Accelerometer Market Analysis

The Accelerometer Market is expected to register a CAGR of 2.97% during the forecast period.

- The tactical grade of modern high-end accelerometers has penetrated into various defense applications market.

- Moreover, the demand in the commercial aerospace sector is also driving the demand for high-end IMUs. Boeing's aerospace study revealed that over the next three decades, there would be a demand for 35,200 new jet aircraft, globally.

- Furthermore, MEMS accelerators are used in inertial navigation applications to calculate the direction and speed of ships, aircraft, submarines, guided missiles, and spacecraft. High accelerometers have replaced the fragile high-end electromechanical devices.

- However, the fusion of accelerometers on devices may increase the cost of a device. Along with the cost of the device, the accelerometer increases the complexity of a device to be fabricated on to a device.

Accelerometer Market Trends

Aerospace and Defense Industry to Account for a Significant Share in the Market

- The defense application is expected to create a significant demand for accelerometers, owing to the increasing adoption of high-end accelerometers in small-diameter missiles, underwater navigators, and unmanned aerial vehicles and also increasing beneficiaries of high-end MEMS sensors in military applications.

- Furthermore, high-end MEMS accelerators are being deployed along with gyroscopes in inertial navigation applications to calculate the direction and speed of defense applications, such as ships, aircraft, submarines, guided missiles, and spacecraft.

- To meet the increasing demand for IMUs and AHRS systems for military applications, market players are producing custom MEMS-based accelerometers, with enhanced bias stability.

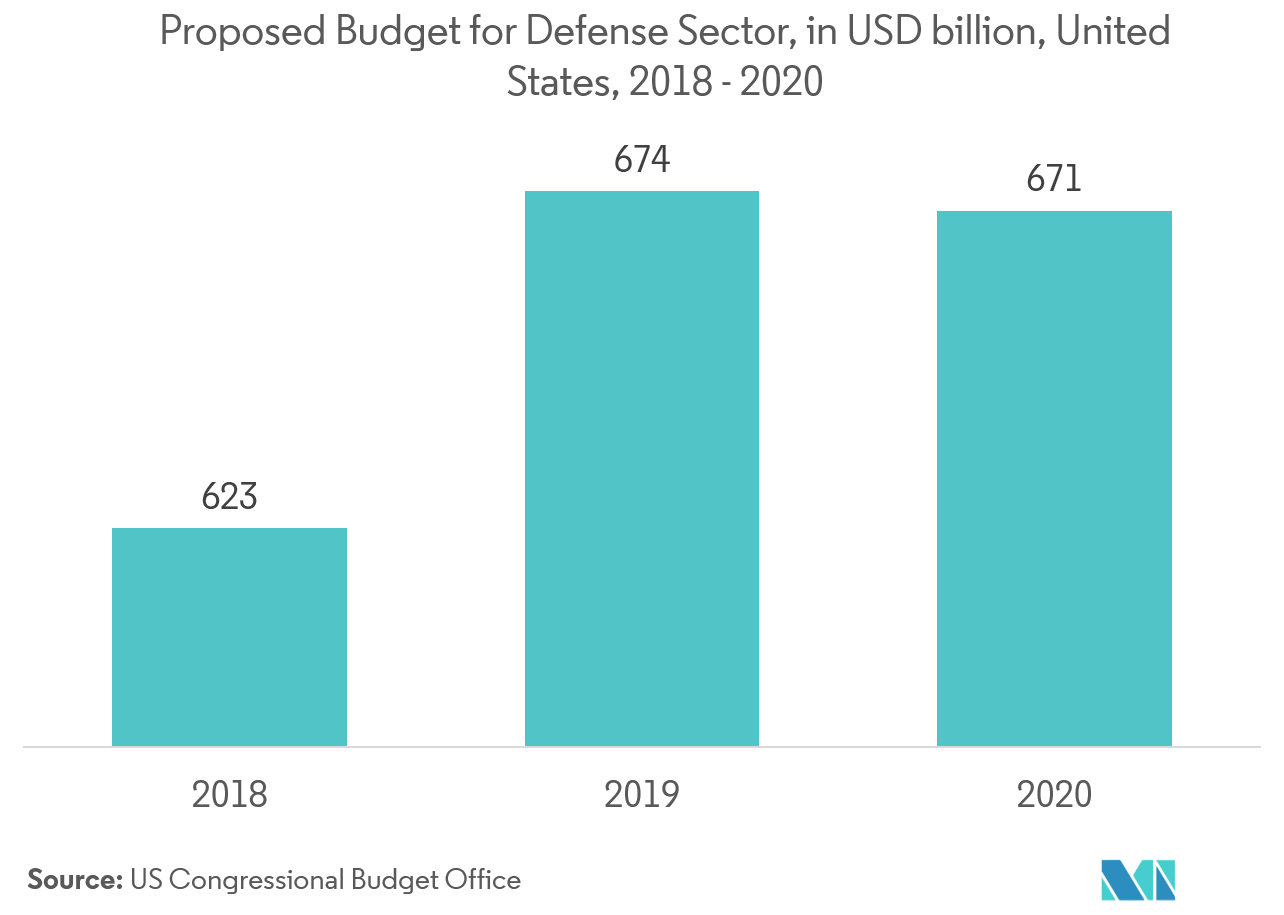

- The military spending trends will drive the growth of the market and the United States has the largest spending in the military and defense sector and therefore the largest market for accelerometers.

North America to Dominate the Market

- North America is witnessing a growth in the development of new high-performance accelerometers as companies in the region are investing in introducing advanced and innovative accelerometers. The increased spending by the US defense is the major factor driving the growth of accelerometers in the region.

- With this rise, the country also focuses on precision-guided munitions (PGMs), such as laser-guided bombs and cruise missiles that have become the weapons of choice for the US military, providing a high degree of accuracy while avoiding widespread collateral damage.

- These applications demand high performance, compact form factor, a ruggedized accelerometer to improve tactical IMUs for long duration guidance without GPS.

- North America is also a pioneer in the adoption of IoT which will also drive the growth of the market in the region.

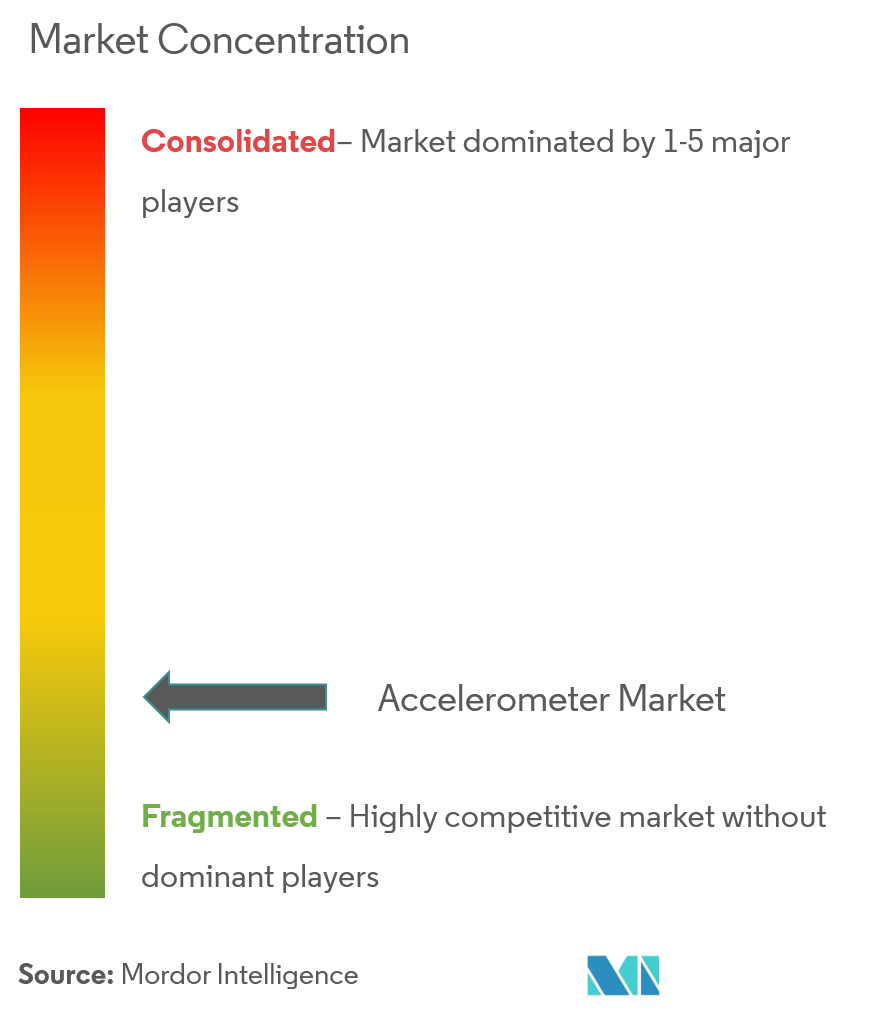

Accelerometer Industry Overview

The accelerometer market is highly fragmenteddue to the presence of many players in the market. Some key players in the market Robert Bosch GmBH,Honeywell International Inc.,Analog Devices Inc., among others. Some key recent developments in the market include:

- April2019 - iXblue’s iXal A5 was introduced as a first navigation-grade accelerometer dedicated to high-performance applications. The iXal A5 can be used in various high-performance civil and defense applications, including land, air, surface, and underwater navigation, guidance, bridge monitoring, and stability, as well as offshore drilling platform monitoring.

- April2019 - STMicroelectronics launched STM32GO for smarter industrial applications.STM32 has a microcontroller, an accelerometer, a MEMS microphone in the industrial IoT development kit. This development kit is useful for proactive maintenance for manufacturing equipment as it detects slight changes at early stages of failure – before serious damage or expense.

Accelerometer Market Leaders

-

Honeywell International Inc.

-

Analog Devices Inc.

-

Robert Bosch GmbH

-

Northrop Grumman LITEF GmbH

-

Rockwell Automation Inc.

- *Disclaimer: Major Players sorted in no particular order

Accelerometer Industry Segmentation

Accelerometers are used to measure the acceleration of a moving body. The use of accelerometers is increasing due to their applications in various configurations. The accelerometers have applications in various end-user segments, such as aerospace and defense, industrial, consumer electronics, automotive, and other end-user industries, such as health care and energy.

| By End User | Aerospace and Defense | ||

| Industrial | |||

| Consumer Electronics | |||

| Automotive | |||

| Other End users | |||

| Geography | North America | United States | |

| Canada | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Rest Of The World | |||

Accelerometer Market Research FAQs

What is the current Accelerometer Market size?

The Accelerometer Market is projected to register a CAGR of 2.97% during the forecast period (2025-2030)

Who are the key players in Accelerometer Market?

Honeywell International Inc., Analog Devices Inc., Robert Bosch GmbH, Northrop Grumman LITEF GmbH and Rockwell Automation Inc. are the major companies operating in the Accelerometer Market.

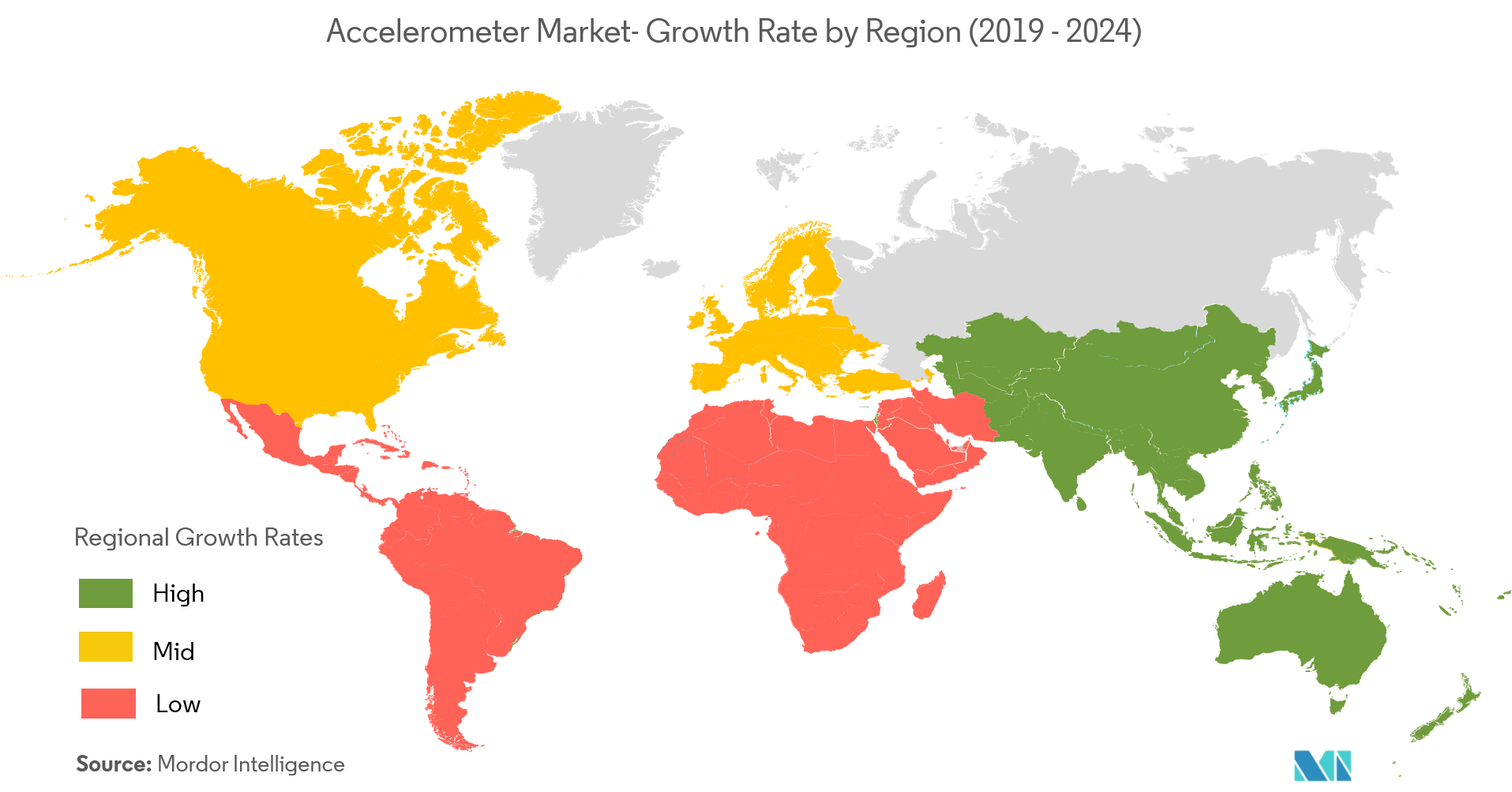

Which is the fastest growing region in Accelerometer Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Accelerometer Market?

In 2025, the North America accounts for the largest market share in Accelerometer Market.

What years does this Accelerometer Market cover?

The report covers the Accelerometer Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Accelerometer Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Accelerometer Industry Report

Statistics for the 2025 Accelerometer market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Accelerometer analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.