Bulk Acoustic Wave Sensors Market Size and Share

Bulk Acoustic Wave Sensors Market Analysis by Mordor Intelligence

The Bulk Acoustic Wave Sensors Market is expected to register a CAGR of 12.09% during the forecast period.

- With the wide boom of 4G LTE and wireless networks around the world, the new wave spectrum is needed to handle the massive wireless traffic. Since 3G network uses 5 bands and LTE is already using more than 20 4G LTE bands, with 5G about to explore in the near future, more than 40 bands will be used.

- Moreover, Qorvo is doing some serious work in BAW technology in advanced filtering solutions for next-gen high-end mobile products which need more filters, as well as for advanced radar and communications systems. These BAW sensors can solve the toughest interference and coexistence challenges worldwide. They also enable operators and manufacturers to deliver higher speeds and greater bandwidth by utilizing spectrum that might be lost with older filtering technologies.

- BAW sensors generally deliver superior performance with lower insertion loss at higher frequency levels. They are less sensitive to temperature change. Hence, the frequency ranges handled by BAW is ideal for extremely challenging applications.

- The increasing demand for advanced wireless technology, like LTE, has made the application of new RF features mandatory in tablets and smartphones. Since there is a low manufacturing cost of the BAW sensors, which can act as a driver for the BAW market in the forecast period.

- Therefore, the growing shipments of smart gadgets, such as smartphones and tablets, over the forecast period is expected to create a significant demand for BAW filters, owing to the increasing proliferation of LTE networks.

- Furthermore, BAW sensors have a small form factor and deliver improved performances, which are expected to be the major cause of their adoption in the coming years.

Global Bulk Acoustic Wave Sensors Market Trends and Insights

Telecommunications Industry has the Fastest Growth Rate

- BAW sensors are now snowballing in the market, migrating from defense and industrial markets to consumer wireless applications. These BAW sensors are fabricated for use below 500 MHz, the economic range or the sensors is above 1.5 GHz. Above 1.9 GHz.

- BAW sensors become competitive against surface acoustic wave sensors. The increasing usage of internet compatible devices like smartphones, tablets, and other electronic communication devices is growing the integration of BAW sensors.

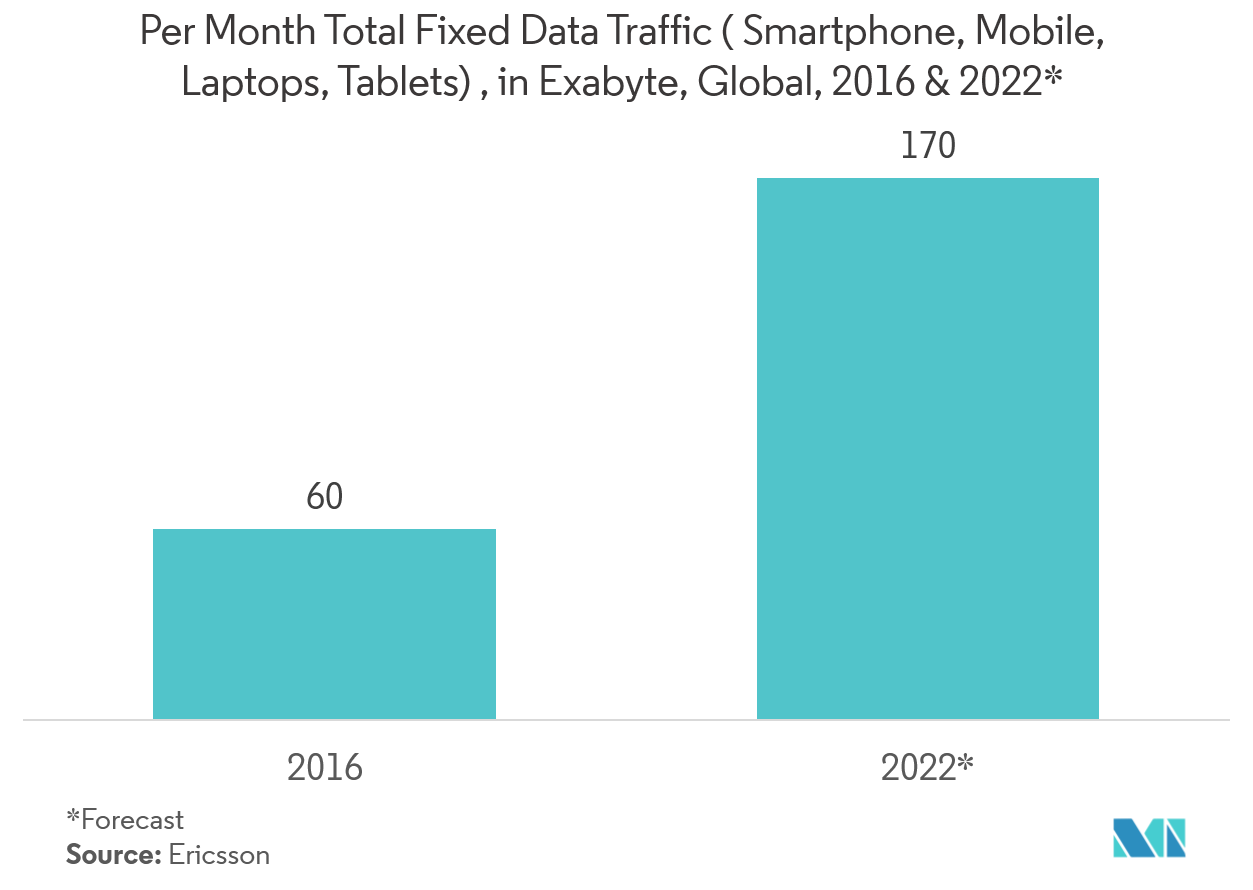

- The highest penetration of BAW sensors has been witnessed in the telecommunication sector. The cost has been reduced to be competitive with existing technologies, therefore there is high data traffic per month globally, which is expected to drive the market during the forecast period.

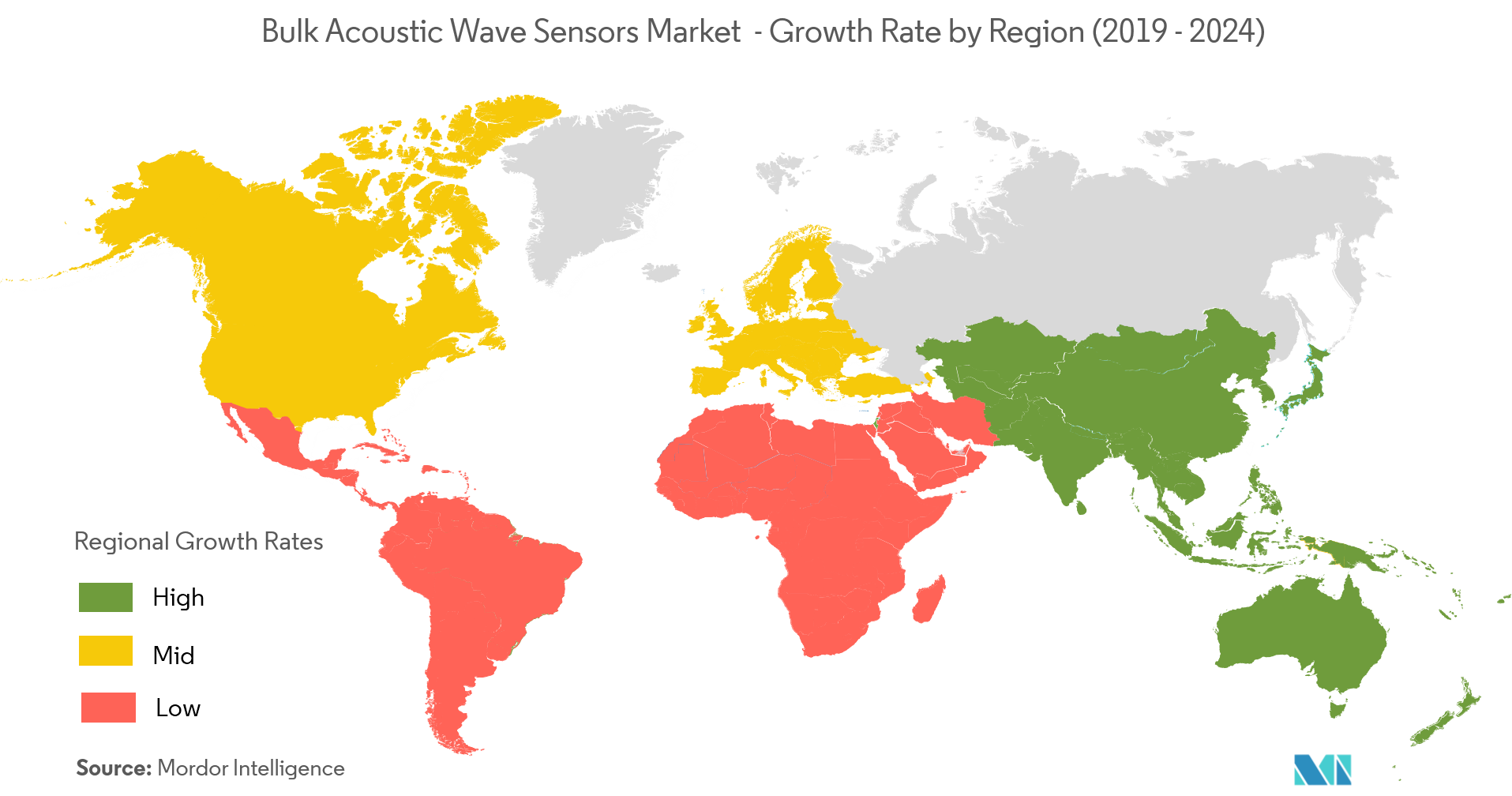

Asia-Pacific Dominant in the Market

- Asia-Pacific region has the highest number of mobile subscriptions in the world. The number of subscriptions is around 4.2 billion, which accounts for close to 53% of the total number of subscriptions.

- In automobile applications, in the developed and developing economies, such as the United States, China, South Korea, Japan, and India, which are expected to witness substantial growth during the forecast period. North America followed the Asia–Pacific region, due to the presence of various key players in this region.

- Europe and Latin America offer potential growth opportunities in the BAW sensors market due to the increasing demand for advanced technologies from various verticals, thereby, is expected to drive the market in the regions.

Competitive Landscape

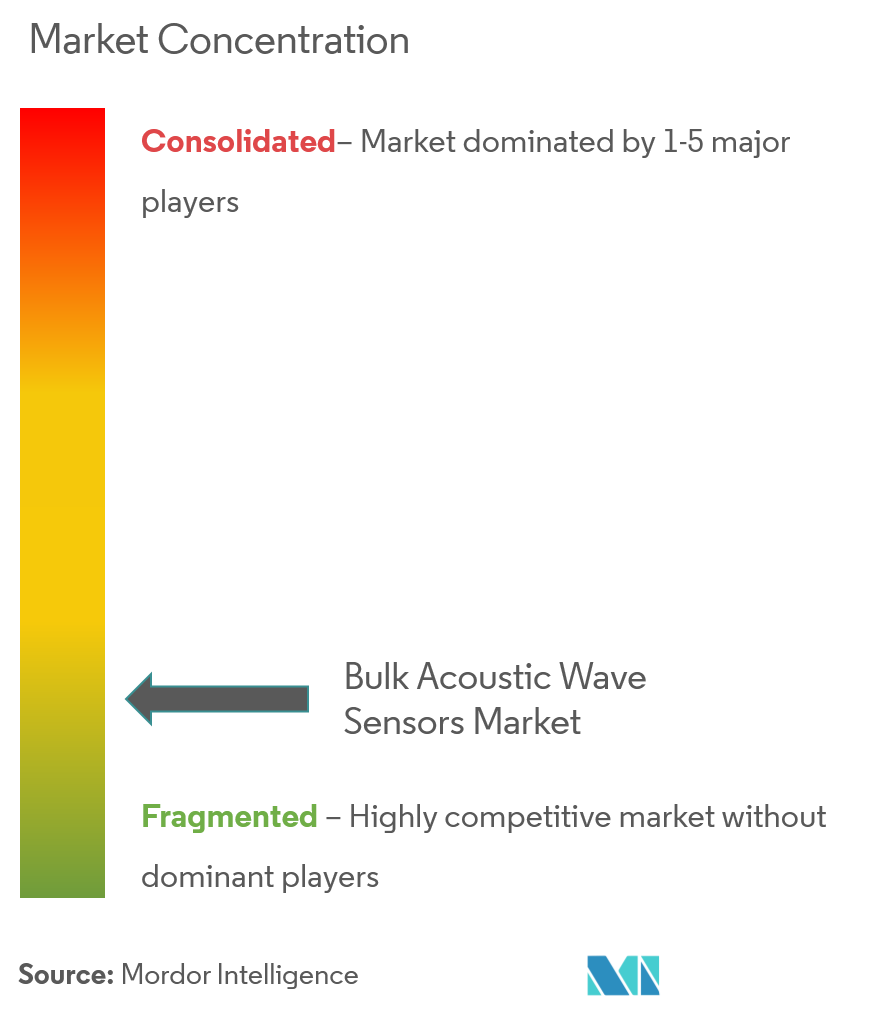

The major players include Panasonic Corp., CTS Corporation, TDK Epcos AG, Teledyne Microwave Solutions, Murata Manufacturing Co. Ltd, and Raltron electronics Corporation, amongst others. The market is fragmented due to the high competition in the market.Hence, market concentration will be low.

- July 2018 -Scott Vasquez introduced Qorvo's new 5G wireless infrastructure solutions withMicrowaveJournal to migrate to 5Gthat connect the world, introduced the smallest Bulk Acoustic Wave (BAW) sensor available that can handle 5W of RF average input power, with peaks up to 40W. The new filter solves reliability, assembly, test and space constraint challenges involved in designing massive MIMO telecom infrastructure for 5G migration.

Bulk Acoustic Wave Sensors Industry Leaders

Panasonic Corp.

Murata Manufacturing Co. Ltd

TDK Epcos - TDK Corporation

CTS Corporation

Teledyne Wireless LLC

- *Disclaimer: Major Players sorted in no particular order

Global Bulk Acoustic Wave Sensors Market Report Scope

A bulk acoustic wave is an acoustic wave that travels through piezoelectric materials; a material which produces electric currents. The increasing market activities in the BAW devices, the applications of BAW sensors are growing in the defense, industrial, and commercial wireless application. Different types of substrates have been used for BAW sensors with the demand more driven by economics and fabrication constraints.

| Automotive |

| Aerospace & Defence |

| Consumer Electronics |

| Healthcare |

| Industrial |

| Telecommunications |

| Other End-user Industries |

| North America |

| Europe |

| Asia-Pacific |

| Rest of the World |

| By End-user Industry | Automotive |

| Aerospace & Defence | |

| Consumer Electronics | |

| Healthcare | |

| Industrial | |

| Telecommunications | |

| Other End-user Industries | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Key Questions Answered in the Report

What is the current Bulk Acoustic Wave Sensors Market size?

The Bulk Acoustic Wave Sensors Market is projected to register a CAGR of 12.09% during the forecast period (2025-2030)

Who are the key players in Bulk Acoustic Wave Sensors Market?

Panasonic Corp., Murata Manufacturing Co. Ltd, TDK Epcos - TDK Corporation, CTS Corporation and Teledyne Wireless LLC are the major companies operating in the Bulk Acoustic Wave Sensors Market.

Which is the fastest growing region in Bulk Acoustic Wave Sensors Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Bulk Acoustic Wave Sensors Market?

In 2025, the Asia Pacific accounts for the largest market share in Bulk Acoustic Wave Sensors Market.

What years does this Bulk Acoustic Wave Sensors Market cover?

The report covers the Bulk Acoustic Wave Sensors Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Bulk Acoustic Wave Sensors Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Bulk Acoustic Wave Sensors Market Report

Statistics for the 2025 Bulk Acoustic Wave Sensors market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Bulk Acoustic Wave Sensors analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.