Data Center Automation Market Analysis

The Data Center Automation Market is expected to register a CAGR of 17.83% during the forecast period.

- The boom in social networking, analytics, cloud computing, and mobile computing is projected to positively impact the need for data center automation. Approximately 80% of the data generated is unstructured, containing raw audio, file, or text from various sources, such as blogs and social media platforms.

- Big Data needs to be concise to be analyzed. However, manually handling an enormous amount of data would lead to a high probability of error. Thus, automation plays a vital role in data centers by performing looked-for tasks, which is expected to drive market growth during the forecast period.

- The market includes several opportunities as the company that owns and operates a data center hires third parties to take over data center management. At the same time, they keep as many processes in-house as possible. As an alternative to managed services, automation can eliminate errors, save time, and optimize the processes for better cost-savings

- The Organisation for Economic Co-operation and Deployment (OECD) and various sources claim that during the COVID-19 pandemic, internet usage increased by as much as 60% and that demand for data centers increased as a result of the internet of things (IoT) and video streaming services.

Data Center Automation Market Trends

Growth in Cloud Computing and Online Applications

- Digitization significantly increased the volume and speed of data generation. The primary driver for data center automation is the increase in cloud adoption across both big and small businesses, which is the need for agility and flexibility in the face of accelerating innovation and disruptions from competitors.

- Increased data traffic was the main underlying factor responsible for the demand for cloud data storage. With an increase in IoT adoption worldwide, device connectivity is also growing. Hence, there is an accumulation of vast piles of data.

- As per estimates by Cisco, there are over 50 billion smart connected devices in the world. The data collected from such devices can be analyzed to generate customer transaction patterns and help companies understand the propensity of their consumers.

- In recent years, cloud adoption significantly grew, and with the recent COVID-19 pandemic, which accelerated digital technologies adoption globally, the trend was further fueled. According to a report by IBM, a single manufacturing site can generate more than 2,200 terabytes of data in one month, and a single production line can generate more than 70 terabytes per day-yet most data remain unanalyzed and unsecured. Therefore, companies are moving to cloud storage to secure and utilize this data.

- Also, IBM reported that approximately 90% of the data was generated in the last two years. Due to the massive data generation, there is an increasing demand for low-cost data backup/storage across enterprises. It is analyzed to create significant opportunities for the data center automation market during the forecast period.

- A centralized control method is offered by automated data center management. It can build a log repository for tracking modifications and auditing user activity. Thus, real-time notifications are sent out for any unauthorized activity. Businesses can automate the production of reports and visuals like graphs and charts attributable to data center automation. Automatic data display in reports, charts, and graphs allow for quicker, more straightforward interpretation and more precise insights.

North America to Lead the Market

- With multiple prominent players in the region and the early adoption of advanced technologies across several end-user verticals, the North American region is expected to hold a significant market share. It will continue its dominance throughout the forecast period. Moreover, early adoption of newer technologies, significant investments in R&D for cloud-based solutions, and enhanced IT infrastructure are also anticipated to drive market growth further.

- A significant driver behind the investments in the market is the continuous evolution and new technology applications to unlock volumes that were previously considered non-commercial. With an investment series across healthcare, retail, communications, and manufacturing applications in the country, the market for cloud-based solutions is expected to witness significant growth over the forecast period.

- The country made multiple efforts to modernize its infrastructure. To achieve this, the US Army planned to spend up to USD 249 million to deploy private cloud computing services and data centers. General Dynamics, HP, and Northrop Grumman were among the service providers selected for the Army Private Cloud contract, providing cloud computing services to consolidate data centers using a secure private cloud.

- In the United States, cloud-based computing adoption is increasing rapidly, owing to which the data centers in the country are also witnessing an increase. According to Credit Suisse, the United States currently accounts for the highest number of hyperscale data centers worldwide, holding more than one-third of the total hyperscale data centers in the country. It creates significant opportunities for data center automation in the region.

Data Center Automation Industry Overview

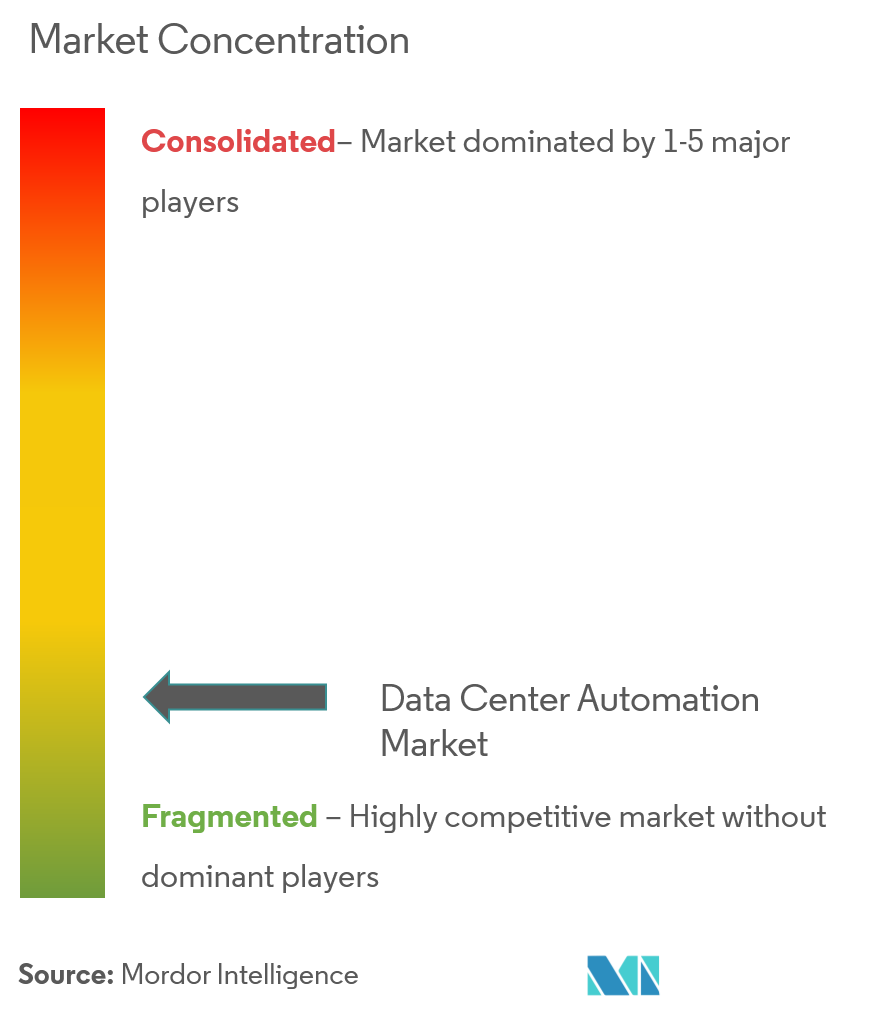

The data center automation market is highly fragmented due to many players offering the service. Some major players who offer cloud and AI services also offer data automation as a bundled service, another reason for the fragmentation of the market. Some key companies in the firm include Oracle, Fujitsu, HP, and Microsoft, among others. Some key recent developments in the market include:

- August 2022- ABB and ATS Global have established a Memorandum of Understanding (MoU) agreement to expand the ABB Ability Data Center Automation (DCA) market. With its headquarters in the Netherlands, the business earned the Global System Integrator (GIS) title. It will cooperate with ABB to pool resources and expertise, evaluate the benefits and efficiency of potential customer alliances using data centers, and expand each party's businesses.

Data Center Automation Market Leaders

-

Cisco Systems Inc.

-

ABB Limited

-

Hewlett Packard Enterprise Company

-

Oracle Corporation

-

Microsoft Corporation

- *Disclaimer: Major Players sorted in no particular order

Data Center Automation Market News

- October 2022: Augtera Networks, one of the prominent players in AI/ML-powered Network Operations Solutions, announced its support for AMD Pensando DPUs, which will enable purpose-built Network AI in next-generation data centers. By automating anomaly detection, problem root identification, noise elimination, and alerting of collaboration and ticketing applications like Slack and ServiceNow, Augtera Network AI makes network administration easier.

- September 2022-Juniper Networks has released the Apstra extension for adaptive data center management and automation. In conjunction with the release, Juniper unveiled a new Apstra licensing scheme that offers clients three licensing tiers with the ability to upgrade as necessary.

Data Center Automation Industry Segmentation

Data center automation is the process of managing and automating the workflow and processes of a data center facility. It automates the bulk of the data center operations, management, monitoring, and maintenance tasks performed manually by human operators.

The data center automation market is segmented by solution (server, database, network, and other solutions), data center type (Tier 1, Tier 2, Tier 3, and Tier 4), deployment mode (on-premise, cloud), end-user vertical (BFSI, healthcare, retail, manufacturing, IT and telecom, and other end-user verticals), and geography (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa).

The market sizes and forecasts are provided in value (USD million) for all the above segments.

| By Solution | Server |

| Database | |

| Network | |

| Other Solutions | |

| By Data Center Type | Tier 1 |

| Tier 2 | |

| Tier 3 | |

| Tier 4 | |

| By Deployment Mode | On-premise |

| Cloud | |

| By End-user Vertical | BFSI |

| Healthcare | |

| Retail | |

| Manufacturing | |

| IT and Telecom | |

| Other End-user Verticals | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Latin America | |

| Middle East & Africa |

Data Center Automation Market Research FAQs

What is the current Data Center Automation Market size?

The Data Center Automation Market is projected to register a CAGR of 17.83% during the forecast period (2025-2030)

Who are the key players in Data Center Automation Market?

Cisco Systems Inc., ABB Limited, Hewlett Packard Enterprise Company, Oracle Corporation and Microsoft Corporation are the major companies operating in the Data Center Automation Market.

Which is the fastest growing region in Data Center Automation Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Data Center Automation Market?

In 2025, the North America accounts for the largest market share in Data Center Automation Market.

What years does this Data Center Automation Market cover?

The report covers the Data Center Automation Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Data Center Automation Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Data Center Automation Industry Report

Statistics for the 2025 Data Center Automation market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Data Center Automation analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.