Automatic Liquid Filling Market Analysis

The Automatic Liquid Filling Market is expected to register a CAGR of 7% during the forecast period.

- In the industries, such as food, beverage, and pharmaceutical, which require the process to be free from any contamination, and if the products are filled with the automatic filling machine, there is no human touch, and thus, supports the growth of the automatic filling machine market.

- Furthermore, with the intense competition in the market, companies are continuously undergoing various business reengineering practices, to optimize their working efficiency and reduce operating costs, so as to increase the profit margins. Therefore, as the demand for flexible filling solutions is increasing, automatic filling machine can adapt to the changing packaging requirements without incurring much of the costs, to varied filling needs, such as volume, speed, and type of container.

- However, high initial investments, and training the company personnel to operate these machines, are few drawbacks, which act as restraints during the forecasted period.

Automatic Liquid Filling Market Trends

Cosmetics Industry Offers Potential Growth

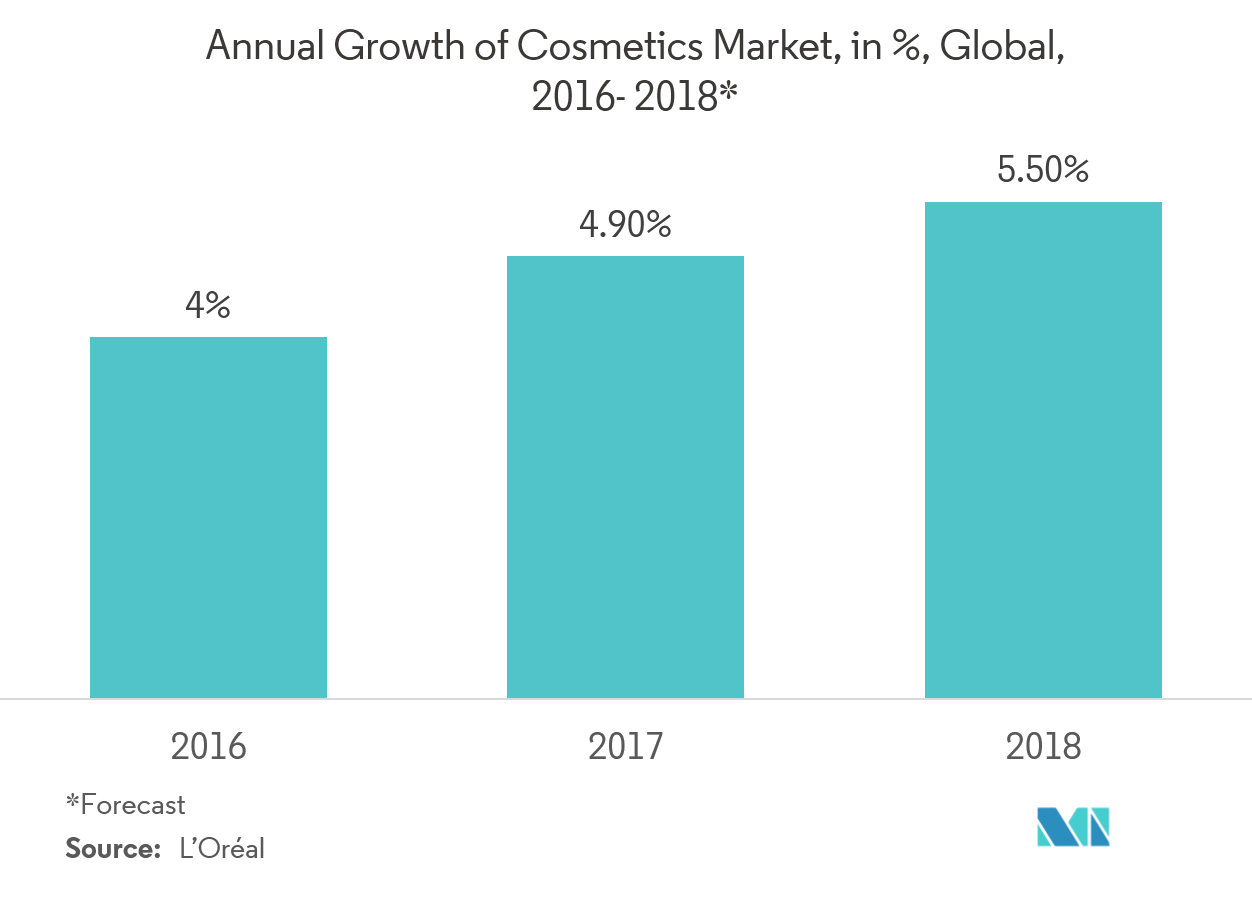

- Nowadays, cosmetics are considered to be one of the essential commodities of life. As the market is evolving rapidly, and globalization is at its peak, cosmetics emerging in the market have been demanding attractive packaging styles, and the whole packaging industry revolves around consumer preference. This demand for innovative packaging has played an important role in driving sales.

- For instance, when it comes to face creams, men do not like to stick their fingers into a jar. Thus, the companies are offering creams in pump packages. And for this, the automatic liquid filling machines play a crucial role.

- Furthermore, under hair care products, the demand for shampoo is very high. According to Drug Store News, the sales value of shampoo was valued at USD 554.18 million, in 2018, and it is expected to increase every year. Therefore, for shampoo manufacturers, automatic liquid filling equipment may help in fulfilling the demand

- Furthermore, under cosmetics, the fragrance industry has the highest growth, and it is forecasted by International Flavors and Fragrances, that in 2019, the market for flavor and fragrance in Europe may be valued at USD 5 billion. The demand for fragrances is increasing among the working women, because of the increase in disposable income. And this may create a huge market opportunity for the automatic liquid filling machines.

- Therefore, with the increase in demand for other cosmetics products, such as oils, creams, or any gel-based products, cosmetics suppliers see a positive opportunity. Thus, in return, it may create a market for automatic liquid filling equipment, among the manufactures.

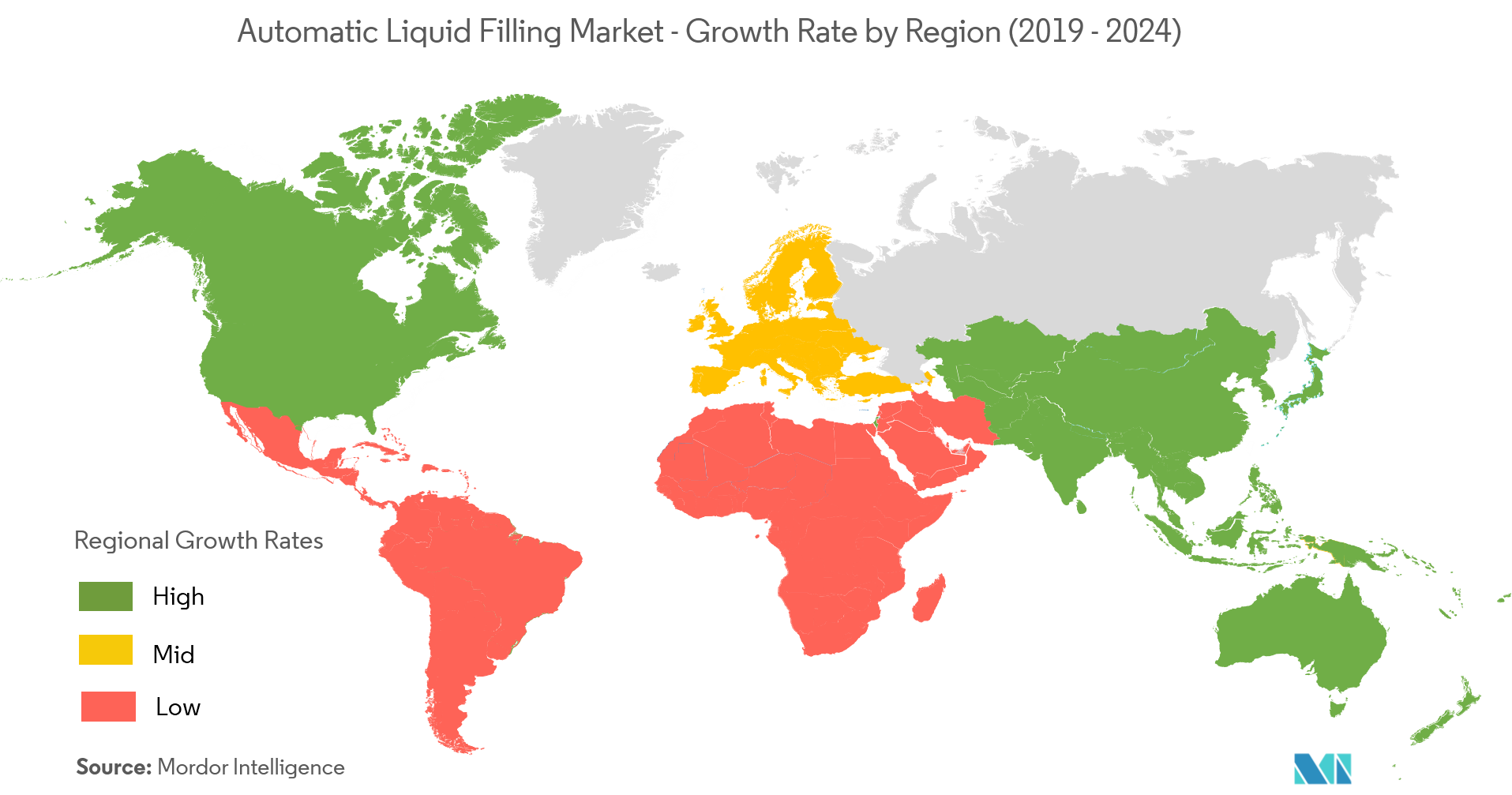

Asia- Pacific to Witness Fastest Growth

- The Asia-Pacific regions feature the highest demand for skincare, and particularly luxury products, as stated by L'Oréal. It is favored by the rising disposable income of consumers, the trend of online shopping, coupled with an increasing consumer base of people interested in personal hygiene and physical appearance. This is supported by highly populated countries, like India and China.

- Furthermore, with health-conscious consumers increasing awareness regarding the various benefits of products, the people are shifting toward healthy drinks, such as organic fruit juices, sugarfree liquid refreshments, etc. This trend is creating a market for automatic liquid filling equipment. As the entire process is operated through computers, there is no chance of any contamination. This acts as a catalyst for this market.

- Furthermore, according to the International Wine and Spirits Record (IWSR), China is expected to increase its wine imports by 8 %, in 2019. The increase in demand for wines may create an indirect demand for automatic liquid filling, among the manufactures, because it may help in reducing the assembly line process, by minimizing human errors.

- Therefore, the abovementioned factors are expected to help in increasing the demand for the automatic liquid filling market, in the Asia-Pacific regions.

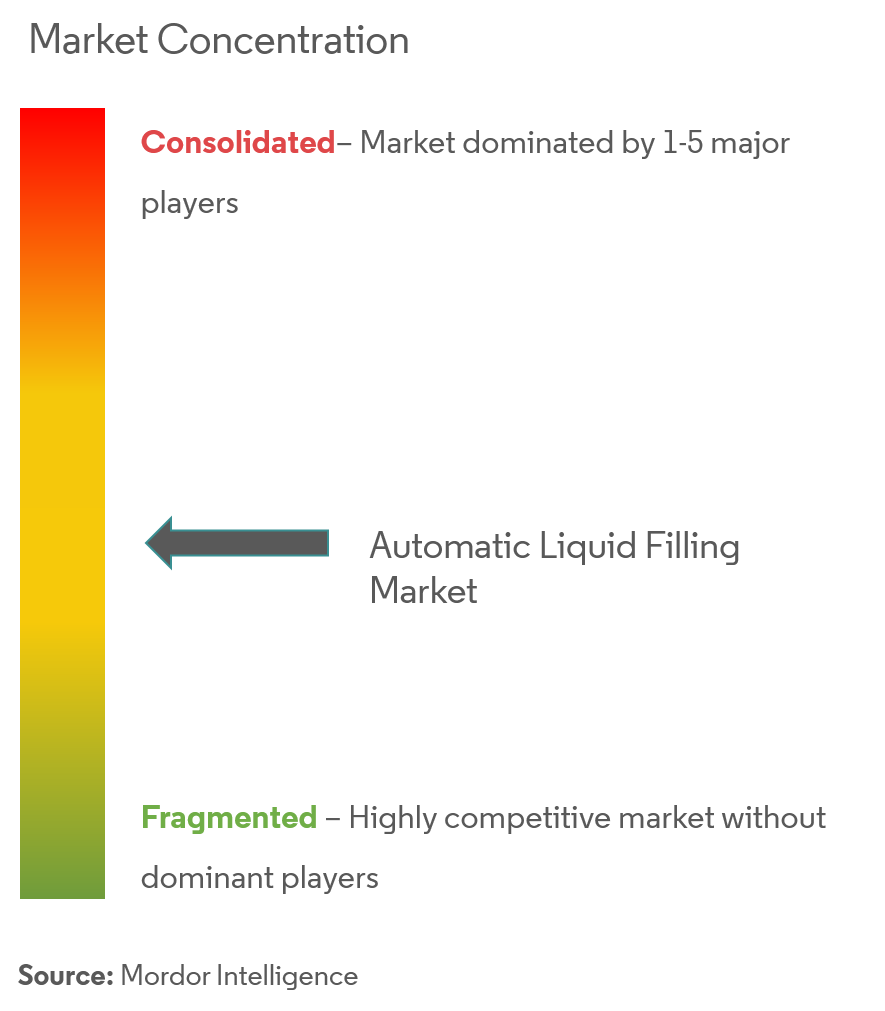

Automatic Liquid Filling Industry Overview

Theautomatic liquid filling market is fragmented and is competitive in nature. Some of the key players in this market areBosch Packaging Technology,Krones Group AG,E-PAK Machinery, etc.Product launches, high expense on research and development (R&D), partnerships and acquisitions, etc. are the prime growth strategies adopted by these companies, to sustain the intense competition. Some of the recent developments are:

- May 2019 - JBTlaunched the AsepFlex Filler, ‘to overcome problems associated with current pouch packaging’ for sports, on-the-go breakfast drinks, and infant nutrition products. This filling can fill a range of products, from the water, like liquids to high viscous products, like smoothies. Furthermore, it can be technically configured for multi-flavor filling or filling plastics bottles or pouches at the same time.

Automatic Liquid Filling Market Leaders

-

Bosch Packaging Technology

-

Krones Group AG

-

E-PAK Machinery

-

ProMach ( Federal Mfg. Co.)

-

JBT Corporation

- *Disclaimer: Major Players sorted in no particular order

Automatic Liquid Filling Industry Segmentation

Latest packaging technologies make it possible to pack different kinds of liquids, with any sort of chemical composition or viscosity, to the designed containers of any shapes and sizes. The functional expectation of customers is easy pouring and convenient experience for different aged consumers, thus, there is an increasing demand for flexible filling solutions, which can adapt to the changing packaging requirements, without incurring much of the costs.

| By Liquid Category | Consumable Liquids | ||

| Liquid Drugs | |||

| Industrial Liquids | |||

| Liquid Chemicals | |||

| Cosmetics | |||

| Others Liquids | |||

| By Filling Variation | Pressure | ||

| Viscosity | |||

| Foaming Characteristics | |||

| By Type | Aseptic Filler | ||

| Rotary Filler | |||

| Volumetric Filler | |||

| Net Weight Filler | |||

| Piston Filler | |||

| Other Types | |||

| By End-user Industry | Food and Beverage | ||

| Healthcare and Pharmaceutical | |||

| Cosmetic | |||

| Other End-users Industries | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| India | |||

| Japan | |||

| Rest of Asia-Pacific | |||

| Rest of the World | |||

Automatic Liquid Filling Market Research FAQs

What is the current Automatic Liquid Filling Market size?

The Automatic Liquid Filling Market is projected to register a CAGR of 7% during the forecast period (2025-2030)

Who are the key players in Automatic Liquid Filling Market?

Bosch Packaging Technology, Krones Group AG, E-PAK Machinery, ProMach ( Federal Mfg. Co.) and JBT Corporation are the major companies operating in the Automatic Liquid Filling Market.

Which is the fastest growing region in Automatic Liquid Filling Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Automatic Liquid Filling Market?

In 2025, the North America accounts for the largest market share in Automatic Liquid Filling Market.

What years does this Automatic Liquid Filling Market cover?

The report covers the Automatic Liquid Filling Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Automatic Liquid Filling Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Automatic Liquid Filling Equipment Industry Report

Statistics for the 2025 Automatic Liquid Filling market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Automatic Liquid Filling analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.