3D Sensors Market Analysis

The 3D Sensor Market is expected to register a CAGR of 18% during the forecast period.

- Increasing sensor compatibility with the Internet of Things platform is gradually becoming a prerequisite for promoting remote monitoring and control. The IoT-connected appliances have opened massive opportunities for sensors in several industrial, medical, consumer electronics, automobile, applications etc. According to Cisco's Annual Internet Report, by 2023, there will be nearly 30 billion network-connected devices and connections, up from 18.4 billion in 2018. By 2023, IoT devices will make up 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018. Such an increase in IoT devices would drive the growth of the studied market.

- Moreover, governments' initiatives for smart homes and buildings are helping the adoption of 3D sensors faster. Recently, councils in Leeds, Suttons, and Richmond advanced IoT technology in homes to better support residents and make services more efficient. Further, in July 2022, Senet, Inc., and Iota Communications, Inc., a data analytics software, low power, vast area network (LPWAN) wireless communication company, announced a partnership to deliver LoRaWANthrough 915 MHz unlicensed spectrum and IotaComm's800 MHz FCC-licensed spectrum network connectivity, for facilitating the adoption of smart infrastructure 3D sensors.

- Increasing demand for consumer electronics is expected to provide opportunities to increase the company's revenue. Further, the global demand for smartphones has been witnessing an upsurge owing to several factors, such as increasing disposable income, the advent of 5G, and the development of telecom infrastructure. For instance, according to Ericsson, the number of smartphone subscriptions worldwide amounted to 6,259 million recently and is expected to reach 7,690 million in 2027.

- Recently, TDK Corporation announced the addition of the HAR 3927 to its Micronas direct-angle Hall-effect sensor family. This product employs proprietary 3D HAL pixel-cell technology and addresses the demand for ISO 26262-compliant development. The sensor includes a ratiometric analog output and a digital SENT interface by SAE J2716 rev. Such developments will further drive market growth.

- Further, in May 2022, Infineon and pmdtechnologies collaborated to create 3D depth-sensing technology for Magic Leap 2, allowing for advanced cutting-edge industrial and medical applications. The IRS2877C Time-of-Flight imager captures the physical environment around the user and assists the device in understanding and eventually interacting with it.

- Furthermore, the industry 4.0 revolution, in which machines are becoming more intelligent and intuitive, is increasing the need for the industrial applications of sensors. According to the IFR forecasts, global adoption is expected to increase significantly to 518,000 industrial robots operational across factories all around the globe by 2024. The positive growth trajectory of the industrial robots market is expected to drive the demand for sensors during the same period.

- Several types of research regarding biosensors focusing on increasing efficiency and accuracy and tackling limitations are expected to spearhead the adoption of biosensors. For instance, in August 2022, a new study from the University of Chicago's Pritzker School of Molecular Engineering showed that a flexible, stretchable computing chip worn directly on the skin could collect and analyze health data in real-time using artificial intelligence (AI). The device, a neuromorphic computing chip, utilizes semiconductors and electrochemical transistors to collect data from biosensors touching the skin. Unlike other wearables like smartwatches, which leave a small gap between the user's skin and the device, the chip is designed to be worn directly to improve sensor accuracy and data collection. Also, in July 2022, researchers from the School of Science at IUPUI reported that they were working to create a new biosensor that could meet future COVID-19 testing requirements for speed and efficiency.

- The COVID-19 outbreak had an enormous impact on the studied market. Many end-user enterprises were impacted, including those in electronics manufacturing. A large part of manufacturing includes work on the factory floor, where people are in close contact as they collaborate to boost productivity. Additionally, manufacturing services has been a historically slow industry when adapting to change. Tasks such as product assembly, prototype development, and risk assessment are sensitive workflows that need in-depth planning. For such reasons, manufacturers had to make significant adjustments during this COVID-19 period.

3D Sensors Market Trends

Automotive to Hold Significant Share

- 3D Sensors are widely used in the automotive industry to monitor various aspects of a car, including its temperature, coolant system, oil pressure, and vehicle speed. The rising demand for safer and cleaner vehicles drives the need for 3D sensors in the automotive industry. For instance, sensors provide information regarding clean and effective fuel combustion in the engine, which helps in significantly reducing exhaust emissions values and fuel consumption.

- According to IBEF, India could be a shared mobility leader by 2030, opening up electric and autonomous vehicle opportunities. Further, in April 2022, Tata Motors announced plans to invest INR 24,000 crores (USD 3.08 billion) in its passenger vehicle business over the next five years. In addition, according to CAAM, in April 2022, around 210,000 commercial motorcars and 996,000 passenger vehicles were produced in China. Such investment in automobiles will further drive market growth.

- Further, according to the American Automotive Policy Council, automakers and their suppliers are America's largest manufacturing sector, responsible for ~3% of America's GDP. Over the past five years alone, the FCA US, Ford, and General Motors have announced their investments of around USD 35 billion in their US assembly, engine, and transmission plants, R&D labs, administrative offices, and other infrastructure connecting and supporting them.

- The market is also getting increasingly competitive, with various established and new players developing and launching more unique products in the automation market. For instance, in July 2022, Universal Robots unveiled a new 20 kg payload cobot to help machines in heavy lifting. The launch of these more potent, faster, and more capable cobots aims at accelerating the company's expansion in high-growth segments, including healthcare, consumer electronics, etc., meeting the rising demand for automation across numerous industries.

- Furthermore, the car and automotive sector is one area that is likely to be affected significantly by the 3D modeling market, consequently boosting the 3D sensor market. Additionally, a lot of technological advancements are carried out by various vendors in the market. Recently, Yokohama Rubber and Zenrin started the practical testing of a sensor attached to the inner surface of a tire as part of a pilot study investigating road surface and tread wear measurement using an IoT-enabled road surface-sensing system.

- Further, in June 2022, Sentronics announced a partnership with HORIBA UK to launch the next-generation Ultrasonic Fuel Consumption Measurement Sensor, the HORIBA RealFlow: Powered by Sentronics, for the automotive industry. Featuring the latest patented technology in ultrasonic fuel flow sensing, the HORIBA RealFlow offers accurate under-bonnet installation and real-time measurement of fuel consumption for automotive validation and verification of test applications. With an improved flow measurement accuracy of ±0.5% over an expanded turndown range of 1000:1, it offers optimum performance compared to its predecessor.

North America to Hold Significant Market Share

- In North America, the United States is expected to be the largest growing market, owing to the great demand from consumer electronics and automotive sectors, employing 3D sensors for multiple applications in their domains.

- With the increasing adoption of smartphone devices in the US, the demand for sensors is expected to increase simultaneously in the market. According to the US Census Bureau and Consumer Technology Association, the sales of smartphones in the US reached USD 74.7 billion in 2022 compared to USD 73 billion in 2021. With the increasing adoption of smartphones in the market, the demand for 3D sensors is also expected to increase at the same speed.

- Recently, Qualcomm launched its second-generation 3D Sonic Sensor under-display fingerprint reader. The new scanner would offer a 77% larger fingerprint reader area and 50% faster than its first-gen scanner, featured in Samsung's Galaxy S20 and Note20 models.

- Moreover, Apple's product, iPhone, plays a significant role in increasing the demand for smartphones in the United States. For instance, in September 2022, Apple unveiled the iPhone 14 and iPhone 14 Plus in California. A unique, larger 6.7-inch size joins the popular 6.1-inch design, with a new dual-camera system, Crash Detection, a smartphone industry-first safeness service with Emergency SOS via satellite, and multiple helpful battery life on iPhone. Similarly, a trend of people keen on trying innovative technology is rising in Canada.

- Also, consumers today prefer enhanced image quality, such as laptops and Ultra HD or 4K television sets. This is, further expected to drive the 3D sensor market. In addition, the fast adoption of new technology in this region, such as self-driving cars, is expected to drive the demand for 3D sensors in the automotive sector.

3D Sensors Industry Overview

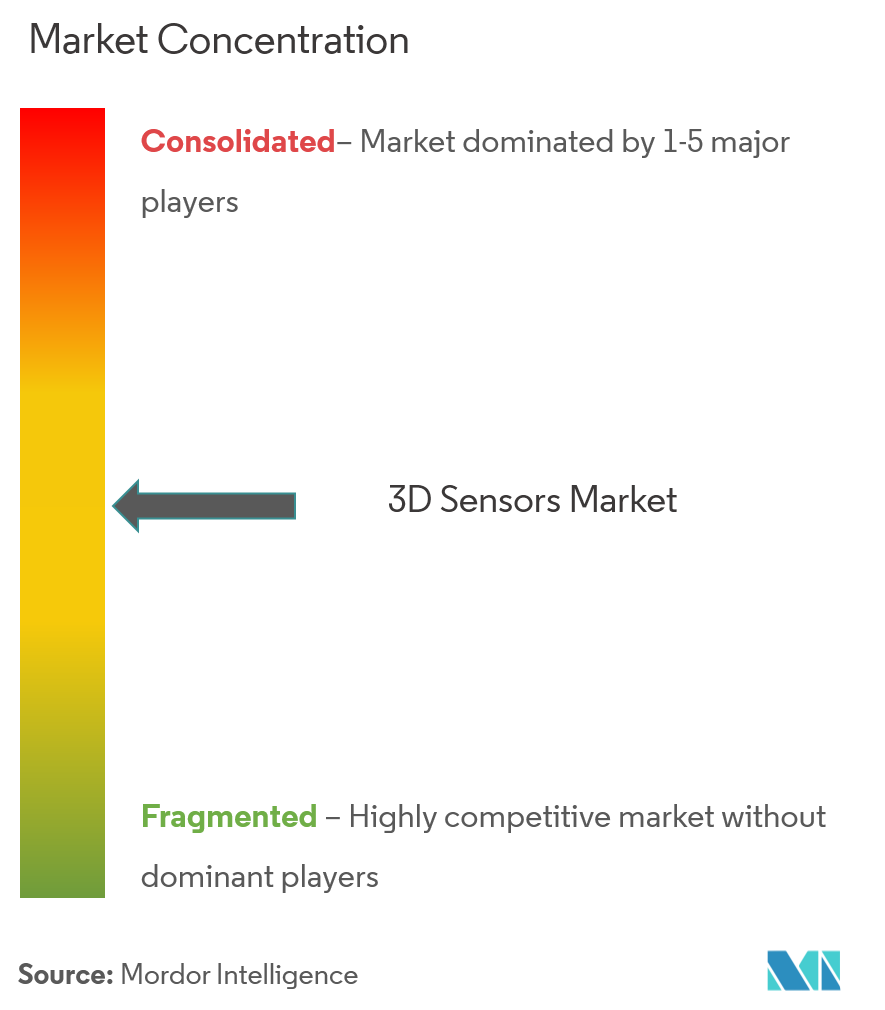

The 3D sensor market is moderately competitive. However, with increased innovations and sustainable products, to maintain their position in the global market, many companies are increasing their market presence by securing new contracts by tapping new markets.

In September 2022, Ouster, Inc., a leading manufacturer of high-resolution digital lidar sensors, released a 3D industrial lidar sensor suite for high-volume material handling applications. The industrial line of high-resolution OS0 and OS1 sensors is designed to meet the needs of forklifts, port equipment, and autonomous mobile robot (AMR) manufacturers while remaining affordable for high-volume production fleets. According to the company, its industrial sensor suite's 3D capabilities outperform legacy 2D laser scanners by providing superior resolution, range, and field of view without increasing system cost or complexity.

In June 2022, ST introduced the first 3D sensor with meta-optics. The direct time-of-flight sensor is a depth sensor used in smartphones, virtual reality headsets, and robotics. Meta-optics can replace existing complex and multi-element lenses; they collect more light, perform multiple functions in a single layer, and enable new forms of sensing in smartphones and other devices while taking up less space.

3D Sensors Market Leaders

-

Intel Corporation

-

Sick AG

-

Infineon Technologies AG

-

Panasonic Corporation

-

Cognex Corporation

- *Disclaimer: Major Players sorted in no particular order

3D Sensors Market News

- August 2022 : ams OSRAM, a global leader in optical solutions, announced the release of a 2.2Mpixel global shutter visible and near-infrared (NIR) image sensor with the low-power characteristics and small size required in the latest 2D and 3D sensing systems for virtual reality (VR) headsets, smart glasses, drones, and other consumer and industrial applications.

- July 2022 : Toposens, a Munich-based high-tech startup, launched its first commercial Toposens 3D COLLISION AVOIDANCE SYSTEM for mobile robots based on the company's proprietary Toposens 3D ultrasonic echolocation technology. Following more than seven years of R&D and product commercialization represents a significant milestone for the company.

- April 2022 : Panasonic unveiled the LUMIX GH6, the latest flagship model in the LUMIX G Series, a stunning digital mirrorless camera based on the Micro Four Thirds system standard. With advanced processing technology and innovative features, the LUMIX GH6 provides outstanding mobility and high video performance, making it an ideal partner for the global content creator community.

3D Sensors Industry Segmentation

3D Sensor is a depth-sensing technology that improves camera facial and objects recognition. The procedure of capturing a real-world object's length, width, and height with greater clarity and detail than is possible with a variety of different technologies. The studied market is segmented by product, such as Position Sensor, Image Sensor, Temperature Sensor, and Accelerometer Sensor, other technologies like Ultrasound, Structured Light, and Time of Flight, various End-user Vertical such as Consumer Electronics, Automotive, Healthcare, and multiple geographies. The market sizes and forecasts are provided in terms of value (USD million) for all the above segments.

The impact of COVID-19 on the market and impacted segments are also covered under the scope of the study. Further, the disruption of the factors affecting the market's expansion in the near future has been covered in the study regarding drivers and restraints.

| By Product | Position Sensor | ||

| Image Sensor | |||

| Temperature Sensor | |||

| Accelerometer Sensor | |||

| Other Products | |||

| By Technology | Ultrasound | ||

| Structured Light | |||

| Time of Flight | |||

| Other Technologies | |||

| By End User Vertical | Consumer Electronics | ||

| Automotive | |||

| Healthcare | |||

| Other End User Verticals | |||

| By Geography | North America | United States | |

| Canada | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Rest of the Asia-Pacific | |||

| Latin America | Mexico | ||

| Middle East & Africa | |||

3D Sensors Market Research FAQs

What is the current 3D Sensor Market size?

The 3D Sensor Market is projected to register a CAGR of 18% during the forecast period (2025-2030)

Who are the key players in 3D Sensor Market?

Intel Corporation, Sick AG, Infineon Technologies AG, Panasonic Corporation and Cognex Corporation are the major companies operating in the 3D Sensor Market.

Which is the fastest growing region in 3D Sensor Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in 3D Sensor Market?

In 2025, the North America accounts for the largest market share in 3D Sensor Market.

What years does this 3D Sensor Market cover?

The report covers the 3D Sensor Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the 3D Sensor Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

3D Sensor Industry Report

Statistics for the 2025 3D Sensor market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. 3D Sensor analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.