisition and partnership with other companies are the common strategies to enhance the company presence and boost the market.

Meat Substitutes Market Leaders

General Mills, Inc.

The Hain Celestial Group, Inc.

Nasoya Foods USA, LLC

Conagra Brands, Inc.

Kellogg Company

*Disclaimer: Major Players sorted in no particular order

Meat Substitutes Market Report - Table of Contents

-

1. INTRODUCTION

-

1.1 Study Deliverables

-

1.2 Study Assumptions

-

1.3 Scope of the Study

-

-

2. RESEARCH METHODOLOGY

-

3. EXECUTIVE SUMMARY

-

4. MARKET DYNAMICS

-

4.1 Market Drivers

-

4.2 Market Restraints

-

4.3 Porter's Five Forces Analysis

-

4.3.1 Threat of New Entrants

-

4.3.2 Bargaining Power of Buyers/Consumers

-

4.3.3 Bargaining Power of Suppliers

-

4.3.4 Threat of Substitute Products

-

4.3.5 Intensity of Competitive Rivalry

-

-

-

5. MARKET SEGMENTATION

-

5.1 By Source

-

5.1.1 Soy

-

5.1.2 Mycoprotein

-

-

5.2 By Category

-

5.2.1 Frozen/Refrigerated

-

5.2.2 Unfrozen

-

-

5.3 Geography

-

5.3.1 North America

-

5.3.1.1 United States

-

5.3.1.2 Canada

-

5.3.1.3 Mexico

-

5.3.1.4 Rest of North America

-

-

5.3.2 Europe

-

5.3.2.1 Spain

-

5.3.2.2 United Kingdom

-

5.3.2.3 Germany

-

5.3.2.4 France

-

5.3.2.5 Italy

-

5.3.2.6 Russia

-

5.3.2.7 Rest of Europe

-

-

5.3.3 Asia Pacific

-

5.3.3.1 China

-

5.3.3.2 Japan

-

5.3.3.3 India

-

5.3.3.4 Australia

-

5.3.3.5 Rest of Asia-Pacific

-

-

5.3.4 South America

-

5.3.4.1 Brazil

-

5.3.4.2 Argentina

-

5.3.4.3 Rest of South America

-

-

5.3.5 Middle East and Africa

-

5.3.5.1 South Africa

-

5.3.5.2 United Arab Emirates

-

5.3.5.3 Rest of Middle East and Africa

-

-

-

-

6. COMPETITIVE LANDSCAPE

-

6.1 Most Active Companies

-

6.2 Most Adopted Strategies

-

6.3 Market Share Analysis

-

6.4 Company Profiles

-

6.4.1 General Mills, Inc.

-

6.4.2 The Hain Celestial Group, Inc.

-

6.4.3 Nasoya Foods USA, LLC

-

6.4.4 Conagra Brands, Inc.

-

6.4.5 Kellogg Company

-

6.4.6 Field Roast

-

6.4.7 The Tofurky Company, Inc.

-

6.4.8 Superior Natural

-

- *List Not Exhaustive

-

-

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

Meat Substitutes Industry Segmentation

The global gluten-free meat substitutes market has been segmented by source (which includes Soy and Mycoprotein); by category (which includes Frozen/Refrigerated and unfrozen) and by geography (which includes North America, Europe, Asia-Pacific, South America and Middle East and Africa).

| By Source | |

| Soy | |

| Mycoprotein |

| By Category | |

| Frozen/Refrigerated | |

| Unfrozen |

| Geography | |||||||||

| |||||||||

| |||||||||

| |||||||||

| |||||||||

|

Meat Substitutes Market Research FAQs

What is the current Meat Substitutes Market size?

The Meat Substitutes Market is projected to register a CAGR of 7% during the forecast period (2024-2029)

Who are the key players in Meat Substitutes Market?

General Mills, Inc., The Hain Celestial Group, Inc., Nasoya Foods USA, LLC, Conagra Brands, Inc. and Kellogg Company are the major companies operating in the Meat Substitutes Market.

Which is the fastest growing region in Meat Substitutes Market?

Europe is estimated to grow at the highest CAGR over the forecast period (2024-2029).

Which region has the biggest share in Meat Substitutes Market?

In 2024, the North America accounts for the largest market share in Meat Substitutes Market.

What years does this Meat Substitutes Market cover?

The report covers the Meat Substitutes Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the Meat Substitutes Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

Meat Substitutes Industry Report

Statistics for the 2024 Meat Substitutes market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Meat Substitutes analysis includes a market forecast outlook to 2029 and historical overview. Get a sample of this industry analysis as a free report PDF download.