GCC Rigid Packaging Market Analysis

The GCC Rigid Packaging Market is expected to register a CAGR of 5.73% during the forecast period.

- Rise in demand for domestically manufactured goods has led to a rise in demand for effective rigid packaging solutions, thus driving the growth of the rigid packaging market in major countries within GCC.

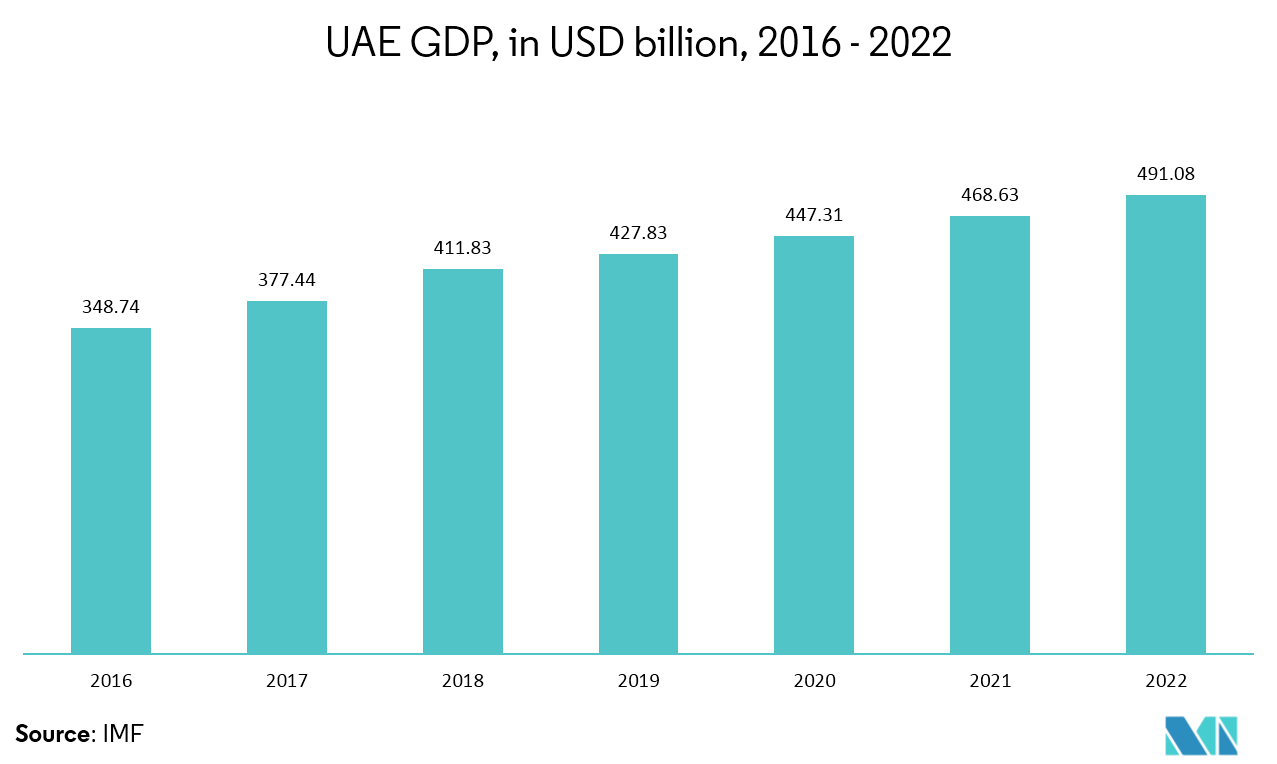

- The high per capita income and younger demographic profile of GCC nations have a positive effect on the demand for high-value luxury goods and electronics goods. The working expatriate population is the reason for the increase in demand for consumer goods. Additionally, the regional governments have been emphasizing to improve their infrastructure to bring in an influx of tourists to their countries.

- Government support for domestic food production is continuing to reduce reliance on imports, which is supporting the growth of the local food and beverage providers.

GCC Rigid Packaging Market Trends

PET to Hold Major Share

In GCC region, the Polyethylene terephthalate (PET) segment of the market studied is estimated to expand at the highest rate, due to the high demand for PET resins in the manufacturing of bottles for soft drinks and other beverages. The demand for rigid packaging from the food and beverage industry is expected to be constant, which is also driving the demand for PET in the region.

Saudi Arabia currently recycles about 10% of its PET (polyethylene terephthalate) bottles. The recycling percentage is expected to grow with increasing focus of the government toward recycling, which, in turn, is likely to drive the demand of PET in the country.

In 2017, the Gulf Cooperation Council (GCC) has drafted technical regulations intended for food packages, food supplements, and food. This is further estimated to increase the demand for PET in the packaging industry.

GCC Rigid Packaging Industry Overview

The GCC rigid packaging market is competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability. In Aug 2018, Amcor Limited and Bemis Company Inc. entered a definitive agreement, under which, Amcor would acquire Bemis for a USD 6.8 billion all-stock transactions.

GCC Rigid Packaging Market Leaders

-

Amcor Limited

-

Al Watania Plastics

-

Schott AG

-

Ball Corporation

-

RAK Ghani Glass LLC

- *Disclaimer: Major Players sorted in no particular order

GCC Rigid Packaging Industry Segmentation

The rigid packaging market is segmented by material and end-user vertical. The materials are further segmented by plastic, glass, metal, and paper whereas the end-user vertical is segmented into food and beverage, pharmaceutical, personal care and industrial.

| By Material Type | Plastic |

| Glass | |

| Metal | |

| Other Material Types | |

| By End-user Vertical | Food and Beverage |

| Pharmaceutical | |

| Personal Care | |

| Industrial | |

| By Country | Saudi Arabia |

| UAE | |

| Qatar | |

| Rest of GCC |

GCC Rigid Packaging Market Research FAQs

What is the current GCC Rigid Packaging Market size?

The GCC Rigid Packaging Market is projected to register a CAGR of 5.73% during the forecast period (2025-2030)

Who are the key players in GCC Rigid Packaging Market?

Amcor Limited, Al Watania Plastics, Schott AG, Ball Corporation and RAK Ghani Glass LLC are the major companies operating in the GCC Rigid Packaging Market.

What years does this GCC Rigid Packaging Market cover?

The report covers the GCC Rigid Packaging Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the GCC Rigid Packaging Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

GCC Rigid Packaging Industry Report

Statistics for the 2025 GCC Rigid Packaging market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. GCC Rigid Packaging analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.