Airless Tires Market Analysis

The Global Airless Tires Market is expected to register a CAGR of 4.5% during the forecast period.

Airless tires are otherwise known as solid or non-pneumatic tires that are not supported by air pressure. They are generally produced conventionally with plastic or rubber, but these days 3D printing manufacturing process is also being employed. These tires prevent accidents from flat-tires, blowouts, etc., and ensure passenger safety. Moreover, the increase in the number of heavy commercial vehicles, such as heavy-duty trucks, and heavy construction equipment due to urbanization and globalization, is also expected to drive the market.

However, high capital investment for setting up new manufacturing facilities as well as volatile raw material prices might restrain the market growth. Limited performance of solid tires with respect to suspension and friction, coupled with heat dissipation issues, might also limit the market growth. Demand for airless/solid tires in the aftermarket from passenger vehicles as well as technological advancements involving advanced materials are expected to present considerable opportunities for market expansion.

Off-road vehicles are expected to be the largest market for airless tires. Also, solid tires for construction and industrial applications have been in use for quite some time, which reflects their high market share. Major companies, such as Michelin, are researching airless tires for passenger applications as well, which might become mainstream toward the end of the forecast period. growing segment.

Airless Tires Market Trends

Certain advantages of airless tires expected to drive the market

Over the years in automobile history, tires have become an integral part in all types of vehicles. Since tires control the motion of a vehicle, there have been many accidents across the world because of tires. For instance, in the United States alone, more than 700 fatalities are caused each year due to tire-related issues. According to studies, it has also been found that fatality rate because of tire related issues have been more than that of cell-phone driving deaths.

Flat tires, tire blowouts, and worn-out tires are the most common issues associated with pneumatic tires. It is estimated that every second, seven flat tires occur in the United States alone. This pertains to around 220 million flat tires per year. Also, many studies across the world now suggest that a considerable number of people, especially millennials do not even know how to replace a flat tire. Using airless tires will see the risk of a flat tire being mitigated.

Frameworks such as CAFÉ and standards set by EPA, NHTSA, etc., across the world, are demanding increased mileage figures to reduce the emissions from vehicles. According to the latest framework, which was introduced in the United States in 2012, the automaker’s average fuel economy was expected to reach 35.5 mpg in 2016 and go up to 54.5 mpg in 2025. To achieve this, automotive manufacturers are leaving no stone unturned to reduce the overall weight of the vehicle. By employing airless tires that won’t go flat, spare tires can be avoided from vehicles. A typical spare tire, along with associated equipment to change it, weighs around 40 to 50 pounds. This amount of weight can be saved from a vehicle, which would increase the MPG figures.

Off-road vehicles expected to hold the largest market share

The share of off-road segment among different vehicle tires is expected to be the highest in 2022, and it is expected to be the largest segment in 2027 as well, but with a decrease in total share value.

Off-road vehicles, especially construction and industrial vehicles, such as backhoes, forklifts, skid steer loaders, telehandlers, etc., use solid tires. Generally solid tires for these kinds of equipment are designed so as to provide low operational costs at harsh work environments.

Solid tires for off road equipment are also designed to last approximately three times longer than pneumatic tires, as they are made from special rubber compounds. Their tear strength is also more than double of most pneumatic ones, which helps keep the tires intact even when traveling over debris-filled areas.

Major companies such as Michelin, Bridgestone, Continental AG, Trelleborg AB, GRI Tires, etc., offer solid tires in their portfolio for the aforementioned applications. The constantly growing building and infrastructure industry around the world, along with the increasing inventory handling in airports, ports, and warehouses, is expected to record a growth in machinery sales. This, in turn, will drive the demand for solid tires over the forecast period.

Airless Tires Industry Overview

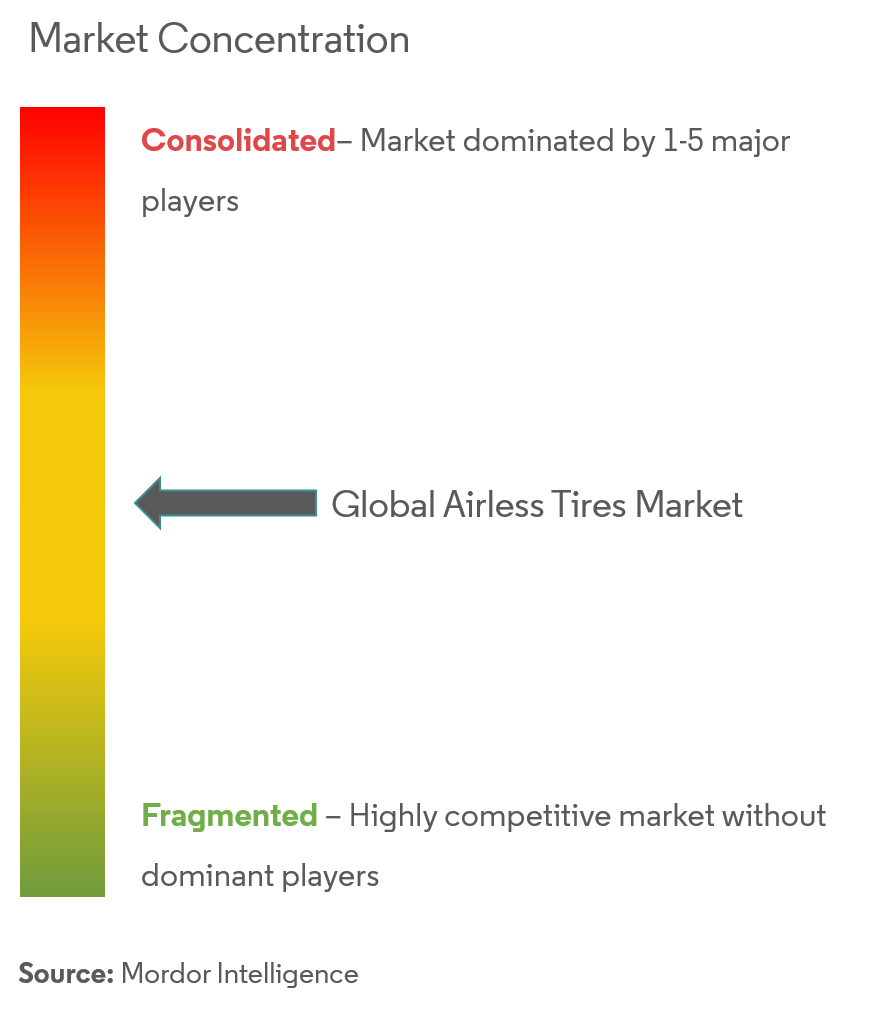

The airless tire market is expected to be neither a fragmented nor consolidated one. As of now major players like Michelin and Bridgestone have a few of these tires in their portfolio. They are also in the process of developing further models, especially for passenger vehicles. Companies are also tying up with auto manufacturers in this market which is further expected to increase the competition. Small and medium players in this business have a scope in the after-market segment which might lead to a fragmented situation.

- Sumitomo Rubber Industries, Ltd. (Sumitomo Rubber) unveiled its Smart Tyre Concept. This new technology development concept aims to achieve tires with "Even Greater Safety" and "Even Higher Environmental Performance" even as the business climate facing the automotive industry is undergoing massive changes owing to environmental issues and the advent of artificial intelligence and Internet of Things. Five development trends at the heart of Sumitomo Rubber's Smart Tyre Concept are Airless Tyres, Performance Sustaining Technology, Active Tread, Sensing Core for sensing road conditions, and Life Cycle Assessment (LCA) for enhancing the environmental performance of products throughout their life cycles.

Airless Tires Market Leaders

-

Michelin

-

The Goodyear Tire & Rubber Company

-

Continental AG

-

Bridgestone Corporation

-

Trelleborg AB

- *Disclaimer: Major Players sorted in no particular order

Airless Tires Market News

- In October 2021, Michelin demonstrated The Uptis airless tires that are made from rubber and fiberglass and promises to be longer-lasting, fuel-saving, and recyclable.

- In April 2021, Toyo Tires will embark on the commercialization of airless tires that do not fill with air. By the end of 2021, a production line for producing airless tires will be introduced at the Sendai Plant (Iwanuma City, Miyagi Prefecture), and production tests will be conducted. The company will examine the feasibility of business by verifying the quality, cost and marketability. As airless tires are currently not allowed to run on public roads by law, it is likely that the commercialized product will be for small mobility applications such as golf carts.

Airless Tires Industry Segmentation

Airless tires are otherwise known as solid or non-pneumatic tires that are not supported by air pressure. They are generally produced conventionally with plastic or rubber, but these days 3D printing manufacturing process is also being employed. These tires prevent accidents from flat tires, blowouts, etc., and ensure passenger safety.

The Global airless tires market is segmented by vehicle type, material, and geography.

By vehicle type, the market has been segmented into Passenger Vehicles, Commercial Vehicles, and Off-Road Vehicles.

By material type, the market has been segmented into Rubber and Plastic.

By geography, the market has been segmented into North America, Europe, Asia-Pacific, and the Rest of the World.

| Vehicle Type | Passenger Vehicles | ||

| Commercial Vehicles | |||

| Off-Road Vehicles | |||

| Material | Rubber | ||

| Plastic | |||

| Geography | North America | United States | |

| Canada | |||

| Rest of North America | |||

| Europe | Germany | ||

| UK | |||

| France | |||

| Spain | |||

| Rest of Europe | |||

| Asia Pacific | China | ||

| Japan | |||

| India | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Rest of the World | South America | ||

| Middle East & Africa | |||

Airless Tires Market Research FAQs

What is the current Global Airless Tires Market size?

The Global Airless Tires Market is projected to register a CAGR of 4.5% during the forecast period (2025-2030)

Who are the key players in Global Airless Tires Market?

Michelin, The Goodyear Tire & Rubber Company, Continental AG, Bridgestone Corporation and Trelleborg AB are the major companies operating in the Global Airless Tires Market.

What years does this Global Airless Tires Market cover?

The report covers the Global Airless Tires Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Global Airless Tires Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Airless Tires Industry Report

Statistics for the 2025 Global Airless Tires market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Global Airless Tires analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.

.webp)