Analytics as a Service Market Analysis

The Analytics as a Service Market is expected to register a CAGR of 25% during the forecast period.

- The era of industry 4.0 and its adoption by almost all the sectors globally are driving the organization to move to the cloud. The automation is creating a massive amount of data on day to day basis. The collected data is then analyzed for the pattern and is used for predicting future incidences. This opportunity is increasing with the commercialization of IoT-enabled Devices.

- The analytics optimizes complex operations like logistics for almost all industries to reduce production costs. The performance of the internal assets helps increase the organization's profit margin. In addition to enabling historical data analysis, predictive analytics, which manufacturers can use to schedule predictive maintenance. This allows manufacturers to prevent costly asset breakdowns and avoid unexpected downtime.

- These are the major factors driving the growth of analytics as a service market. However, the increasing data breach incidences restrict organizations from adopting cloud services due to privacy concerns. Also, the uncertainty of the return on investment for these services limits the analytics as a service market.

- Data security issues and the availability of complicated analytical procedures are expected to hamper the growth of the Analytics as a Service Market. With this, the expanding company requirement to better understand consumer activities and behavior and manage created data will present significant opportunities for the Analytics as a Service Market.

- Companies have allowed their employees to work from home during the Covid-19 pandemic, which has increased the usage of video conferencing platforms like Microsoft Teams and Zoom, significantly increasing the growth of the analytics-as-a-service industry. Furthermore, the growing need for cloud computing technologies drives the market's expansion. By giving access, cloud computing enables employees to operate from any place. Employees may access the necessary data and documents by utilizing specific credentials, ensuring security while allowing them to work from home. This circumstance is propelling the AaaS industry forward.

Analytics as a Service Market Trends

Telecom and IT Segment to Grow Significantly

- The telecom analytics type of business intelligence satisfies the optimization of the complex needs of the telecom industry. Telecom analytics aims to decrease operational costs and maximize profits by increasing sales, reducing fraud, and improving risk management.

- One of the reasons driving the market growth is increased awareness of the Internet of Things (IoT). The requirement for storing large amounts of data that must be evaluated is expected to increase in the coming years. The proliferation of innovative COVID-19 and the public's growing data utilization have resulted in the development of open-source data sets and visualizations, driving the market growth.

- Analytics is applied to telecommunications to improve visibility and gain insight into the organization's core operations and internal processes. It also helps in gaining knowledge of market conditions, spotting trends before they emerge, and then establishing forecasts based on the insights gained. Big data is now playing a significant role in this.

- According to the survey conducted by Zoom Video Communications, in March 2021, the study focused on event participation in person and virtually after the coronavirus (COVID-19) epidemic. Music performances, conferences, and religious services were examples of events. After the pendamic, 52 percent of respondents in the United States said they would attend events both in person and via video conferencing. In Japan, 65 percent of respondents agreed. Meanwhile, 10 percent of Indian respondents said they would only attend events through video conferencing after the epidemic.

- The increased use of IoT devices propels Analytics as a Services Market. According to a survey conducted by Appinventiv, with an estimated 19 million endpoints by 2023, connected automobiles are expected to be the largest category of the worldwide 5G Internet of Things (IoT) endpoint market. The global installed base of 5G IoT endpoints is expected to expand from 3.5 million in 2020 to approximately 49 million in 2023.

North America Region to Hold the Largest Share

- North America occupies the largest market share, mainly owing to the presence of many market players and the rising demand for the analytics platform. The growth of machine-to-machine communication (M2M) has also opened doors for cloud solutions in the region, with the United States being one of the largest cloud solutions markets in the world.

- Most large equipment manufacturers have local data centers for computing needs, as they operate and deploy their equipment globally. Thus, the manufacturers require analytics solutions to help maintain track of the facilities.

- Furthermore, social media apps such as Twitter, Instagram, Facebook, and YouTube generate massive amounts of data. The growing demand among businesses to analyze social media data for their specialized purposes is one element driving the expansion of the Analytics as a Service Market. For instance, IBM Corporation provides market analytics for sectors based on Twitter data, and the companies in the North American region are spending more investment in R&D to provide advanced analytics solutions.

- The companies in the North American region are making strategic partnerships and developing Analytics services. For instance, in February 2022, Teradata and Microsoft established a global partnership to connect the Teradata Vantage data platform with Microsoft Azure. With this partnership, organizations looking to upgrade their data analytics workloads with security, dependability, and flexibility - even on a large scale - can use both organizations' technologies.

- The Canadian e-commerce industry also offers a helping hand in boosting the demand for big data solutions. According to Worldpay, Canadian e-commerce sales crossed the mark of USD 50 billion in 2018, and it is expected to reach USD 80 billion by 2022.

Analytics as a Service Industry Overview

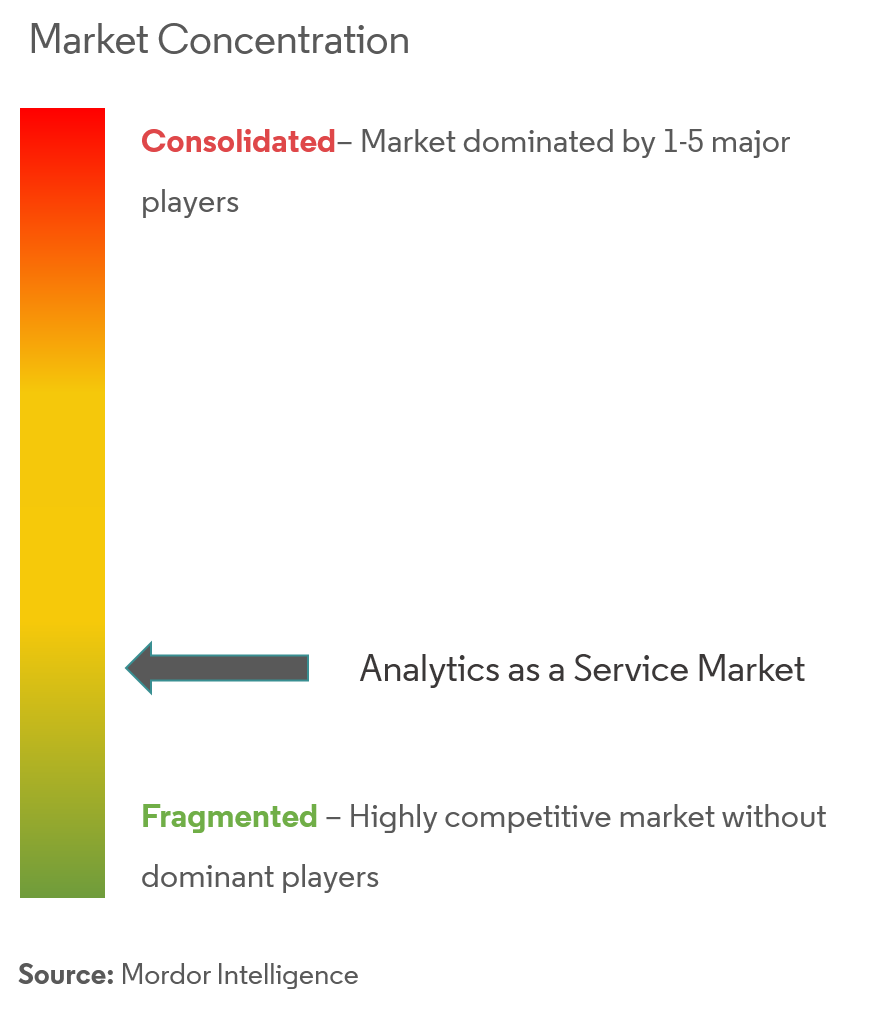

Analytics service is fragmented and has the potential to shift rivalry, opening up numerous new avenues for differentiation and value-added services. The huge expansion of capabilities in analytics technology also pushes the companies to keep up with rivals and gives away too much of the improved product performance. This environment escalates costs and erodes industry profitability. The major Analytics solution providers are partnering with various companies and technologies that support their overall product offerings.

- May 2022 - Wipro and Informatica have partnered to offer cloud-based data and analytics to market through the Wipro Fullstride cloud services data platform. By combining the offers of cloud hyperscalers with Wipro's platforms, IP, talent, and partner-led solutions, Informatica and Wipro have created a one-stop marketplace that creates business value and customer outcomes. Wipro's well-known data, analytics, and artificial intelligence (AI) skills, combined with Informatica's complete AI-powered data management solution, will enable cloud-based transformations to scale.

Analytics as a Service Market Leaders

-

IBM Corporation

-

Microsoft Corporation

-

Oracle Corporation

-

SAP SE

-

Hewlett Packard Enterprise Company

- *Disclaimer: Major Players sorted in no particular order

Analytics as a Service Market News

- April 2022 - Kyndryl announced the expansion of strategic partnership with SAP to assist customers in overcoming digital transformation challenges Kyndryl will provide services that complement the RISE with an SAP solution, such as proven migration tools and scalable offerings, AI-driven business data management and analytics solutions, application modernization, and more, as part of the expanded collaboration.

- August 2022 - Morae Global Corporation, one of the global leaders in digital and business transformation for the legal industry, and Intelligent Voice Limited, a provider of secure speech and natural language processing eDiscovery solutions for regulated and privacy-sensitive organizations, have announced a global strategic partnership to bring Intelligent Voice data analytics to Morae clients. Morae's Intelligent Voice, available as an integrated solution with RelativityOne and Relativity Server, helps corporate legal and compliance departments meet their eDiscovery requirements for analyzing and producing unstructured audio and video evidence.

Analytics as a Service Industry Segmentation

The scope of the study for analytics as a service market has considered the applications of analytics in SMEs and LEs in a wide range of End-user verticals globally. Whereas the after-sales services are not considered for market estimation.

The Analytics as a Service Market is segmented by Enterprise Size (Small and Medium Enterprise, Large Enterprise), End-user Industry (IT and Telecommunication, BFSI, Healthcare, Retail, Manufacturing), and Geography.

| By Enterprise Size | Small and Medium Enterprises |

| Large Enterprises | |

| By End-User Industry | IT and Telecommunication |

| Energy and Power | |

| BFSI | |

| Healthcare | |

| Retail | |

| Manufacturing | |

| Other End-user Industries | |

| By Geography | North America |

| Europe | |

| Asia Pacific | |

| Latin America | |

| Middle East and Africa |

Analytics as a Service Market Research FAQs

What is the current Analytics as a Service Market size?

The Analytics as a Service Market is projected to register a CAGR of 25.0% during the forecast period (2025-2030)

Who are the key players in Analytics as a Service Market?

IBM Corporation, Microsoft Corporation, Oracle Corporation, SAP SE and Hewlett Packard Enterprise Company are the major companies operating in the Analytics as a Service Market.

Which is the fastest growing region in Analytics as a Service Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Analytics as a Service Market?

In 2025, the North America accounts for the largest market share in Analytics as a Service Market.

What years does this Analytics as a Service Market cover?

The report covers the Analytics as a Service Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Analytics as a Service Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Analytics as a Service Industry Report

Statistics for the 2025 Analytics as a Service market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Analytics as a Service analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.