Electro Optics Market Size and Share

Electro Optics Market Analysis by Mordor Intelligence

The Electro Optics Market is expected to register a CAGR of 4.03% during the forecast period.

- Major regions across the globe are witnessing a technological transformation, with increasing different types of attacks makes imagery in decision-making processes very crucial and thereby driving the use of electro-optics technologies to better counter the increasing security threats and making the process of decision making faster. Thus, there is a need by the armed forces to make its electro-optics systems advanced enough to cope up with the security threats

- Moreover, the electro optics system are also being used for non-destructive testing in the aerospace sector and also the border protection agencies use these systems for monitoring an intrusion attempt. As terrorist activities are on a rise across various regions, there is an immense need for advanced surveillance systems and the need to prevent intrusion attempts by the terrorist organization, which is driving the market forward

- Some of the main tasks of the armed forces are surveillance, intelligence, and target acquisition which are provided by electro optics system. These equipment include multispectral day and night imaging sensors, laser rangefinders(LRF), night vision goggles, and infrared targeting pods among others. These capabilities have lead to the growth of electro optics market in defense and military applications

Global Electro Optics Market Trends and Insights

Defense Segment to Witness High Growth

- With the increasing demand for technologically advanced security and surveillance systems due to the increasing acts of insurgency, also the increasing demand for the drone-powered electro-optical systems for surveillance and night watch are some of the factors driving the market.

- These systems present various advantages, such as in case of low visibility, low light cameras are used as they give better performance with comparatively less power consumption and better output. Moreover, laser range finders are used in both day or night time and in nearly all environmental conditions, such as haze, smoke, fog, and rain.

- With the ongoing advancements in electro optics system, they have enabled 24-hour situational awareness, 360-degree rotation, guidance for defense gunnery, and automated object detection. These systems can recognize the targets in the day or at night and in high as well as in low contrast environments.

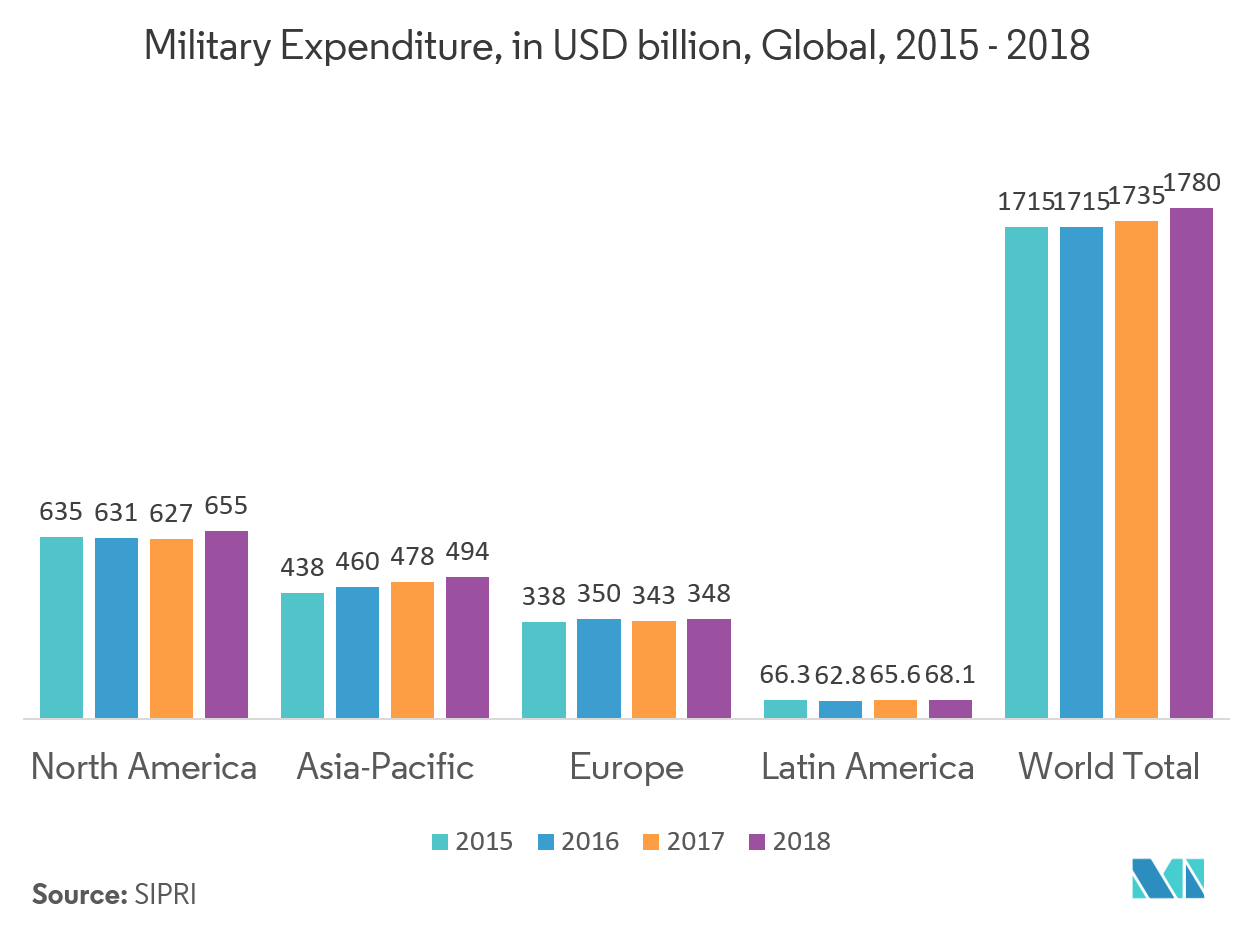

- Owing to the increasing military expenditure worldwide, with the armed forces acquiring various devices such as electro optical systems and also developing new technologies in this field, the market is expected to witness further growth.

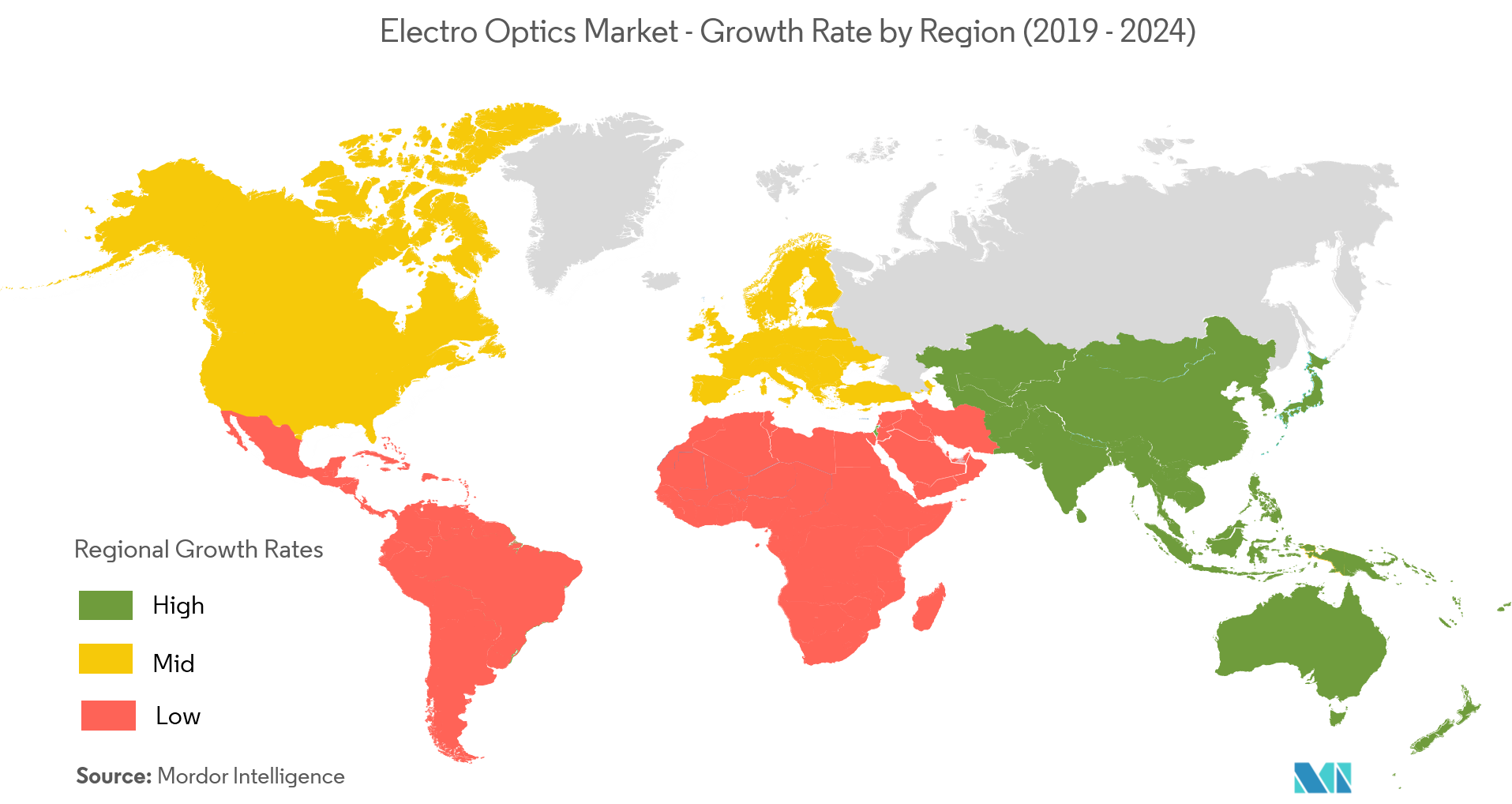

Asia-Pacific to Witness High Growth

- Electro optics and related equipment are being increasingly used by the armed forces in this region due to the advantages provided by these systems such as enabling fast-paced decision-making through effective imagery solution, intelligence gathering and targeting solutions.

- Amongst the Asia Pacific region, growing economies like China and India are the ones who are highly investing in procurement of these systems. This is primarily driven by the fact that these countries are continuously trying to modernize their armed forces to face any security threats from terrorist organizations in a better way.

- Moreover, soldier modernization programs are also driving the market in this region. The development of eye-safe laser equipment that is harmless on a soldier eyes have become a global need and will replace the existing equipment used for search applications for defense forces is also a factor which drives the market.

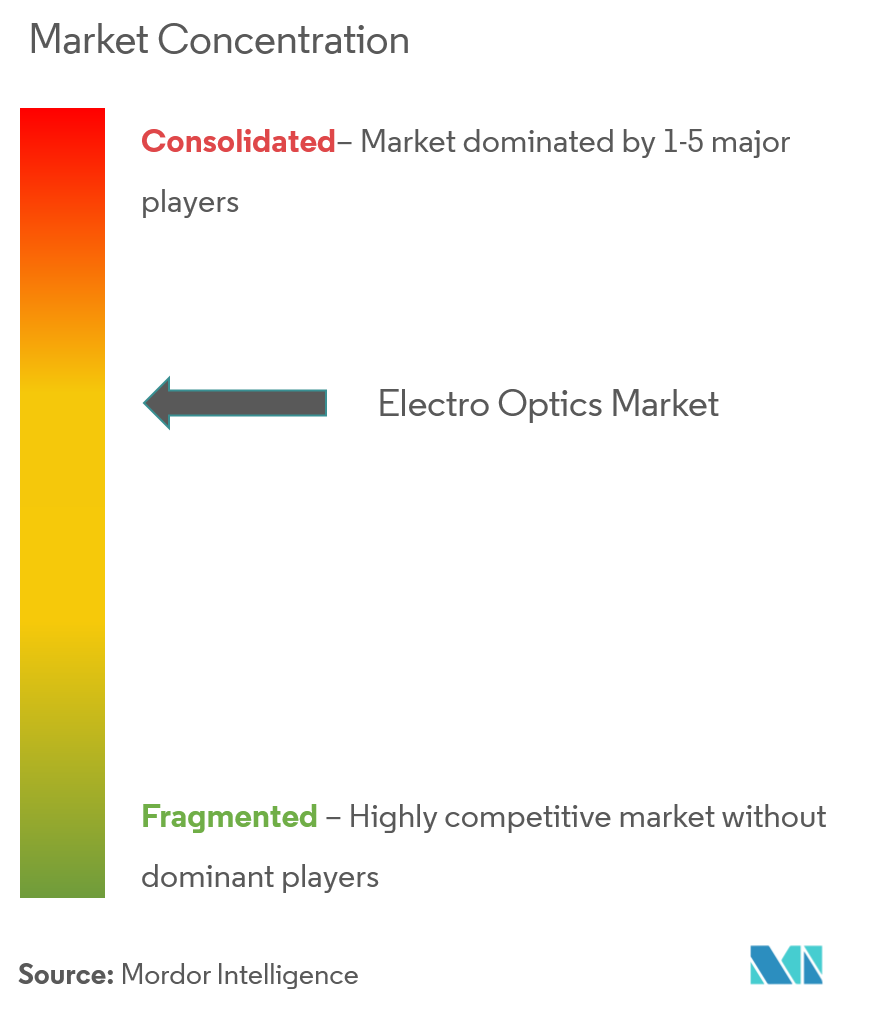

Competitive Landscape

The electro optics market is highly competitive owing to the presence of many large players in the market operating their business in domestic as well as in the international market. The market is moderately concentrated with certain major players accounting for a significant share. Majorplayers in the market are adopting strategies like product and technological innovation and mergers and acquisitions. Some of the major players in the market are

- June 2019 - Lockheed Martin successfully delivered the 500thElectro-Optical Targeting System (EOTS). EOTS is the world's first sensor to combine forward-looking infrared and infrared search and track functionality to provide F-35 pilots with precise air-to-air and air-to-ground targeting capability.

- March 2019 -FLIR Systems, Inc. announced that it has completed its previously announced acquisition of Endeavor Robotic Holdings, Inc., a leading developer of battle-tested, tactical unmanned ground vehicles (UGVs) for the global military, public safety, and critical infrastructure markets, from Arlington Capital Partners.

Electro Optics Industry Leaders

-

Lockheed Martin Corporation

-

Thales Group

-

Flir Systems Inc

-

BAE Systems plc

-

Northrop Grumman Corporation

- *Disclaimer: Major Players sorted in no particular order

Global Electro Optics Market Report Scope

Electro-optics is a branch of electronics and material physics involving components, devices, and systems which operate by the propagation and interaction of light with various materials. It is the technology which is designed to interact between the electromagnetic (optical) and the electrical (electronic) state of materials.

| Air Based |

| Land Based |

| Naval Based |

| Defense |

| Aerospace |

| Homeland Security |

| North America |

| Europe |

| Asia-Pacific |

| Latin America |

| Middle East & Africa |

| By Application Platform | Air Based |

| Land Based | |

| Naval Based | |

| By End User | Defense |

| Aerospace | |

| Homeland Security | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Key Questions Answered in the Report

What is the current Electro Optics Market size?

The Electro Optics Market is projected to register a CAGR of 4.03% during the forecast period (2025-2030)

Who are the key players in Electro Optics Market?

Lockheed Martin Corporation, Thales Group, Flir Systems Inc, BAE Systems plc and Northrop Grumman Corporation are the major companies operating in the Electro Optics Market.

Which is the fastest growing region in Electro Optics Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Electro Optics Market?

In 2025, the North America accounts for the largest market share in Electro Optics Market.

What years does this Electro Optics Market cover?

The report covers the Electro Optics Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Electro Optics Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Electro Optics Market Report

Statistics for the 2025 Electro Optics market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Electro Optics analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.