Food-grade Industrial Gases Market Size and Share

Food-grade Industrial Gases Market Analysis by Mordor Intelligence

The Food-grade Industrial Gases Market is expected to register a CAGR of 6.5% during the forecast period.

- The increasing demand for fresh products and packaged food has led to the use of industrial gases in the food and beverage sector. The increasing working hours and changing lifestyles have affected the growth of convenience or packaged food. This has resulted in the growth of packing technologies and frozen foods. Nitrogen, carbon dioxide, and oxygen are the major industrial gases that are used in various food applications, such as freezing, packaging, chilling, and grinding.

- Food-grade industrial gases are classified as processing aids or additives. Nitrogen is an innert gas and is extensively used to delay oxidative and hydrolytic rancidity in fat-rich foods. Carbon dioxide is used in cooling, freezing, modified atmosphere packaging, and carbonization. Higher concentrations of carbon dioxide (above 5%) effectively act as antimicrobial agents, thereby, delaying food spoilage.

- The companies are increasingly investing in packaging technologies that are free from synthetic preservatives, by replacing them with food-grade industrial gases. For example, Deccan Field Agro Industries from India utilized active modified atmosphere packaging (AMAP), in order to extend the shelf life of papaya by over four weeks and to export the fruit to Dubai.

Global Food-grade Industrial Gases Market Trends and Insights

Increasing Application in Modified Air Packaging (MAP)

The demand for packaged food products is increasing at a faster pace, resulting in the food industries adopting atmospheric modified packaging, because it not only helps in increasing the shelf life of the products, but also maintains their organoleptic properties. As MAP is used to extend the shelf life of various food products, such as cheese, pasta, meat products, and others, without the use of chemicals, it being used in packaging fresh as well as organic food products. The three main gases used in MAP include oxygen, carbon dioxide, and nitrogen, which, in turn, accelerate the growth in the use of industrial food gases across the world. As MAP uses preservatives to retain the freshness of packaged food, primarily organic and fresh fruits and vegetables, meat products, and others, the doses used are in alignment with the ongoing trend of clean-labeled products across the world.

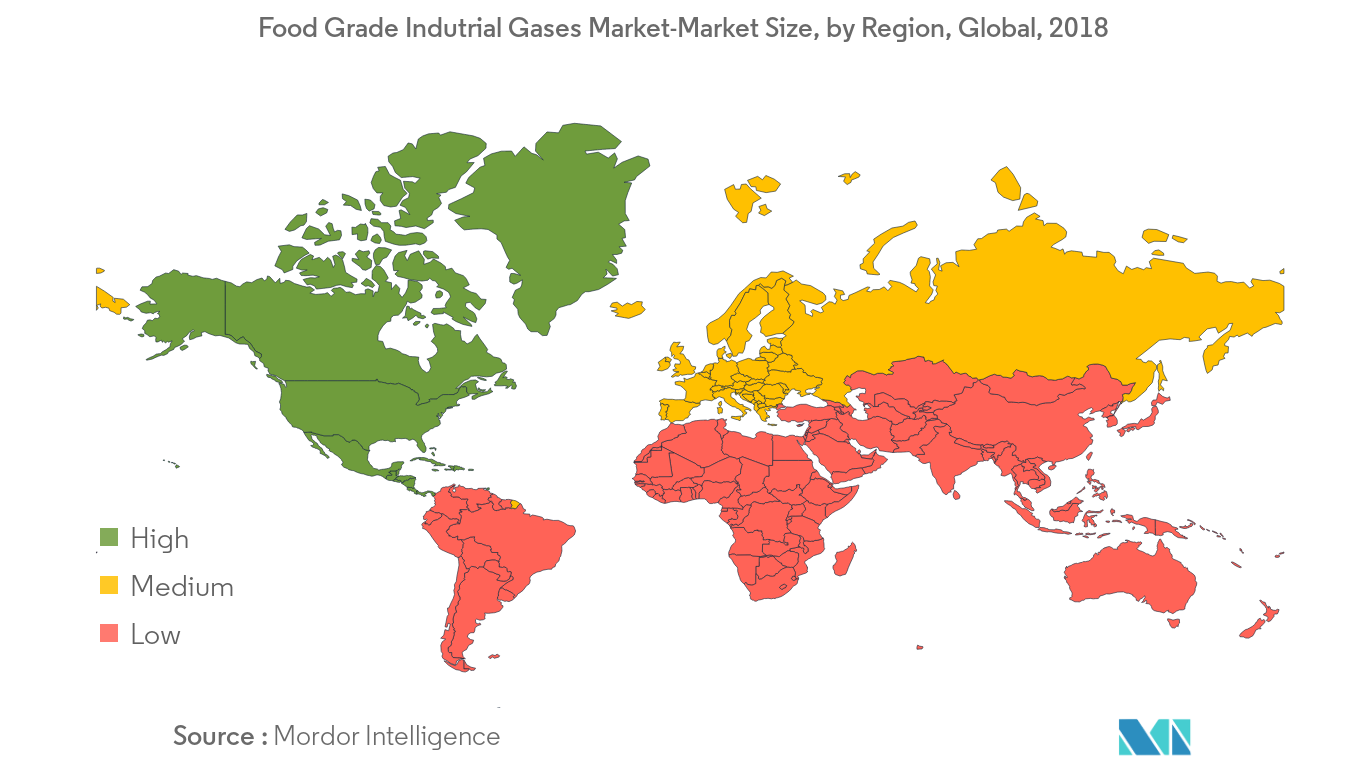

The North American Region Registered a Significant Market Share

The rising demand from various end-use industries, such as processed foods, bakery and confectionery, and breakfast cereals, in the region, are some of the major factors that are expected to boost the North American food-grade industrial gasses market, during the forecast period. Millennials, comprising a major demand group in the region, are largely focusing on consuming food products that are convenient and can be consumed with minimal preparation, owing to their busy work schedules. This has led to an increased demand for packaged food products, as they can be easily reconstituted. There is a rising trend of healthy snacks in the United States, which offers a great opportunity for industrial food-grade gases, in terms of frozen and chilled, packed snack food products. According to the government of Alberto, there has been a significant increase in the demand for ready-to-eat breakfast cereals, among the Canadian consumers, which is yet another factor that is accelerating the market for various food-grade industrial gases. Moreover, the region has the highest per capita consumption of meat products across the world. Thus, the usage of industrial gases in the meat industry is fueling the growth of the market.

Competitive Landscape

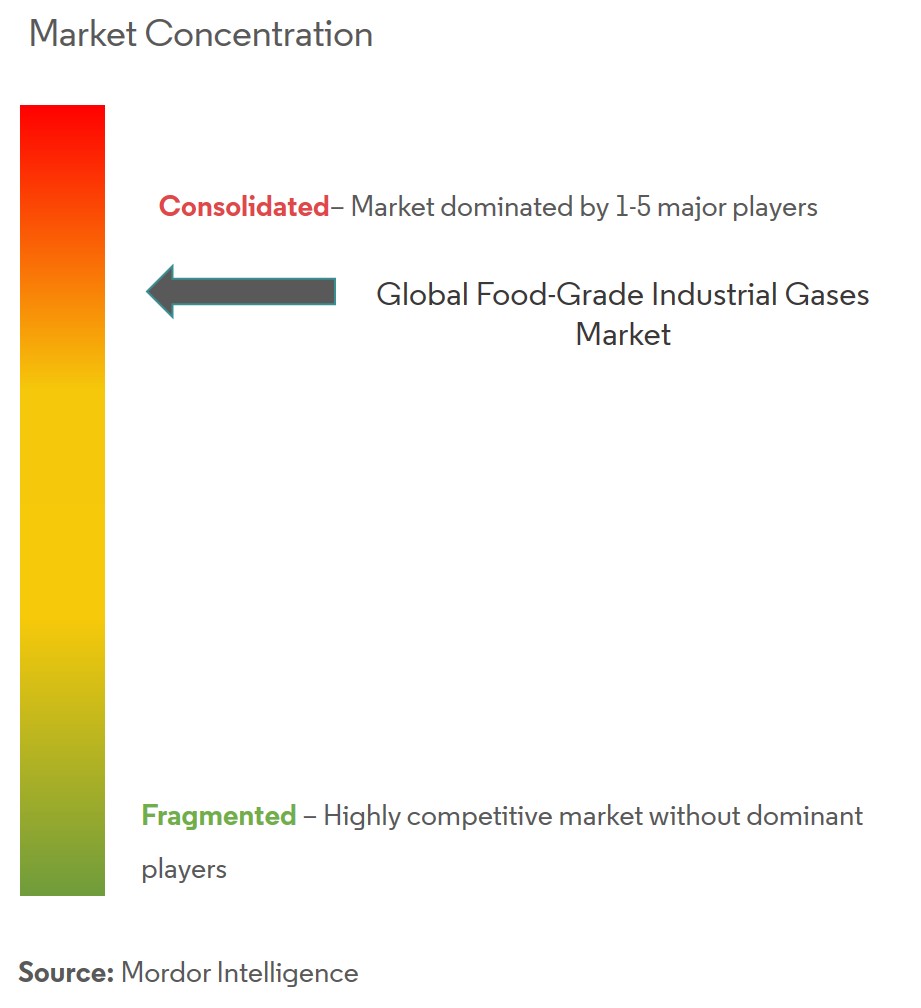

The global food-grade industrial gases market is a highly competitive one, with major shares being held by the active players, such as Linde PLC, Air Liquide SA, and others. Mergers and acquisitions and product innovations are the most preferred strategies by the companies, to strengthen their market dominance. These strategies help the companies expand their presence across the global market. For instance, Linde PLC acquired Praxair, which is one of America's largest industrial gas companies, to capitalize itself within the American market. The key players are also focusing on expanding their network of innovation centers, enabling them to collaborate with the customers on new product developments and reformulations, and make investments.

Food-grade Industrial Gases Industry Leaders

Linde plc

Air Products & Chemicals, Inc.

Air Liquide S.A.

Messer Group

Wesfarmers Limited

- *Disclaimer: Major Players sorted in no particular order

Global Food-grade Industrial Gases Market Report Scope

The major industrial gases being used in the food and beverage industry include carbon dioxide, nitrogen, oxygen, and other types. Food-grade industrial gases play an important role in different products, such as beverages, meat, poultry, and seafood products, dairy and frozen products, bakery and confectionery products, fruits and vegetables, and others. The market report on industrial food-grade gases provides an outlook on the potential markets in each region.

| Carbon Dioxide |

| Nitrogen |

| Oxygen |

| Other Types |

| Beverages |

| Meat, Poultry, and Seafood Products |

| Dairy and Frozen Products |

| Bakery and Confectionery Products |

| Fruits and Vegetables |

| Other End-use Industries |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America | |

| Europe | Spain |

| United Kingdom | |

| France | |

| Germany | |

| Russia | |

| Italy | |

| Rest of Europe | |

| Asia-Pacific | China |

| Japan | |

| India | |

| Australia | |

| Rest of Asia-Pacific | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Middle East and Africa | South Africa |

| Saudi Arabia | |

| Rest of Middle East & Africa |

| By Type | Carbon Dioxide | |

| Nitrogen | ||

| Oxygen | ||

| Other Types | ||

| By End-use Industry | Beverages | |

| Meat, Poultry, and Seafood Products | ||

| Dairy and Frozen Products | ||

| Bakery and Confectionery Products | ||

| Fruits and Vegetables | ||

| Other End-use Industries | ||

| Geography | North America | United States |

| Canada | ||

| Mexico | ||

| Rest of North America | ||

| Europe | Spain | |

| United Kingdom | ||

| France | ||

| Germany | ||

| Russia | ||

| Italy | ||

| Rest of Europe | ||

| Asia-Pacific | China | |

| Japan | ||

| India | ||

| Australia | ||

| Rest of Asia-Pacific | ||

| South America | Brazil | |

| Argentina | ||

| Rest of South America | ||

| Middle East and Africa | South Africa | |

| Saudi Arabia | ||

| Rest of Middle East & Africa | ||

Key Questions Answered in the Report

What is the current Food-grade Industrial Gases Market size?

The Food-grade Industrial Gases Market is projected to register a CAGR of 6.5% during the forecast period (2025-2030)

Who are the key players in Food-grade Industrial Gases Market?

Linde plc, Air Products & Chemicals, Inc., Air Liquide S.A., Messer Group and Wesfarmers Limited are the major companies operating in the Food-grade Industrial Gases Market.

Which is the fastest growing region in Food-grade Industrial Gases Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Food-grade Industrial Gases Market?

In 2025, the North America accounts for the largest market share in Food-grade Industrial Gases Market.

What years does this Food-grade Industrial Gases Market cover?

The report covers the Food-grade Industrial Gases Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Food-grade Industrial Gases Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Page last updated on:

Food-grade Industrial Gases Market Report

Statistics for the 2025 Food-grade Industrial Gases market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Food-grade Industrial Gases analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.