Fog Networking Market Analysis

The Fog Networking Market size is estimated at USD 2.18 billion in 2025, and is expected to reach USD 4.34 billion by 2030, at a CAGR of 14.75% during the forecast period (2025-2030).

Although fog networking is a new technology in the technological market, it is, however, already making its mark in the market.

- Fog networking enlarges the technology of cloud computing to the network edge, and thus makes it ideal for IoT, 5G, AI, and many more technologies that require real-time analysis of data, at a faster pace. For instance, Citi Bank uses beacon technology to understand ATM users' purchasing behavior and provides incentives to customers to use Citi cards in local areas for transactions.

- Fog nodes are deployed close to end devices, and they act as smart processors that have the capability to analyze real-time data and give instant results.

- Devices, ranging from personal wearables and home appliances to industrial sensors, generate a vast amount of data that needs to be processed, in order to gain insights. Fog networking not only provides real-time analysis with low latency, but also addresses security concerns that prevail in cloud computing.

- Fog networking is useful in applications like connected vehicles, connected healthcare, traffic management, and many other that require low latency. For instance, smart traffic will not work if the latency is too high.

Fog Networking Market Trends

Smart Meter to Witness Higher Growth

- A smart meter is an electronic device that records the consumption of electrical energy units and communicates it to the power company from which the power is supplied.

- Many power companies across the world are planning to adopt smart meters to remotely monitor consumers' energy consumptions and to prevent fraudulent energy consumption. Moreover, smart energy and metering solutions are becoming more prevalent in both businesses and households.

- The data collected by smart meters is sufficient to draw inferences, such as the behavior, sleeping cycle, home occupancy, eating routines, etc. of the consumers. However, for it to make sense, the data needs to be analyzed in real-time.

- The data collected per household can be used by various organizations. For instance, an electric or power company can sell its products or services based on energy units consumed.

- As smart meters produce a tremendous amount of data, which is hard to process and analyze, even with cloud computing, there is a need for fog computing, which offers a place for collecting, computing, and storing smart meter data before transmitting it to the cloud.

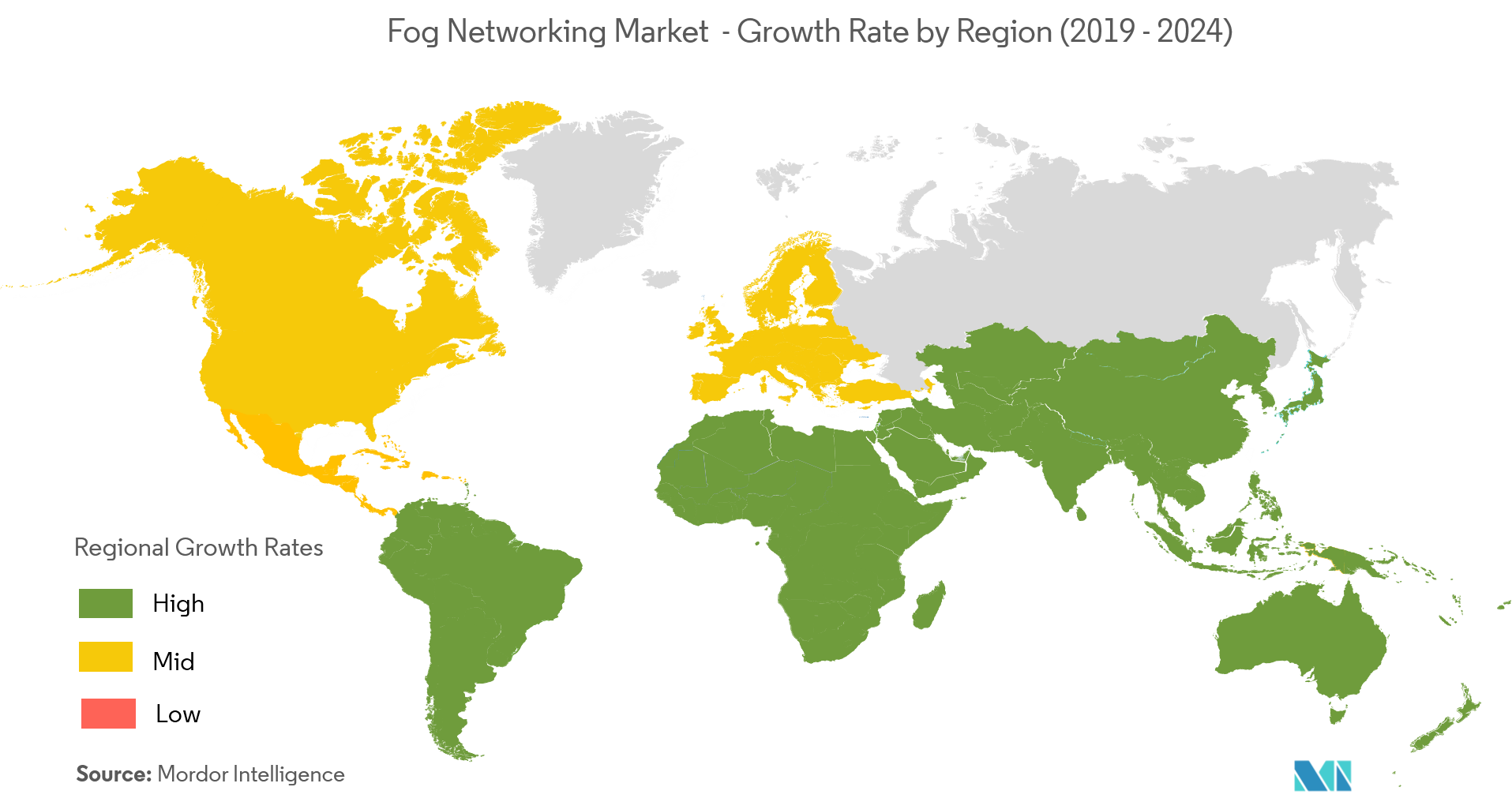

North America Occupies the Largest Market Share

- The North American region occupies the largest share in the market, as most fog networking enterprises are based out of North America. Moreover, most cloud computing providers working in this region have already started offering fog networking hardware and software solutions, to stay up to date with the technology.

- The OpenFog Consortium, which is a consortium of high tech companies and academic institutions across the world, aiming at the standardization and promotion of fog computing in various capacities and fields, including companies like Cisco, Dell, Intel, and Microsoft, is also headquartered in the United States. More companies are joining this consortium, to gain insights about fog computing.

- The North American region is also the leader in IoT and 5G technology, which generates a huge amount of data to be processed in real time.

- With the emergence of connected cars in the region, the market is expected to witness huge growth, as the cars will need to communicate with not only each other but also traffic lights, where traffic lights will act as fog nodes. Moreover, these cars will require real-time analysis of data to function accurately.

Fog Networking Industry Overview

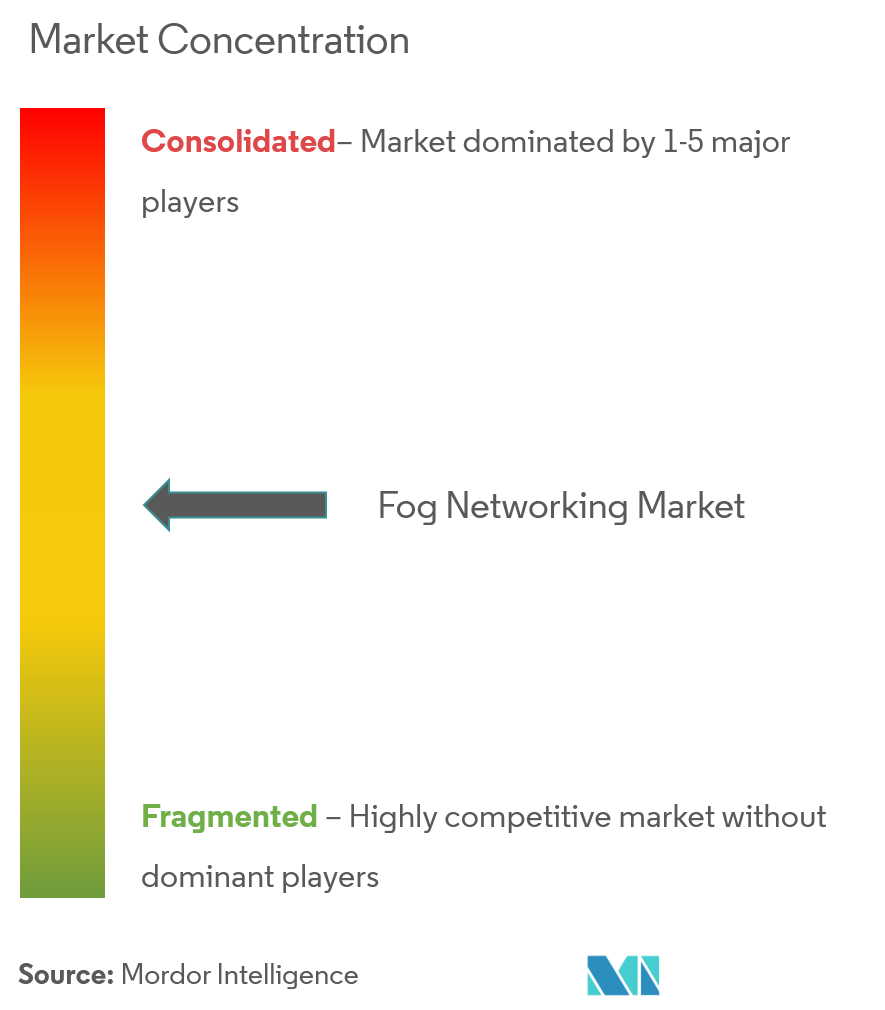

The fog networkingmarket is competitive in nature, with many international players. The market is concentrated, with the presence of various multinationals focusing on strategies like product innovation, mergers, and acquisitions, to expand their reach and stay ahead of the competition.

- April 2018 - Amazon developed a technology tobring machine learning smarts to edge computing, through AWS Greengrass. The latest version (v1.5.0) can run Apache MXNet and TensorFlow Lite models locally on edge devices based on NVIDIA Jetson TX2 and Intel Atom architectures.

Fog Networking Market Leaders

-

Amazon Web Services, Inc.

-

Microsoft Corporation

-

IBM Corporation

-

Intel Corporation

-

Cisco Systems, Inc.

- *Disclaimer: Major Players sorted in no particular order

Fog Networking Industry Segmentation

Fog networking is a decentralized computing infrastructure in which data, compute, storage, and other applications are located somewhere between the data source and the cloud. Like edge computing, fog networking brings the advantages and power of the cloud closer to where the data is created and acted upon, so that the data has to travel less, which results in faster processing speed.

| By Component | Hardware |

| Software and Service | |

| By End-user Application | Smart Meter |

| Building and Home Automation | |

| Smart Manufacturing | |

| Connected Healthcare | |

| Connected Vehicle | |

| Other End-user Applications | |

| Geography | North America |

| Europe | |

| Asia-Pacific | |

| Rest of the World |

Fog Networking Market Research FAQs

How big is the Fog Networking Market?

The Fog Networking Market size is expected to reach USD 2.18 billion in 2025 and grow at a CAGR of 14.75% to reach USD 4.34 billion by 2030.

What is the current Fog Networking Market size?

In 2025, the Fog Networking Market size is expected to reach USD 2.18 billion.

Who are the key players in Fog Networking Market?

Amazon Web Services, Inc., Microsoft Corporation, IBM Corporation, Intel Corporation and Cisco Systems, Inc. are the major companies operating in the Fog Networking Market.

Which is the fastest growing region in Fog Networking Market?

Asia Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Fog Networking Market?

In 2025, the North America accounts for the largest market share in Fog Networking Market.

What years does this Fog Networking Market cover, and what was the market size in 2024?

In 2024, the Fog Networking Market size was estimated at USD 1.86 billion. The report covers the Fog Networking Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Fog Networking Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Fog Networking Industry Report

Statistics for the 2025 Fog Networking market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Fog Networking analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.